Personal Loan Interest Rates Today: Factors Affecting Your Rate

Table of Contents

Your Credit Score: The Foundation of Your Interest Rate

Your credit score is arguably the most significant factor determining your personal loan interest rate. Lenders use your credit score to assess your creditworthiness – essentially, how likely you are to repay the loan. A higher credit score signifies lower risk to the lender, resulting in a lower interest rate. Conversely, a lower credit score indicates higher risk, leading to higher interest rates or even loan rejection.

- Credit score ranges and their impact on rates: Generally, credit scores range from 300 to 850. Scores above 700 typically qualify for the most favorable personal loan interest rates. Scores below 600 often result in significantly higher rates or loan denials.

- Importance of checking your credit report for errors: Before applying for a loan, thoroughly review your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) for any errors. Errors can negatively impact your score and your ability to secure a low interest rate.

- Strategies to improve your credit score before applying: If your credit score is less than ideal, work on improving it before applying for a loan. This includes paying down debt, paying bills on time, and keeping your credit utilization low.

- Impact of hard inquiries (multiple loan applications) on your score: Each time you apply for a loan, a "hard inquiry" is recorded on your credit report. Multiple hard inquiries in a short period can slightly lower your credit score, so it's best to shop around strategically and compare offers from multiple lenders within a short timeframe.

Loan Amount and Term Length: Balancing Affordability and Cost

The amount you borrow and the repayment period (loan term) significantly affect your personal loan interest rate. Larger loan amounts generally come with higher interest rates because they represent a greater risk to the lender. Similarly, longer loan terms often result in higher interest rates because the lender is exposed to the risk for a longer period.

- Relationship between loan amount and interest rate: Borrowing a smaller amount typically results in a lower interest rate compared to borrowing a larger sum.

- Impact of loan term length on monthly payments and overall interest paid: While a longer loan term results in lower monthly payments, you'll end up paying significantly more interest over the life of the loan. Shorter terms mean higher monthly payments but lower overall interest.

- Strategies for finding the optimal balance between loan amount and repayment period: Carefully consider your budget and financial goals when choosing a loan amount and term. Use a loan amortization calculator to understand the total interest paid under different scenarios.

- The concept of amortization and its effect on interest paid: Amortization is the process of paying off a loan in installments. In the early stages of repayment, a larger portion of your payment goes towards interest, while in later stages, more goes towards principal.

