Pakistan Stock Exchange Portal Down: Volatility And Tensions Impact Trading

Table of Contents

The Pakistan Stock Exchange Outage: Technical Issues or Something More?

The sudden outage of the PSE portal left many questioning the cause. Was it a simple technical glitch, a sophisticated cyberattack, or something else entirely? The lack of immediate transparency fueled speculation and added to the existing market anxieties.

- Speculation regarding the cause of the outage: Initial reports suggested potential technical difficulties, possibly related to server overload due to increased trading activity or a software malfunction. However, speculation about a potential cyber security incident also emerged, given the heightened geopolitical climate. Without official confirmation, uncertainty reigned.

- Reports from official sources and news outlets: As of [Insert Date and Time], official statements from the PSE regarding the cause of the outage are still pending. News outlets are reporting varied accounts, emphasizing the need for clear and timely communication from the exchange.

- Duration of the outage and its impact on scheduled trading sessions: The outage lasted for [Insert Duration], significantly impacting scheduled trading sessions and causing considerable disruption for investors and brokers. This disruption has the potential for serious financial consequences.

Impact on Investors and Trading Activities

The PSE downtime had immediate and potentially long-lasting consequences for investors. Many faced lost trading opportunities, inability to execute orders, and potential financial losses depending on the nature of their pending transactions.

- Effect on pending transactions and order executions: Investors with pending buy or sell orders were left in limbo, unable to ascertain the status of their trades. This uncertainty exacerbated the market anxiety.

- Investor sentiment and its potential impact on future market behavior: The outage further eroded already fragile investor confidence. This negative sentiment could lead to reduced trading volumes and potentially trigger a further decline in market indices.

- Analysis of potential short-term and long-term consequences: The short-term impact includes immediate financial losses for some investors and a disruption to market liquidity. Long-term consequences could include a decrease in foreign investment and a general loss of confidence in the PSE's stability and reliability.

Rising Volatility in the Pakistani Stock Market: Underlying Factors

The PSE outage is just one symptom of a broader issue: rising volatility in the Pakistani stock market. Several underlying factors contribute to this instability, including political uncertainty, economic challenges, and global market trends.

- Recent political developments and their influence on investor confidence: Recent political developments and uncertainty regarding the government’s economic policies have shaken investor confidence. Political instability often leads to market uncertainty and capital flight.

- Economic indicators (inflation, currency fluctuations, etc.) and their impact on the PSE: High inflation rates, currency devaluation, and other macroeconomic challenges put pressure on the PSE, making it difficult for investors to predict future market trends. These factors create a volatile investment climate.

- Global market trends and their correlation with the Pakistani stock market: Global events, such as changes in interest rates or geopolitical tensions in other regions, can also impact the Pakistani stock market, further contributing to volatility.

Geopolitical Tensions and their Effect on Investment

Geopolitical tensions and international relations play a significant role in shaping investor sentiment and market stability in Pakistan. The current geopolitical climate adds another layer of uncertainty.

- Impact of regional conflicts and international sanctions on the PSE: Regional conflicts and potential international sanctions can significantly impact investor confidence and lead to capital outflows from the PSE. This is particularly true when these events directly or indirectly affect Pakistan's economy.

- Investor risk assessment in light of current geopolitical climate: Investors are likely to conduct a thorough risk assessment in the current geopolitical climate. This could result in reduced investment in the Pakistani stock market until the uncertainty subsides.

- Strategies for navigating market volatility during times of geopolitical uncertainty: Investors need strategies to mitigate risk during periods of geopolitical uncertainty. Diversification, hedging, and a longer-term investment approach are some options.

The Future of the Pakistan Stock Exchange and Investor Confidence

The future of the PSE depends on addressing the technical vulnerabilities exposed by the recent outage and mitigating the broader economic and geopolitical challenges.

- Measures the PSE might take to prevent future disruptions and enhance investor confidence: The PSE needs to invest in robust infrastructure, improve its cybersecurity measures, and enhance its communication strategies to rebuild investor trust. Transparency and timely updates are essential.

- Governmental response and potential policy changes to stabilize the market: The government's response and potential policy changes will significantly influence investor confidence. Clear and consistent economic policies are needed to stabilize the market.

- Expert opinions on the long-term prospects of the Pakistani stock market: Expert opinions on the long-term outlook for the PSE are diverse. Some experts remain optimistic about the country's long-term growth potential, while others are more cautious given the current challenges.

