Personal Loans With Low Interest Rates Today: Get Financing Starting Under 6%

Table of Contents

Understanding Personal Loans with Low Interest Rates

Factors Affecting Interest Rates

Several factors determine the interest rate you'll receive on a personal loan. Understanding these is crucial to securing personal loans with low interest rates.

-

Credit Score: Your credit score is the most significant factor. A higher credit score (typically above 700) demonstrates creditworthiness and makes you a less risky borrower, resulting in lower interest rates. Improving your credit score involves paying bills on time, keeping your credit utilization low, and avoiding new credit applications.

-

Debt-to-Income Ratio (DTI): Lenders assess your DTI—the percentage of your monthly income dedicated to debt payments—to gauge your ability to repay the loan. A lower DTI indicates better financial health and improves your chances of getting a lower interest rate. Strategies to lower your DTI include reducing existing debt and increasing your income.

-

Loan Amount and Term: The amount you borrow and the repayment period influence interest rates. Larger loan amounts and longer terms typically carry higher interest rates due to increased risk for the lender. Shorter loan terms, while requiring higher monthly payments, often result in lower overall interest costs.

-

Lender Type: Different lenders offer varying interest rates. Banks generally offer competitive rates, especially for borrowers with excellent credit. Credit unions often provide lower rates to their members, while online lenders may offer more flexibility but potentially higher rates.

Finding the Best Low-Interest Personal Loans

Finding the best personal loans with low interest rates requires careful research and comparison.

-

Online Comparison Tools: Several reputable websites allow you to compare loan offers from multiple lenders simultaneously, saving you time and effort. Be sure to use trusted and secure platforms.

-

Pre-qualification: Pre-qualifying for a loan lets you see potential interest rates without affecting your credit score significantly. This allows you to shop around and compare offers before applying formally.

-

Reading the Fine Print: Always carefully review the loan agreement before signing. Pay close attention to the Annual Percentage Rate (APR), fees, and repayment terms to ensure you understand the complete cost of borrowing.

How to Qualify for Low Interest Rates on Personal Loans

Improving Your Creditworthiness

Improving your creditworthiness is key to securing personal loans with low interest rates.

-

Practical Steps:

- Pay all bills on time and in full.

- Reduce high credit card balances.

- Monitor your credit reports regularly for errors.

- Avoid opening multiple new credit accounts in a short period.

-

Dispute Errors: If you find errors on your credit report, dispute them immediately with the credit bureaus. Inaccurate information can negatively impact your credit score.

-

Building Positive Credit History: Responsible credit use over time builds a strong credit history, leading to better loan offers.

Negotiating with Lenders

While not always guaranteed, negotiating interest rates is possible, especially if you have multiple loan offers.

- Negotiation: Present your best credit score and DTI, and highlight your stable income and responsible financial history.

- Multiple Offers: Having offers from competing lenders strengthens your negotiating position. Let lenders know you're comparing rates.

- Communication: Be polite, professional, and clear in your communication.

Alternative Financing Options with Potentially Lower Rates

Credit Unions

Credit unions often offer lower interest rates on personal loans than banks. They are member-owned cooperatives, and membership often comes with access to competitive financial products.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers directly with individual lenders, sometimes resulting in lower interest rates. However, it's crucial to research platforms carefully and understand the risks involved.

Balance Transfer Cards (if applicable)

If you primarily need to consolidate high-interest credit card debt, a balance transfer card with a 0% APR introductory period can be a viable option. However, remember that this is a temporary solution and you’ll need a plan to pay off the balance before the introductory period expires.

Conclusion

Securing personal loans with low interest rates is achievable with careful planning and responsible financial management. By understanding the factors influencing interest rates, improving your creditworthiness, and exploring alternative financing options, you can significantly reduce borrowing costs. Don't wait! Secure your future with personal loans with low interest rates starting under 6% – start your search now! Find the best low-rate personal loans, affordable personal loans, and the best personal loan interest rates to suit your needs.

