Podcast: A Fresh Perspective On Personal Finance

Table of Contents

The Power of Audio Learning for Personal Finance

Podcasts are transforming how we learn and consume information, and personal finance is no exception. Their unique advantages make them a surprisingly effective tool for building financial literacy.

Convenience and Accessibility

Podcasts offer unparalleled convenience. Listen while commuting, exercising, doing chores, or even relaxing – maximizing your learning time without sacrificing your schedule. This flexibility makes it easy to incorporate personal finance education into your daily routine.

- Listen anytime, anywhere: No need to be chained to your desk or computer.

- No need for screens: Perfect for multitasking or relaxing without eye strain.

- Fits seamlessly into your existing routine: Turn your commute, workout, or even chores into valuable learning time.

- Easy to manage: Subscribe to your favorite podcasts and receive new episodes automatically.

Engaging and Relatable Content

Many personal finance podcasts go beyond dry statistics and theoretical concepts. They feature interviews with financial experts, real-life success stories, and relatable anecdotes, making complex financial topics more digestible and relatable.

- Expert advice in an approachable format: Learn from leading financial advisors and experts in an accessible way.

- Learn from diverse perspectives and experiences: Hear stories from people from all walks of life, sharing their financial journeys.

- Humanizes the often-dry subject of personal finance: Connects financial concepts with real-world scenarios, making them more meaningful.

Top Podcast Topics for Beginners

Finding the right personal finance podcast can feel overwhelming. Here are some key topics to look for, especially if you’re just starting your financial literacy journey.

Budgeting Basics

Mastering budgeting is the cornerstone of sound personal finance. Look for podcasts that guide you through creating a realistic budget, tracking expenses, and identifying areas for improvement.

- Zero-based budgeting techniques: Learn how to allocate every dollar you earn to a specific purpose.

- 50/30/20 budgeting rule explained: Understand the basics of allocating your income to needs, wants, and savings.

- Apps and tools to simplify budgeting: Discover helpful tools to automate tracking and analysis of your finances.

Debt Reduction Strategies

Dealing with debt can be stressful, but podcasts offer effective strategies for tackling it head-on. Explore different repayment methods and avoid future debt traps.

- Snowball vs. avalanche debt repayment methods: Weigh the pros and cons of different strategies.

- Strategies for negotiating with creditors: Learn how to potentially reduce your interest rates and monthly payments.

- Avoiding high-interest debt: Understand the risks of credit cards and payday loans, and develop strategies to avoid them.

Investing for Beginners

Investing can seem daunting, but podcasts break down the fundamentals, explore different investment vehicles, and help you develop a long-term investment strategy tailored to your goals.

- Understanding stock markets and bonds: Learn the basics of these common investment vehicles.

- Diversification strategies: Discover how to spread your investments across different asset classes to mitigate risk.

- Retirement planning and investing: Develop a long-term investment strategy to secure your financial future.

Finding the Right Personal Finance Podcast

Navigating the world of personal finance podcasts requires a strategic approach. Here's how to find the perfect fit for your needs.

Identify Your Needs and Goals

What specific financial areas do you want to improve? Are you focused on budgeting, investing, debt reduction, or a combination? Identifying your priorities will help you narrow your search.

Explore Podcast Platforms

Utilize popular podcast platforms like Apple Podcasts, Spotify, Google Podcasts, Stitcher, and others to search for podcasts relevant to your needs. Read reviews and check episode descriptions carefully.

Consider the Podcast Host's Expertise and Style

Do you prefer a formal, academic approach or a more casual, conversational style? The host's personality and expertise can significantly impact your learning experience.

Conclusion

Podcasts provide a revolutionary way to approach personal finance. By offering convenient, engaging, and accessible content, they empower you to take control of your financial future. Whether you're a complete beginner or looking to refine your existing strategies, there's a personal finance podcast out there waiting to help you achieve your financial goals. Start listening today and discover the transformative power of a personal finance podcast! Find your perfect podcast and embark on your journey towards financial freedom!

