Palantir Technology Stock: Wall Street's Pre-May 5th Prediction

Table of Contents

Pre-May 5th Analyst Sentiment on Palantir Technology Stock

Overall sentiment on Palantir Technology stock before May 5th appears cautiously optimistic, though opinions vary widely. While some analysts maintain a bullish outlook, citing strong government contract wins and increasing commercial adoption, others express more reserved optimism, highlighting the competitive landscape and the company's high valuation. A neutral stance is also prevalent, with many analysts waiting for the May 5th announcements before making definitive calls.

-

Analyst A's prediction and rationale: Analyst A at [Investment Firm A] has a target price of $[Target Price] for Palantir Technology stock, citing the company's growing presence in the commercial sector and the potential for substantial revenue growth from its Foundry platform as key drivers. Their rationale emphasizes Palantir's innovative data analytics capabilities.

-

Analyst B's prediction and rationale: Conversely, Analyst B at [Investment Firm B] holds a more conservative view, projecting a target price of $[Target Price]. They express concerns about Palantir's dependence on government contracts and the intensifying competition from established tech giants in the big data analytics market. Their prediction factors in the risk of slower-than-expected growth in the commercial sector.

-

Overall consensus among analysts: The consensus among analysts is mixed, reflecting the uncertainty surrounding Palantir's future performance. While the potential for significant growth is acknowledged, the associated risks, particularly concerning competition and profitability, are also considered.

-

Significant news influencing predictions: Recent contract wins with major government agencies and the successful launch of new features on the Foundry platform have positively influenced some analysts' predictions. However, concerns remain about the overall macroeconomic climate and its impact on Palantir's customer acquisition and expansion plans.

Key Factors Influencing Palantir Stock Price Predictions

Several crucial factors are shaping the predictions surrounding Palantir Technology stock:

-

Government contracts and their impact: Palantir's substantial revenue stream from government contracts is a double-edged sword. While providing stability, it also raises concerns about dependence on government spending and potential budget cuts. The scale and renewal of these contracts significantly impact investor confidence in Palantir's long-term growth.

-

Commercial market growth and adoption: The success of Palantir's expansion into the commercial sector is critical to its future valuation. Increased adoption of its Foundry platform by private sector clients is a crucial indicator of sustainable growth and reduced reliance on government funding.

-

Competition in the big data analytics market: The big data analytics market is highly competitive, with established players like [mention competitors] posing significant challenges to Palantir. Maintaining its competitive edge through innovation and strategic partnerships is vital for Palantir's sustained success.

-

Palantir's financial performance and profitability: Palantir's financial performance, particularly its revenue growth, profitability margins, and cash flow, directly influences investor sentiment. Consistent improvement in these key performance indicators (KPIs) is crucial for boosting investor confidence.

-

Overall market conditions and investor sentiment: Broader market trends and overall investor risk appetite significantly affect Palantir's stock price. Periods of market volatility or shifts in investor sentiment can lead to fluctuations in Palantir's stock valuation regardless of the company's performance.

Analyzing Palantir's Recent Financial Performance

Palantir's recent financial performance shows a mixed bag. While revenue growth has been impressive, reaching [insert revenue figures] in [period], the company still faces challenges in achieving sustained profitability.

-

Revenue growth: Palantir has demonstrated consistent revenue growth, driven primarily by government contracts and increasing commercial adoption. However, the rate of this growth remains a point of analysis for investors.

-

Profitability metrics: Profitability remains a focus area, with analysts closely examining metrics such as operating margins and net income to assess the long-term sustainability of the company’s business model.

-

Customer acquisition: Palantir’s ability to successfully acquire and retain both government and commercial clients is crucial for long-term growth. The pace of customer acquisition influences investor confidence.

-

Comparison to previous quarters/years: Comparing Palantir's recent financial performance to prior periods helps identify trends and assess the effectiveness of the company's growth strategies.

