Palantir Stock Forecast Revised: A Deep Dive Into The Market Upswing

Table of Contents

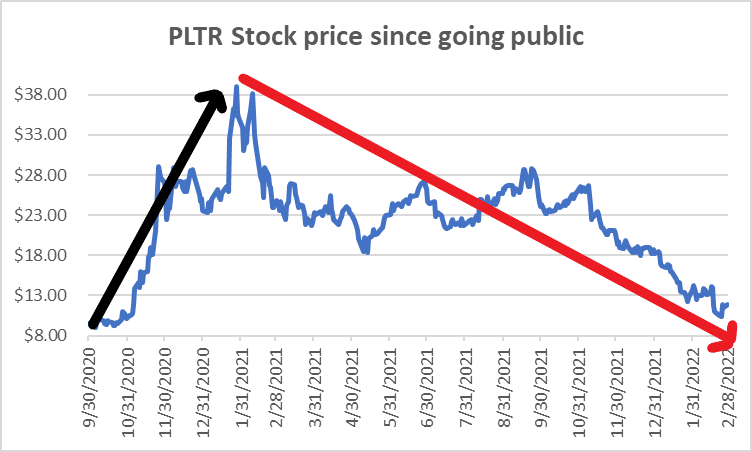

Analyzing Palantir's Recent Performance & Growth

Revenue Growth and Key Contracts

Palantir's recent financial reports paint a picture of encouraging growth. The company has consistently demonstrated increasing revenue, fueled by significant contract wins in both the government and commercial sectors. This positive momentum significantly impacts the Palantir stock price.

- Large Contract Wins: Palantir secured a multi-year, multi-million dollar contract with a major European defense agency in Q3 2023, showcasing continued success in the government sector. Another notable win included a significant partnership with a Fortune 500 company in the financial services industry.

- Year-over-Year Revenue Growth: Palantir has consistently shown double-digit revenue growth year-over-year, exceeding market expectations in several quarters. This sustained growth signifies a healthy trajectory for the company.

- Key Government Agencies & Commercial Clients: Palantir's client list includes numerous government agencies (including continued work with the US intelligence community) and large commercial enterprises across various industries. This diverse client base reduces reliance on any single entity.

Keywords: Palantir revenue, PLTR contracts, government contracts Palantir, commercial contracts Palantir, Palantir growth, PLTR revenue growth.

Expansion into New Markets & Product Diversification

Palantir's strategic expansion into new markets and product diversification is a crucial factor driving its potential upswing. The company is actively pursuing opportunities beyond its traditional government focus.

- New Product Launches: Recent product launches, like new AI-powered solutions, are attracting interest from diverse sectors, widening Palantir's addressable market.

- Strategic Partnerships: Collaborations with leading technology companies enhance Palantir's product offerings and expand its reach into new customer segments.

- Market Penetration Strategies: Palantir is employing targeted strategies to penetrate key industries like healthcare and finance, leveraging its data analytics capabilities.

Keywords: Palantir product diversification, Palantir new markets, Palantir expansion strategy, Palantir AI, Palantir partnerships.

Factors Influencing the Palantir Stock Forecast

Geopolitical Landscape & Increased Government Spending

The geopolitical landscape significantly impacts Palantir's prospects. Increased global instability and escalating tensions often lead to higher government spending on defense and intelligence technologies, benefiting Palantir.

- Increased Defense Budgets: Several countries are increasing their defense budgets, creating opportunities for Palantir's data analytics and intelligence solutions.

- Geopolitical Events: Global events often drive demand for advanced data analytics capabilities, strengthening Palantir's position.

- Palantir's Position: The company's strong relationships with key government agencies solidify its position to benefit from increased defense spending.

Keywords: Geopolitical risk Palantir, government spending on technology, defense spending Palantir, global instability, international relations.

Technological Advancements and Competitive Landscape

Palantir's continued technological innovation and its competitive positioning within the big data and analytics market are crucial drivers of its future performance.

- Key Technological Advancements: Palantir consistently invests in R&D, developing cutting-edge technologies that give it a competitive edge.

- Comparison with Competitors: While competitors like Databricks and Snowflake exist, Palantir's focus on complex data integration and analysis provides a unique value proposition.

- Competitive Advantages: Palantir's proprietary platform and strong data security capabilities provide a significant competitive advantage.

Keywords: Palantir technology, Palantir competitors, big data analytics stock, data integration, data security, AI in data analytics.

Investor Sentiment and Market Conditions

Investor sentiment towards Palantir and broader market conditions play a role in its stock price fluctuations.

- Analyst Ratings: While ratings vary, several analysts maintain a positive outlook on Palantir's long-term potential.

- Institutional Ownership: Changes in institutional ownership can indicate shifts in investor confidence and influence the stock price.

- Market Trends: Factors like interest rates and inflation impact the overall market sentiment and can affect Palantir's valuation.

Keywords: Palantir investor sentiment, PLTR stock price prediction, market outlook Palantir, interest rates, inflation.

Potential Risks and Challenges

High Valuation and Profitability Concerns

Palantir's valuation relative to its current profitability remains a concern for some investors. A high valuation can make the stock vulnerable to market corrections.

Dependence on Government Contracts

A significant portion of Palantir's revenue comes from government contracts. This dependence makes the company susceptible to changes in government spending policies and priorities.

Intense Competition in the Data Analytics Market

The data analytics market is highly competitive. Palantir faces competition from established players and emerging startups, requiring continuous innovation to maintain its market share.

Conclusion

This revised Palantir stock forecast suggests a potential upswing driven by factors including strong revenue growth, expansion into new markets, and increased government spending. However, investors should carefully consider the risks associated with Palantir's high valuation and dependence on government contracts. While a bullish outlook exists, thorough due diligence and a diversified investment strategy are crucial. Before making any investment decisions regarding Palantir stock, conduct your own research and consider consulting a financial advisor. Stay informed about the latest developments in the Palantir stock market and continue your research on the Palantir stock forecast to make informed decisions. Remember, this is not financial advice; always conduct your own thorough research before investing in any stock, including Palantir.

Featured Posts

-

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Automakers

May 10, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Automakers

May 10, 2025 -

Air Traffic Controller Safety Warnings Preceded Newark System Failure

May 10, 2025

Air Traffic Controller Safety Warnings Preceded Newark System Failure

May 10, 2025 -

Nl Federal Election Candidate Comparisons And Insights

May 10, 2025

Nl Federal Election Candidate Comparisons And Insights

May 10, 2025 -

Stiven King Kritikuye Trampa Ta Maska Ostanni Novini

May 10, 2025

Stiven King Kritikuye Trampa Ta Maska Ostanni Novini

May 10, 2025 -

The Closure Of Anchor Brewing Company What Happens Next

May 10, 2025

The Closure Of Anchor Brewing Company What Happens Next

May 10, 2025