Palantir Stock Prediction 2025: Should You Invest Now?

Table of Contents

Palantir's Current Financial Performance and Growth Prospects

Palantir Technologies, a leading provider of big data analytics platforms for government and commercial clients, has experienced a period of significant growth, but also volatility. Analyzing its current financial performance is key to any Palantir stock forecast.

Revenue Growth and Profitability

Palantir's revenue growth has been impressive in recent years, driven by strong demand for its data analytics solutions. However, profitability remains a key area of focus for investors. Examining key metrics like revenue growth rate, operating margins, and free cash flow is crucial for assessing the company's long-term sustainability. [Insert Chart/Graph showing revenue growth and profitability over the past few years].

- Government Contracts: A substantial portion of Palantir's revenue comes from government contracts, particularly in the defense and intelligence sectors. The stability and longevity of these contracts are crucial for predicting future revenue streams.

- Commercial Sector Growth: Palantir's expansion into the commercial sector is a vital aspect of its growth strategy. Tracking the growth of its commercial client base and the success of its platform in various industries (e.g., finance, healthcare) is essential.

- Partnerships and Acquisitions: Strategic partnerships and acquisitions can significantly impact Palantir's future growth trajectory. Analyzing the potential synergies and benefits of these collaborations is crucial.

- Customer Acquisition and Retention: Understanding Palantir's customer acquisition costs and retention rates provides valuable insights into the company's long-term sustainability and profitability.

Market Analysis and Competitive Landscape

Understanding Palantir's position within the broader big data and analytics market is crucial for a realistic Palantir stock forecast.

Industry Trends in Big Data Analytics

The big data and analytics market is experiencing explosive growth, driven by increasing data volumes, advanced analytics techniques, and the rise of cloud computing. This presents significant opportunities for Palantir, but also intense competition.

Key Competitors and Their Strategies

Palantir faces competition from established players like Databricks and Snowflake, each employing different strategies and technologies. Analyzing Palantir's competitive advantages (e.g., its strong government relationships, specialized platforms) and disadvantages (e.g., high pricing, complex platform) is key.

- Technological Advancements: The rapid pace of technological change necessitates continuous innovation. Palantir's ability to adapt and integrate emerging technologies (AI, machine learning, cloud computing) into its offerings will be critical for maintaining its competitive edge.

- Market Saturation and Expansion: Assessing the level of market saturation and identifying potential areas for future market expansion (e.g., new industries, geographies) is essential.

- Brand Strength and Market Positioning: Palantir's brand reputation and market positioning significantly influence its ability to attract and retain clients.

Factors Influencing Palantir Stock Price in 2025

Numerous factors, beyond Palantir's internal performance, can significantly impact its stock price in 2025.

Macroeconomic Factors

Global economic conditions (inflation, interest rates, recessionary risks) significantly influence investor sentiment and stock valuations. A strong economy generally favors growth stocks like Palantir, while a recession could lead to decreased investment and lower stock prices.

Geopolitical Events

Geopolitical instability and global conflicts can significantly impact Palantir's government contracts and overall business. Increased defense spending in response to geopolitical tensions could benefit Palantir, but conversely, prolonged conflicts or instability could disrupt operations and negatively affect investor confidence.

Technological Advancements

The rapid evolution of technology continues to shape the big data and analytics landscape. Palantir's ability to adapt and innovate in response to emerging technologies (AI, cloud computing) is crucial for its future success and will impact its stock price.

- Regulatory Changes: Changes in data privacy regulations and cybersecurity laws can impact Palantir's operations and potentially affect investor confidence.

- Data Security and Privacy: Data breaches and security concerns are significant risks for companies operating in the data analytics space. Maintaining robust security measures is vital for Palantir.

- Leadership and Strategy Changes: Any significant changes in company leadership or strategic direction could affect investor sentiment and the company's stock price.

Expert Opinions and Analyst Predictions

Analyzing expert opinions and analyst predictions provides valuable insights, but it's crucial to remember that these are just opinions and not guarantees.

Consensus Estimates from Financial Analysts

Numerous financial analysts provide price targets and predictions for Palantir stock. [Insert summary of analyst predictions and their ranges, citing sources]. These predictions represent a range of views, reflecting the inherent uncertainty in the stock market.

Divergent Views and Potential Risks

It's important to consider both bullish and bearish perspectives on Palantir's future. Bearish predictions often highlight risks such as intense competition, dependence on government contracts, and the challenges of expanding into the commercial sector. [Include sources for contrasting viewpoints].

- Bullish Arguments: Focus on Palantir's technological innovation, strong government relationships, and growth potential in the commercial sector.

- Bearish Arguments: Highlight the company's high valuation, dependence on a few key clients, and the competitive landscape.

- Unexpected Events: Unexpected events (e.g., economic downturns, geopolitical crises) can significantly impact stock prices and should be considered.

- Disclaimers: Remember that stock predictions are not guarantees and should be treated with caution.

