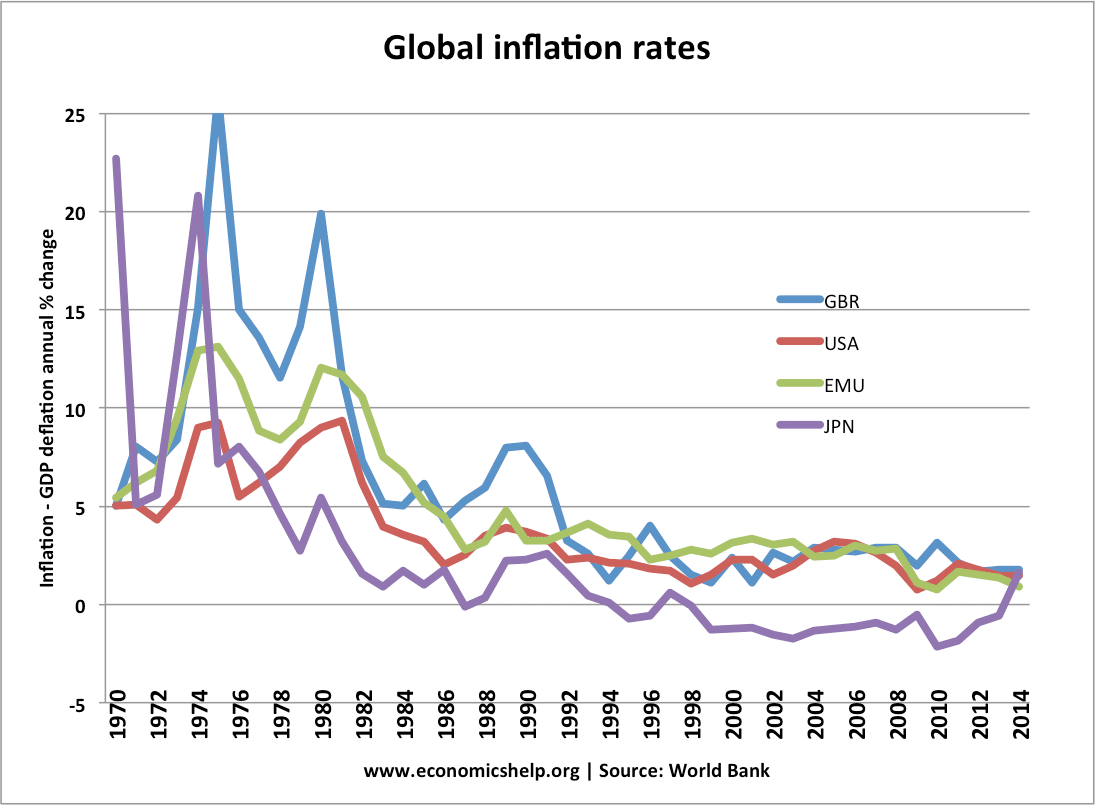

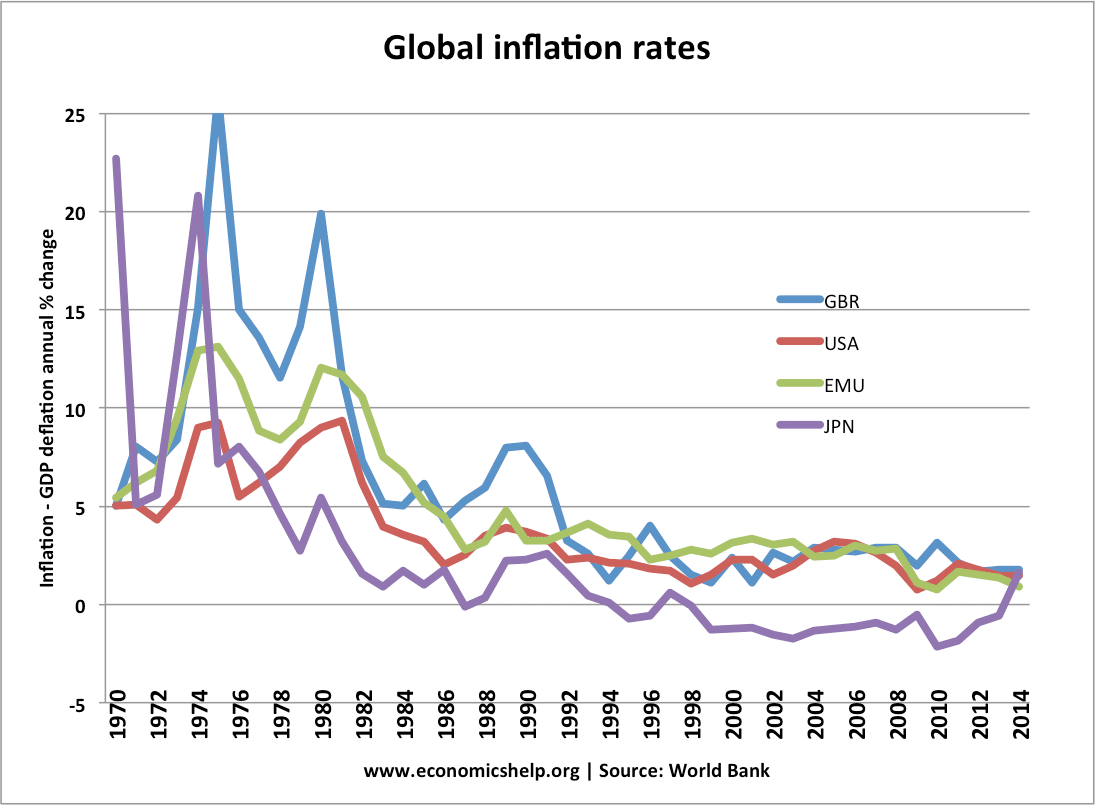

Podcast: Making The Most Of Low Inflation Rates

Table of Contents

Saving Strategies During Low Inflation

Low inflation means your money retains its purchasing power for longer. This is a golden opportunity to supercharge your savings.

Maximize Your Savings Accounts

Traditional savings accounts often offer meager returns. However, during low inflation, even small gains can be beneficial. Consider these options:

- High-Yield Savings Accounts: These accounts offer interest rates significantly higher than standard accounts. Shop around and compare rates from different banks and credit unions to find the best deal. Look for accounts with no monthly fees.

- Certificates of Deposit (CDs): CDs offer fixed interest rates for a specific term (e.g., 6 months, 1 year, 5 years). While your money is locked in for the term, you'll generally earn a higher interest rate than with a savings account. Consider your liquidity needs before committing to a CD.

- Automate Your Savings: Set up automatic transfers from your checking account to your savings account each month. This ensures consistent contributions and helps you build your savings effortlessly. Even small, regular contributions add up over time.

- Bank Promotions and Bonus Rates: Many banks offer introductory bonus rates or promotions on new savings accounts. Take advantage of these opportunities to boost your savings early on.

The Power of Budgeting in Low Inflation

