Palantir's Path To A Trillion-Dollar Market Cap: A 2030 Projection

Table of Contents

Can Palantir, the enigmatic data analytics giant, truly reach a trillion-dollar market cap by 2030? This ambitious projection demands a close examination of the company's strengths, weaknesses, and the overall market landscape. Palantir's Trillion-Dollar Market Cap is a bold claim, but the potential, fueled by its cutting-edge technology and expanding market presence, warrants a thorough analysis. This article aims to dissect the feasibility of this ambitious goal, exploring the factors that could contribute to its success—or its failure.

2. Main Points:

H2: Palantir's Competitive Advantages and Market Dominance:

Palantir's current market position is built on a foundation of proprietary technology and strategic market penetration. Its success hinges on maintaining and expanding these advantages.

H3: Proprietary Technology and Data Advantage:

Palantir's core strength lies in its proprietary platforms: Gotham, focused on government and defense contracts, and Foundry, designed for commercial applications. These platforms offer unparalleled data integration and analytics capabilities.

- Palantir Foundry: This platform facilitates the integration of disparate data sources, providing users with a unified view of their data landscape for improved decision-making.

- Gotham platform: Specifically designed for high-security government and defense applications, Gotham ensures the secure analysis of sensitive data.

- Data Security: Palantir prioritizes robust data security, a critical advantage in the increasingly sensitive world of big data solutions.

- Diverse Data Integration: The platforms' ability to seamlessly integrate diverse data sources, from structured databases to unstructured text and images, sets Palantir apart from competitors.

Key to Palantir's success is its ability to leverage its "data advantage," using its proprietary algorithms to extract actionable insights from vast and complex datasets. This capability is crucial across a variety of sectors.

H3: Expanding Market Share in Key Sectors:

Palantir is strategically expanding its presence across key sectors:

- Government Contracts: Palantir's Gotham platform has secured significant government contracts, particularly in defense and intelligence. Continued success in this area will be vital for future growth. These contracts often represent multi-year, high-value agreements, providing revenue predictability.

- Commercial Applications (Foundry): Palantir Foundry is increasingly gaining traction in the commercial sector, helping organizations across various industries—from finance and healthcare to energy and manufacturing—improve operational efficiency and make better data-driven decisions. Success stories are crucial here to generate more interest and build credibility.

- Healthcare Analytics: Palantir is actively exploring the healthcare sector, leveraging its analytics capabilities to improve patient outcomes, streamline processes, and reduce costs. The vast amount of data in healthcare presents a huge opportunity.

H2: Financial Projections and Growth Trajectory:

Reaching a trillion-dollar market cap necessitates significant and sustained financial growth.

H3: Revenue Growth and Profitability:

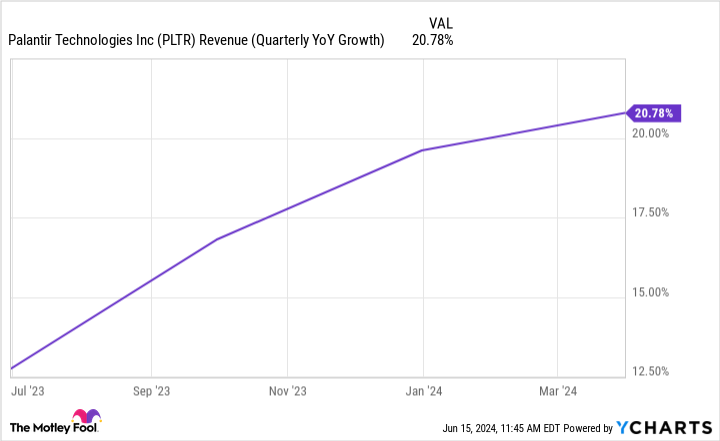

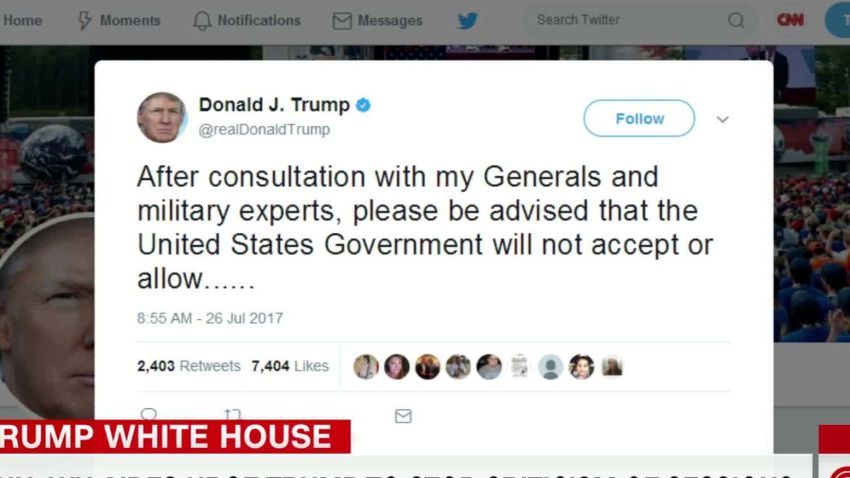

Analyzing Palantir's historical financial performance and projecting future revenue requires careful consideration of various factors. While past performance isn't indicative of future results, a realistic assessment of revenue growth, driven by increasing market adoption of its platforms, is crucial. This requires examining:

- Market size projections: Growth projections in the big data analytics market are essential for understanding Palantir's potential market share.

- Pricing models: Understanding how Palantir's pricing strategy will evolve and how it will respond to market pressures is key.

- Operating expenses: Managing operational expenses while maintaining innovation and growth is a significant challenge.

Accurate financial projections, ideally supported by visualizations like charts and graphs, are essential to evaluate the feasibility of the trillion-dollar valuation. Credible third-party financial analyses should be incorporated into this section.

H3: Strategic Acquisitions and Partnerships:

Strategic acquisitions and partnerships can significantly accelerate Palantir's growth trajectory. Acquiring companies with complementary technologies or expertise could provide access to new markets and technologies.

- Complementary Technologies: Acquisitions could enhance Palantir’s existing capabilities, offering new analytics tools or expanding data integration capabilities.

- New Market Access: Strategic partnerships could open doors to new customer segments or geographical markets.

- Synergies: The success of acquisitions and partnerships depends on effective integration and the ability to leverage synergies.

H2: Challenges and Risks to Achieving a Trillion-Dollar Market Cap:

Despite its strengths, several factors could hinder Palantir's path to a trillion-dollar market cap.

H3: Competition and Technological Disruption:

The big data analytics market is competitive. Key competitors, including established players and emerging startups, pose a significant challenge.

- Competitive Landscape: Analyzing the strengths and weaknesses of key competitors is crucial to assessing Palantir's position within the market.

- Technological Disruption: The rapid pace of technological advancement necessitates constant innovation to maintain a competitive edge. New technologies or approaches could potentially disrupt Palantir's market position.

H3: Regulatory and Geopolitical Risks:

Regulatory hurdles and geopolitical instability present potential risks to Palantir's operations and growth.

- Data Privacy Regulations: Stricter data privacy regulations, such as GDPR, could impact Palantir's operations and its ability to collect and analyze data.

- Geopolitical Uncertainty: Political instability or international conflicts could disrupt operations or limit access to certain markets.

3. Conclusion:

Reaching a trillion-dollar market cap by 2030 is an ambitious but not impossible goal for Palantir. The company possesses significant competitive advantages, including proprietary technology and a strong position in key sectors. However, challenges such as competition, technological disruption, and regulatory risks must be carefully considered. This analysis suggests that while Palantir's path to a trillion-dollar valuation is fraught with challenges, its innovative technology and strategic market positioning offer a compelling case for significant future growth. Investing in Palantir's future requires careful consideration of the opportunities and risks outlined in this analysis. Further research into Palantir's market potential and the broader big data analytics market is crucial for any investor considering a position in this ambitious company. The Palantir trillion-dollar valuation remains a compelling, yet uncertain, prospect.

