Palantir (PLTR) Stock: Buy Or Sell Before May 5th? Expert Opinion

Table of Contents

The Palantir (PLTR) stock price has seen significant fluctuations recently, leaving investors wondering whether to buy, sell, or hold before May 5th. This article analyzes current market trends, expert opinions, and key financial indicators to help you make an informed decision about your Palantir investment. We'll examine the factors influencing PLTR's price and offer insights into potential future performance. This analysis aims to provide a clear picture of the current state of PLTR, helping you navigate this potentially volatile investment landscape.

Analyzing Palantir's Recent Performance and Future Outlook

Q4 2022 Earnings and Revenue Growth:

Palantir's Q4 2022 earnings report offered a mixed bag for investors. While revenue growth exceeded expectations, reaching [Insert actual revenue figure and percentage growth], profitability remained a challenge. Key metrics to consider include:

- Revenue Growth: [Insert percentage and compare to previous quarters and analysts' estimates]. This demonstrates [positive/negative] momentum compared to previous performance.

- Profitability: [Insert relevant metrics like net income, operating income, and margins. Analyze the trend and compare to previous quarters]. This indicates [positive/negative] progress in achieving profitability.

- Guidance for Q1 2023 and beyond: Palantir's guidance for the coming quarters is crucial. [Summarize the company's forecast and highlight any significant changes in expectations]. This offers insights into the company’s projected short-term trajectory.

Analyzing these key metrics within the context of the broader market is critical for understanding the complete picture of PLTR's performance and the potential for future growth.

Government Contracts and Commercial Growth:

Palantir's revenue streams are derived from both government contracts and its growing commercial sector. Understanding the balance between these two sources is crucial for evaluating the stability and future growth potential of the company.

- Government Contracts: Palantir holds significant government contracts, contributing a substantial portion of its revenue. The stability and potential for renewal of these contracts are key factors affecting long-term growth. [Include data on recent contract wins and renewals if available]. This stability provides a degree of certainty but may hinder overall growth potential.

- Commercial Growth: Palantir’s commercial sector is expanding, offering opportunities for significant growth. [Analyze the company's success in securing new commercial clients and expanding its market share]. This represents substantial upside potential but comes with higher risk and potential volatility.

The relative strength and future prospects of these sectors directly impact the PLTR stock price. A balanced and robust growth strategy in both sectors is ideal for long-term stability and growth.

Competition and Market Position:

Palantir operates in a competitive landscape, vying for market share with established players in the data analytics and big data markets. Key competitors include [List key competitors and briefly describe their strengths and weaknesses].

- Competitive Advantages: Palantir's competitive advantages include [List key advantages such as its proprietary technology, strong government relationships, and growing commercial presence].

- Competitive Disadvantages: However, challenges exist, such as [List key disadvantages like high reliance on specific customer sectors, complex product offerings, and price sensitivity in certain markets].

Understanding Palantir's competitive position within the data analytics industry is essential to assessing its long-term growth prospects and its ability to sustain profitability in the face of competitive pressure. Palantir's market share in relation to competitors is also a critical factor to assess.

Expert Opinions and Predictions for PLTR Stock

Analyst Ratings and Price Targets:

Financial analysts offer a range of opinions on Palantir's stock. [Summarize the consensus rating (buy, hold, or sell) and the range of price targets from reputable sources like Yahoo Finance, Bloomberg, or others]. It's important to note that these are just predictions and should not be considered financial advice.

- Rationale: Understand the reasoning behind each analyst's rating. [Include examples of specific factors analysts consider, such as revenue growth, profitability, and market competition]. Variations in price targets often reflect different assessments of these factors.

- Divergent Opinions: It’s important to note instances of divergent opinions among analysts. This highlights the uncertainty inherent in predicting future stock performance and underscores the importance of conducting your own research.

Considering Macroeconomic Factors:

Macroeconomic factors play a significant role in influencing the stock market and, by extension, Palantir's stock price.

- Interest Rates and Inflation: Rising interest rates and high inflation can negatively impact investor sentiment and lead to decreased valuations for growth stocks, potentially affecting PLTR’s price. [Explain how macroeconomic conditions affect investor behaviour and subsequently impact PLTR.]