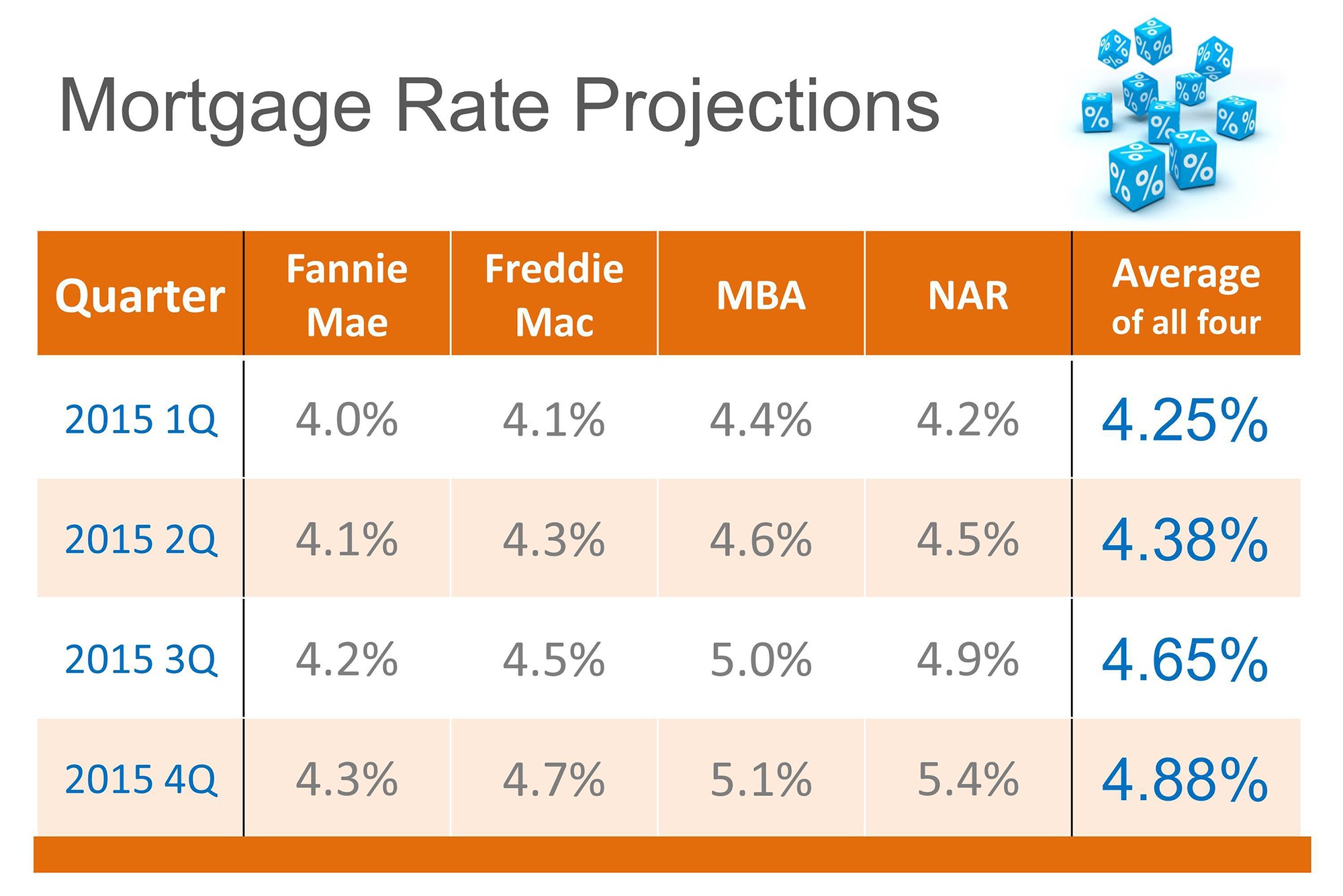

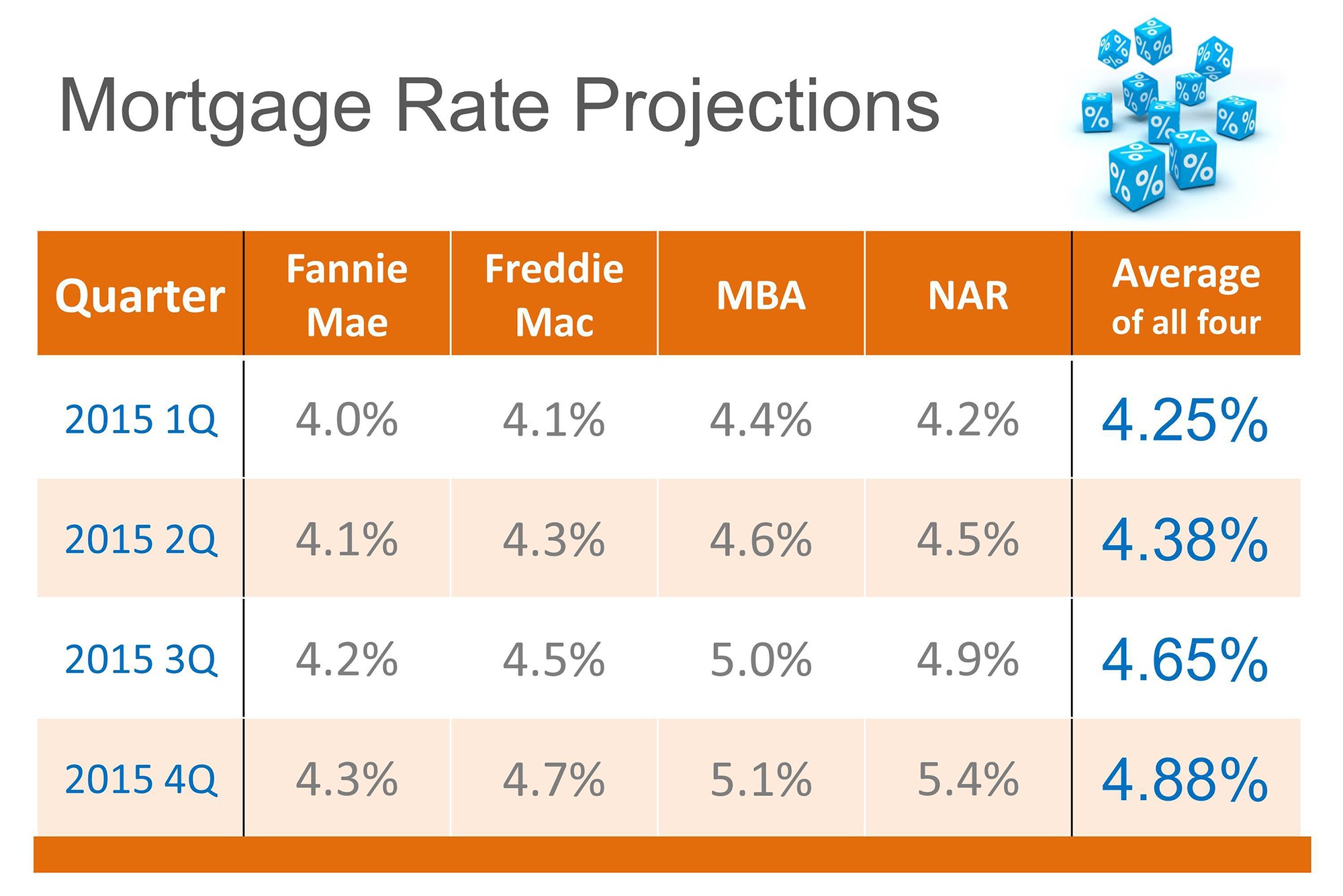

Lender Type and Market Conditions: A Comparative Analysis

Different lenders offer varying personal loan interest rates. Banks, credit unions, and online lenders all have their own pricing structures. Furthermore, prevailing market conditions, such as the prime rate, significantly influence interest rates across the board.

