Optimizing Commodity Trading: Walleye's Credit Strategy For Core Clients

Table of Contents

Understanding Walleye's Credit Risk Assessment Process for Commodity Trading

Walleye employs a rigorous and multifaceted credit assessment process designed to minimize risk while maximizing opportunities for our clients. Our comprehensive approach goes beyond simple credit checks, incorporating advanced analytics and a deep understanding of the commodity markets. We consider a range of crucial factors to provide a holistic view of each client's creditworthiness:

- Financial History and Stability: We meticulously review a client's financial history, assessing their profitability, liquidity, and overall financial health. This involves analyzing balance sheets, income statements, and cash flow projections.

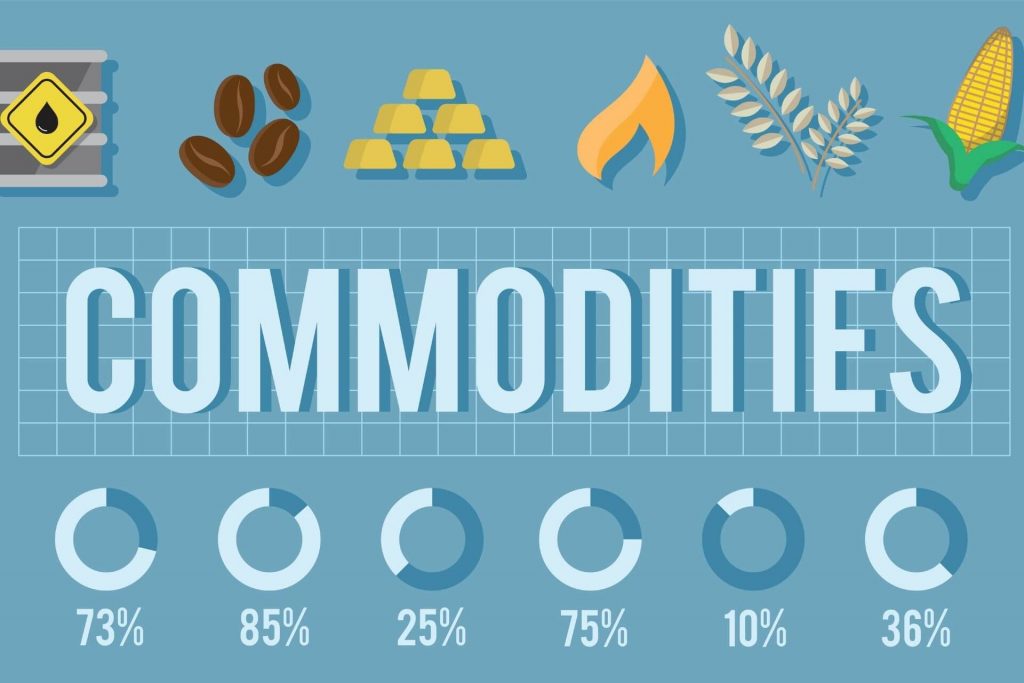

- Market Analysis and Commodity Price Volatility: Our analysis extends beyond the client's financials to encompass a thorough understanding of the specific commodity markets they operate in. We factor in price volatility, market trends, and potential geopolitical risks that could impact their trading activities.

- Trading Volume and Frequency: The volume and frequency of a client's trading activities significantly influence their credit risk profile. Higher trading volumes often require larger credit lines, demanding a more in-depth assessment.

- Collateral Assessment and Availability: We carefully evaluate the collateral offered by clients to secure credit facilities. The type, value, and liquidity of the collateral are critical considerations in our risk assessment.

- Credit Scoring and Rating Models: We utilize sophisticated credit scoring and rating models, incorporating both quantitative and qualitative data to generate a comprehensive creditworthiness assessment. This involves leveraging advanced data analytics and machine learning techniques to identify potential risks and opportunities.

Our commitment to transparency ensures that clients are kept fully informed throughout the assessment process, fostering trust and collaboration. This data-driven approach allows us to minimize risk and offer tailored credit solutions that align perfectly with our clients’ needs.