Featured Posts

-

Rescates De Paw Patrol Piratas 15 Minutos De Diversion En Espanol You Tube

May 28, 2025

Rescates De Paw Patrol Piratas 15 Minutos De Diversion En Espanol You Tube

May 28, 2025 -

Krisis Infrastruktur Jalan Raya Bali Pernyataan Surya Paloh

May 28, 2025

Krisis Infrastruktur Jalan Raya Bali Pernyataan Surya Paloh

May 28, 2025 -

Lotto Winner Winning Shop Revealed Big Prize Awaits

May 28, 2025

Lotto Winner Winning Shop Revealed Big Prize Awaits

May 28, 2025 -

The Kyle Stowers Phenomenon A Look At His Journaling Routine

May 28, 2025

The Kyle Stowers Phenomenon A Look At His Journaling Routine

May 28, 2025 -

Arsenal Transfer News Agbonlahors Prediction On Premier League Player Pursuit

May 28, 2025

Arsenal Transfer News Agbonlahors Prediction On Premier League Player Pursuit

May 28, 2025

Latest Posts

-

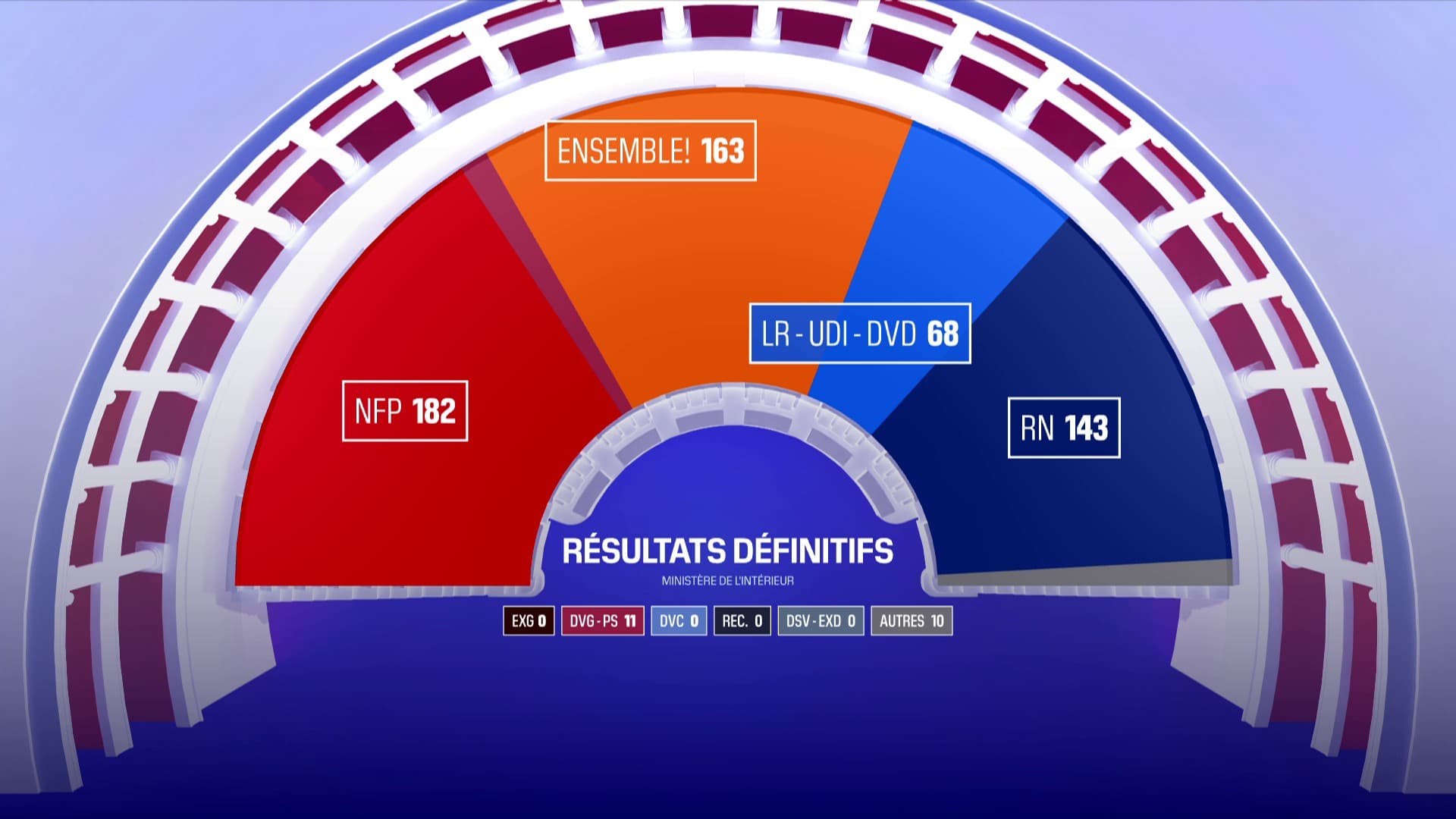

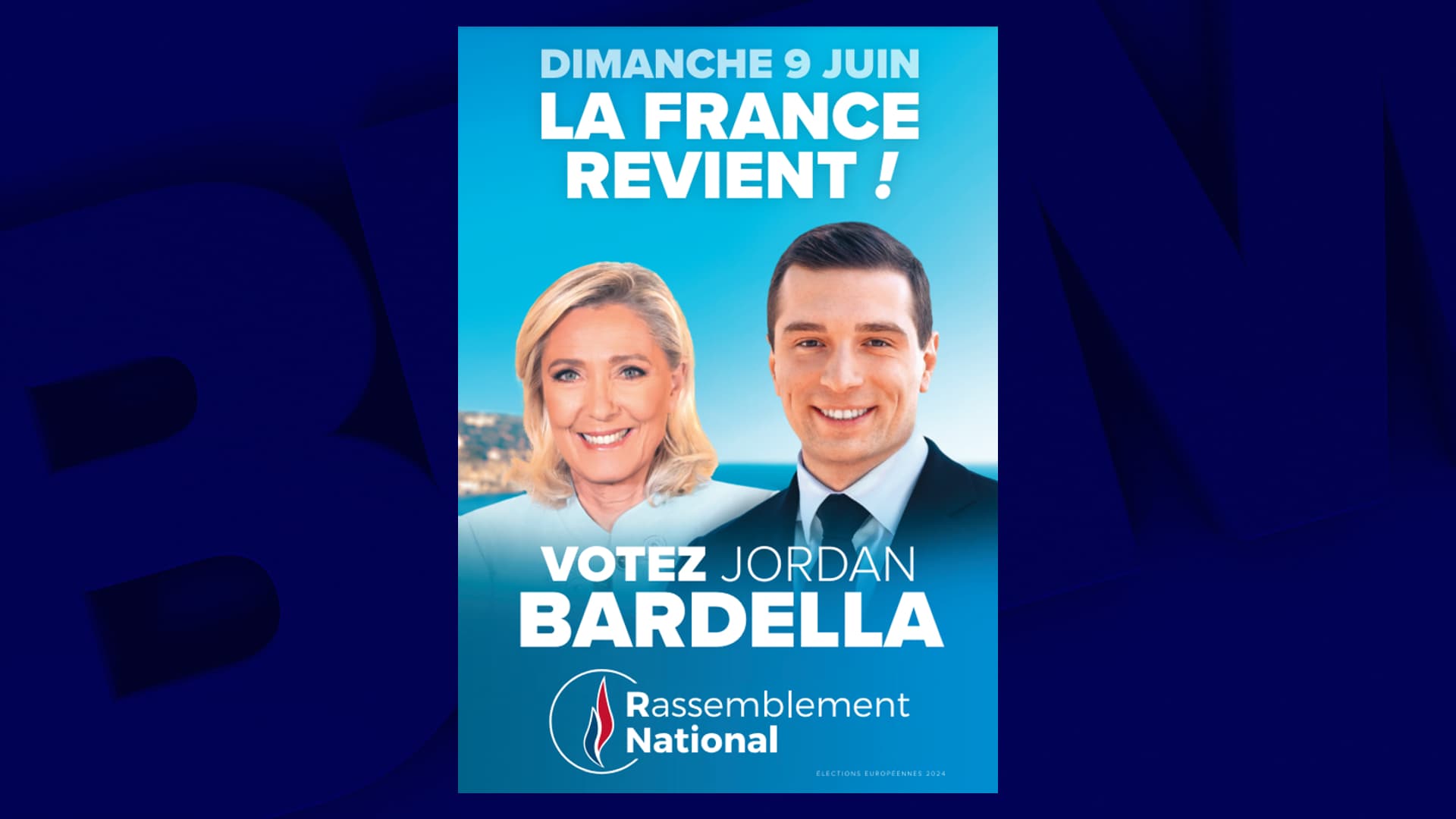

Elections Assemblee Nationale Le Rn Entre Frontieres Et Confrontation Avec Lfi

May 30, 2025

Elections Assemblee Nationale Le Rn Entre Frontieres Et Confrontation Avec Lfi

May 30, 2025 -

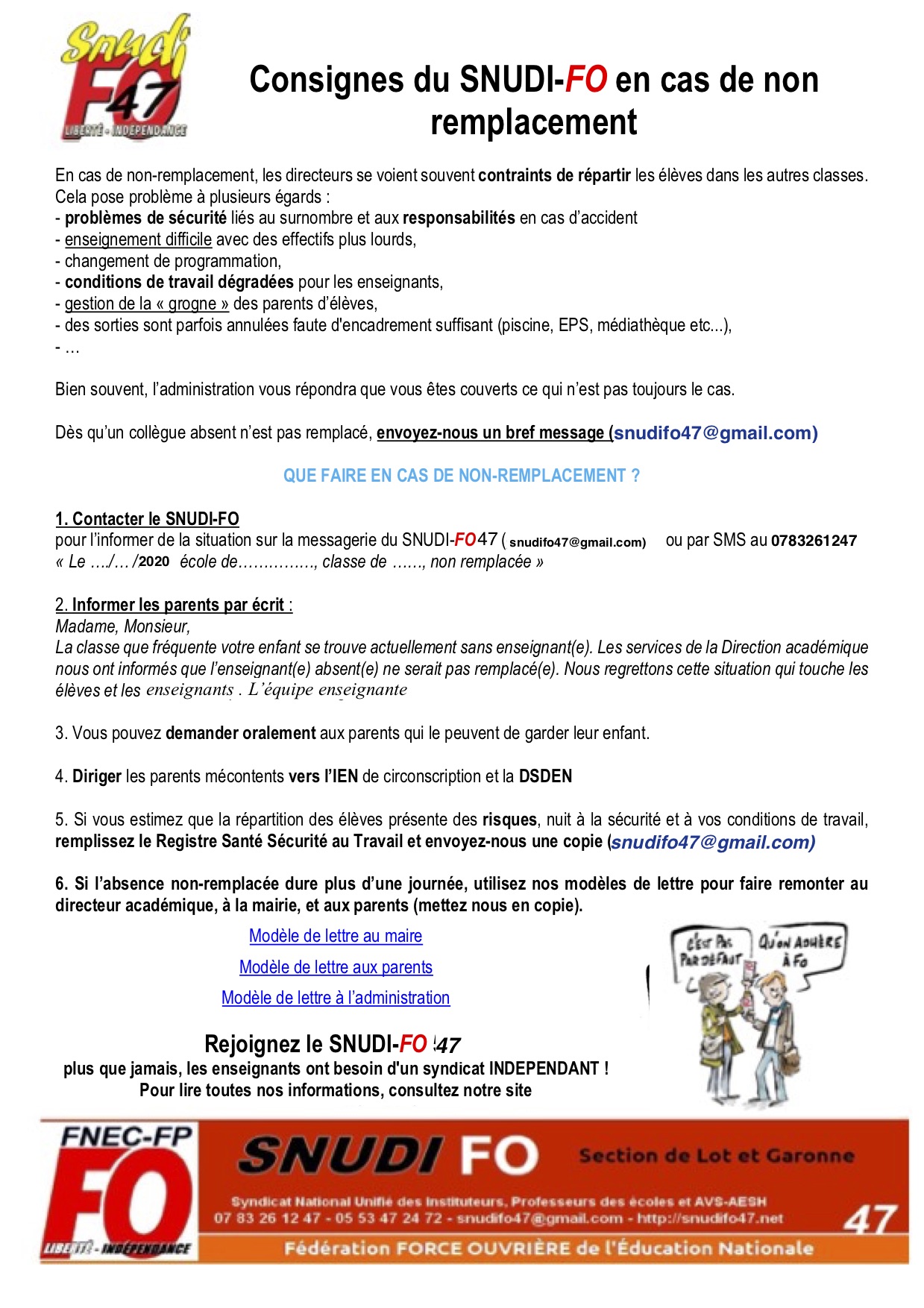

Manque De Professeurs Remplacants A L Ecole Bouton D Or Situation Critique

May 30, 2025

Manque De Professeurs Remplacants A L Ecole Bouton D Or Situation Critique

May 30, 2025 -

Assemblee Nationale Frontieres Et Desordre La Strategie Du Rn Face A Lfi

May 30, 2025

Assemblee Nationale Frontieres Et Desordre La Strategie Du Rn Face A Lfi

May 30, 2025 -

L Emission Integrale Europe 1 Soir 19 03 2025

May 30, 2025

L Emission Integrale Europe 1 Soir 19 03 2025

May 30, 2025 -

Assemblee Nationale Le Rn Et Lfi Une Bataille Pour Le Controle Du Recit

May 30, 2025

Assemblee Nationale Le Rn Et Lfi Une Bataille Pour Le Controle Du Recit

May 30, 2025