Pakistan Stock Exchange Offline: Market Instability Amidst Rising Tensions

Table of Contents

Political Instability and its Impact on the PSX

Pakistan's current political climate is characterized by significant uncertainty, directly impacting investor confidence and the PSX's performance. The ongoing political maneuvering and power struggles create a climate of fear, discouraging both domestic and foreign investment. This political risk Pakistan faces translates into tangible market consequences.

- Recent political events and their market reactions: Recent no-confidence votes, changes in government, and periods of political unrest have all resulted in sharp drops in the PSX's benchmark index. News cycles heavily influence daily trading volumes and investor sentiment.

- Impact of policy uncertainty on investment decisions: The lack of clear and consistent policy direction makes long-term investment planning extremely challenging. Investors are hesitant to commit capital when the regulatory environment is unpredictable.

- Decreased foreign investment due to political risks: Political instability is a major deterrent to foreign direct investment (FDI). International investors are often risk-averse and will seek more stable markets when political uncertainty looms large. This outflow of foreign capital exacerbates the existing economic pressures.

- Examples of specific stocks affected by political instability: Sectors sensitive to government policy, such as energy, infrastructure, and finance, tend to be disproportionately affected. Companies with significant government contracts often experience heightened volatility during periods of political change. This translates to fluctuations in the PSX's KSE-100 index.

Economic Factors Contributing to Market Volatility

Underlying Pakistan's political instability are significant economic challenges that further fuel market volatility. High inflation, currency devaluation, and a burgeoning national debt create a perfect storm of uncertainty. This economic uncertainty in Pakistan significantly impacts the PSX.

- Inflation rates and their impact on consumer spending and business activity: Soaring inflation erodes purchasing power, impacting consumer spending and slowing down economic growth. Businesses face increased input costs, leading to reduced profitability and impacting stock valuations.

- Currency fluctuations and their effect on import/export businesses and investor sentiment: The Pakistani Rupee's devaluation makes imports more expensive, increasing inflation and hurting businesses reliant on imported goods. This instability damages investor confidence and leads to capital flight.

- Rising national debt and its implications for the PSX: Pakistan's growing national debt raises concerns about its ability to service its obligations, potentially leading to credit rating downgrades and reduced investor confidence in the PSX.

- Potential government interventions and their projected effects: Government interventions, while sometimes necessary, can also add to uncertainty. Unforeseen policy changes can cause abrupt shifts in market sentiment and further increase volatility.

The Possibility of a Pakistan Stock Exchange Offline Scenario

While a complete Pakistan Stock Exchange offline scenario is not currently imminent, the extreme nature of the challenges facing the country makes it a possibility that needs consideration. Several factors could trigger such a drastic event.

- Extreme political upheaval and its potential consequences: A complete breakdown of law and order, or a prolonged period of extreme political instability, could disrupt market operations.

- Severe economic collapse and its effect on market functionality: A severe economic crisis could lead to a complete loss of confidence, causing a market crash and making it functionally impossible to maintain the PSX.

- Cybersecurity threats and their potential to disrupt trading: Cyberattacks targeting the PSX's infrastructure could temporarily or permanently disrupt trading activities. While unlikely to cause a permanent "offline" status, it can severely impact trust and functioning.

- Historical precedents (if any) of market shutdowns in similar situations: While a complete shutdown of the PSX is unprecedented, studying the responses of other stock markets to similar crises can provide valuable insights into potential scenarios.

Investor Behavior and Market Sentiment

Investor behavior in the face of such uncertainty reveals a clear shift from bullish to bearish sentiment. This is reflected in increased risk aversion and defensive investment strategies.

- Increased sell-offs and capital flight: Investors are pulling their money out of the PSX, leading to increased sell-offs and exacerbating market declines.

- Shift in investor sentiment from bullish to bearish: Positive investor sentiment has given way to widespread pessimism, as reflected in the declining market indices.

- Strategies adopted by investors to mitigate risks: Investors are diversifying their portfolios, shifting to safer assets, and adopting hedging strategies to minimize potential losses.

- The role of speculation and panic selling in market fluctuations: Speculation and panic selling contribute to the amplification of market volatility, creating a self-fulfilling prophecy of declining prices.

Conclusion

The instability in the Pakistan Stock Exchange is a complex issue driven by a dangerous interplay of political and economic factors. High inflation, currency devaluation, political uncertainty, and a rising national debt all contribute to a climate of fear, impacting investor confidence and causing significant market volatility. Understanding the factors contributing to the potential for a Pakistan Stock Exchange offline scenario is crucial for informed investment decisions. While a complete shutdown remains unlikely in the short term, the risks are real, and vigilance is necessary. Stay updated on the latest developments to navigate the ongoing market instability. Regularly monitor news sources for updates on political and economic events and their impact on the PSX. Only through informed decision-making can you mitigate risks and make sound investment choices in this turbulent environment.