Budgeting is crucial, regardless of the inflation rate, but it becomes even more important during periods of low inflation. A well-structured budget helps you maximize your savings and reach your financial goals faster.

- Detailed Budget Tracking: Create a detailed budget that tracks all your income and expenses. Use budgeting apps (like Mint or YNAB), spreadsheets, or even a notebook to maintain accurate records.

- Identify Spending Areas for Reduction: Analyze your spending habits to identify areas where you can cut back. Even small reductions can make a significant difference over time.

- Goal-Oriented Budgeting: Set realistic savings goals (e.g., emergency fund, down payment, retirement) and track your progress regularly. This helps you stay motivated and focused on your financial objectives.

Investing Wisely in a Low Inflation Environment

While low inflation is good for savers, it also presents opportunities for investors. However, a cautious approach is needed.

Diversify Your Investment Portfolio

Diversification is key to mitigating risk in any market, but especially crucial during periods of low inflation.

- Asset Class Diversification: Spread your investments across different asset classes, including stocks, bonds, real estate, and potentially alternative investments. This reduces your exposure to any single asset's performance fluctuations.

- Index Funds and ETFs: These provide diversified exposure to a broad range of stocks or bonds, reducing the need for extensive individual stock research. They offer a relatively low-cost way to diversify your portfolio.