Conclusion

Predicting Palantir's stock price in 2025 is inherently challenging, given the complex interplay of factors influencing its performance. While Palantir shows promise with its innovative technology and growing market share, potential investors must carefully consider its financial performance, competitive landscape, and the various macroeconomic and geopolitical factors at play. This analysis highlights the importance of thorough due diligence before making any investment decisions. Remember that this article is for informational purposes only and does not constitute financial advice. Before investing in Palantir stock or any other security, conduct your own thorough research and consult with a qualified financial advisor. Your investment decisions regarding a Palantir Stock Prediction 2025 should always be based on your individual risk tolerance and financial goals.

Featured Posts

-

Stiven King Vernulsya V X I Napal Na Ilona Maska

May 10, 2025

Stiven King Vernulsya V X I Napal Na Ilona Maska

May 10, 2025 -

Dijon Vs Concarneau Score Final 0 1 National 2 04 04 2025

May 10, 2025

Dijon Vs Concarneau Score Final 0 1 National 2 04 04 2025

May 10, 2025 -

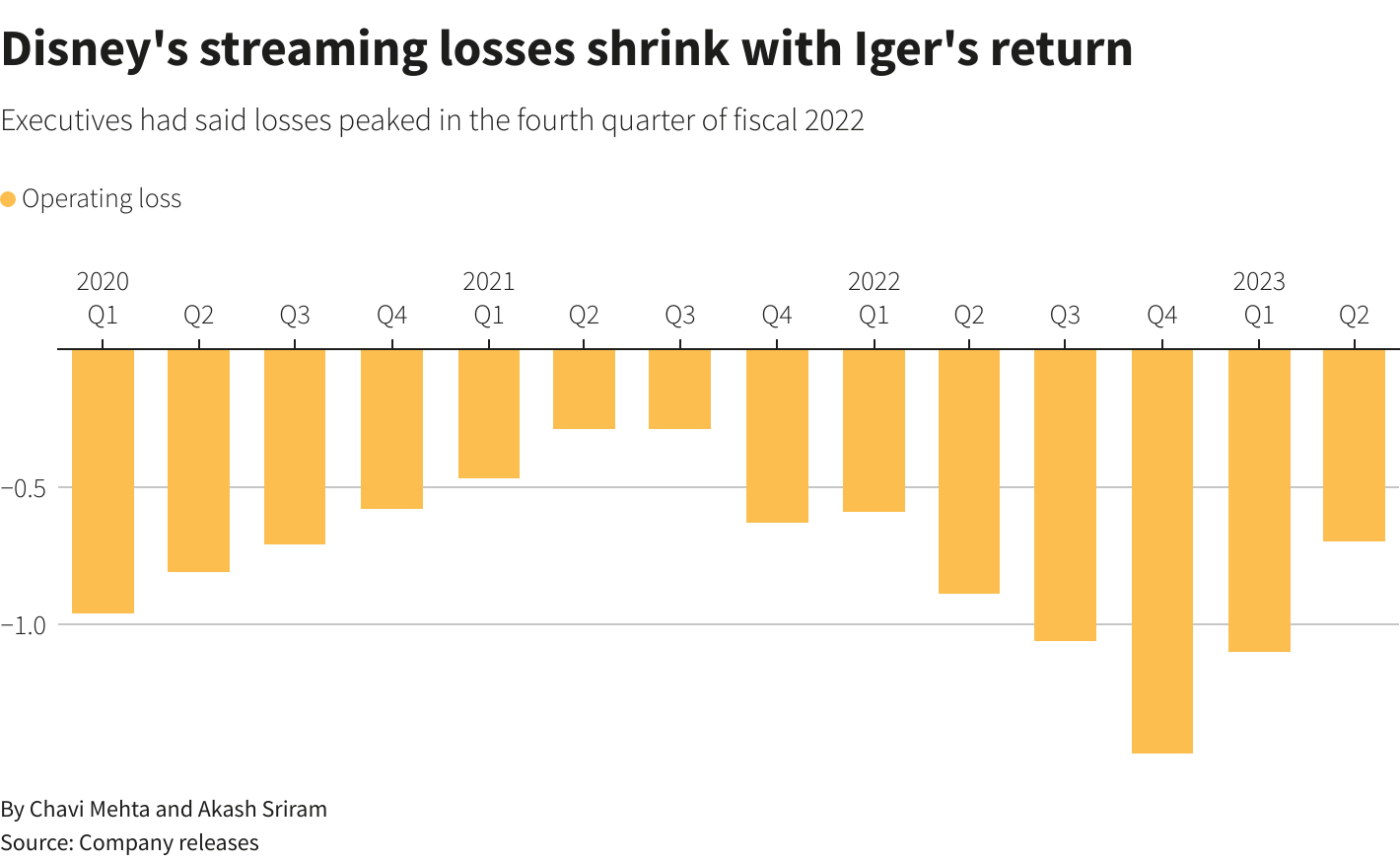

Disneys Increased Profit Strong Parks And Streaming Performance

May 10, 2025

Disneys Increased Profit Strong Parks And Streaming Performance

May 10, 2025 -

The Kreischers Marriage And The Netflix Stand Up Routine

May 10, 2025

The Kreischers Marriage And The Netflix Stand Up Routine

May 10, 2025 -

Palantir Stock Is It Too Late To Buy In 2024 For Potential 2025 Gains

May 10, 2025

Palantir Stock Is It Too Late To Buy In 2024 For Potential 2025 Gains

May 10, 2025