Featured Posts

-

Trumps Plan To Restrict Migrants Right To Challenge Detention

May 10, 2025

Trumps Plan To Restrict Migrants Right To Challenge Detention

May 10, 2025 -

Edmonton Oilers Leon Draisaitls Recovery Timeline And Impact On Playoffs

May 10, 2025

Edmonton Oilers Leon Draisaitls Recovery Timeline And Impact On Playoffs

May 10, 2025 -

Analysis Trumps Selection Of Casey Means For Surgeon General

May 10, 2025

Analysis Trumps Selection Of Casey Means For Surgeon General

May 10, 2025 -

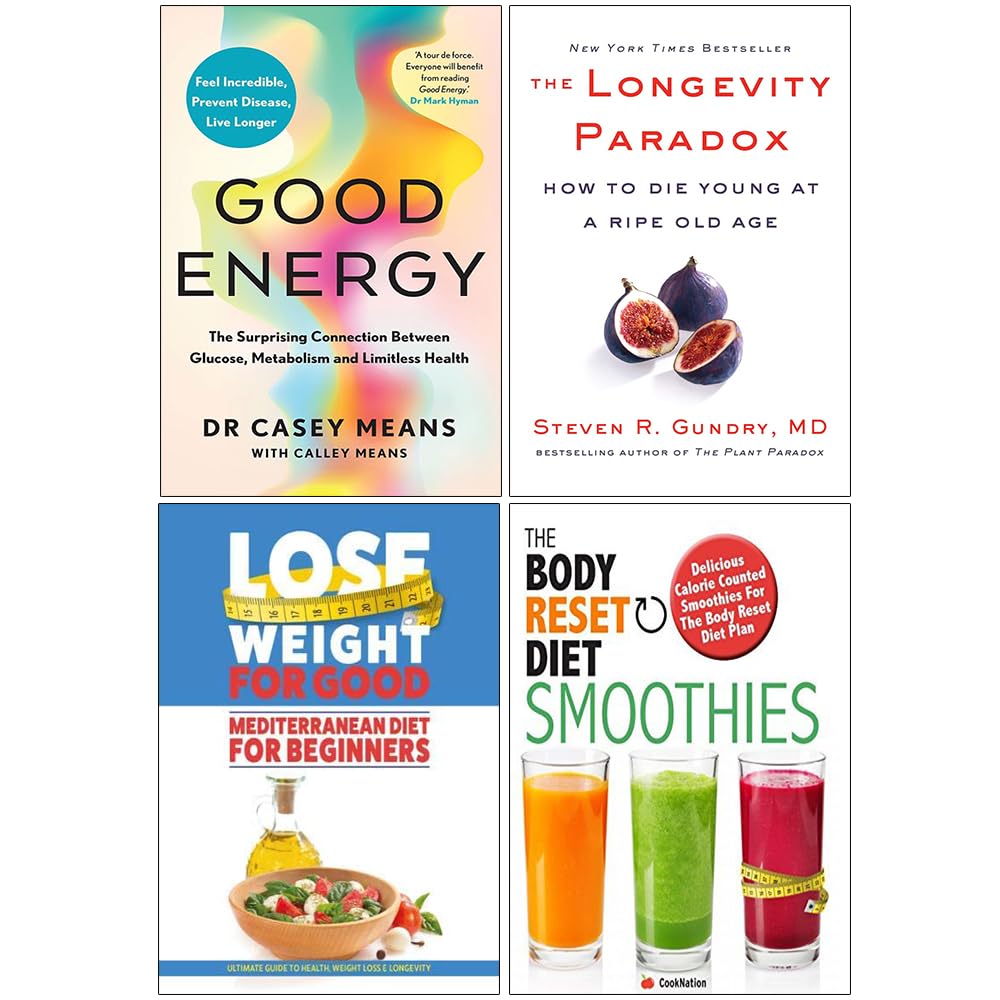

Understanding Trumps Policy On Transgender Individuals In The Military

May 10, 2025

Understanding Trumps Policy On Transgender Individuals In The Military

May 10, 2025 -

Mstwa Fyraty Me Alerby Alqtry Bed Rhylh En Alahly Almsry

May 10, 2025

Mstwa Fyraty Me Alerby Alqtry Bed Rhylh En Alahly Almsry

May 10, 2025