- Comparison of interest rates from different lenders: Always compare offers from multiple lenders before making a decision. Interest rates and fees can vary substantially.

- Advantages and disadvantages of each type of lender: Banks often offer a wide range of loan options, while credit unions may offer lower rates to their members. Online lenders are often known for their convenience and speed of application.

- Impact of current economic conditions on interest rates: Interest rates generally rise during periods of economic growth and fall during economic downturns. Stay informed about prevailing market conditions.

- Understanding APR (Annual Percentage Rate) and its components: The APR is the total annual cost of borrowing, including interest and fees. It provides a comprehensive comparison of loan offers.

The Impact of Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) is a crucial factor lenders consider when assessing your loan application. DTI represents the percentage of your gross monthly income that goes towards debt payments. A high DTI indicates a higher risk to lenders, as it suggests you may struggle to manage additional debt.

- Calculating your debt-to-income ratio: Divide your total monthly debt payments by your gross monthly income.

- Strategies for lowering your DTI: Reduce your debt, increase your income, or both to lower your DTI before applying for a loan.

- How lenders use DTI to assess risk: Lenders use DTI as an indicator of your ability to repay the loan. A lower DTI improves your chances of approval and helps you secure a better interest rate.

Additional Fees and Charges: Hidden Costs to Consider

Beyond the interest rate, several fees can impact the overall cost of your personal loan. Understanding these fees is crucial to making an informed decision.

- Common types of personal loan fees: These include origination fees, prepayment penalties, late payment fees, and others.

- How to compare loans considering these additional costs: Don't just focus on the interest rate; compare the total cost of the loan, including all fees.

- Avoiding unnecessary fees: Carefully review the loan agreement before signing to understand all associated fees. Choose a lender with transparent and reasonable fee structures.

Conclusion

Understanding today's personal loan interest rates requires a comprehensive view of several interacting factors. Your credit score, the loan amount and term, the lender's policies, market conditions, your debt-to-income ratio, and associated fees all play a significant role in the interest rate you'll receive. By carefully considering these elements and comparing offers from multiple lenders, you can secure the best possible personal loan interest rate and make a smart financial decision. Start comparing personal loan interest rates today and find the best loan for your needs!

Featured Posts

-

Hailee Steinfeld And Fiance Josh Allens Wedding A Four Month Engagement Celebration

May 28, 2025

Hailee Steinfeld And Fiance Josh Allens Wedding A Four Month Engagement Celebration

May 28, 2025 -

Padres On Deck Seeking Revenge Against The Rockies

May 28, 2025

Padres On Deck Seeking Revenge Against The Rockies

May 28, 2025 -

Gunners Beat Spurs To Striker Signing 58m Bid Rejected

May 28, 2025

Gunners Beat Spurs To Striker Signing 58m Bid Rejected

May 28, 2025 -

Dangerous Climate Whiplash A Global Urban Crisis

May 28, 2025

Dangerous Climate Whiplash A Global Urban Crisis

May 28, 2025 -

Beyonce And Taylor Swifts Dominance 2025 Ama Nominations

May 28, 2025

Beyonce And Taylor Swifts Dominance 2025 Ama Nominations

May 28, 2025

Latest Posts

-

Epcots Flower And Garden Festival What To See And Do

May 30, 2025

Epcots Flower And Garden Festival What To See And Do

May 30, 2025 -

Le Ministre Tabarot Confirme L Ouverture Du Tunnel De Tende Pour Juin

May 30, 2025

Le Ministre Tabarot Confirme L Ouverture Du Tunnel De Tende Pour Juin

May 30, 2025 -

Planning Your Trip To The Epcot Flower And Garden Festival

May 30, 2025

Planning Your Trip To The Epcot Flower And Garden Festival

May 30, 2025 -

Tunnel De Tende Ouverture Prevue En Juin Selon Le Ministre Tabarot

May 30, 2025

Tunnel De Tende Ouverture Prevue En Juin Selon Le Ministre Tabarot

May 30, 2025 -

Ouverture Du Tunnel De Tende En Juin Confirmation Du Ministre Tabarot

May 30, 2025

Ouverture Du Tunnel De Tende En Juin Confirmation Du Ministre Tabarot

May 30, 2025