Personal Loan Interest Rates Today: What You Need To Know Before Applying

Table of Contents

Understanding Current Personal Loan Interest Rates

Personal loan interest rates are dynamic, fluctuating based on various economic and individual factors. Market conditions, the overall health of the economy, and the Federal Reserve's actions all play a role. Beyond the broader economic landscape, your personal circumstances heavily influence the interest rate you'll receive.

-

Current Average Interest Rates: The average interest rate for personal loans varies greatly depending on the loan amount. For smaller loans (under $5,000), you might see rates ranging from 8% to 20%, while larger loans ($10,000-$50,000) could range from 7% to 18%. These are just estimates, and the actual rate you qualify for will depend on your creditworthiness.

-

Types of Personal Loans and Interest Rates: Secured personal loans, backed by collateral like a car or savings account, typically offer lower interest rates (potentially 5% to 15%) compared to unsecured loans (which might range from 10% to 30%), because the lender has less risk. Other loan types, like debt consolidation loans or payday loans, will also have different interest rate ranges.

-

Finding Up-to-Date Information: To find the most current information on personal loan interest rates, consult reputable online comparison websites specializing in personal loans. Many banks and credit unions also publish their current rates on their websites. Remember that these rates are subject to change daily.

Factors Affecting Your Personal Loan Interest Rate

Several key factors influence the interest rate a lender offers. Understanding these elements is crucial for securing a favorable rate.

-

Credit Score: Your credit score is paramount. A higher score (700 or above is generally considered good) demonstrates creditworthiness and reduces lender risk, resulting in significantly lower interest rates. Improve your credit score by paying bills on time, maintaining low credit utilization, and avoiding new credit applications.

-

Debt-to-Income Ratio (DTI): Your DTI is the percentage of your gross monthly income that goes towards debt payments. A lower DTI indicates a greater capacity to repay a loan, making you a less risky borrower and potentially securing a lower interest rate. Managing your DTI involves paying down existing debts and budgeting effectively.

-

Loan Amount and Term: Larger loan amounts typically come with higher interest rates, reflecting increased lender risk. Similarly, longer loan terms (more months to repay) usually mean higher overall interest costs, although monthly payments will be lower. Find a balance between affordability and the total interest you'll pay.

-

Loan Type (Secured vs. Unsecured): As mentioned earlier, secured loans, where you pledge collateral, typically offer lower interest rates than unsecured loans because they provide a safety net for the lender. Consider if you're comfortable pledging assets to secure a lower rate.