- Individual Stock Research (If Applicable): If you choose to invest in individual stocks, conduct thorough research before investing. Understand the company's financial health, industry trends, and potential risks.

- Regular Portfolio Rebalancing: Periodically rebalance your portfolio to maintain your desired asset allocation. This involves selling some assets that have performed well and buying others that have underperformed, bringing your portfolio back to your target allocation.

Explore Long-Term Investment Opportunities

Low inflation generally favors long-term investments. Your returns are less likely to be eroded by rising prices.

- Long-Term Growth Assets: Consider investing in assets expected to appreciate over time, such as real estate or certain stocks with strong growth potential.

- Retirement Planning: Low inflation creates a favorable environment for long-term retirement planning. Maximize contributions to retirement accounts (401(k), IRA) to take advantage of the compounding effect over time.

- Financial Advisor Consultation: Consult with a qualified financial advisor to develop a long-term investment strategy tailored to your individual financial situation, risk tolerance, and investment goals.

Debt Management During Low Inflation

Low inflation can be a good time to tackle debt aggressively.

Prioritize High-Interest Debt

High-interest debt, such as credit card debt, can significantly impact your financial health.

- Aggressive Debt Repayment: Focus on paying down high-interest debts as quickly as possible to minimize interest payments and reduce your overall debt burden. Consider the debt avalanche or debt snowball methods.

- Debt Consolidation: Explore debt consolidation options to potentially lower your interest rates and simplify your payments. This could involve consolidating multiple high-interest debts into a single loan with a lower interest rate.

- Debt Repayment Plan: Create a detailed debt repayment plan that outlines your monthly payments and projected payoff dates. Stick to your plan diligently to stay on track.

Negotiate Lower Interest Rates

Contact your creditors to negotiate lower interest rates on your existing loans or credit cards.

- Interest Rate Negotiation: Many creditors are willing to negotiate lower interest rates for loyal customers or those with good credit scores.

- Shop Around for Better Rates: Compare interest rates from different lenders before taking out new loans or credit cards to secure the best possible rates.

Conclusion

Low inflation rates present a valuable chance to improve your financial situation. By implementing smart saving strategies, investing wisely, and effectively managing debt, you can build a strong financial foundation. Remember to budget meticulously, diversify your investments, and prioritize high-interest debt repayment. Take advantage of this period of low inflation to build wealth and secure your financial future. Listen to our podcast to learn more about making the most of low inflation rates and securing your financial future. Don't miss out on this opportunity to build wealth during periods of low inflation – tune in now!

Featured Posts

-

Berkane Constantine Dates Et Lieux Des Matchs De La Coupe De La Caf

May 27, 2025

Berkane Constantine Dates Et Lieux Des Matchs De La Coupe De La Caf

May 27, 2025 -

It Ends With Us Legal Battle Taylor Swift And Blake Livelys Position Revealed Exclusive

May 27, 2025

It Ends With Us Legal Battle Taylor Swift And Blake Livelys Position Revealed Exclusive

