Palantir Stock Forecast 2025: Analyzing The Potential For A 40% Jump

Table of Contents

Palantir's Current Market Position and Financial Performance

Palantir's recent financial performance provides a crucial foundation for any Palantir stock price prediction. Examining key indicators helps determine the potential for future growth.

H3: Revenue Growth and Profitability

Palantir has demonstrated consistent revenue growth, though profitability remains a key focus. Analyzing quarterly and annual reports reveals trends in crucial KPIs:

- Revenue Growth: While precise figures fluctuate, sustained double-digit percentage growth in revenue is a key indicator for positive Palantir stock price predictions. [Insert chart showing revenue growth over the past few years].

- Operating Margins: Improving operating margins are vital for sustained profitability and investor confidence. Tracking this metric year-over-year provides insight into Palantir's cost management efficiency. [Insert chart comparing operating margins over time].

- Net Income: A move towards consistent net profitability would significantly bolster investor sentiment and the Palantir stock price. [Insert data showing net income trends].

- Comparison to Competitors: Compared to competitors like Databricks and Snowflake, Palantir's growth rate and profitability need to be benchmarked to gauge its competitive advantage.

H3: Government Contracts and Commercial Partnerships

Palantir's revenue streams are significantly influenced by government contracts and commercial partnerships.

- Key Government Clients: Government contracts provide a stable revenue base, but their renewal cycles must be considered. [List key government clients and contract values if available].

- Significant Commercial Deals: Expansion into the commercial sector is critical for long-term growth. [List key commercial partners and their contributions to revenue].

- Long-term Impact: The balance between government and commercial contracts will significantly impact Palantir's future revenue streams and overall stock price.

Factors Contributing to Potential 40% Stock Price Increase

Several factors could contribute to a 40% rise in the Palantir stock price by 2025.

H3: Technological Innovation and Product Development

Palantir's continuous investment in R&D is a significant driver of potential growth.

- New Product Releases: The successful launch of new products and features, particularly in the AI and data analytics space, can attract new clients and expand market share. [List any new products and their potential market impact].

- Competitive Advantages: Palantir's focus on AI and its ability to integrate diverse data sources provide competitive advantages in the market.

H3: Expanding Market Opportunities in AI and Data Analytics

The burgeoning AI and big data analytics markets present immense growth opportunities.

- Market Size Projections: Market research indicates significant growth in these sectors over the next few years. [Cite relevant market research reports with projected growth rates].

- Market Penetration Strategies: Palantir's strategic initiatives to penetrate new markets, particularly in the commercial sector, are crucial to capturing market share.

H3: Improving Investor Sentiment and Market Confidence

Positive investor sentiment and increased market confidence can significantly impact Palantir's stock price.

- Stock Price Movements: Tracking recent stock price movements and identifying trends can give insights into current investor sentiment.

- Analyst Ratings: Analyzing analyst ratings and their rationale provides valuable perspectives on the future potential of Palantir.

- Catalysts for Growth: Positive news, strategic partnerships, or significant contract wins can act as catalysts, increasing investor confidence.

Potential Risks and Challenges

Despite the positive factors, several risks could hinder Palantir's growth.

H3: Competition and Market Saturation

The data analytics market is becoming increasingly competitive.

- Key Competitors: Identifying and analyzing the strategies of major competitors is critical. [List key competitors and their market share].

- Mitigation Strategies: Palantir's ability to maintain its competitive advantage through innovation and strategic partnerships is crucial.

H3: Economic Uncertainty and Geopolitical Risks

Macroeconomic factors and geopolitical events can significantly impact Palantir's business.

- Economic Downturns: Economic downturns can reduce government spending and commercial investment in data analytics.

- Geopolitical Instability: Geopolitical risks can impact contract awards and overall business operations.

- Mitigation Strategies: Diversification of revenue streams and proactive risk management strategies can help mitigate these risks.

Conclusion

Predicting a 40% jump in Palantir's stock price by 2025 involves considering numerous variables. While Palantir's technological advantages, expanding market opportunities, and potential for improved investor sentiment present significant upsides, competitive pressures and macroeconomic uncertainties pose substantial challenges. Therefore, a 40% increase is a possibility, but not a certainty. This analysis suggests that the probability of such a significant jump depends largely on Palantir's continued success in executing its growth strategy and navigating the challenges in the dynamic data analytics landscape. Conduct your own thorough due diligence before investing in Palantir stock. The potential for substantial growth exists, but inherent risks associated with the stock market should always be acknowledged.