Conclusion

The Pakistan Stock Exchange portal outage highlights the vulnerability of the market to both technical failures and broader economic and geopolitical forces. The current volatility underscores the need for robust infrastructure, transparent communication, and proactive measures to maintain investor confidence. The government and the PSE must work together to address these challenges and create a more stable and reliable environment for investors.

Call to Action: Stay informed about developments in the Pakistan Stock Exchange. Regularly monitor news and official updates regarding the PSE and its ongoing efforts to ensure stable and reliable trading. Understanding the factors influencing Pakistan Stock Exchange performance is crucial for navigating the market effectively and making informed investment decisions. Keep abreast of the situation and adapt your investment strategies accordingly.

Featured Posts

-

Elizabeth Line Strikes February And March Disruption Dates And Routes

May 09, 2025

Elizabeth Line Strikes February And March Disruption Dates And Routes

May 09, 2025 -

Inter Milans Shock De Ligt Pursuit Loan Move With Option To Buy

May 09, 2025

Inter Milans Shock De Ligt Pursuit Loan Move With Option To Buy

May 09, 2025 -

F1 Future Uncertain Clarksons Intervention Plan And The Ferrari Disqualification Risk

May 09, 2025

F1 Future Uncertain Clarksons Intervention Plan And The Ferrari Disqualification Risk

May 09, 2025 -

Mind The Gap Accessibility For Wheelchair Users On The Elizabeth Line

May 09, 2025

Mind The Gap Accessibility For Wheelchair Users On The Elizabeth Line

May 09, 2025 -

Is Daycare Harmful For Kids A Critical Look At The Arguments

May 09, 2025

Is Daycare Harmful For Kids A Critical Look At The Arguments

May 09, 2025

Latest Posts

-

Edmonton Oilers Projected To Win Against Los Angeles Kings Betting Analysis

May 10, 2025

Edmonton Oilers Projected To Win Against Los Angeles Kings Betting Analysis

May 10, 2025 -

Oilers Vs Kings Series Betting Odds And Predictions

May 10, 2025

Oilers Vs Kings Series Betting Odds And Predictions

May 10, 2025 -

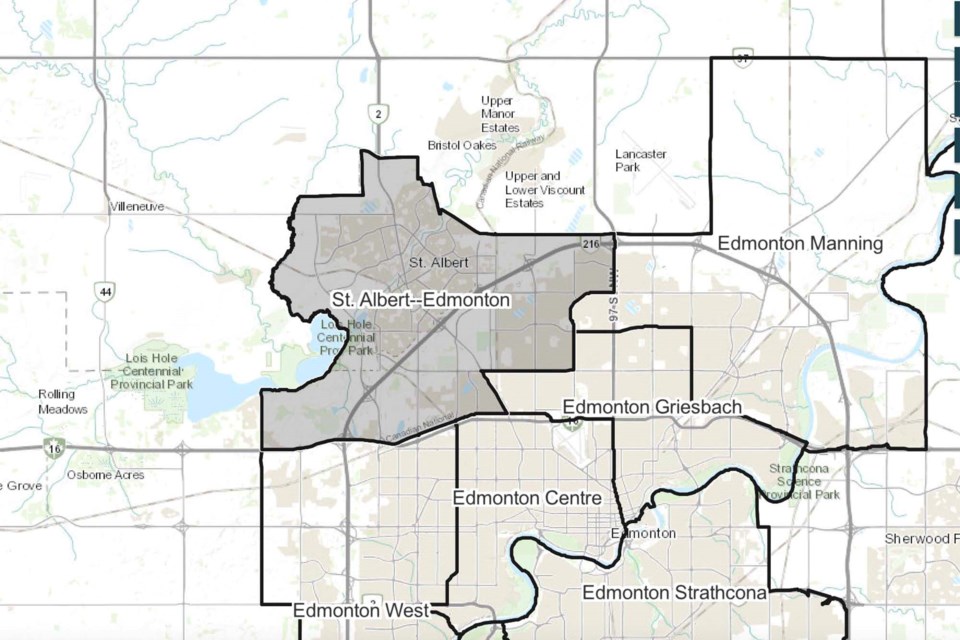

How Federal Riding Redistribution Will Impact Edmonton Voters

May 10, 2025

How Federal Riding Redistribution Will Impact Edmonton Voters

May 10, 2025 -

Edmontons Nordic Spa Closer To Reality Following Rezoning Approval

May 10, 2025

Edmontons Nordic Spa Closer To Reality Following Rezoning Approval

May 10, 2025 -

Young Thugs Uy Scuti Release Date Hints And Album Expectations

May 10, 2025

Young Thugs Uy Scuti Release Date Hints And Album Expectations

May 10, 2025