Palantir Competitors: 2 Stock Predictions For Superior Growth (3-Year Outlook)

Table of Contents

Analyzing Palantir's Strengths and Weaknesses

To identify superior growth opportunities, we must first understand Palantir's current position.

Palantir's Market Position and Competitive Advantages

Palantir boasts several key strengths:

- Government Contracts: A substantial portion of Palantir's revenue stems from lucrative government contracts, providing a stable revenue stream.

- Data Integration Capabilities: Palantir's platform excels at integrating data from disparate sources, a crucial advantage in today's complex data landscape.

- Strong Brand Recognition: Palantir has established a strong brand reputation for sophisticated data analytics solutions.

However, Palantir also faces challenges:

- High Pricing: Its solutions are known for being expensive, limiting accessibility for smaller companies and organizations.

- Complex Technology: The platform's complexity can pose a barrier to entry for less technically skilled users, requiring significant training and support.

- Limited Scalability in Certain Markets: While powerful, Palantir's platform may not scale as efficiently as some competitors in specific market segments.

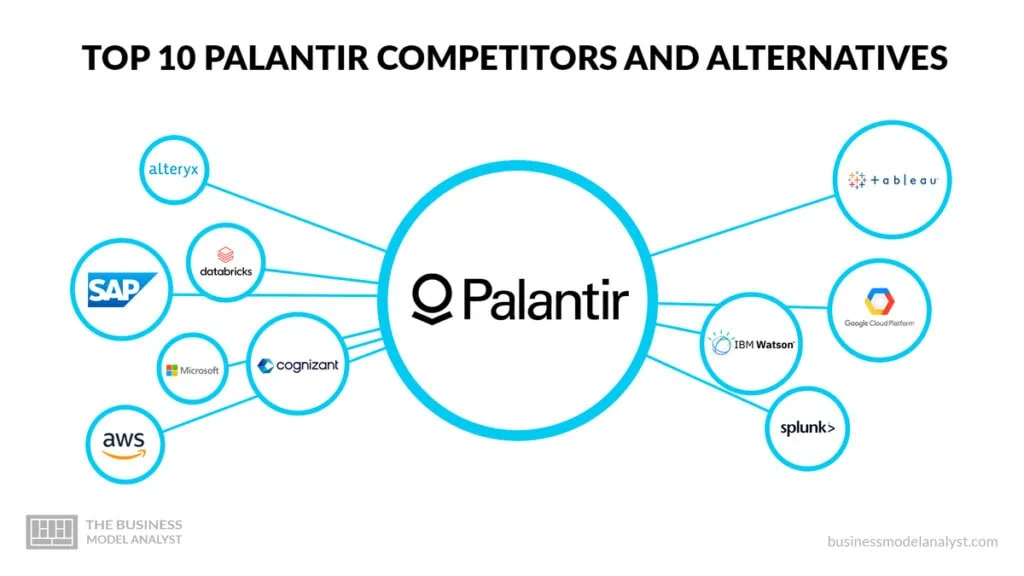

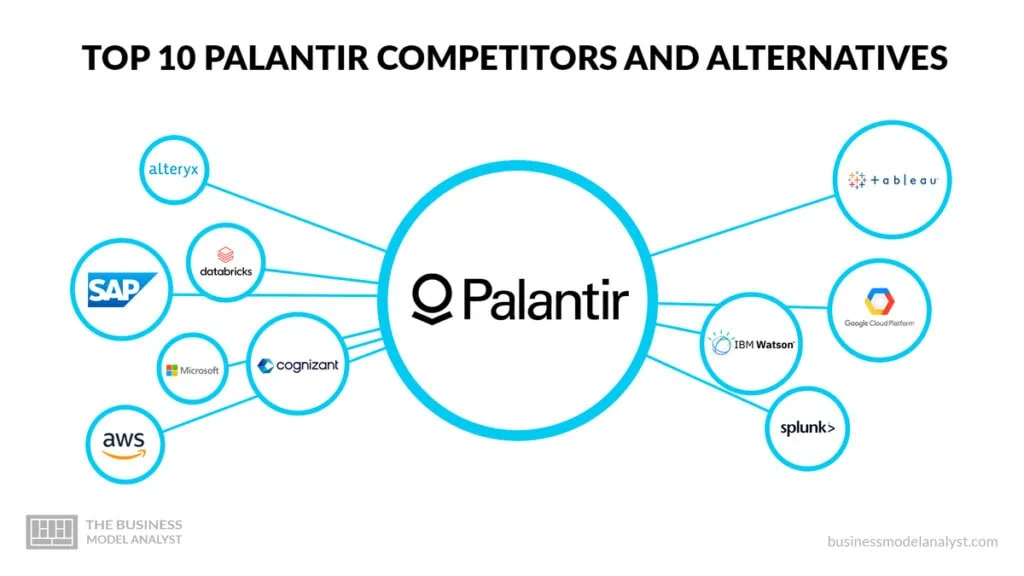

Identifying Key Competitors based on Strengths and Weaknesses

Based on Palantir's strengths and weaknesses, several competitors warrant close examination. Their selection is justified by overlapping capabilities or market segments:

- Databricks: Offers a unified analytics platform, focusing on scalability and open-source technologies. Their strength lies in their strong community and ecosystem.