Featured Posts

-

Travailler A Dijon Opportunites Au Rooftop Dauphine Et Restaurants

May 09, 2025

Travailler A Dijon Opportunites Au Rooftop Dauphine Et Restaurants

May 09, 2025 -

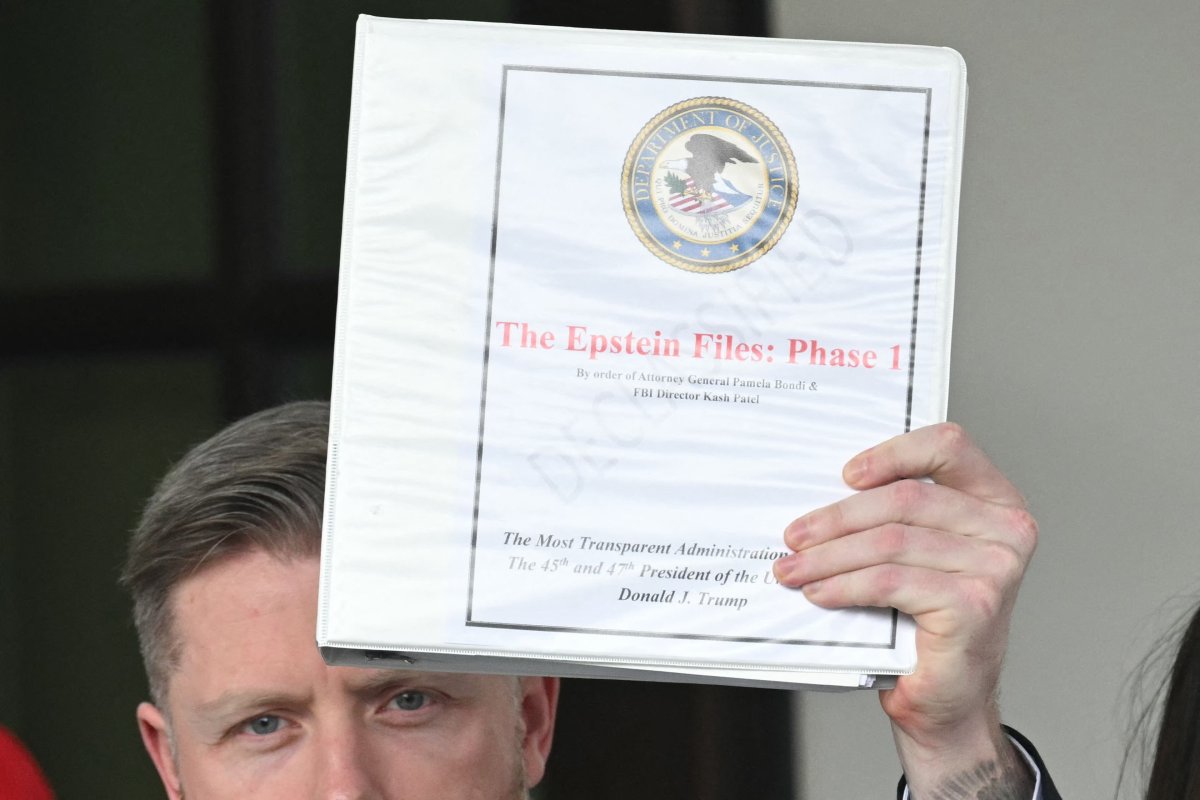

Public Opinion On Ag Pam Bondis Release Of Jeffrey Epstein Files A Voting Perspective

May 09, 2025

Public Opinion On Ag Pam Bondis Release Of Jeffrey Epstein Files A Voting Perspective