May 27, 2025 -

Chitras Century Not Enough J And K Falls To Goa In Cricket Match

May 27, 2025

Chitras Century Not Enough J And K Falls To Goa In Cricket Match

May 27, 2025 -

Ghosts Season 4 Episode 16 St Hettys Day A Powerful Reveal

May 27, 2025

Ghosts Season 4 Episode 16 St Hettys Day A Powerful Reveal

May 27, 2025 -

The Fight To Preserve Affinity Graduations In The Face Of Anti Dei Policies

May 27, 2025

The Fight To Preserve Affinity Graduations In The Face Of Anti Dei Policies

May 27, 2025

Latest Posts

-

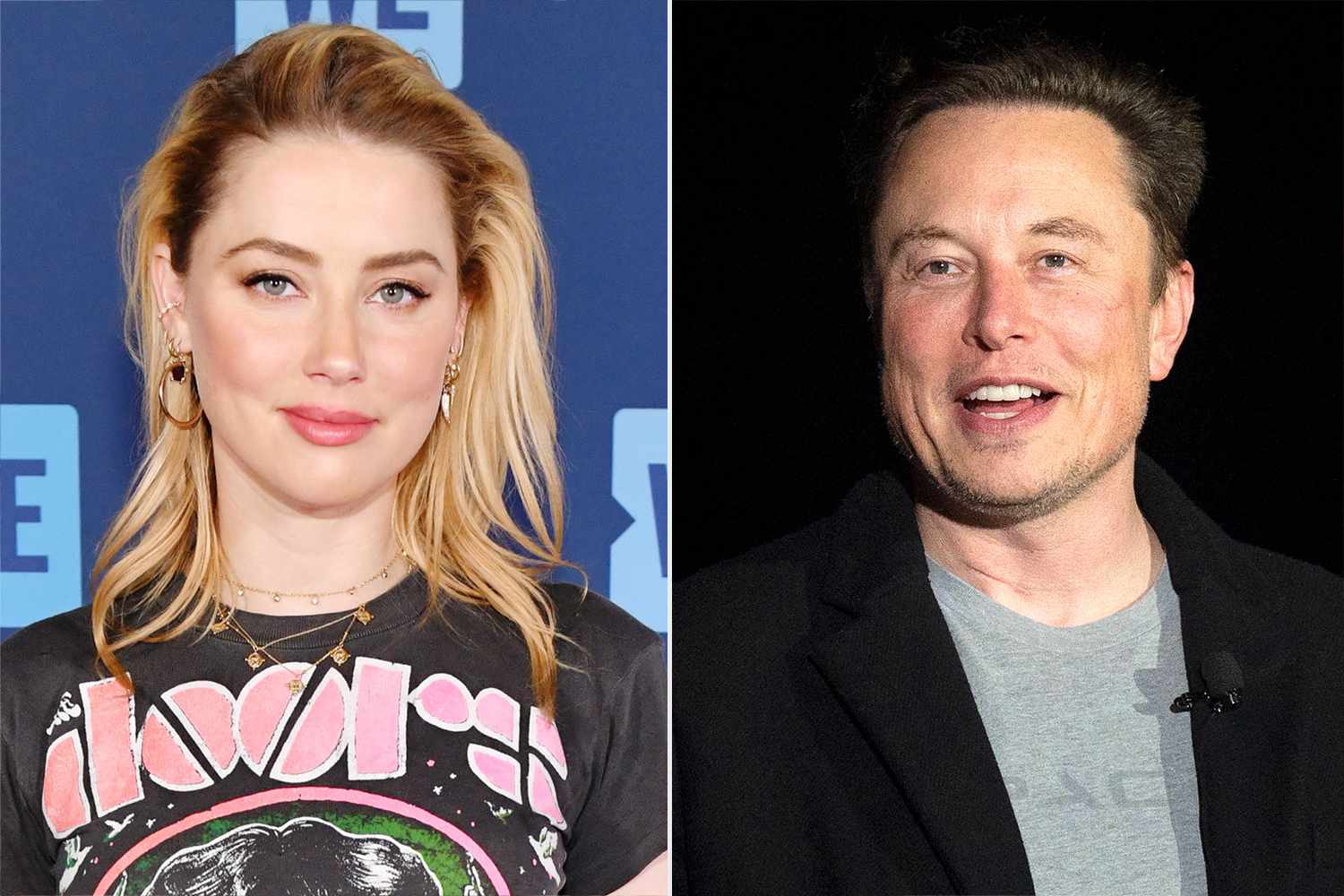

New Twins Old Dispute Examining The Elon Musk Amber Heard Relationship

May 30, 2025

New Twins Old Dispute Examining The Elon Musk Amber Heard Relationship

May 30, 2025 -

Elon Musks Daughters Modeling Career A Look At The Family Dynamics

May 30, 2025

Elon Musks Daughters Modeling Career A Look At The Family Dynamics

May 30, 2025 -

Years After Embryo Dispute Are These Twins Elon Musk S

May 30, 2025

Years After Embryo Dispute Are These Twins Elon Musk S

May 30, 2025 -

Amber Heards Twins A New Chapter In The Musk Heard Saga

May 30, 2025

Amber Heards Twins A New Chapter In The Musk Heard Saga

May 30, 2025 -

Amber Heards Twins And The Elon Musk Connection A Timeline Of Events

May 30, 2025

Amber Heards Twins And The Elon Musk Connection A Timeline Of Events

May 30, 2025