PBOC Yuan Intervention: Below Projections For The First Time This Year

Table of Contents

Reasons Behind the Reduced PBOC Yuan Intervention

Several factors contribute to the reduced PBOC Yuan intervention observed this year. Understanding these underlying causes is crucial for comprehending the current state of the Chinese currency and its future trajectory.

Weakening External Demand

Decreased global demand for Chinese exports has placed significant downward pressure on the Yuan. Reduced trade surpluses directly impact the PBOC's ability to effectively support the currency through Forex Intervention. The weakening external demand is a key driver of the reduced intervention.

- Technology Sector Decline: Reduced global tech spending has led to lower demand for Chinese-manufactured electronics and components.

- Manufacturing Slowdown: Global economic uncertainty has dampened demand for manufactured goods, impacting Chinese exports significantly.

- Geopolitical Factors: Rising trade tensions and sanctions have further constrained export growth, putting additional pressure on the Yuan.

Capital Outflows

Increased capital flight, as investors seek higher returns in other markets, further contributes to the weakening Yuan. Concerns about China's economic growth slowing down are a primary driver of these capital outflows.

- Diversification Strategies: Global investors are diversifying their portfolios, moving away from Chinese assets due to perceived risks.

- Higher Interest Rates Elsewhere: Attractive interest rates in other developed economies are incentivizing capital flight from China.

- Regulatory Uncertainty: Changes in Chinese regulations and policies contribute to investor uncertainty, prompting capital outflows.

Shifting Policy Priorities

The PBOC might be prioritizing other economic goals, such as domestic stability, over strict Yuan management. This shift in focus implies a trade-off between maintaining a stable currency exchange rate and addressing other pressing economic concerns.

- Focus on Domestic Consumption: Stimulating domestic demand and consumption might be prioritized over maintaining a specific Yuan exchange rate.

- Debt Management: Addressing the high levels of corporate debt within the Chinese economy might be a more pressing concern.

- Inflation Control: Balancing the need for currency stability with managing inflationary pressures within the Chinese economy.

Implications of Reduced Intervention for the Yuan

The reduced PBOC Yuan intervention has several significant implications for the Chinese currency and the global economy. Understanding these implications is vital for businesses and investors navigating the changing landscape.

Increased Volatility

Less PBOC intervention leads to a more volatile Yuan exchange rate. This uncertainty can significantly impact international trade and investment decisions, making future planning challenging.

- Sharp Fluctuations: The Yuan's value is expected to experience larger and more frequent fluctuations against the US dollar and other major currencies.

- Hedging Costs: Businesses will face increased costs associated with hedging against currency risks.

- Investment Uncertainty: The heightened volatility makes it difficult for investors to accurately predict future returns on Yuan-denominated assets.

Depreciation Pressure

The Yuan could face further depreciation against the US dollar and other major currencies. This depreciation could impact inflation and import costs in China, potentially leading to increased prices for consumers.

- Import Costs: A weaker Yuan makes imports more expensive, potentially fueling inflation.

- Inflationary Pressures: Rising import costs can translate into higher consumer prices, impacting purchasing power.

- Competitiveness Concerns: While a weaker Yuan can boost exports, it also raises concerns about potential trade imbalances.

Impact on Global Markets

A weaker Yuan can impact global trade balances and currency valuations, creating uncertainty in international markets. Changes in the Yuan's value have far-reaching consequences for the global economy.

- Currency Wars: A significant devaluation of the Yuan could trigger competitive devaluations by other countries, potentially destabilizing the global financial system.

- Trade Imbalances: Changes in the Yuan's value can exacerbate existing trade imbalances between China and other nations.

- Global Market Volatility: Uncertainty surrounding the Yuan's future can spill over into other global markets, creating wider economic instability.

Future Outlook for PBOC Yuan Intervention

Predicting the future of PBOC Yuan intervention is complex, with several potential scenarios. The PBOC's response will be influenced by a range of economic and political factors.

Potential for Increased Intervention

The PBOC may increase intervention if the Yuan depreciates too rapidly, or if the government sets new exchange rate targets. This would represent a return to a more active role in managing the currency's value.

- Emergency Intervention: Significant and rapid depreciation could trigger immediate intervention to stabilize the market.

- New Exchange Rate Targets: The government may set new, more restrictive targets for the Yuan's exchange rate.

- Increased Forex Reserves Use: The PBOC might utilize its substantial foreign exchange reserves to support the Yuan.

Continued Reduced Intervention

The PBOC might maintain a less interventionist approach, allowing market forces to determine the Yuan's value more freely. This strategy could lead to greater market efficiency but also increased volatility.

- Market Efficiency: Allowing market forces to dictate the exchange rate could lead to a more efficient pricing mechanism.

- Increased Volatility: This approach could lead to higher levels of volatility, potentially creating challenges for businesses and investors.

- Gradual Adjustment: The PBOC may adopt a gradual approach, incrementally reducing its intervention over time.

Policy Adjustments

The Chinese government may implement other economic policies to support the Yuan, including fiscal and monetary policy adjustments. These complementary measures aim to stabilize the currency and support economic growth.

