Palantir Stock: Should You Invest Before May 5th? Analysis And Predictions

Table of Contents

Palantir's Recent Performance and Financial Health

Revenue Growth and Profitability

Analyzing Palantir's recent quarterly and annual reports reveals a mixed bag. While revenue growth has been impressive, consistent profitability remains a challenge. Let's look at the numbers:

- Q4 2022 Revenue: [Insert actual Q4 2022 revenue figure and percentage change compared to Q4 2021]. This growth was primarily fueled by strong performance in both government and commercial sectors.

- Full Year 2022 Revenue: [Insert actual full-year 2022 revenue and percentage change compared to 2021]. This signifies continued expansion despite economic headwinds.

- Profitability: While Palantir demonstrates significant revenue growth (Palantir revenue), achieving consistent net income (Palantir earnings) remains a focus. The company is actively working on improving its operating margins through cost optimization and increased efficiency. Analyzing Palantir financial statements is crucial for understanding this dynamic. PLTR stock performance directly reflects these financial realities.

The key drivers of Palantir's revenue growth include:

- Increased government contracts, especially in defense and intelligence.

- Expansion of commercial partnerships across various sectors, including finance and healthcare.

Key Contracts and Partnerships

Palantir's success hinges on securing and maintaining significant contracts and partnerships. Examining these relationships provides insights into the company's growth trajectory.

- Government Contracts: Palantir holds substantial contracts with various government agencies worldwide. These contracts often involve long-term commitments, providing a stable revenue stream. However, dependence on government funding (Palantir government contracts) presents inherent risk.

- Commercial Partnerships: Palantir is actively expanding its commercial client base, securing partnerships with major players in finance, healthcare, and other industries. These partnerships offer significant growth potential. The nature and scope of these (Palantir commercial partnerships) are key factors to watch.

- Key Clients: [List examples of key Palantir clients, highlighting the importance of these relationships to the company’s overall success]. The strength and stability of these relationships are vital indicators for assessing the future of Palantir.

Future Projections and Growth Potential

Market Analysis and Industry Trends

Palantir operates within the rapidly expanding big data and artificial intelligence (AI) markets. This presents both substantial opportunities and intense competition.

- Market Size: The global big data analytics market is projected to reach [insert market size prediction and source]. The AI market is similarly experiencing exponential growth.

- Competitive Landscape: Palantir faces stiff competition from established tech giants and emerging players. However, its unique platform and focus on complex data analysis provide a competitive edge.

- Government Technology Spending: Continued government investment in technology (government technology spending) significantly benefits Palantir, bolstering its revenue stream. However, changes in government priorities could impact its growth.

Palantir's competitive advantages include:

- Proprietary technology and advanced data analytics capabilities.

- Strong relationships with government agencies and commercial clients.

- A focus on solving complex problems across various sectors.

Palantir's Product Innovation and Development

Palantir's ongoing product development is crucial for maintaining its competitive advantage and driving future growth.

- Palantir Foundry: This platform facilitates data integration and analysis across multiple sources, offering a powerful solution for businesses and government agencies.

- Palantir Gotham: This platform is specifically designed for government agencies, providing advanced data analytics capabilities for national security and intelligence operations. Further advancements in Palantir Gotham could significantly boost government contracts.

- AI-Driven Solutions: Palantir is increasingly integrating AI and machine learning into its platform, enhancing its analytical capabilities and providing more valuable insights for its clients. (AI driven solutions) are a crucial element for continued growth. Following the (Palantir product roadmap) is key for investors.

Risks and Potential Downsides of Investing in Palantir Stock

Valuation and Stock Price Volatility

Palantir's stock price has historically been volatile. Understanding its valuation and the factors driving this volatility is crucial for investors.

- Valuation Metrics: [Discuss relevant valuation metrics such as P/S ratio, and explain their implications for the stock's current price]. These metrics must be considered in relation to Palantir's growth potential and risk profile.

- Stock Price Volatility: Palantir's stock price fluctuates significantly due to factors such as market sentiment, earnings reports, and news related to its contracts and partnerships. PLTR stock price should be monitored closely.

Geopolitical and Economic Risks

Several factors could negatively impact Palantir's performance.