Risk Factors to Consider Before Investing in Palantir Technology Stock

Investing in Palantir Technology stock involves several risks that potential investors should carefully consider:

-

Dependence on government contracts: As discussed earlier, a significant reliance on government contracts exposes Palantir to the risks associated with government budget cycles, political changes, and potential contract delays or cancellations.

-

Competition from established players: The competitive landscape is fierce, with established players offering similar solutions and potentially outcompeting Palantir in terms of pricing and market share.

-

High valuation compared to other tech stocks: Palantir's stock valuation is often considered high relative to its peers, increasing the risk of a substantial price correction if the company fails to meet investor expectations.

-

Potential for slower-than-expected growth: While Palantir exhibits growth potential, there's always a risk that the company might not achieve the expected growth rates, leading to disappointing financial results and a negative impact on the stock price.

Potential Investment Strategies for Palantir Technology Stock (Pre-May 5th)

Given the pre-May 5th predictions and the inherent risks involved, investors can consider several strategies:

-

Buy and hold strategy: This long-term strategy is suitable for investors who believe in Palantir's long-term growth potential and are willing to ride out short-term market fluctuations.

-

Short-term trading strategy: This more aggressive approach involves buying and selling shares based on short-term price movements and market sentiment. It requires careful monitoring of the market and a higher risk tolerance.

-

Dollar-cost averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of the stock price. It helps mitigate the risk of investing a lump sum at a potentially high price.

-

Options trading strategies: Options trading offers more complex strategies, allowing investors to leverage their investment and potentially profit from price movements, but with increased risk.

-

Importance of risk management: Regardless of the chosen strategy, proper risk management is crucial. Investors should diversify their portfolios and only invest an amount they can afford to lose.

Conclusion

Predictions for Palantir Technology stock before May 5th are mixed, reflecting the complexity of the company's business model and its dependence on both government and commercial markets. Key factors influencing these predictions include the performance of government contracts, the pace of commercial adoption of the Foundry platform, the intensity of competition, and Palantir's financial performance. While the potential for significant growth exists, investors must acknowledge the considerable risks associated with Palantir Technology stock, including its high valuation and reliance on government contracts. Conduct thorough research and consider your own risk tolerance before making any investment decisions regarding Palantir Technology stock. Stay informed on the latest developments and continue monitoring the Palantir Technology stock price post-May 5th.

