OPEC+ To Review Oil Production Quotas: July's Impact On Markets

Table of Contents

Current Global Oil Market Conditions

The global oil market currently faces a complex interplay of factors influencing supply and demand. Geopolitical instability, particularly the ongoing war in Ukraine, significantly impacts oil availability and price volatility. Existing sanctions against certain oil-producing nations further complicate the situation, creating uncertainty and impacting the reliability of supply chains.

- Current oil prices and their volatility: Oil prices have experienced significant fluctuations in recent months, driven by geopolitical events and fluctuating demand. This volatility creates challenges for businesses and consumers alike, making accurate forecasting difficult.

- Major oil-consuming countries and their energy needs: Major economies, including the US, China, and European Union countries, rely heavily on oil for transportation, manufacturing, and heating. Changes in OPEC+ oil production quotas directly affect their energy security and economic stability.

- Impact of renewable energy sources on oil demand: The global transition towards renewable energy sources, such as solar and wind power, is gradually reducing reliance on fossil fuels. However, the transition is ongoing, and oil remains a critical energy source in the near to mid-term.

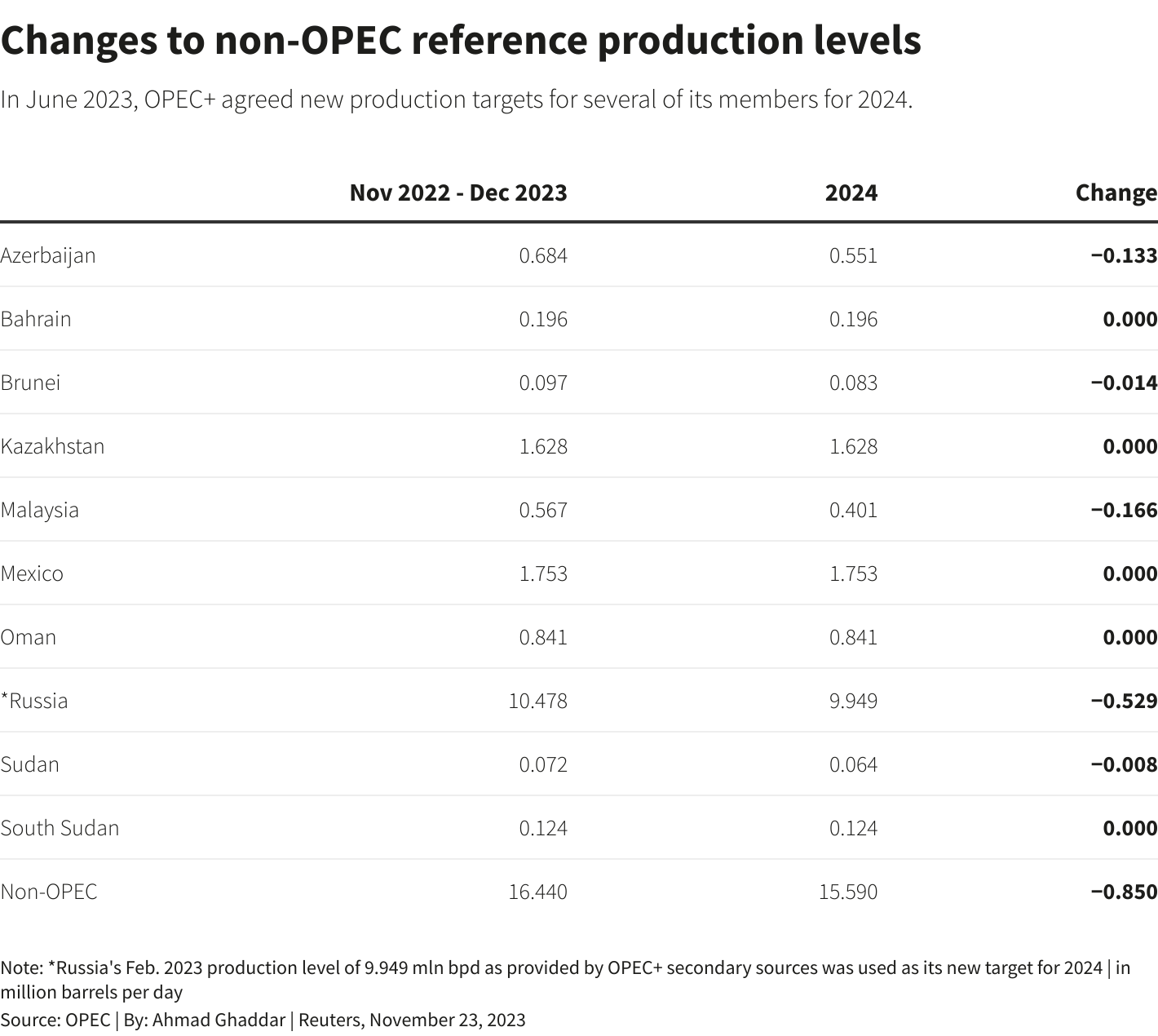

- Analysis of existing OPEC+ production agreements: Current OPEC+ agreements aim to balance supply and demand, ensuring market stability and preventing drastic price swings. However, the effectiveness of these agreements is constantly challenged by unforeseen geopolitical events and fluctuating global demand.

OPEC+'s Strategic Considerations for July's Meeting

OPEC+'s decision-making process for the July meeting will be complex, considering various internal and external factors. Each member country has its own economic needs and production capacities, leading to potential disagreements on production targets. Geopolitical considerations, including relationships with major oil-consuming nations, also heavily influence the final decision.

- Pressure from major oil-consuming nations to increase production: Major oil importers consistently pressure OPEC+ to increase production to lower prices and ensure energy security. This pressure is especially intense during periods of high inflation and economic uncertainty.

- Internal disagreements among OPEC+ members regarding production targets: Reaching a consensus among OPEC+ members, with diverse economic interests and production capabilities, is a continuous challenge. Balancing the needs of individual countries often proves difficult.