- C3.ai: Provides an enterprise AI platform for developing and deploying AI applications. Its focus on enterprise AI solutions positions it to compete with Palantir in certain sectors.

- Snowflake: A cloud-based data warehouse provider, emphasizing ease of use and scalability. Snowflake's strength lies in its cloud-native architecture and accessibility.

- Amazon Web Services (AWS) & Microsoft Azure: These cloud giants offer a broad range of data analytics services, including machine learning and data warehousing, providing strong competition through comprehensive ecosystem offerings.

Two Promising Palantir Competitors for Superior Growth

Based on our analysis, two competitors stand out as offering superior growth potential over the next three years.

Competitor #1: Databricks - Detailed Analysis and 3-Year Growth Prediction

Company Overview: Databricks provides a unified analytics platform built on Apache Spark, catering to a broad range of users from data scientists to business analysts. Its open-source roots and emphasis on scalability are key differentiators.

Competitive Advantages: Databricks addresses Palantir's weaknesses by offering a more accessible, scalable, and cost-effective solution. Its open architecture allows for greater flexibility and integration with existing tools.

Growth Drivers: Databricks' projected growth is fueled by:

- Technological Innovation: Continuous advancements in Apache Spark and its unified platform.

- Market Expansion: Growing adoption of cloud-based analytics solutions across various industries.

- Strategic Partnerships: Collaborations with major cloud providers enhance its reach and capabilities.

Financial Projections & Rationale: While predicting future performance is inherently risky, based on current market trends and Databricks' strong position, we project a compound annual growth rate (CAGR) of 35-45% over the next three years. This is supported by the expanding market for cloud-based data analytics and Databricks' strong customer acquisition. This is a prediction and not financial advice.

Competitor #2: Snowflake - Detailed Analysis and 3-Year Growth Prediction

Company Overview: Snowflake is a cloud-based data warehouse solution known for its scalability and ease of use. It offers a flexible and cost-effective alternative to traditional on-premise data warehousing solutions.

Competitive Advantages: Snowflake directly tackles Palantir's high pricing and complexity issues. Its pay-as-you-go model and user-friendly interface make it accessible to a wider range of users.

Growth Drivers: Snowflake's projected growth is driven by:

- Cloud Adoption: The ongoing migration of businesses to cloud infrastructure.

- Data Explosion: The ever-increasing volume of data needing storage and analysis.

- Strong Partnerships: Collaborations with major data analytics vendors further boost its market presence.

Financial Projections & Rationale: Considering Snowflake's market penetration and strong growth trajectory, we project a CAGR of 30-40% over the next three years. This prediction considers potential market saturation and competitive pressures but reflects Snowflake's strong current performance. This is a prediction and not financial advice.

Investment Considerations and Risk Assessment

Factors Affecting Growth Predictions

Several factors could impact the projected growth of Databricks and Snowflake:

- Market Volatility: Economic downturns could affect investment in data analytics solutions.

- Competition: Intense competition from other players in the big data analytics market could impact market share.

- Regulatory Changes: New regulations could impact data privacy and security, affecting the industry as a whole.

Diversification and Portfolio Management

It is crucial to remember that these are predictions, not guarantees. Diversifying investments across various sectors and asset classes is essential to mitigate risk. Thorough due diligence, including reviewing financial statements and understanding the competitive landscape, is necessary before making any investment decisions.

Conclusion: Investing in Palantir Competitors for Long-Term Growth

Databricks and Snowflake emerge as promising Palantir competitors with potentially superior growth over the next three years. Their competitive advantages in terms of scalability, cost-effectiveness, and ease of use position them favorably against Palantir in a rapidly expanding market. However, remember that investing in the stock market carries inherent risks. Conduct thorough due diligence and consider your personal risk tolerance before investing in any of these companies or their alternatives. Begin your research into promising Palantir competitors today!

Featured Posts

-

From Scatological Documents To Podcast Gold An Ai Driven Solution

May 10, 2025

From Scatological Documents To Podcast Gold An Ai Driven Solution

May 10, 2025 -

Enquete Apres La Chute Mortelle D Un Ouvrier A Dijon

May 10, 2025

Enquete Apres La Chute Mortelle D Un Ouvrier A Dijon

May 10, 2025 -

Dissecting Trumps Transgender Military Ban An Opinion Piece

May 10, 2025

Dissecting Trumps Transgender Military Ban An Opinion Piece

May 10, 2025 -

Sudden Shift White House Withdraws Nomination Taps Maha Influencer For Surgeon General

May 10, 2025

Sudden Shift White House Withdraws Nomination Taps Maha Influencer For Surgeon General

May 10, 2025 -

Report Uk Considering Visa Restrictions For Pakistan Nigeria And Sri Lanka

May 10, 2025

Report Uk Considering Visa Restrictions For Pakistan Nigeria And Sri Lanka

May 10, 2025