- Recessionary Fears: Fears of a recession can also dampen investor confidence, impacting investment in growth-oriented companies like Palantir. [Explain the relationship between economic downturns and investor behaviour towards technology stocks.]

Understanding the broader economic context is crucial for accurately assessing the risks and opportunities associated with investing in PLTR.

Risk Assessment and Investment Strategies

Potential Risks Associated with Investing in PLTR:

Investing in Palantir carries inherent risks:

- Stock Price Volatility: PLTR stock is known for its volatility, meaning the price can fluctuate significantly in short periods.

- Government Contract Dependence: Reliance on government contracts can introduce uncertainty, particularly around contract renewals and potential budget cuts.

- Competitive Pressures: Intense competition in the data analytics market poses a risk to Palantir's market share and profitability.

Effective risk mitigation strategies include diversification of your portfolio and a thorough understanding of Palantir's business model and financial performance.

Buy, Sell, or Hold: A Strategic Recommendation:

Based on the analysis of Palantir's Q4 2022 earnings, future outlook, expert opinions, and macroeconomic factors, the recommendation before May 5th is [Buy/Sell/Hold].

- Rationale: [Clearly explain the reasoning behind this recommendation, referencing specific data points and expert opinions from the previous sections. Be clear and concise.]

- Caveats: [Acknowledge any uncertainties or limitations of the analysis, reminding the reader that this is not financial advice].

- Individual Circumstances: The optimal strategy depends on individual risk tolerance and financial goals.

Conclusion:

This analysis of Palantir (PLTR) stock before May 5th has considered recent financial performance, expert opinions, and market conditions. The decision to buy, sell, or hold PLTR stock requires careful consideration of the risks and potential rewards.

Call to Action: Ultimately, the best decision regarding your Palantir (PLTR) investment depends on your individual risk tolerance and investment goals. Conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions related to Palantir stock or other securities. Remember to always stay informed about the latest developments concerning Palantir and the broader market. Before making any decisions about buying, selling, or holding PLTR, ensure you understand the risks involved and consider seeking professional financial advice.

Featured Posts

-

Franco Colapintos Drive To Survive Deleted Message The Full Story

May 09, 2025

Franco Colapintos Drive To Survive Deleted Message The Full Story

May 09, 2025 -

Europes Nuclear Shield A French Ministers Perspective

May 09, 2025

Europes Nuclear Shield A French Ministers Perspective

May 09, 2025 -

Mdkhnw Krt Alqdm Asmae Lamet Athrt Altdkhyn Ela Msyrtha

May 09, 2025

Mdkhnw Krt Alqdm Asmae Lamet Athrt Altdkhyn Ela Msyrtha

May 09, 2025 -

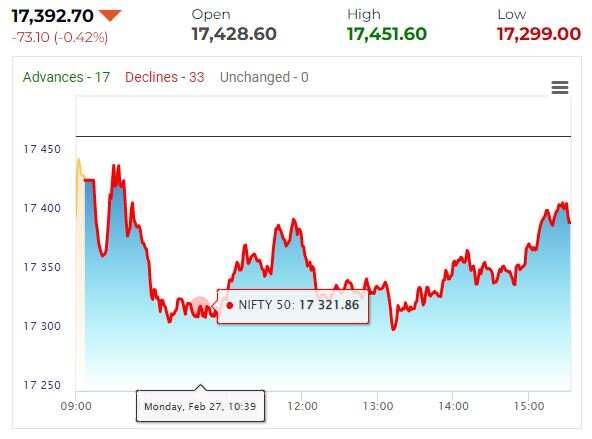

Market Movers Sensex Nifty Record Strong Gains Adani Ports Eternal Stock Analysis

May 09, 2025

Market Movers Sensex Nifty Record Strong Gains Adani Ports Eternal Stock Analysis

May 09, 2025 -

R3 2

May 09, 2025

R3 2

May 09, 2025

Latest Posts

-

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025 -

Analyzing The Bangkok Posts Coverage Of Transgender Equality Issues In Thailand

May 10, 2025

Analyzing The Bangkok Posts Coverage Of Transgender Equality Issues In Thailand

May 10, 2025