Pakistan, Sri Lanka, And Bangladesh: A New Era Of Capital Market Cooperation

Table of Contents

Unlocking Economic Growth Through Regional Integration

Enhanced capital market cooperation can act as a powerful catalyst for economic growth across Pakistan, Sri Lanka, and Bangladesh. By fostering closer ties between these markets, several significant benefits emerge:

-

Increased Foreign Direct Investment (FDI) Inflow: A more integrated regional capital market presents a more attractive proposition for foreign investors, leading to a surge in FDI. This inflow provides crucial capital for infrastructure development, business expansion, and job creation. The improved investor confidence stemming from regional collaboration will make it easier to attract substantial investments.

-

Deeper and More Liquid Capital Markets: The combined market capitalization of the three nations creates a deeper and more liquid market, reducing the cost of capital for businesses and making it easier for them to raise funds. This liquidity benefits both large corporations and small and medium-sized enterprises (SMEs), facilitating their growth and competitiveness.

-

Access to a Wider Pool of Capital: Businesses in each nation gain access to a much larger pool of capital, enabling them to pursue larger-scale projects and expand their operations beyond national borders. This access to diverse funding sources reduces reliance on domestic capital, promoting economic diversification.

-

Diversification of Investment Portfolios: Investors benefit from a broader range of investment opportunities, reducing risk and improving portfolio returns. Diversification across borders minimizes exposure to specific country-level risks, promoting greater financial stability.

-

Promotion of Regional Trade and Investment: Capital market integration fosters increased regional trade and investment, strengthening economic linkages and creating a more integrated South Asian economy. This interconnectedness promotes economic efficiency and shared prosperity.

Addressing Shared Challenges and Opportunities

Pakistan, Sri Lanka, and Bangladesh face similar economic challenges, including infrastructure deficits, poverty, and the need for sustainable development. Capital market cooperation provides a mechanism to address these challenges collaboratively:

-

Joint Infrastructure Projects Financing: The pooling of resources through a regional capital market allows for joint financing of large-scale infrastructure projects—essential for economic growth and development. This collaborative approach facilitates access to funding that individual nations might struggle to obtain independently.

-

Cross-Border Investment Opportunities in Renewable Energy: Collaboration on renewable energy projects allows for the sharing of risk and resources, accelerating the transition to cleaner energy sources. This cooperation can lead to significant environmental and economic benefits.

-

Collaboration on Sustainable Development Initiatives: A coordinated approach to sustainable development goals allows for the efficient allocation of resources and a more impactful contribution to the wider global effort. Joint initiatives can attract significant international funding.

-

Shared Regulatory Frameworks to Improve Transparency and Investor Confidence: Harmonized regulations improve transparency and accountability, encouraging greater investor confidence and facilitating cross-border investment flows. This is critical for fostering a stable and predictable investment climate.

Strengthening Regulatory Frameworks and Investor Confidence

To maximize the benefits of capital market cooperation, robust regulatory frameworks are crucial. This involves:

-

Development of Common Accounting Standards: Harmonizing accounting standards simplifies cross-border transactions and makes it easier for investors to compare companies across the three nations. Uniformity improves transparency and reduces information asymmetry.

-

Improved Investor Protection Mechanisms: Strong investor protection mechanisms are essential to attract and retain foreign investment. This includes clear and enforceable legal frameworks to protect investor rights and address disputes.

-

Enhanced Transparency and Disclosure Requirements: Increased transparency and robust disclosure requirements build trust and confidence among investors. This reduces information asymmetry and minimizes risks.

-

Collaboration Between Securities Regulators: Close collaboration between the securities regulators of the three nations is essential for consistent enforcement of rules and regulations. Joint efforts in monitoring and enforcement greatly improve market integrity.

-

Addressing Concerns about Political and Economic Stability: Addressing concerns related to political and economic stability is crucial to attract long-term investments. Demonstrating political will towards economic reforms and stability will reassure potential investors.

Leveraging Technology for Enhanced Connectivity

Technology plays a pivotal role in facilitating capital market cooperation:

-

Development of Digital Trading Platforms: Developing sophisticated digital trading platforms facilitates seamless cross-border trading, improving efficiency and reducing transaction costs. This also increases market access for a wider range of participants.

-

Use of Blockchain Technology for Secure Transactions: Blockchain technology can enhance the security and transparency of cross-border transactions, reducing fraud and improving efficiency. Its decentralized nature contributes to a more robust and resilient system.

-

Improved Data Sharing and Analysis: Efficient data sharing and analysis allow for better market monitoring, risk assessment, and regulatory oversight. This facilitates informed decision-making and improves market efficiency.

-

Online Investor Education and Awareness Programs: Online platforms can be used to educate investors about the opportunities and risks associated with cross-border investments. Increased financial literacy among investors fosters more informed decisions.

-

Enhanced Cybersecurity Measures: Robust cybersecurity measures are vital to protect the integrity and security of the integrated capital market. This is critical for maintaining investor confidence and preventing cyber threats.

