Pakistan's IMF Bailout: $1.3 Billion Package Under Review Amidst India Tensions

Table of Contents

The $1.3 Billion IMF Bailout: Key Conditions and Expectations

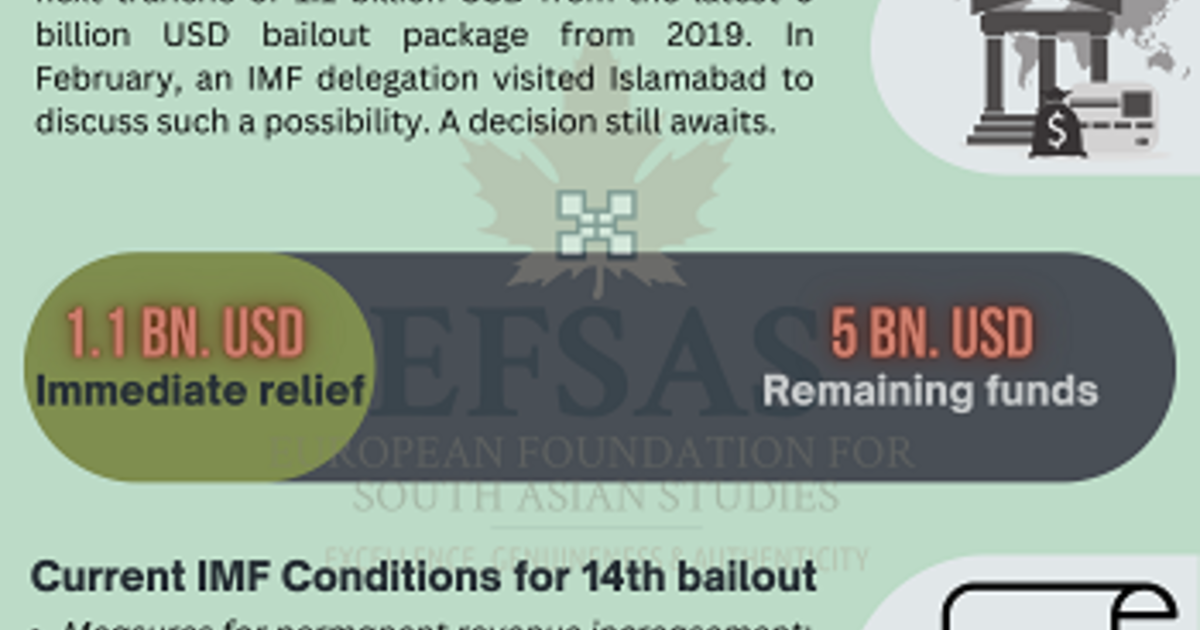

The $1.3 billion IMF bailout package for Pakistan is currently under review, a crucial step in averting a potential economic crisis. The IMF’s approval hinges on Pakistan's commitment to implementing stringent economic reforms. These conditions, designed to ensure fiscal consolidation and long-term economic stability, are demanding and far-reaching. The IMF loan conditions primarily focus on fiscal reforms, structural adjustments, and enhanced governance.

-

Fiscal Reforms: The IMF demands significant fiscal reforms to address Pakistan's unsustainable debt levels. This includes:

- A substantial increase in tax revenue through broadening the tax base and improving tax collection efficiency.

- Strict control over government spending, reducing subsidies and prioritizing essential public services.

- Implementation of measures to curtail wasteful expenditure and improve budgetary transparency.

-

Structural Adjustments: Significant structural adjustments are required across key sectors. This includes:

- Reforming the energy sector to improve efficiency and reduce losses in power generation and distribution.

- Overhauling the taxation system to make it fairer, simpler, and more efficient.

- Implementing reforms to improve the business environment and attract foreign investment.

-

Anti-Corruption Measures: The IMF has emphasized the need for strong anti-corruption measures to improve governance and boost investor confidence. This includes:

- Strengthening institutional frameworks to combat corruption at all levels of government.

- Improving transparency and accountability in public procurement and resource allocation.

- Enhancing the independence and effectiveness of anti-corruption agencies.