- Changes in Government Spending: Reductions in government spending on technology could significantly affect Palantir's revenue.

- Global Economic Downturns: Economic uncertainty can impact both government and commercial spending, potentially affecting Palantir's growth.

- Geopolitical Instability: International tensions and geopolitical events could influence Palantir's ability to secure and maintain contracts. These (geopolitical risk) and (economic uncertainty) factors warrant careful consideration. Recognizing Palantir risk factors is essential for informed investment.

Conclusion

This analysis has examined Palantir's recent performance, future outlook, and inherent risks, particularly in relation to the significance of May 5th. Palantir presents considerable growth potential within the expanding big data and AI markets. However, investors must carefully weigh this potential against the risks associated with its stock price volatility and reliance on government contracts.

Should you invest in Palantir stock before May 5th? The decision depends on your risk tolerance and investment strategy. Conduct thorough due diligence, consider consulting a financial advisor, and carefully evaluate all the latest news and financial reports regarding Palantir before making any investment choices. Remember to regularly assess the situation and re-evaluate your Palantir stock investment strategy accordingly.

Featured Posts

-

10 Agensi Dari Pas Selangor Salurkan Bantuan Kepada Mangsa Tragedi Putra Heights

May 09, 2025

10 Agensi Dari Pas Selangor Salurkan Bantuan Kepada Mangsa Tragedi Putra Heights

May 09, 2025 -

Wynne And Joanna All At Sea Review And Analysis

May 09, 2025

Wynne And Joanna All At Sea Review And Analysis

May 09, 2025 -

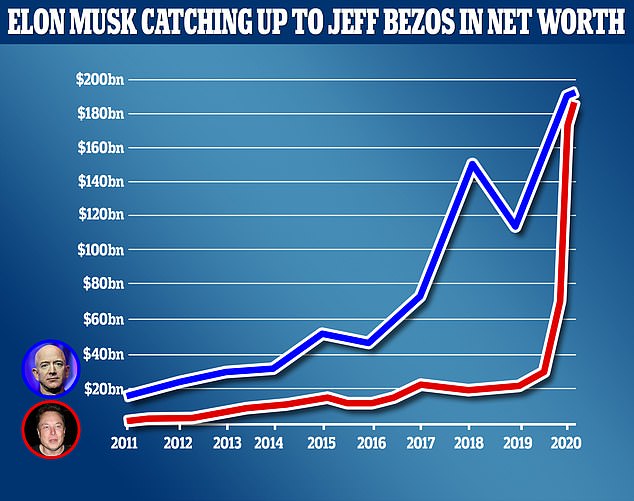

Understanding Elon Musks Wealth Strategies And Investments

May 09, 2025

Understanding Elon Musks Wealth Strategies And Investments

May 09, 2025 -

Vu Viec Bao Mau Bao Hanh Tre Em Tien Giang Cong Dong Can Lam Gi

May 09, 2025

Vu Viec Bao Mau Bao Hanh Tre Em Tien Giang Cong Dong Can Lam Gi

May 09, 2025 -

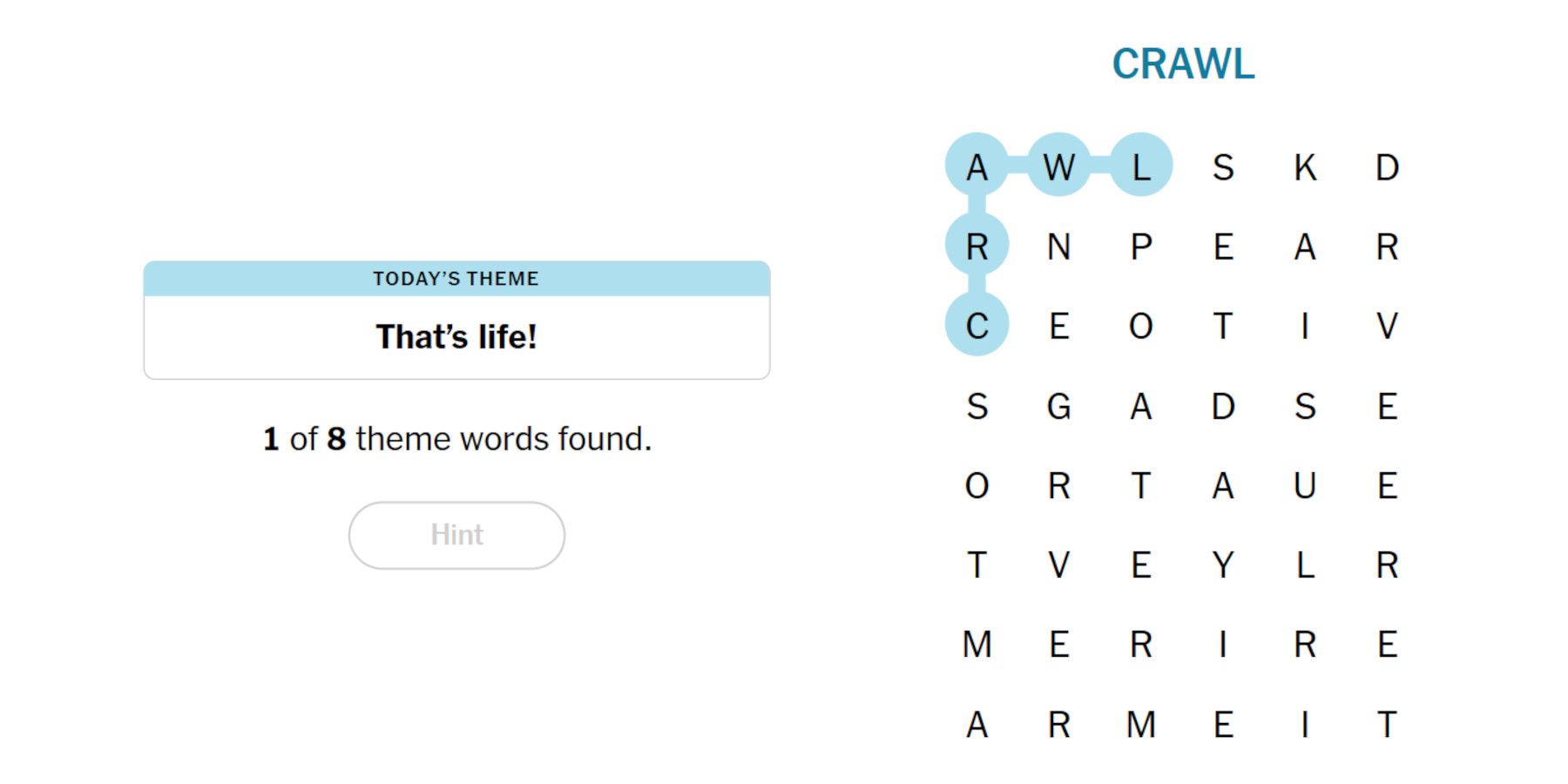

Nyt Strands April 12 2024 Solutions Game 405

May 09, 2025

Nyt Strands April 12 2024 Solutions Game 405

May 09, 2025

Latest Posts

-

Samuel Dickson Life And Legacy Of A Canadian Lumber Industry Pioneer

May 09, 2025

Samuel Dickson Life And Legacy Of A Canadian Lumber Industry Pioneer

May 09, 2025 -

Olly Murs To Headline Massive Music Festival At Beautiful Castle Near Manchester

May 09, 2025

Olly Murs To Headline Massive Music Festival At Beautiful Castle Near Manchester

May 09, 2025 -

Hundreds Of Caravans Transform Uk City Residents Voice Concerns

May 09, 2025

Hundreds Of Caravans Transform Uk City Residents Voice Concerns

May 09, 2025 -

Uk Citys Transformation Caravan Sites And Growing Ghetto Concerns

May 09, 2025

Uk Citys Transformation Caravan Sites And Growing Ghetto Concerns

May 09, 2025 -

Mbaryat Barys San Jyrman Fy Dwry Abtal Awrwba Thlyl Wtwqeat

May 09, 2025

Mbaryat Barys San Jyrman Fy Dwry Abtal Awrwba Thlyl Wtwqeat

May 09, 2025