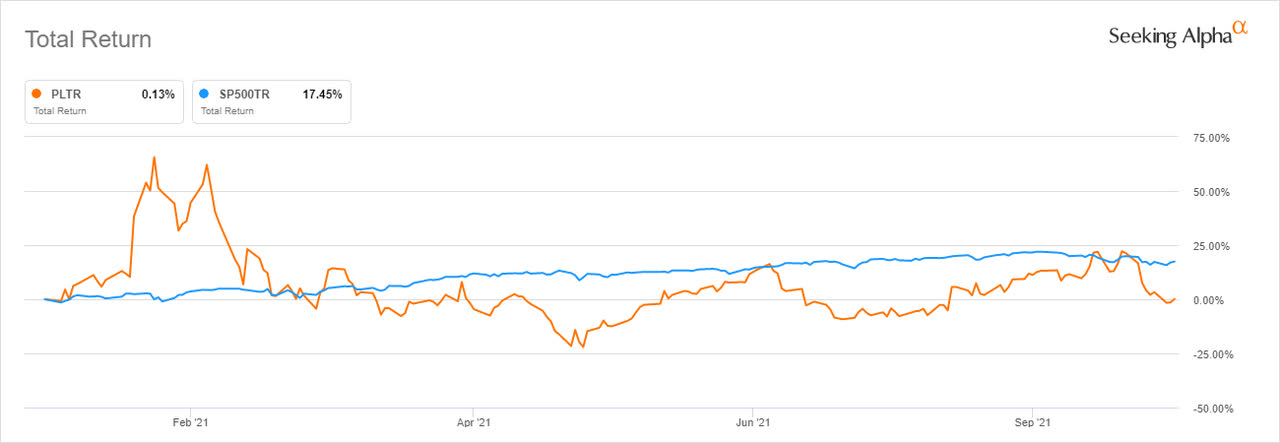

Palantir Stock: To Buy Or Not To Buy Before May 5th?

Table of Contents

Palantir's Recent Financial Performance and Upcoming Earnings Report (May 5th):

Palantir's upcoming earnings report on May 5th will be a significant event for investors. Analyzing Q1 2024 expectations is crucial for understanding the potential impact on the stock price. Investors will be keenly watching revenue growth, profitability, and key performance indicators (KPIs) to gauge the company's overall health. A comparison against industry competitors like Snowflake and Databricks will provide further context.

- Projected revenue growth percentage: Analysts' estimates for Q1 2024 revenue growth vary, but a consensus needs to be established and included here based on current market predictions. (Replace this with actual figures closer to May 5th).

- Expected EPS (earnings per share): Similar to revenue growth, the projected EPS for Q1 2024 is crucial. A positive surprise could significantly boost the stock price, while a miss could lead to a decline. (Replace this with actual figures closer to May 5th).

- Analysis of any recent contract wins or losses: Significant contract wins, particularly in the government sector, can dramatically impact investor sentiment. Similarly, large contract losses could negatively affect the stock price. (Include relevant information available closer to May 5th).

- Comparison of Palantir's valuation to competitors: Evaluating Palantir's valuation relative to its competitors, such as Snowflake and Databricks, is essential. Is Palantir overvalued or undervalued compared to its peers? This analysis requires a thorough look at metrics like Price-to-Sales (P/S) ratio.

Government Contracts and Future Growth Potential:

Palantir's substantial reliance on government contracts is a double-edged sword. While this provides a stable revenue stream, it also presents risks. The company's diversification strategy into the commercial sector is vital for long-term growth. Expansion into new markets and technological advancements will determine its future success.

- Percentage of revenue from government contracts: Quantifying the percentage of revenue derived from government contracts helps assess the risk associated with potential changes in government spending or geopolitical events. (Insert the current percentage).

- Growth prospects in commercial sectors (e.g., healthcare, finance): Palantir's success in penetrating commercial sectors like healthcare and finance will significantly influence its future growth trajectory. The analysis should include the potential market size and competitive landscape in these sectors.

- Impact of new product releases and technological innovations: The introduction of new products and technological advancements is key to maintaining a competitive edge. Analyzing the market reception and potential impact of these innovations is crucial.

- Geopolitical risks and their potential impact on government contracts: Geopolitical instability or changes in government priorities can significantly impact Palantir's government contracts. This analysis should assess the potential risks and their likely impact.

Risk Assessment and Potential Downsides:

Investing in Palantir stock carries inherent risks. The company's high valuation makes it susceptible to market corrections. The competitive landscape is dynamic, with new entrants constantly emerging. Data privacy and security concerns also pose a significant risk.

- Valuation compared to industry peers: A detailed comparison of Palantir's valuation with industry peers like Snowflake and Databricks is crucial to assess whether it's overvalued.

- Potential impact of economic downturns: Economic downturns can significantly impact government and commercial spending, directly affecting Palantir's revenue.

- Risks related to data privacy and security: Data breaches and security concerns could severely damage Palantir's reputation and business.

- Competitive threats and their potential impact: The emergence of new competitors with similar offerings poses a risk to Palantir's market share and growth.

Technical Analysis of Palantir Stock: (Optional)

(This section would include charts and technical indicators, along with a clear disclaimer about the limitations of technical analysis in predicting future stock performance.)

Conclusion:

Palantir's stock presents a complex investment proposition. While its strong government contracts provide a stable base and its expansion into the commercial sector offers significant growth potential, the high valuation and competitive landscape introduce substantial risk. The May 5th earnings report will be a critical catalyst. Whether to buy, sell, or hold Palantir stock before May 5th depends heavily on your risk tolerance and investment horizon.

Call to Action: Conduct thorough research, considering all the factors discussed above, before making any investment decisions regarding Palantir stock. Remember that this analysis is not financial advice. Always consult with a qualified financial advisor before investing in any stock. For further information, refer to Palantir's investor relations page and reputable financial news sources. Remember to always prioritize responsible investing and consider your personal risk tolerance when making investment decisions related to Palantir stock.

Featured Posts

-

Dijon Violente Agression Au Lac Kir Trois Blesses

May 10, 2025

Dijon Violente Agression Au Lac Kir Trois Blesses

May 10, 2025 -

Hundreds In Caravans Is This Uk City Becoming A Ghetto

May 10, 2025

Hundreds In Caravans Is This Uk City Becoming A Ghetto

May 10, 2025 -

Guilty Plea Lab Owner Faked Covid 19 Test Results During Pandemic

May 10, 2025

Guilty Plea Lab Owner Faked Covid 19 Test Results During Pandemic

May 10, 2025 -

Elon Musks Financial Empire From Pay Pal To Space X And Beyond

May 10, 2025

Elon Musks Financial Empire From Pay Pal To Space X And Beyond

May 10, 2025 -

Transgender Equality In Thailand Recent Developments And The Role Of The Bangkok Post

May 10, 2025

Transgender Equality In Thailand Recent Developments And The Role Of The Bangkok Post

May 10, 2025