Paris Facing Financial Strain: Analysis Of The Luxury Sector's Decline

Table of Contents

Decreased Tourist Spending & Geopolitical Instability

The decline in international tourism has severely impacted luxury spending in Paris. This is a major factor in the Paris luxury sector decline.

Impact of Reduced International Travel

Geopolitical uncertainty, economic downturns in key markets (like China and Russia), and the lingering effects of the pandemic have significantly reduced international travel. This directly translates to less spending in the luxury sector.

- Fewer high-spending tourists visiting flagship stores: Luxury boutiques rely heavily on high-spending tourists, and their absence is acutely felt.

- Reduced demand for luxury hotels and Michelin-starred restaurants: The occupancy rates in luxury hotels and the number of diners in top restaurants have dropped considerably.

- Lower occupancy rates in luxury accommodations: From exclusive hotels to high-end apartments, occupancy rates reflect the decrease in luxury tourism.

- Impact of visa restrictions and travel advisories: Bureaucratic hurdles and safety concerns deter potential high-spending visitors.

Geopolitical Factors and Consumer Confidence

The ongoing war in Ukraine, rising inflation, and global economic uncertainty have dampened consumer confidence worldwide, impacting discretionary spending on luxury goods. This is a crucial aspect of the Paris luxury sector decline.

- Impact of sanctions and economic instability on luxury purchasing power: Economic sanctions and global instability directly impact the spending power of high-net-worth individuals, the primary consumers of luxury goods.

- Shifting consumer priorities towards essential goods: In times of economic uncertainty, consumers tend to prioritize essential goods over luxury items.

- Increased reluctance to make large luxury purchases: The fear of economic downturn makes potential buyers hesitant to commit to significant luxury purchases.

Increased Competition from Emerging Luxury Markets

The rise of domestic luxury brands in emerging markets presents a significant challenge to the Parisian luxury sector, contributing significantly to the Paris luxury sector decline.

Rise of Domestic Luxury Brands in Asia and the Middle East

Strong domestic luxury brands in China and the Middle East are increasingly attracting consumers who previously favored European brands.

- Increased brand awareness and loyalty to domestic luxury brands: These brands effectively cater to local tastes and preferences, fostering strong brand loyalty.

- Competitive pricing strategies of emerging luxury brands: Often, these brands offer competitive pricing, making them more attractive to a wider range of consumers.

- Focus on catering to local tastes and preferences: Understanding and meeting the specific needs and preferences of their target markets gives these brands a competitive edge.

E-commerce and the Shift in Luxury Consumption

The growth of online luxury retail channels is a double-edged sword. While it expands reach, it also intensifies competition and requires significant investment in digital infrastructure. This is a key factor in the Paris luxury sector decline.

- Increased competition from online luxury retailers: Global online retailers compete directly with Parisian boutiques, impacting sales.

- Need for enhanced digital marketing and e-commerce strategies: Parisian brands need to invest heavily in robust digital platforms and marketing to remain competitive.

- Maintaining the exclusive experience of luxury shopping online: Replicating the exclusive in-store experience online is a significant challenge for Parisian luxury brands.

Rising Costs and Economic Pressures

Increased operating costs and economic pressures are squeezing profit margins, further contributing to the Paris luxury sector decline.

Inflation and Increased Operating Costs

Rising costs of raw materials, labor, and rent significantly impact the profitability of Parisian luxury businesses.

- Impact of inflation on raw material costs for luxury goods: Inflation affects the cost of producing luxury goods, impacting profit margins.

- Rising labor costs and employee benefits: Increased salaries and benefits add to operating expenses.

- Increased property taxes and operating expenses: High property taxes and other operating costs further strain the profitability of businesses.

The Impact on Parisian Businesses and Employment

The decline in the luxury sector is leading to job losses and business closures, impacting the overall economic health of Paris. This is a serious consequence of the Paris luxury sector decline.

- Job losses in the luxury retail, hospitality, and tourism sectors: The decline directly translates to job losses across various sectors related to the luxury industry.

- Business closures and bankruptcies: Many businesses are struggling to remain profitable and are facing closures or bankruptcy.

- Impact on local tax revenue and economic growth: The decline affects local tax revenue and overall economic growth in Paris.

Conclusion

The decline of the Paris luxury sector is a multifaceted problem stemming from decreased tourism, increased global competition, and rising economic pressures. Addressing this Paris luxury sector decline requires a strategic approach. This includes investing in tourism infrastructure, supporting local businesses through targeted initiatives, and adapting to the ever-evolving landscape of luxury consumption. Understanding the dynamics of the Paris luxury sector decline is crucial for policymakers, businesses, and stakeholders. Proactive measures are needed to ensure the long-term health and prosperity of this iconic industry, preventing further negative impacts on Paris's economy and global standing. Ignoring this Paris luxury sector decline could have devastating long-term consequences. We must act now to revitalize this vital sector.