-

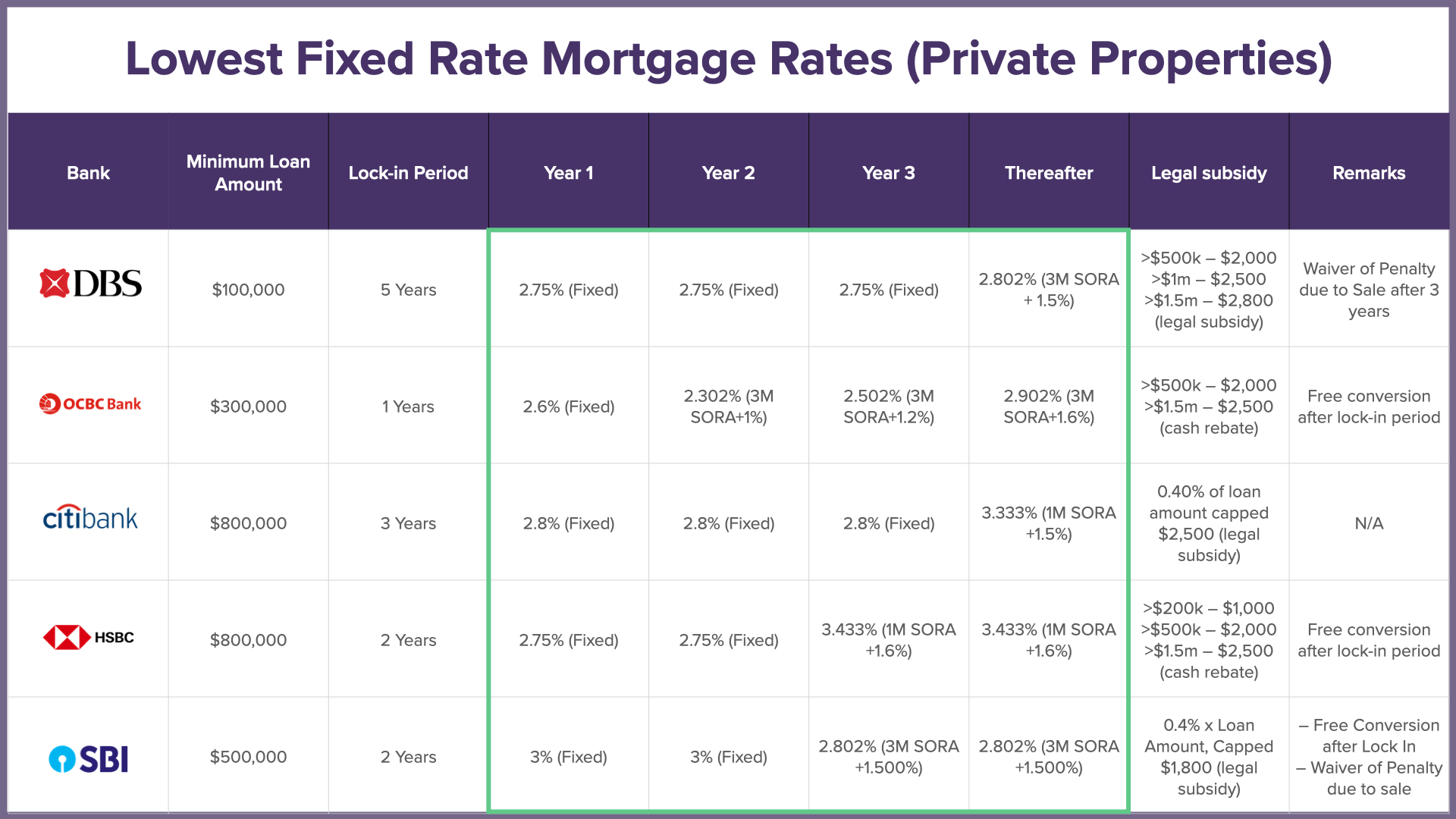

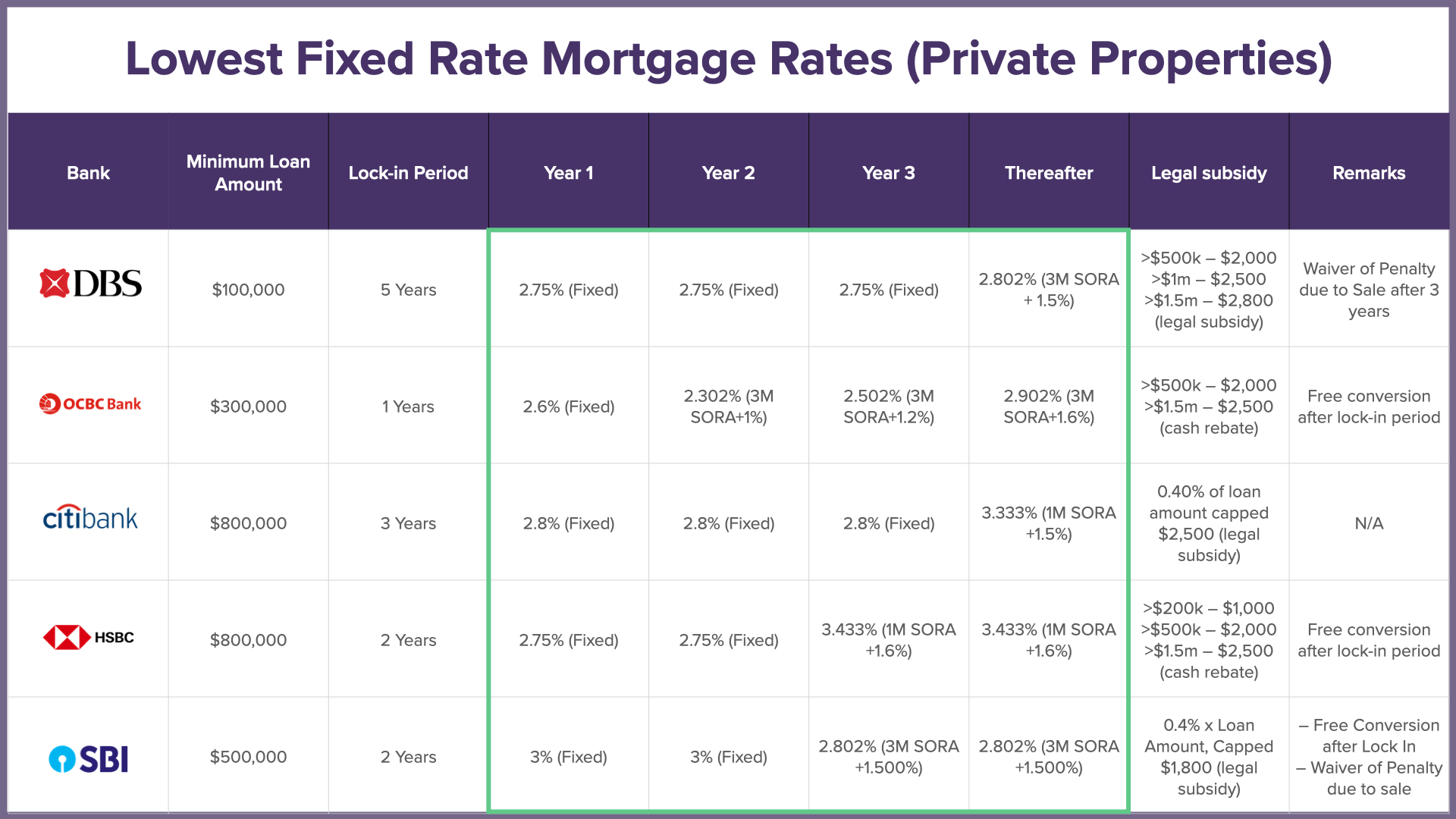

Lender: Interest rates vary considerably among lenders. Banks, credit unions, and online lenders all offer personal loans, but their rates and terms differ. Shopping around and comparing multiple offers is essential to finding the best deal.

How to Find the Best Personal Loan Interest Rate

Securing the most favorable personal loan interest rate requires a proactive and informed approach.

-

Check Your Credit Report: Before applying for a loan, check your credit report through AnnualCreditReport.com for errors and to understand your credit score. Addressing any inaccuracies can significantly improve your chances of securing a lower rate.

-

Shop Around: Compare offers from at least three to five different lenders. Use online comparison tools to streamline the process and identify lenders offering competitive interest rates and terms.

-

Negotiate: Don't be afraid to negotiate with lenders. If you have a strong credit score and attractive financial profile, you may be able to negotiate a lower interest rate.

-

Consider Pre-qualification: Many lenders offer pre-qualification, which allows you to see what rates you might qualify for without affecting your credit score. This helps you gauge your eligibility and compare offers before formally applying.

-

Read the Fine Print: Carefully review all loan terms and conditions, including fees, interest rates, and repayment schedules, before signing any agreement.

Conclusion

Understanding personal loan interest rates today is crucial for securing a loan that works for your budget. Key factors influencing your interest rate include your credit score, debt-to-income ratio, the loan amount and term, the loan type (secured vs. unsecured), and the lender you choose. Remember that