Personal Loan Interest Rates Today: Find Financing Starting Under 6%

Table of Contents

Factors Influencing Personal Loan Interest Rates

Several crucial factors determine the personal loan interest rates you'll encounter. Understanding these factors is the first step toward securing a favorable rate.

Your Credit Score: The Cornerstone of Your Rate

Your credit score is arguably the most significant factor influencing your personal loan interest rate. Lenders use your credit score to assess your creditworthiness – essentially, your likelihood of repaying the loan. A higher credit score translates to a lower interest rate, reflecting the lender's lower perceived risk.

- Excellent Credit (750+): Expect personal loan rates under 6%, potentially even lower with exceptional offers.

- Good Credit (700-749): You'll likely secure rates between 6% and 12%, depending on other factors.

- Fair Credit (650-699): Interest rates will typically fall between 12% and 20%, significantly increasing the cost of borrowing.

- Poor Credit (Below 650): Securing a loan might be difficult, and if approved, you'll face substantially higher rates, often exceeding 20%. You may need to consider secured loans or alternative lending options.

It's crucial to check your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) for accuracy. Disputes can be filed to correct any errors, potentially improving your credit score and securing better personal loan interest rates.

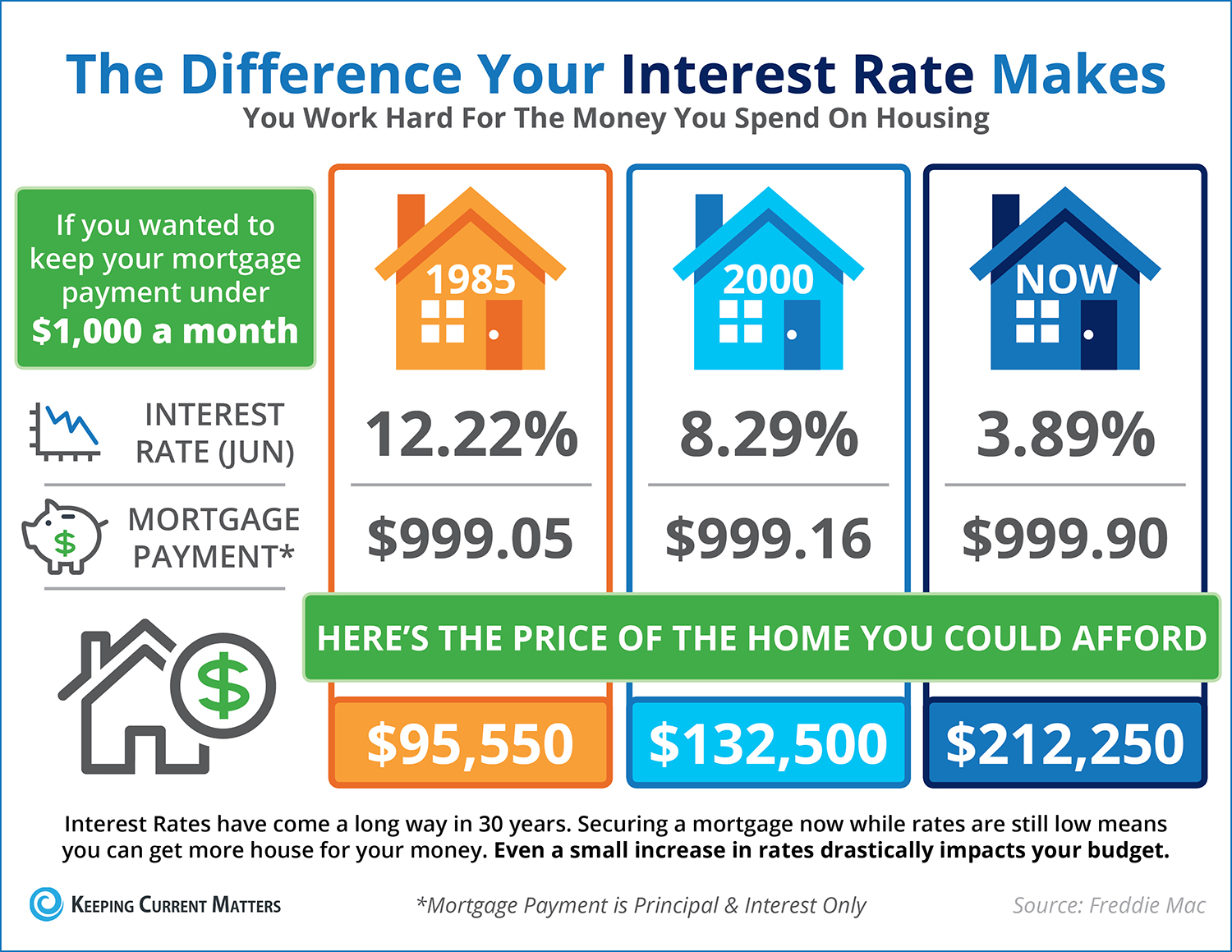

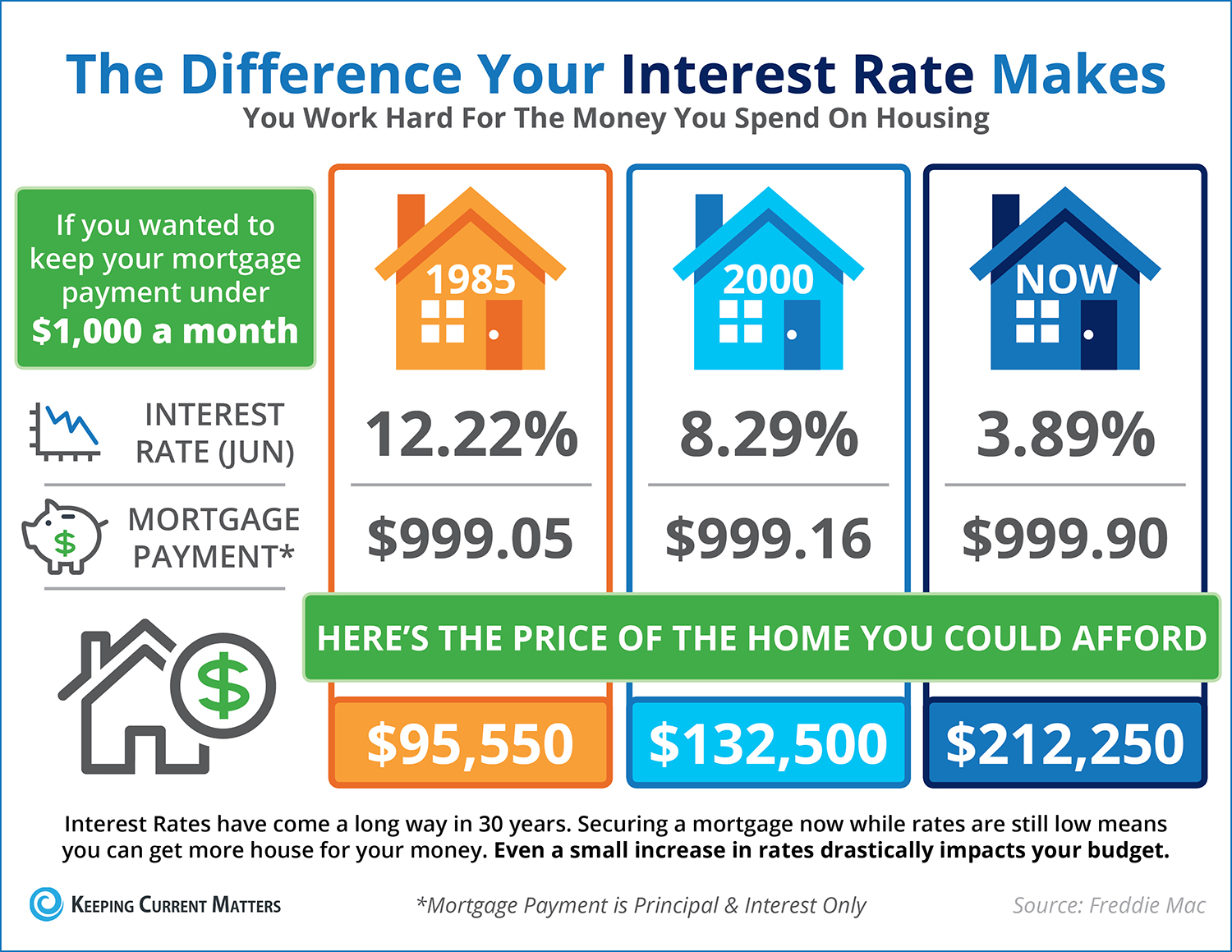

Loan Amount and Term: Size and Duration Matter

The amount you borrow and the length of your repayment term also play a role in determining your interest rate. Larger loan amounts and longer terms generally result in higher rates because they represent a greater risk for lenders.

- Loan Amount: A $5,000 loan might attract a lower rate than a $20,000 loan, all other factors being equal.

- Loan Term: A 36-month loan will usually have a lower interest rate than a 60-month loan for the same amount because the lender's risk is reduced with a shorter repayment period.

Carefully consider your borrowing needs and repayment capacity to balance the loan amount and term for the best possible interest rate.

Lender Type: Banks, Credit Unions, and Online Lenders

Different lenders offer varying personal loan interest rates. Each type has its own strengths and weaknesses.

- Banks: Typically offer a wide range of loan products but might have stricter eligibility criteria and potentially higher rates than credit unions.

- Credit Unions: Often offer more competitive interest rates and better terms for members, but membership requirements might apply.