Featured Posts

-

Snls Bad Harry Styles Impression How He Really Felt

May 10, 2025

Snls Bad Harry Styles Impression How He Really Felt

May 10, 2025 -

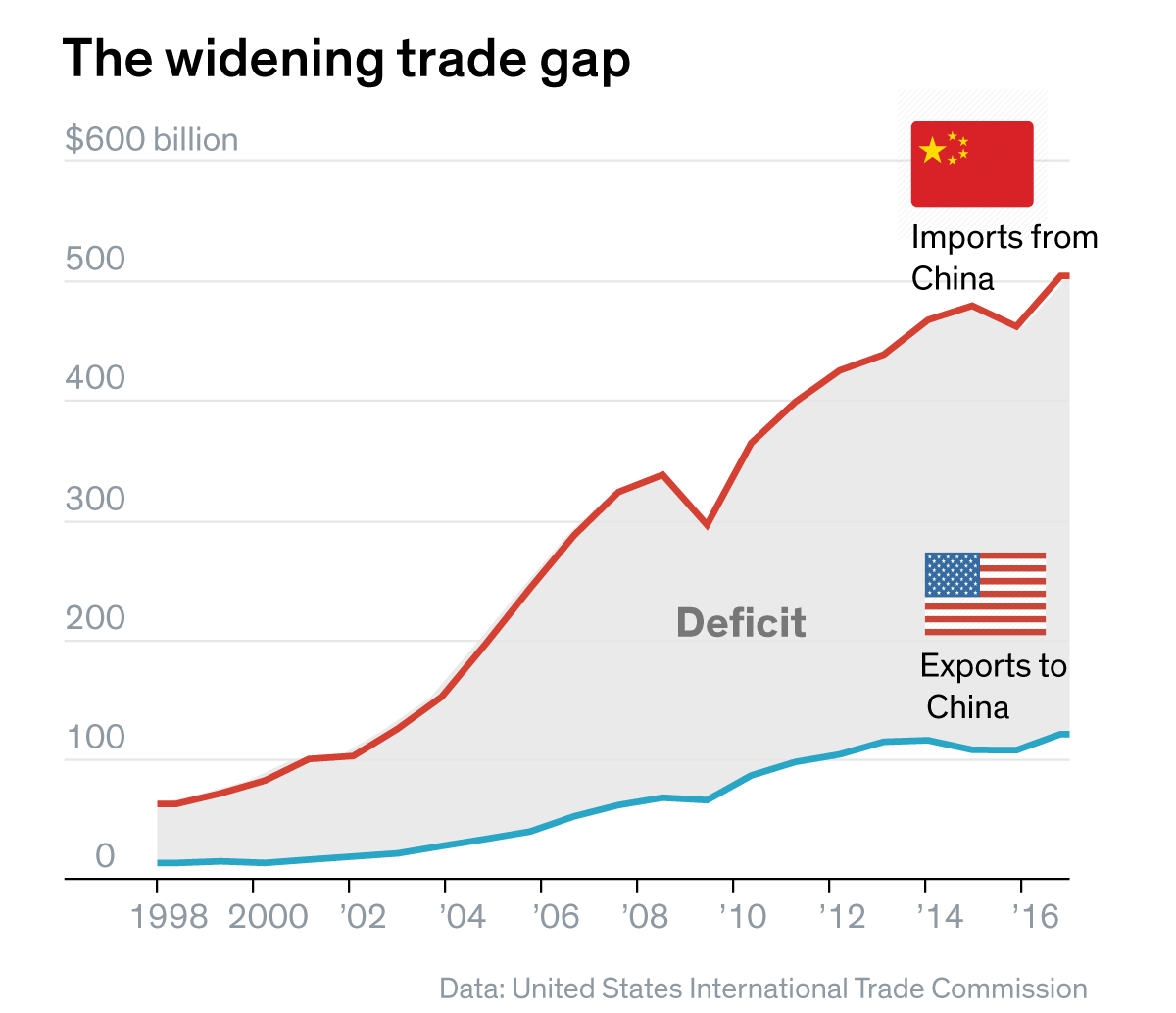

Donald Trumps Billionaire Friends Post Tariff Losses Since Liberation Day

May 10, 2025

Donald Trumps Billionaire Friends Post Tariff Losses Since Liberation Day

May 10, 2025 -

Young Thugs Uy Scuti Album Expected Release Date And Tracklist Rumors

May 10, 2025

Young Thugs Uy Scuti Album Expected Release Date And Tracklist Rumors

May 10, 2025 -

U S China Trade Talks Exclusive Look At Xis Security Envoys Role

May 10, 2025

U S China Trade Talks Exclusive Look At Xis Security Envoys Role

May 10, 2025 -

Activist Proposes Uterus Transplants For Transgender Women To Give Birth

May 10, 2025

Activist Proposes Uterus Transplants For Transgender Women To Give Birth

May 10, 2025