- Fiscal Stimulus: Increased government spending could boost economic activity and support the Yuan indirectly.

- Monetary Policy Easing: Lowering interest rates could stimulate investment and growth, potentially supporting the Yuan.

- Structural Reforms: Implementing structural economic reforms to improve efficiency and attract foreign investment.

Conclusion

The recent decrease in PBOC Yuan intervention marks a significant shift in China's currency management strategy. The reasons behind this reduction are multifaceted, encompassing weakening external demand, capital outflows, and a potential shift in policy priorities. The implications are far-reaching, potentially leading to increased Yuan volatility, depreciation pressure, and ripple effects across global markets. The future outlook remains uncertain, with possibilities ranging from renewed intervention to a continued less interventionist approach.

Call to Action: Stay informed about the ongoing developments in PBOC Yuan intervention and its impact on the global economy. Understanding the dynamics of PBOC Yuan intervention is crucial for investors and businesses alike. Continue to monitor reputable sources for up-to-date analysis on the Chinese Yuan and its exchange rate.

Featured Posts

-

Chinas Fentanyl Price Former Us Envoy On The Consequences

May 16, 2025

Chinas Fentanyl Price Former Us Envoy On The Consequences

May 16, 2025 -

35 Seconds Of Shock How An Ex Soldier Subdued Paddy Pimblett

May 16, 2025

35 Seconds Of Shock How An Ex Soldier Subdued Paddy Pimblett

May 16, 2025 -

Roma Monza En Directo Sigue El Partido Online

May 16, 2025

Roma Monza En Directo Sigue El Partido Online

May 16, 2025 -

Dodgers Offseason Review Key Moves And Roster Outlook

May 16, 2025

Dodgers Offseason Review Key Moves And Roster Outlook

May 16, 2025 -

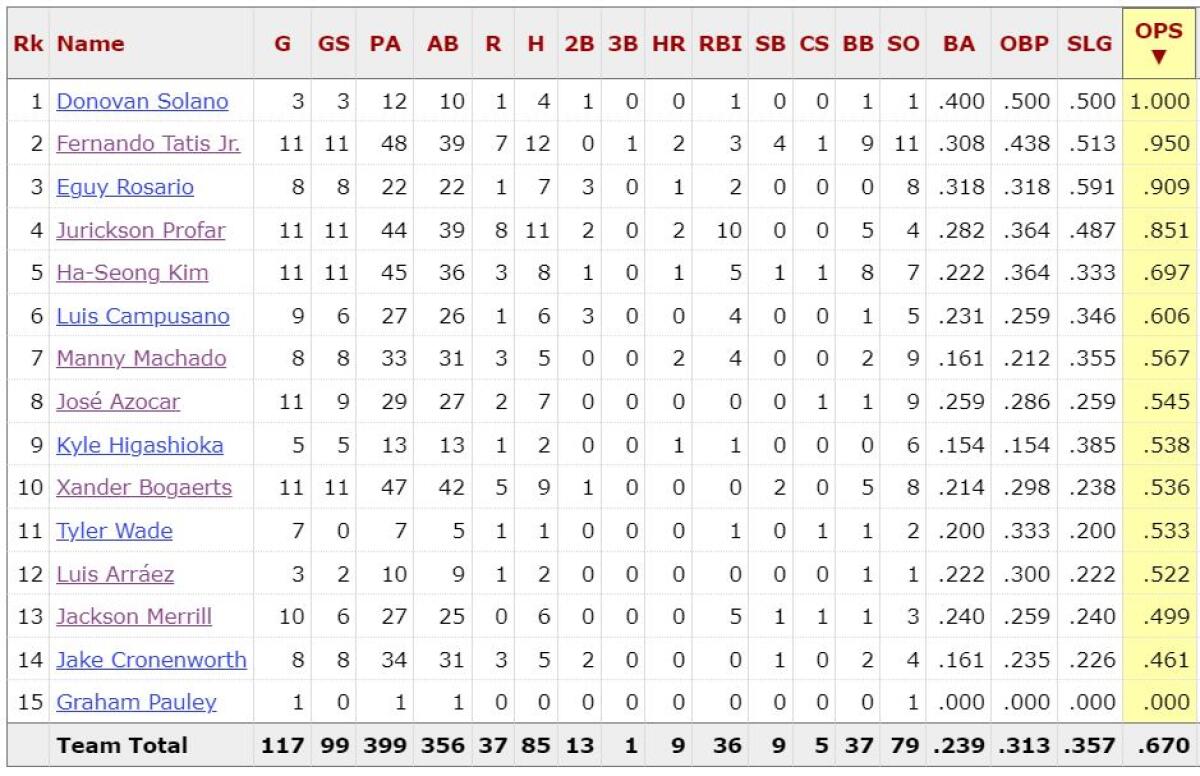

Padres Vs Opponent Pregame Analysis Arraez And Heyward Key To Victory

May 16, 2025

Padres Vs Opponent Pregame Analysis Arraez And Heyward Key To Victory

May 16, 2025