Pakistan, Sri Lanka, And Bangladesh: A New Era Of Capital Market Integration

Table of Contents

Economic Rationale for Integration

The economic case for integrating the capital markets of Pakistan, Sri Lanka, and Bangladesh is compelling. Such integration offers a multitude of benefits, impacting investment flows, regional trade, and the overall efficiency of the financial system.

Increased Investment Flows

Capital market integration promises to significantly boost both foreign direct investment (FDI) and portfolio investment.

- Reduced Investment Barriers: Harmonizing regulations and reducing bureaucratic hurdles will make it easier for foreign investors to access these markets.

- Increased Liquidity: A larger, integrated market creates greater liquidity, making it easier to buy and sell securities, reducing price volatility.

- Diversification Benefits: Investors gain access to a diversified pool of assets, reducing overall portfolio risk. This diversification is particularly beneficial for investors seeking exposure to emerging markets.

Successful capital market integrations in other regions, such as the European Union, provide compelling evidence of the positive impact on investment flows. The EU's single market has significantly increased cross-border investment and spurred economic growth.

Enhanced Regional Trade and Economic Growth

Integration will play a crucial role in facilitating trade finance and stimulating regional economic development within South Asia.

- Improved Access to Capital: Businesses in Pakistan, Sri Lanka, and Bangladesh will gain easier access to capital for expansion and investment, fueling economic growth.

- Reduced Transaction Costs: Streamlined processes and reduced regulatory barriers will lower the costs associated with cross-border transactions.

- Stimulating Cross-Border Trade: Easier access to capital and reduced transaction costs will facilitate the growth of regional value chains, boosting trade between the three countries.

Improved Financial Market Depth and Efficiency

An integrated market fosters competition and improves the overall efficiency of the financial system.

- Increased Competition among Financial Institutions: Integration will encourage competition, leading to more innovative products and services, and potentially lower fees for investors.

- Improved Market Transparency: Harmonized regulations and increased scrutiny will lead to greater transparency and accountability in the markets.

- Greater Efficiency in Resource Allocation: Capital will flow more efficiently to its most productive uses, maximizing economic growth.

Challenges and Obstacles to Integration

While the potential benefits are significant, several challenges and obstacles must be addressed to ensure successful integration of Pakistan, Sri Lanka, and Bangladesh's capital markets.

Regulatory Differences and Harmonization

Significant differences in regulations across the three countries represent a major hurdle.

- Differences in Accounting Standards: Inconsistencies in accounting standards can create difficulties for investors comparing companies across borders.

- Legal Frameworks: Variations in legal frameworks and investor protection mechanisms can deter cross-border investment.

- The Role of Regulatory Bodies: Effective cooperation and coordination between the regulatory bodies of the three countries are crucial for harmonizing regulations and creating a unified framework.

Political and Economic Stability

Political and economic stability is paramount for attracting foreign investment and ensuring the success of the integration process.

- Impact of Political Risks on Investor Confidence: Political instability can significantly impact investor confidence and deter capital flows.

- The Role of Sound Monetary and Fiscal Policies: Sound macroeconomic policies, including prudent monetary and fiscal management, are essential for maintaining stability.

- Potential Headwinds: Addressing internal political and economic challenges within each country is crucial for creating a stable environment conducive to integration.

Infrastructure Gaps and Technological Limitations

Adequate infrastructure, including technology and communication systems, is essential for seamless market integration.

- Robust Clearing and Settlement Systems: Efficient and reliable clearing and settlement systems are crucial for mitigating risk and ensuring smooth transactions.

- Access to High-Speed Internet: Reliable access to high-speed internet is vital for facilitating online trading and investment.

- Digital Financial Services: Developing robust digital financial services will enhance accessibility and efficiency in the market.

Strategies for Successful Integration

A phased approach, focused collaboration, and investment in infrastructure are key strategies for successful integration.

Phased Approach and Pilot Programs

A gradual integration strategy, starting with pilot programs, is recommended.

- Testing the Integration Process: Pilot programs allow for testing the integration process before full-scale implementation, identifying and addressing potential issues.

- Identifying and Addressing Potential Risks and Challenges: A phased approach minimizes the risks associated with a sudden and complete integration.

Enhanced Cooperation and Information Sharing

Increased collaboration between regulatory bodies and market participants is vital.