- Potential impact of sanctions on Russian oil production: Sanctions imposed on Russia have impacted its oil production and exports, affecting global supply. OPEC+'s decision must account for this factor and its ongoing consequences.

- Long-term strategies of OPEC+ to maintain market share: OPEC+ aims to maintain a significant market share in the long term. This long-term strategy necessitates careful management of oil production to prevent a drastic shift in market dynamics.

Potential Outcomes of the July Meeting and Their Market Implications

The July OPEC+ meeting could result in several scenarios, each with significant market implications:

- Scenario 1: Increased production: An increase in OPEC+ oil production quotas would likely lead to lower oil prices, easing inflationary pressures and benefiting oil-consuming nations. However, it might also impact the profitability of OPEC+ member countries.

- Scenario 2: Maintained production quotas: Maintaining the status quo would signify a continuation of the current market strategy, potentially leading to price stability or even moderate increases depending on other market forces.

- Scenario 3: Production cuts: Production cuts would likely result in higher oil prices, increasing inflationary pressures and potentially harming economies heavily reliant on affordable oil. Such a decision would need strong justification given the current global context.

- Impact on different economic sectors (e.g., transportation, manufacturing): Changes in oil prices directly affect transportation costs, impacting manufacturing, logistics, and the overall cost of goods. Fluctuations in OPEC+ oil production quotas have a ripple effect throughout the global economy.

Geopolitical Factors Influencing OPEC+ Decisions

Geopolitical considerations play a crucial role in shaping OPEC+'s decisions. Relationships between OPEC+ members and other global powers, as well as regional conflicts, heavily influence their strategic choices. The ongoing war in Ukraine, for example, adds a layer of geopolitical complexity to the decision-making process, impacting supply chain reliability and overall market stability.

Conclusion

The July OPEC+ meeting on OPEC+ oil production quotas is a critical event with potentially far-reaching consequences for the global energy market. The decision will be shaped by a complex interplay of economic factors, geopolitical considerations, and the internal dynamics within OPEC+. Understanding the potential outcomes is vital for investors, businesses, and governments alike.

Call to Action: Stay informed about the latest developments regarding OPEC+ oil production quotas and their influence on oil prices. Continue to monitor the situation to understand the evolving impact on global energy markets and plan accordingly. Regularly check reputable news sources for updates on OPEC+ decisions and their influence on global oil prices.