Featured Posts

-

Kharkovschina Svadebniy Den Data Pochti 40 Brakosochetaniy Fotoreportazh

May 24, 2025

Kharkovschina Svadebniy Den Data Pochti 40 Brakosochetaniy Fotoreportazh

May 24, 2025 -

La Lutte Contre La Dissidence Chinoise En France

May 24, 2025

La Lutte Contre La Dissidence Chinoise En France

May 24, 2025 -

Amsterdam Stock Exchange 7 Plunge Reflects Growing Trade War Anxiety

May 24, 2025

Amsterdam Stock Exchange 7 Plunge Reflects Growing Trade War Anxiety

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Understanding Net Asset Value Nav

May 24, 2025 -

Cac 40 Fridays Red Weekly Stability Market Update March 7 2025

May 24, 2025

Cac 40 Fridays Red Weekly Stability Market Update March 7 2025

May 24, 2025

Latest Posts

-

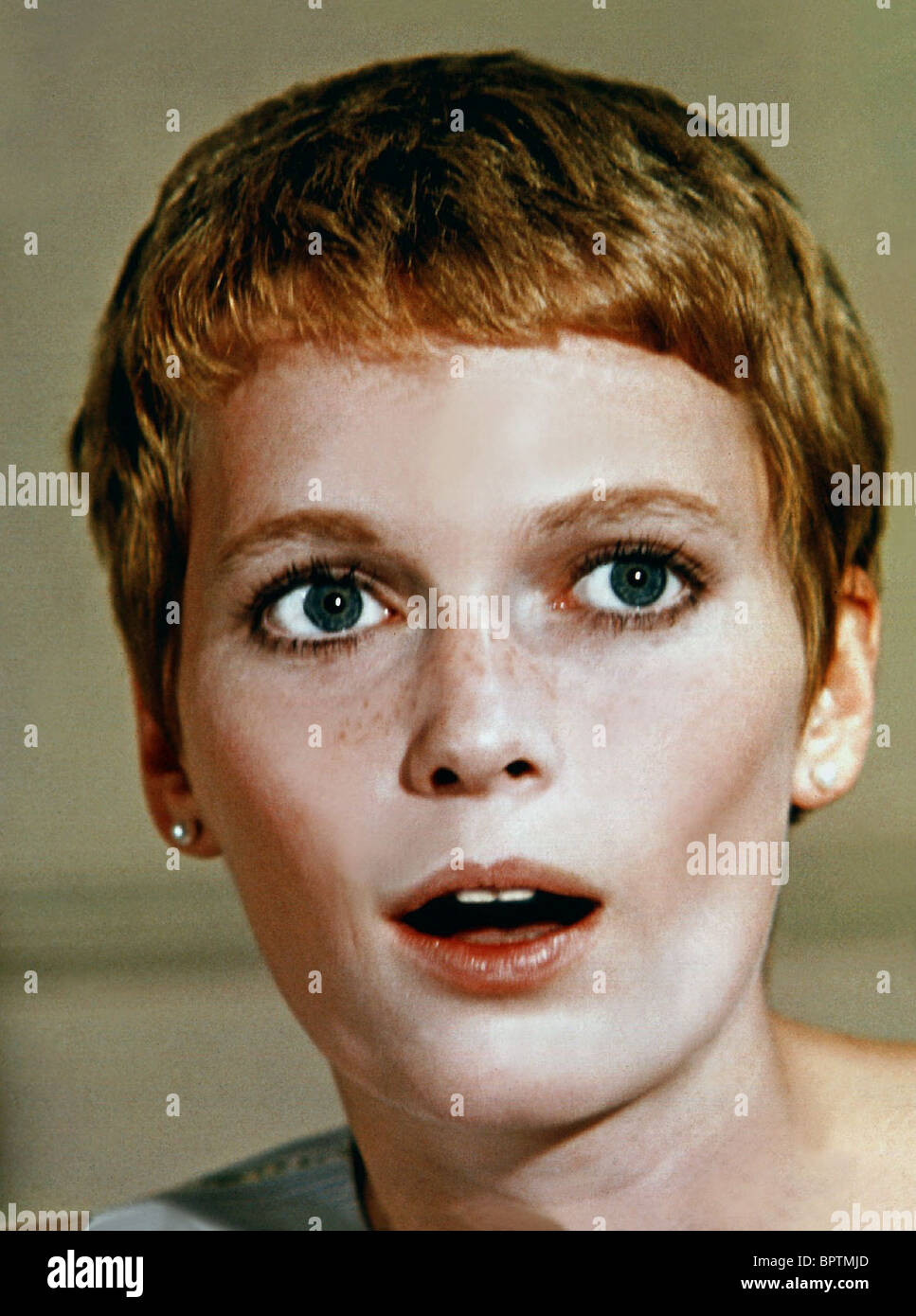

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025 -

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025 -

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025