Featured Posts

-

Miley Cyrus End Of The World Single Gets A Captivating Music Video

May 31, 2025

Miley Cyrus End Of The World Single Gets A Captivating Music Video

May 31, 2025 -

Exploring The Boundaries Of Ai Learning Towards Responsible Ai Development And Deployment

May 31, 2025

Exploring The Boundaries Of Ai Learning Towards Responsible Ai Development And Deployment

May 31, 2025 -

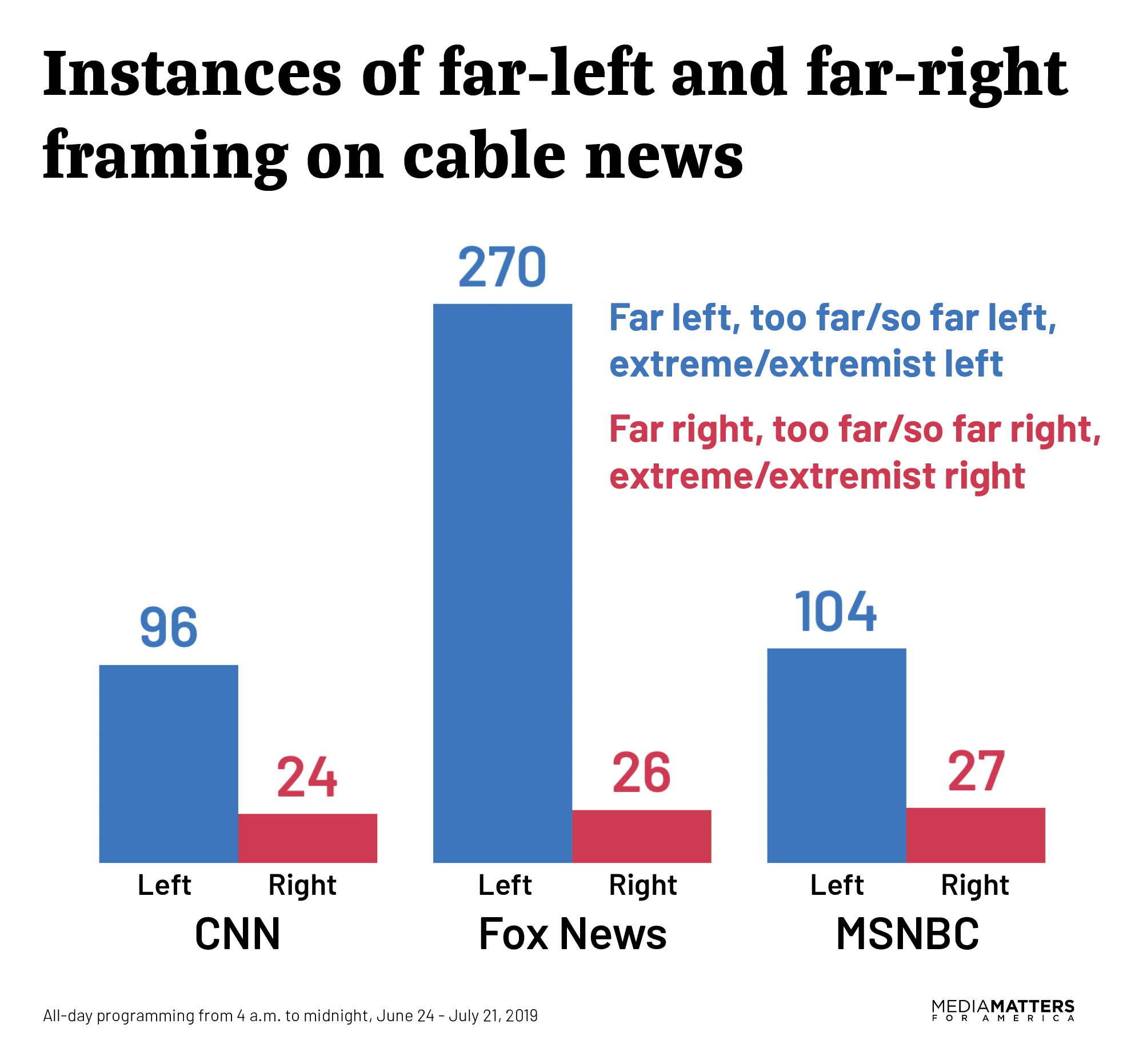

The Murder And The Message How The Far Left Is Framing Islamophobia In France

May 31, 2025

The Murder And The Message How The Far Left Is Framing Islamophobia In France

May 31, 2025 -

Cau Thu Thuy Linh Vuot Qua Vong 1 Swiss Open 2025

May 31, 2025

Cau Thu Thuy Linh Vuot Qua Vong 1 Swiss Open 2025

May 31, 2025 -

Nintendo Switch Examining The Indie Game Legacy

May 31, 2025

Nintendo Switch Examining The Indie Game Legacy

May 31, 2025