Featured Posts

-

Urgent Police Investigation Following Downtown Seattle Double Shooting

May 29, 2025

Urgent Police Investigation Following Downtown Seattle Double Shooting

May 29, 2025 -

Alastqlal Hdf Sam Wghayt Nbylt

May 29, 2025

Alastqlal Hdf Sam Wghayt Nbylt

May 29, 2025 -

The Fantasy Series Henry Cavill Couldnt Resist Better Than The Witcher

May 29, 2025

The Fantasy Series Henry Cavill Couldnt Resist Better Than The Witcher

May 29, 2025 -

Elon Musk Critiques Trumps Agenda Impact On Dogecoins Mission

May 29, 2025

Elon Musk Critiques Trumps Agenda Impact On Dogecoins Mission

May 29, 2025 -

Amman 24th Chinese Bridge Competition Concludes In Jordan

May 29, 2025

Amman 24th Chinese Bridge Competition Concludes In Jordan

May 29, 2025

Latest Posts

-

Skywarn Spotter Training Spring Session Tom Atkins

May 31, 2025

Skywarn Spotter Training Spring Session Tom Atkins

May 31, 2025 -

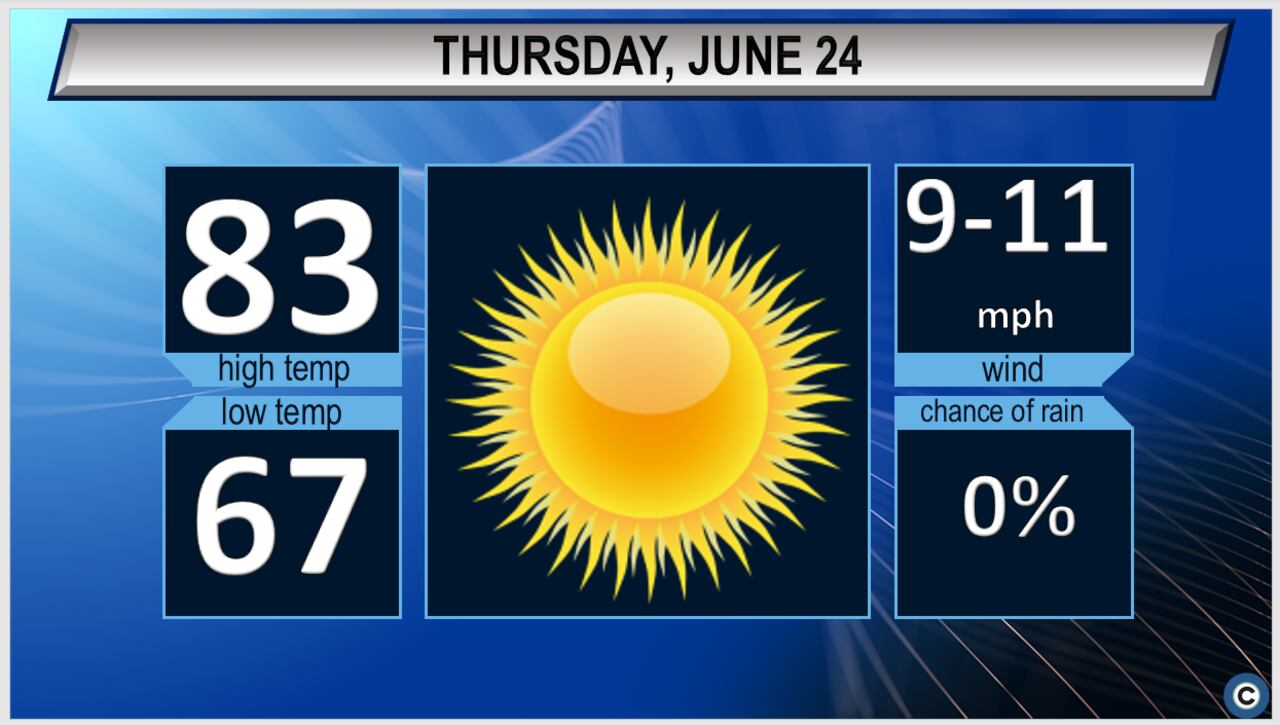

Northeast Ohio Thursdays Rainy Weather Forecast

May 31, 2025

Northeast Ohio Thursdays Rainy Weather Forecast

May 31, 2025 -

Rain Returns To Northeast Ohio Thursday Weather Update

May 31, 2025

Rain Returns To Northeast Ohio Thursday Weather Update

May 31, 2025 -

Learn Skywarn Spotter Skills With Tom Atkins

May 31, 2025

Learn Skywarn Spotter Skills With Tom Atkins

May 31, 2025 -

Spring Skywarn Class With Meteorologist Tom Atkins

May 31, 2025

Spring Skywarn Class With Meteorologist Tom Atkins

May 31, 2025