Building a Stronger Future Through Capital Market Cooperation in South Asia

Capital market cooperation between Pakistan, Sri Lanka, and Bangladesh offers significant advantages, from boosting economic growth and attracting FDI to addressing shared challenges and fostering regional stability. By strengthening regulatory frameworks, leveraging technology, and working collaboratively, these nations can unlock immense potential for shared prosperity. The path forward requires sustained commitment to regional integration and a focus on building a more interconnected and vibrant South Asian economy. We encourage you to learn more about the ongoing initiatives promoting capital market cooperation and regional capital market integration in South Asia by researching organizations such as the South Asian Association for Regional Cooperation (SAARC) and relevant financial institutions. Let's continue the discussion and work towards a stronger future through collaborative efforts in capital market development.

Featured Posts

-

Brekelmans Wil India Zoveel Mogelijk Aan Onze Zijde Houden Een Analyse

May 09, 2025

Brekelmans Wil India Zoveel Mogelijk Aan Onze Zijde Houden Een Analyse

May 09, 2025 -

Dakota Johnsons Family Supports Her At Materialist La Screening

May 09, 2025

Dakota Johnsons Family Supports Her At Materialist La Screening

May 09, 2025 -

Mental Illness And Violence Re Examining Academic Understandings

May 09, 2025

Mental Illness And Violence Re Examining Academic Understandings

May 09, 2025 -

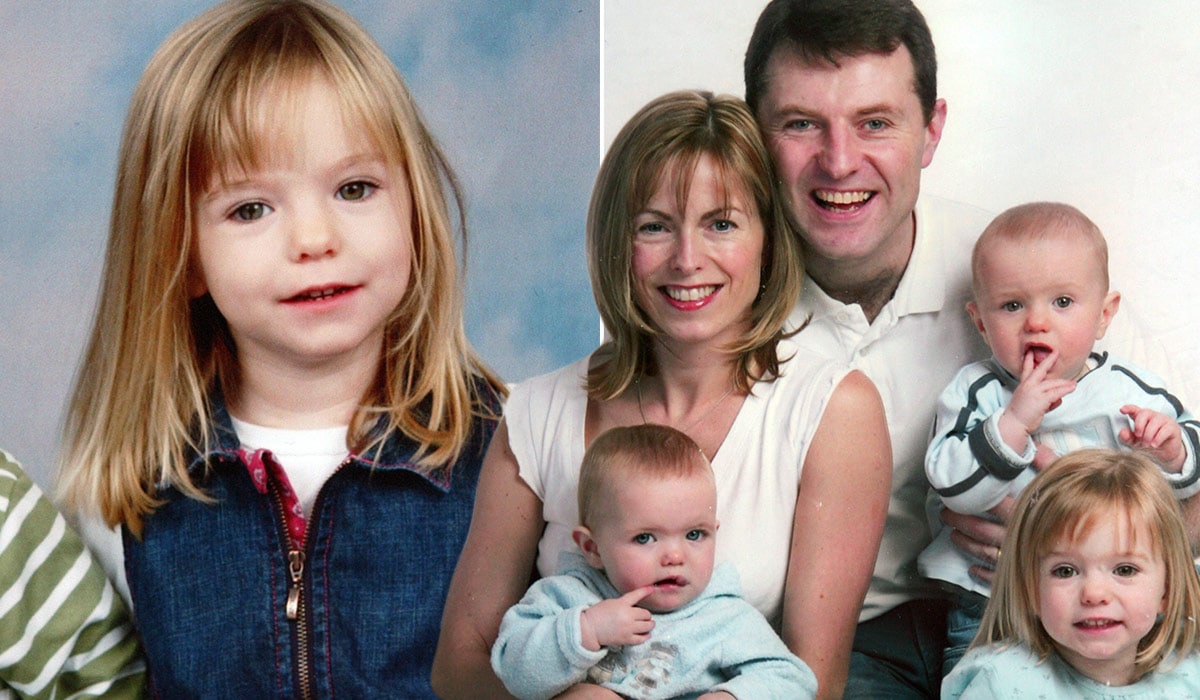

Madeleine Mc Cann Case New Dna Evidence And A 23 Year Old Womans Claim

May 09, 2025

Madeleine Mc Cann Case New Dna Evidence And A 23 Year Old Womans Claim

May 09, 2025 -

Unlocking Savings Elizabeth Arden Skincare At Walmart

May 09, 2025

Unlocking Savings Elizabeth Arden Skincare At Walmart

May 09, 2025

Latest Posts

-

Europes Nuclear Shield A French Ministers Perspective

May 09, 2025

Europes Nuclear Shield A French Ministers Perspective

May 09, 2025 -

Mezhdunarodnaya Izolyatsiya Zelenskogo 9 Maya Bez Gostey

May 09, 2025

Mezhdunarodnaya Izolyatsiya Zelenskogo 9 Maya Bez Gostey

May 09, 2025 -

Pakistan Economic Crisis Imf Reviews 1 3 Billion Aid Amidst Geopolitical Tensions

May 09, 2025

Pakistan Economic Crisis Imf Reviews 1 3 Billion Aid Amidst Geopolitical Tensions

May 09, 2025 -

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 09, 2025

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 09, 2025 -

Klyuchevoe Soglashenie Frantsiya I Polsha Podpisyvayut Dogovor Analiz Ot Unian

May 09, 2025

Klyuchevoe Soglashenie Frantsiya I Polsha Podpisyvayut Dogovor Analiz Ot Unian

May 09, 2025