these rates are dynamic, so regularly check for updates. Don't wait! Start researching personal loan interest rates today to find the best loan for your financial needs. Use online comparison tools to find competitive offers and secure the lowest interest rate possible for your situation. Remember, informed decisions lead to better financial outcomes.

Featured Posts

-

Global Cities Confront The Dangers Of Climate Whiplash

May 28, 2025

Global Cities Confront The Dangers Of Climate Whiplash

May 28, 2025 -

Rome Champ Maintaining Momentum After Victory

May 28, 2025

Rome Champ Maintaining Momentum After Victory

May 28, 2025 -

Chto Izvestno O Novom Filme Uesa Andersona

May 28, 2025

Chto Izvestno O Novom Filme Uesa Andersona

May 28, 2025 -

German Insider Rayan Cherki Update

May 28, 2025

German Insider Rayan Cherki Update

May 28, 2025 -

One Piece Top 5 Most Violent And Dangerous Pirate Crews

May 28, 2025

One Piece Top 5 Most Violent And Dangerous Pirate Crews

May 28, 2025

Latest Posts

-

Comprendre Le Role De Laurent Jacobelli A L Assemblee Nationale

May 30, 2025

Comprendre Le Role De Laurent Jacobelli A L Assemblee Nationale

May 30, 2025 -

Attaques Contre Les Prisons La Visite Ministerielle En Isere Critiquee

May 30, 2025

Attaques Contre Les Prisons La Visite Ministerielle En Isere Critiquee

May 30, 2025 -

Focus Sur Laurent Jacobelli Elu De La Moselle A L Assemblee Nationale

May 30, 2025

Focus Sur Laurent Jacobelli Elu De La Moselle A L Assemblee Nationale

May 30, 2025 -

Europe 1 Retrouvez Aurelien Veron Et Laurent Jacobelli Le Week End

May 30, 2025

Europe 1 Retrouvez Aurelien Veron Et Laurent Jacobelli Le Week End

May 30, 2025 -

Retraite Anticipee Le Rn Explore Une Alliance Avec La Gauche

May 30, 2025

Retraite Anticipee Le Rn Explore Une Alliance Avec La Gauche

May 30, 2025