Geopolitical Tensions with India: Impact on the Bailout

The ongoing geopolitical tensions between India and Pakistan significantly complicate the already challenging situation. These geopolitical risks create uncertainty and negatively affect investor sentiment. Regional instability directly impacts Pakistan's ability to meet the IMF's economic stability requirements.

-

Hindered Economic Recovery: Escalating tensions can divert resources away from crucial economic reforms and hinder efforts to attract foreign investment. The uncertainty discourages both domestic and international investment, slowing down economic recovery.

-

Impact on Foreign Investment and Aid: The tense relationship can deter potential foreign investors and donors, making it harder for Pakistan to secure the necessary funding to support its economic reforms. This further strains Pakistan’s already limited resources.

-

Diplomatic Ramifications: The IMF's decision-making process may be influenced by concerns about regional security and stability. International pressure to de-escalate tensions could be applied, further complicating the bailout process.

Pakistan's Economic Crisis: Underlying Factors and Challenges

Pakistan's current economic crisis is the result of a confluence of long-standing issues, including unsustainable debt levels, dwindling foreign exchange reserves, and political instability. These factors have created a perfect storm, pushing the country to the brink.

-

Unsustainable Debt Levels: Pakistan's high public debt, accumulated over many years, has severely constrained its fiscal space, making it difficult to meet its financial obligations and invest in essential development projects.

-

Current Account Deficit: A persistent current account deficit, reflecting a trade imbalance and reliance on imports, has further depleted Pakistan's foreign exchange reserves, leaving it vulnerable to external shocks.

-

Energy Insecurity and Infrastructure Gaps: Challenges related to energy security and inadequate infrastructure development continue to hinder economic growth and productivity. These structural weaknesses need immediate attention.

Potential Outcomes and Scenarios

The IMF bailout review presents several potential outcomes.

-

Successful Bailout: Successful completion of the review and disbursement of the funds would provide much-needed financial relief and enable Pakistan to implement crucial economic reforms. This could lead to some degree of economic recovery and improved financial stability.

-

Partial Success: A partial success might involve a smaller disbursement or stricter conditions, leaving Pakistan with limited fiscal space and delaying the recovery process. This scenario increases the default risk.

-

Failed Bailout: Failure to secure IMF approval would push Pakistan further into an economic crisis, potentially leading to a default on its debt obligations and severe consequences for the economy and its people.

Conclusion

Pakistan's $1.3 billion IMF bailout package is under intense scrutiny, with the success of the program heavily dependent on the implementation of significant economic reforms. The ongoing geopolitical tensions with India add another layer of complexity, impacting investor confidence and the overall stability of the economy. Meeting the IMF's economic reforms conditions is critical for achieving economic recovery and avoiding a potential default. The outcomes of this review will have profound implications for Pakistan’s economic stability and its relationship with international financial institutions. Stay informed on the latest developments regarding Pakistan's IMF bailout and the ongoing economic challenges. Follow our updates for in-depth analysis and insights into this critical situation. Further research on Pakistan's economic recovery, IMF loan programs, and South Asian economic outlook is recommended for a comprehensive understanding.

Featured Posts

-

Indian Stock Market Today Sensex Nifty Current Levels And Analysis

May 09, 2025

Indian Stock Market Today Sensex Nifty Current Levels And Analysis

May 09, 2025 -

Oilers Vs Kings Nhl Playoffs Game 1 Predictions And Picks

May 09, 2025

Oilers Vs Kings Nhl Playoffs Game 1 Predictions And Picks

May 09, 2025 -

6 3 Loss In Vegas Red Wings Playoff Dream Falters

May 09, 2025

6 3 Loss In Vegas Red Wings Playoff Dream Falters

May 09, 2025 -

23 Year Old Claims To Be Madeleine Mc Cann Dna Test Results Released

May 09, 2025

23 Year Old Claims To Be Madeleine Mc Cann Dna Test Results Released

May 09, 2025 -

Charges Against Polish National And Accomplice In Mc Cann Case Disputed

May 09, 2025

Charges Against Polish National And Accomplice In Mc Cann Case Disputed

May 09, 2025

Latest Posts

-

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025 -

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025