Podcast: Enjoy Low Inflation While It Lasts

Table of Contents

Understanding Current Low Inflation Rates

Current inflation rates, as measured by the Consumer Price Index (CPI), are significantly lower than historical averages in many developed nations. Understanding these rates is crucial for effective financial planning. Several factors contribute to this current low inflation environment, including: global supply chain improvements, technological advancements driving down production costs, and subdued consumer demand in certain sectors.

-

Current Inflation Rates: While specific numbers fluctuate, many countries are experiencing inflation rates considerably below the historical average of the past few decades. It's important to consult up-to-date data from reliable sources to understand the current climate.

-

Factors Contributing to Low Inflation: Beyond the points mentioned above, other factors like increased automation and a stronger dollar (in certain regions) can influence inflation rates.

-

Reliability of Inflation Data: It's crucial to remember that inflation data, while informative, is not a perfect measure. The CPI, for instance, might not fully capture the impact of changes in technology or the quality of goods and services.

-

Economic Data Sources: Reliable sources for inflation data include government statistics websites like the Bureau of Labor Statistics (BLS) in the US, or equivalent agencies in other countries. Staying informed through these channels is crucial for making educated financial decisions.

Smart Saving Strategies During Low Inflation

Low inflation provides an excellent opportunity to boost your savings. Making the most of this environment means being proactive with your personal finance.

-

Building an Emergency Fund: Low inflation makes it easier to save. Focus on building a robust emergency fund (ideally 3-6 months of living expenses) to protect yourself against unforeseen circumstances.

-

Increasing Savings Rates: Utilize budgeting apps and diligently track expenses to identify areas where you can reduce spending and increase your savings rate. Even small changes can add up significantly over time.

-

High-Yield Savings Accounts: Explore high-yield savings accounts to earn a better return on your savings compared to traditional accounts, although returns will still be modest given the low inflation environment.

-

Avoiding Lifestyle Inflation: As your income increases, resist the urge to immediately increase your spending. Consciously allocate a larger portion of any income gains towards savings.

Investment Opportunities in a Low-Inflation Environment

Low inflation can impact different asset classes differently. A well-diversified investment portfolio is essential.

-

Impact on Asset Classes: Low inflation generally benefits certain investments. While the returns on bonds might be lower, stocks may offer better growth potential. Real estate can be a good long-term investment, though its performance is influenced by other economic factors.

-

Adjusting Investment Strategies: With low inflation, you may want to consider a slightly more aggressive investment strategy compared to a high-inflation environment, but always in accordance with your risk tolerance.

-

Portfolio Diversification: Diversification across different asset classes (stocks, bonds, real estate, etc.) is crucial to manage risk and potentially benefit from various market conditions.

-

Long-Term Investment Planning: Maintain a long-term investment horizon and focus on consistent contributions to your investments, regardless of short-term market fluctuations.

-

Potential Risks: Even in a low inflation environment, risks remain. Market corrections and unforeseen economic events can impact your investments. Always be aware of these potential risks and adjust your strategy accordingly.

Preparing for Potential Future Inflation

While current inflation is low, it's vital to prepare for the potential of future inflation increases. Economic forecasting is complex, but it's wise to adopt a proactive approach.

-

Potential for Future Inflation: Several factors, including increased government spending, supply chain disruptions, or shifts in global economic dynamics, could lead to future inflation surges.

-

Inflation Protection Strategies: Consider diversifying investments and exploring inflation-protected securities (TIPS) as a way to protect the purchasing power of your savings and investments.

-

Hedging Techniques: Employ various hedging techniques to mitigate potential losses from future inflation. These strategies might involve investing in commodities or other assets that tend to perform well during inflationary periods.

-

Regular Financial Plan Review: It’s crucial to regularly review and update your financial plan to adapt to changing economic conditions. This ensures your strategies align with the current economic landscape.

Conclusion

Low inflation presents a valuable opportunity to strengthen your financial position. By implementing smart saving strategies, making informed investment decisions, and preparing for potential future shifts, you can maximize the benefits of this current economic climate. Don't miss out!

Listen to our insightful podcast, "Enjoy Low Inflation While It Lasts," for a detailed analysis of current economic trends and actionable strategies to navigate this period of low inflation. Learn how to protect your financial future and build wealth in a low-inflation environment. Start planning your financial success today! [Link to Podcast]

Featured Posts

-

Osimhen Transfer Two Arab Teams Meet Asking Price

May 27, 2025

Osimhen Transfer Two Arab Teams Meet Asking Price

May 27, 2025 -

Taylor Swifts Lawsuit Against Kanye West Details Of The Explicit Lyrics Case

May 27, 2025

Taylor Swifts Lawsuit Against Kanye West Details Of The Explicit Lyrics Case

May 27, 2025 -

Carrie Underwood And Taylor Swift A Source Reveals The Truth Behind Their Feud

May 27, 2025

Carrie Underwood And Taylor Swift A Source Reveals The Truth Behind Their Feud

May 27, 2025 -

Porto Raftis Kai Athina Eisvoles Se Spitia Kai O Tromos Ton Enoikon

May 27, 2025

Porto Raftis Kai Athina Eisvoles Se Spitia Kai O Tromos Ton Enoikon

May 27, 2025 -

Ecb Nin Tarifeler Hakkindaki Uyarisi Ne Anlama Geliyor

May 27, 2025

Ecb Nin Tarifeler Hakkindaki Uyarisi Ne Anlama Geliyor

May 27, 2025

Latest Posts

-

The Future Of The Nissan Primera Electric Sedan Speculation

May 30, 2025

The Future Of The Nissan Primera Electric Sedan Speculation

May 30, 2025 -

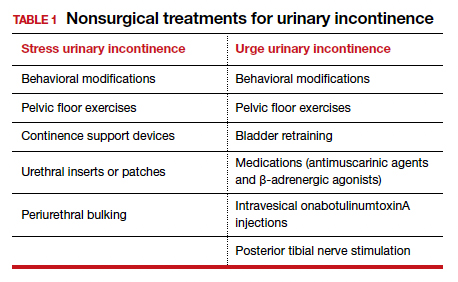

Effective Natural Remedies For Womens Urinary Incontinence Primera

May 30, 2025

Effective Natural Remedies For Womens Urinary Incontinence Primera

May 30, 2025 -

Tileoptiko Programma Kyriakis 16 3 O Ti Prepei Na Deite

May 30, 2025

Tileoptiko Programma Kyriakis 16 3 O Ti Prepei Na Deite

May 30, 2025 -

Savvatiatiko Tileoptiko Programma 3 5 Analytikos Odigos

May 30, 2025

Savvatiatiko Tileoptiko Programma 3 5 Analytikos Odigos

May 30, 2025 -

Will The Nissan Primera Return As An All Electric Sedan

May 30, 2025

Will The Nissan Primera Return As An All Electric Sedan

May 30, 2025