Tailored Credit Facilities for Optimized Commodity Trading

Walleye offers a flexible suite of credit facilities designed to meet the diverse needs of our clients in the commodity trading sector. We understand that a one-size-fits-all approach is inadequate in this dynamic market; therefore, we customize our solutions to match individual trading strategies and risk profiles. Our offerings include:

- Revolving Credit Lines: Providing access to funds as needed, offering flexibility for fluctuating trading needs.

- Term Loans: Offering fixed repayment schedules for long-term projects or investments within the commodity sector.

- Trade Financing Options: Supporting clients in managing the financing aspects of their international commodity transactions, including letters of credit and pre-export financing.

- Letters of Credit: Providing assurance to suppliers and buyers, strengthening trust and facilitating transactions.

We strive to provide competitive interest rates and favorable terms, reflecting our commitment to supporting our core clients' success. This tailored approach ensures that our clients have the financial resources they require to seize opportunities in the ever-changing commodity landscape.

Strengthening Client Relationships through Proactive Credit Management

At Walleye, we prioritize building long-term partnerships with our core clients. Our proactive credit management strategy goes beyond simply providing credit; it involves a commitment to continuous support and collaboration. This approach includes:

- Regular Portfolio Reviews and Risk Assessments: We conduct regular reviews to monitor client performance, assess evolving risk profiles, and proactively identify and address potential issues.

- Early Warning Systems for Potential Credit Issues: We utilize advanced analytics to identify early warning signs of potential credit problems, allowing us to intervene proactively and mitigate risks.

- Dedicated Account Managers for Personalized Support: Each client benefits from a dedicated account manager who provides personalized support and guidance.

- Open Communication and Collaboration with Clients: We foster open communication channels, ensuring that our clients have access to the information and support they need to make informed decisions.

This proactive and collaborative approach builds trust, strengthens our relationships, and ensures the long-term success of our clients.

Case Studies: Successful Implementations of Walleye's Credit Strategy

(Optional: Include 1-2 brief case studies here, quantifying the positive impact of Walleye’s credit strategy on specific clients. For example: "Client X, a major soybean trader, saw a 15% increase in trading volume after implementing Walleye's revolving credit line, leading to a 10% increase in profitability.")

Optimizing Your Commodity Trading with Walleye's Expert Credit Strategies

Walleye's credit strategy provides numerous benefits to our core clients, including reduced risk, optimized trading opportunities, and strengthened client relationships. Our expertise in commodity credit and risk management allows our clients to focus on their core business activities while having the confidence that their financial stability is secure. We empower our clients to navigate the complexities of the commodity markets with confidence.

Optimize your commodity trading today! Contact us to learn more about Walleye's credit solutions and unlock your trading potential with our expert commodity credit management. Let Walleye help you navigate the risks and seize the opportunities in the dynamic world of commodity trading.

Featured Posts

-

Eva Longoria Fiatalosan Es Fitten 50 Evesen

May 13, 2025

Eva Longoria Fiatalosan Es Fitten 50 Evesen

May 13, 2025 -

The Ruin Of A Bollywood Dream Salman Khans R2 Crore Box Office Bomb

May 13, 2025

The Ruin Of A Bollywood Dream Salman Khans R2 Crore Box Office Bomb

May 13, 2025 -

State Of The Union Protest Local Residents Speak Out Against Trump Policies

May 13, 2025

State Of The Union Protest Local Residents Speak Out Against Trump Policies

May 13, 2025 -

Analyzing The Hobbit The Battle Of The Five Armies Themes And Symbolism

May 13, 2025

Analyzing The Hobbit The Battle Of The Five Armies Themes And Symbolism

May 13, 2025 -

Kostyuk Otkazalas Pozhat Ruku Kasatkinoy Podrobnosti

May 13, 2025

Kostyuk Otkazalas Pozhat Ruku Kasatkinoy Podrobnosti

May 13, 2025