- Data Sharing Agreements: Agreements for sharing relevant market data will enhance transparency and improve decision-making.

- Joint Research Initiatives: Joint research can identify and address common challenges facing the three markets.

- Cross-Border Training Programs: Training programs can foster a shared understanding of regulations and best practices.

Investment in Infrastructure and Technology

Investing in modernizing the infrastructure and technology supporting the financial markets is essential.

- Modernizing Clearing and Settlement Systems: Upgrading these systems will enhance efficiency, security, and reliability.

- Developing Digital Platforms for Trading and Investment: Developing user-friendly digital platforms will increase access to the market for a wider range of participants.

Building a Brighter Future: Capital Market Integration in Pakistan, Sri Lanka, and Bangladesh

The integration of Pakistan, Sri Lanka, and Bangladesh capital markets offers immense potential for economic growth and regional prosperity. While challenges exist, a collaborative and phased approach, focusing on regulatory harmonization, infrastructure development, and enhanced cooperation, can pave the way for a successful integration. The benefits – increased investment flows, enhanced regional trade, and improved market efficiency – far outweigh the challenges. Let's work together to make this new era of capital market integration a reality, unlocking the significant economic potential of South Asia. The future of South Asian capital markets hinges on our collective commitment to this transformative initiative.

Featured Posts

-

Palantirs Stock Price Surge Analysts Adjust Forecasts

May 10, 2025

Palantirs Stock Price Surge Analysts Adjust Forecasts

May 10, 2025 -

Totalitarianism Warning Lais Ve Day Speech Underscores Taiwans Security Concerns

May 10, 2025

Totalitarianism Warning Lais Ve Day Speech Underscores Taiwans Security Concerns

May 10, 2025 -

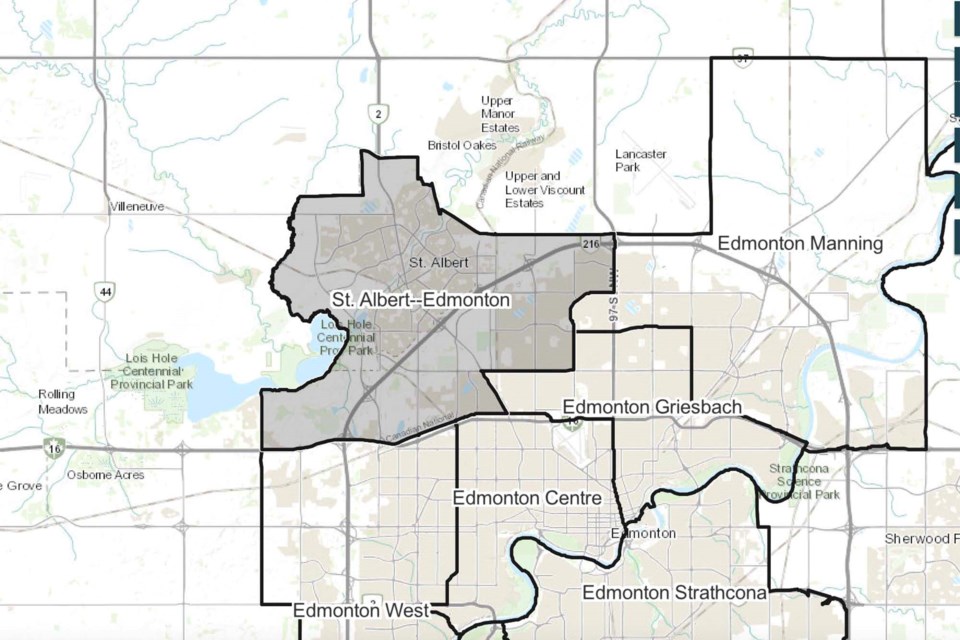

How Federal Riding Redistribution Will Impact Edmonton Voters

May 10, 2025

How Federal Riding Redistribution Will Impact Edmonton Voters

May 10, 2025 -

Whos Running In Your Nl Federal Riding A Voters Guide

May 10, 2025

Whos Running In Your Nl Federal Riding A Voters Guide

May 10, 2025 -

The Transgender Military Ban Unpacking Trumps Rhetoric

May 10, 2025

The Transgender Military Ban Unpacking Trumps Rhetoric

May 10, 2025