- Online Lenders: Offer convenience and potentially faster processing, but carefully compare their fees and rates.

Current Economic Conditions: The Macroeconomic Impact

Prevailing interest rates set by central banks significantly influence personal loan rates. Factors like inflation and economic growth directly affect the lending environment. Higher inflation and economic uncertainty can lead to higher interest rates across the board, impacting personal loans as well. This is an external factor beyond individual control, but awareness of it is crucial in timing loan applications.

How to Find the Best Personal Loan Interest Rates

Finding the best personal loan interest rates requires diligent research and comparison.

Shop Around and Compare: Don't Settle for the First Offer

Never settle for the first offer you receive. Compare offers from multiple lenders – banks, credit unions, and online lenders – to identify the most competitive personal loan rates.

- Use online comparison tools: Several websites offer comparison services for personal loans, allowing you to quickly see rates from various lenders.

- Visit individual lender websites: Check the rates and terms directly on the websites of banks and credit unions in your area, and online lenders.

Check for Fees and APR: The True Cost of Borrowing

Don't focus solely on the interest rate; consider all associated fees and the Annual Percentage Rate (APR). The APR represents the total cost of the loan, including interest and fees.

- Origination fees: A one-time fee charged by the lender upon loan approval.

- Prepayment penalties: Fees charged if you repay the loan early.

Improve Your Credit Score: A Proactive Approach

A higher credit score is your most potent weapon in securing low interest personal loans.

- Pay bills on time: Consistently making timely payments is crucial for building a good credit history.

- Reduce credit utilization: Keep your credit card balances low relative to your available credit.

Consider Secured vs. Unsecured Loans: Collateral's Impact

Secured loans require collateral (e.g., a car or savings account), while unsecured loans don't. Secured loans typically come with lower interest rates because the lender has less risk.

Securing a Personal Loan with Low Interest Rates

Even with a good credit score, securing the best rates requires strategic steps.

Pre-qualification: Check Your Eligibility Without Affecting Credit

Pre-qualify with multiple lenders to get a sense of the rates you're likely to receive without impacting your credit score.

Strong Application: Maximize Your Chances of Approval

Submit a complete and accurate loan application, highlighting your positive financial aspects and demonstrating your ability to repay the loan.

Negotiate the Rate: Sometimes, It Pays to Ask

For larger loan amounts or with excellent credit, you might be able to negotiate a lower interest rate with the lender.

Conclusion

Securing a personal loan with favorable interest rates depends on several key factors, including your credit score, the loan amount and term, the lender you choose, and current economic conditions. By comparing offers from multiple lenders, understanding all associated fees, and proactively improving your credit score, you can significantly improve your chances of securing the best personal loan interest rates. Don't settle for high interest rates! Use the information in this article to find personal loan interest rates under 6% and secure the financing you need. Start comparing personal loan interest rates today!

Featured Posts

-

Comparatif Prix Samsung Galaxy S25 Ultra A 1294 90 E

May 28, 2025

Comparatif Prix Samsung Galaxy S25 Ultra A 1294 90 E

May 28, 2025 -

Wawali Balikpapan Taman Kota Baru Di Setiap Kecamatan

May 28, 2025

Wawali Balikpapan Taman Kota Baru Di Setiap Kecamatan

May 28, 2025 -

Man Utd Transfer News Star Players Future Uncertain Amidst Conflicting Interests

May 28, 2025

Man Utd Transfer News Star Players Future Uncertain Amidst Conflicting Interests

May 28, 2025 -

Social Housing Rent Freeze Private Landlords Exempt

May 28, 2025

Social Housing Rent Freeze Private Landlords Exempt

May 28, 2025 -

Is Tyrese Haliburton Playing Tonight Bulls Pacers Injury News

May 28, 2025

Is Tyrese Haliburton Playing Tonight Bulls Pacers Injury News

May 28, 2025

Latest Posts

-

Ouverture Du Tunnel De Tende En Juin Confirmation Du Ministre Tabarot

May 30, 2025

Ouverture Du Tunnel De Tende En Juin Confirmation Du Ministre Tabarot

May 30, 2025 -

Epcot Flower And Garden Festival 2024 Dates Events And More

May 30, 2025

Epcot Flower And Garden Festival 2024 Dates Events And More

May 30, 2025 -

A French Rape Victims Story Gisele Pelicots Book Optioned By Hbo

May 30, 2025

A French Rape Victims Story Gisele Pelicots Book Optioned By Hbo

May 30, 2025 -

Epcot International Flower And Garden Festival A Complete Guide

May 30, 2025

Epcot International Flower And Garden Festival A Complete Guide

May 30, 2025 -

Hbo Announces Adaptation Of Gisele Pelicots Powerful Memoir

May 30, 2025

Hbo Announces Adaptation Of Gisele Pelicots Powerful Memoir

May 30, 2025