May 09, 2025 -

Figmas New Ai Features Competitive Analysis And Impact

May 09, 2025

Figmas New Ai Features Competitive Analysis And Impact

May 09, 2025 -

The Post Roe Era Examining The Significance Of Over The Counter Birth Control

May 09, 2025

The Post Roe Era Examining The Significance Of Over The Counter Birth Control

May 09, 2025 -

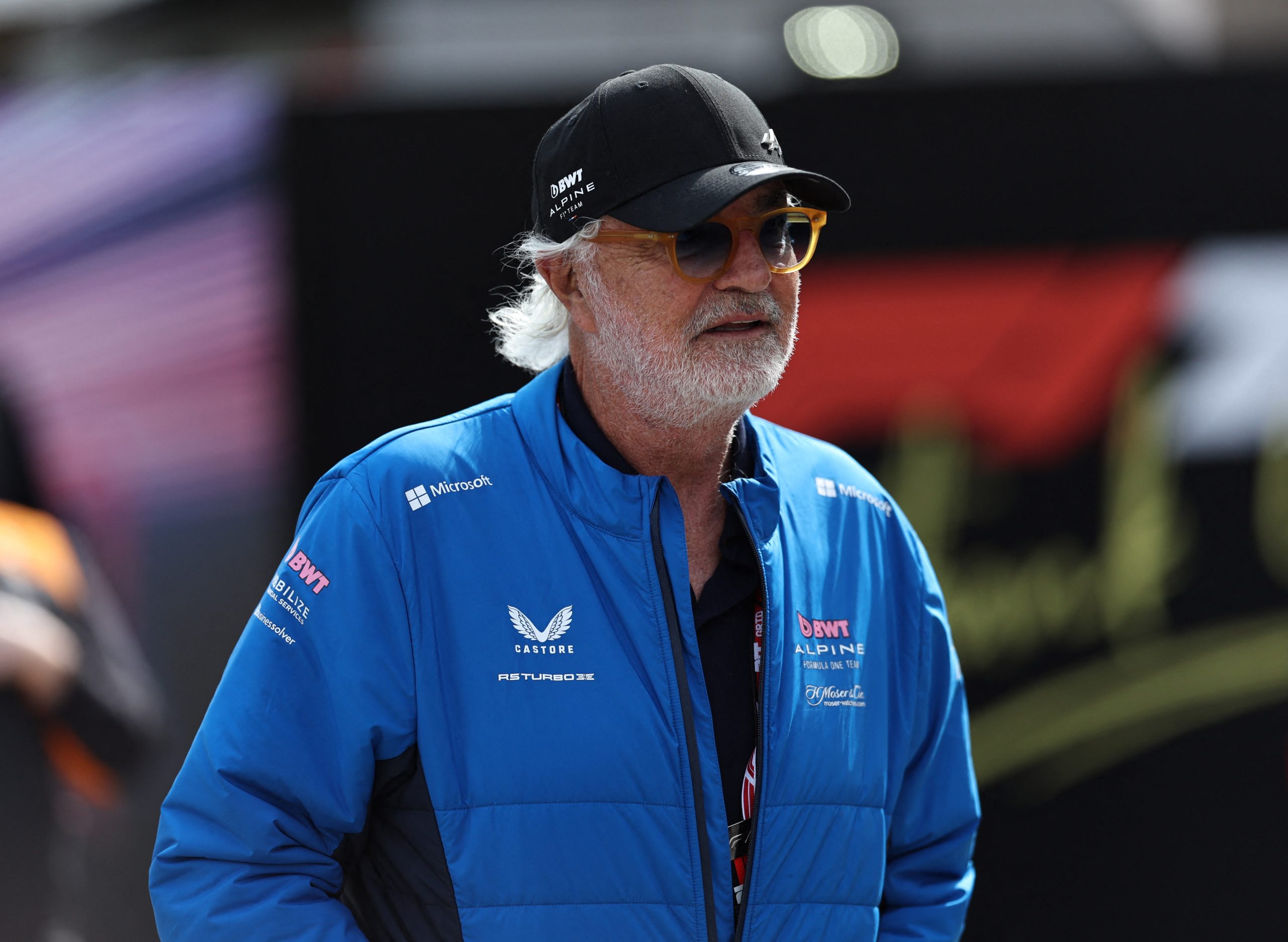

Briatores Power Play Jack Doohan And The I Control You Netflix Scene

May 09, 2025

Briatores Power Play Jack Doohan And The I Control You Netflix Scene

May 09, 2025

Latest Posts

-

Adin Hills 27 Saves Lead Vegas Golden Knights To Victory Over Columbus Blue Jackets

May 10, 2025

Adin Hills 27 Saves Lead Vegas Golden Knights To Victory Over Columbus Blue Jackets

May 10, 2025 -

Golden Knights Defeat Blue Jackets Hills Stellar Performance Secures Win

May 10, 2025

Golden Knights Defeat Blue Jackets Hills Stellar Performance Secures Win

May 10, 2025 -

Barbashev Scores In Ot Golden Knights Defeat Wild In Game 4 Tie Series

May 10, 2025

Barbashev Scores In Ot Golden Knights Defeat Wild In Game 4 Tie Series

May 10, 2025 -

Vegas Golden Knights Even Series Against Minnesota Wild With Barbashevs Overtime Goal

May 10, 2025

Vegas Golden Knights Even Series Against Minnesota Wild With Barbashevs Overtime Goal

May 10, 2025 -

Detroits Playoff Push Falters In Vegas Setback

May 10, 2025

Detroits Playoff Push Falters In Vegas Setback

May 10, 2025