Featured Posts

-

Is Benson Boone Copying Harry Styles The Singers Response

May 10, 2025

Is Benson Boone Copying Harry Styles The Singers Response

May 10, 2025 -

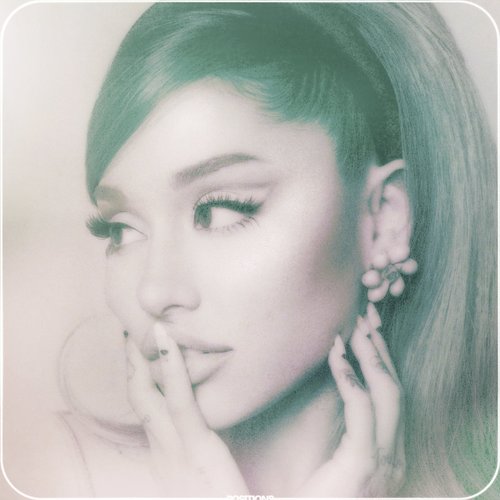

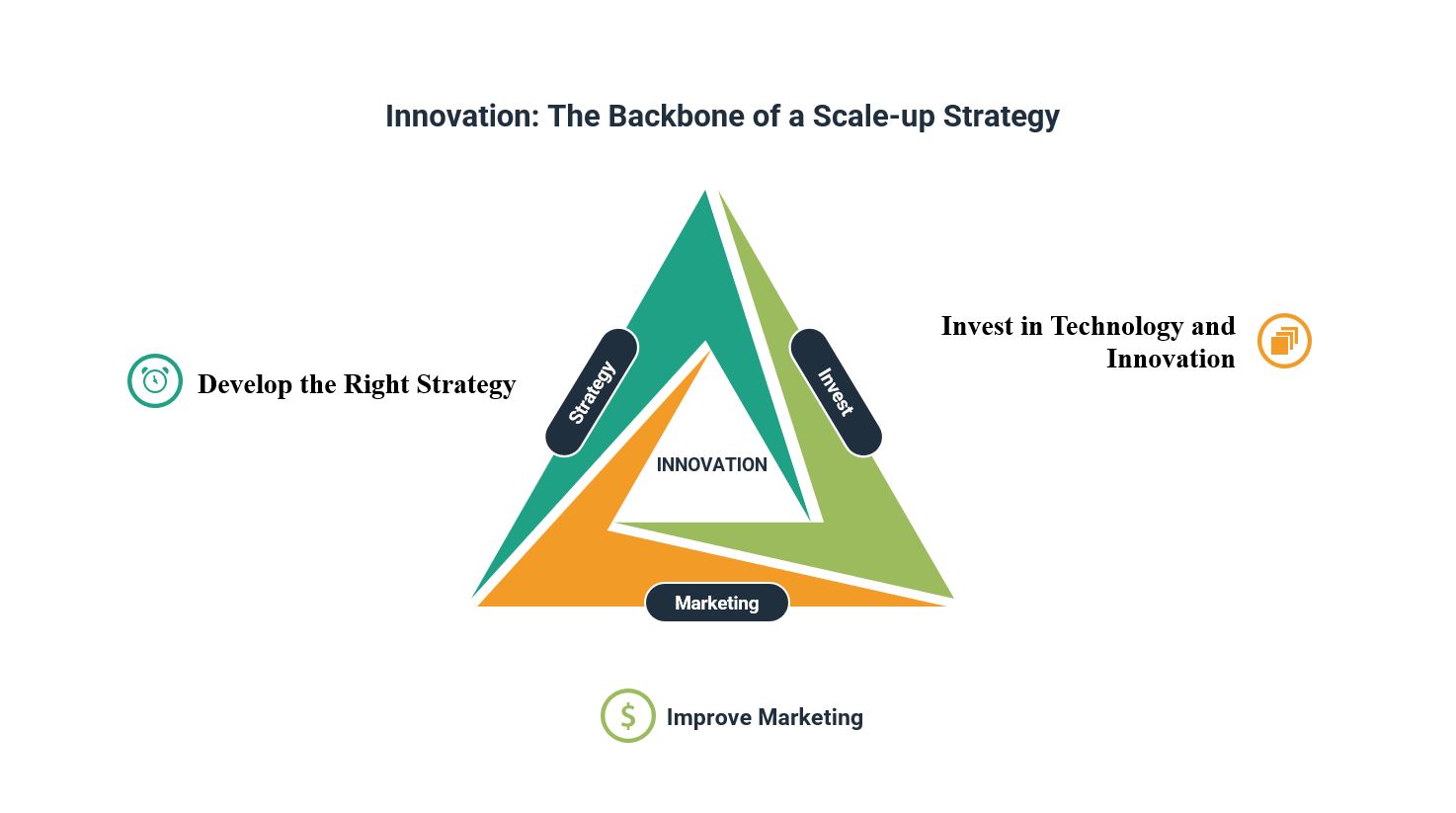

Edmonton Unlimiteds New Tech And Innovation Strategy Scaling For Global Impact

May 10, 2025

Edmonton Unlimiteds New Tech And Innovation Strategy Scaling For Global Impact

May 10, 2025 -

Farcical Misconduct Nottingham Families Plea For Procedural Delay

May 10, 2025

Farcical Misconduct Nottingham Families Plea For Procedural Delay

May 10, 2025 -

Elon Musks Net Worth Soars Tesla Stock Surge After Dogecoin Departure

May 10, 2025

Elon Musks Net Worth Soars Tesla Stock Surge After Dogecoin Departure

May 10, 2025 -

Senate Democrats Accusation Pam Bondi And Hidden Epstein Records

May 10, 2025

Senate Democrats Accusation Pam Bondi And Hidden Epstein Records

May 10, 2025