Post-Trump Inauguration: Analyzing The Net Worth Changes Of Tech Billionaires

Table of Contents

The Immediate Market Reaction to the Trump Presidency

Stock Market Volatility and its Impact

The election and subsequent inauguration of Donald Trump sent shockwaves through the stock market. Initial reactions were mixed, driven by uncertainty surrounding Trump's proposed policies. His promises of significant tax cuts and deregulation ignited hope in some sectors, while others anticipated potential trade wars and increased regulatory scrutiny. This volatility directly impacted the net worth of tech billionaires whose fortunes are heavily tied to their companies' stock performance.

The impact of Trump's proposed policies on tech company valuations was substantial. Tax cuts, for instance, were expected to boost corporate profits, potentially increasing shareholder value. Conversely, the threat of increased trade tariffs caused fluctuations, particularly for companies with significant international operations.

- Examples of Immediate Stock Price Changes:

- Amazon: Experienced an initial surge, reflecting optimism surrounding potential deregulation and tax benefits, followed by a period of stabilization.

- Microsoft: Showed steady growth, partly fueled by increased government contracts and a favorable regulatory environment.

- Apple: Experienced fluctuations largely dependent on consumer sentiment and the ongoing uncertainty surrounding international trade policies, particularly with China.

Investor Sentiment and the Tech Sector

Investor sentiment towards the tech sector during the post-inauguration period was a significant factor influencing net worth changes. The initial uncertainty surrounding Trump's policies led to increased volatility and speculation. Positive news regarding tax cuts and deregulation boosted investor confidence, while negative news related to trade disputes or regulatory crackdowns dampened enthusiasm.

Charts and data from this period would clearly illustrate the changes in investor confidence. For example, we could see how the VIX (volatility index) reacted to key policy announcements and how this correlated with stock prices of major tech companies and the overall net worth of their CEOs.

Long-Term Trends and Policy Impacts

Tax Cuts and Their Effect on Tech Billionaires' Wealth

The Trump administration's tax cuts of 2017 had a profound impact on the net worth of tech billionaires. Lower corporate tax rates significantly boosted company profits, leading to increased shareholder value and enriching the already wealthy owners of these companies. This resulted in a substantial increase in the net worth of many tech billionaires. Specific examples can be provided showcasing the financial benefits reaped by individuals due to the lower tax burden.

Regulatory Changes and their Influence

The impact of deregulation (or increased regulation) under the Trump administration varied across different tech companies. Some sectors experienced significant deregulation, leading to increased profitability and a boost to billionaire net worth. Others faced increased regulatory scrutiny, particularly concerning antitrust issues, which could negatively impact their valuations.

- Impact on Specific Companies:

- Google (Alphabet): Faced increased scrutiny regarding antitrust issues, impacting its stock price and the net worth of its founders.

- Facebook (Meta): Similarly faced regulatory challenges, with investigations into data privacy and monopolistic practices affecting its valuation and CEO's net worth.

- Amazon: Continued to grow despite facing antitrust investigations, but the regulatory climate influenced investor sentiment and stock valuation.

Geopolitical Events and their Ripple Effects

International trade disputes and other geopolitical events during the Trump presidency significantly affected the wealth of tech billionaires. Tariffs imposed on imported goods, for example, increased costs and reduced profitability for some tech companies, impacting their stock prices and the net worth of their owners. The unpredictability of Trump's foreign policy decisions also created market volatility and uncertainty, influencing investor sentiment and impacting valuations.

Comparative Analysis of Individual Tech Billionaires

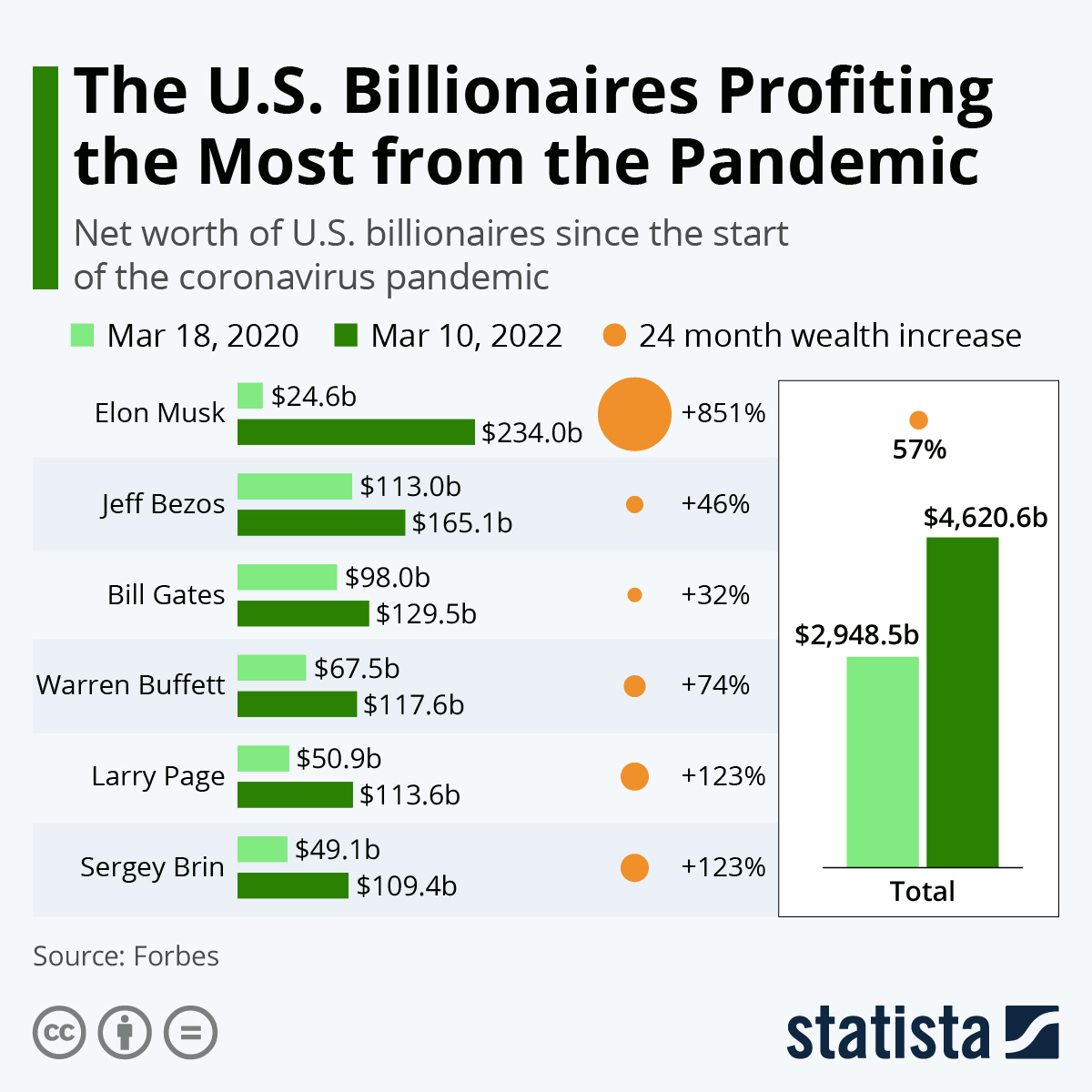

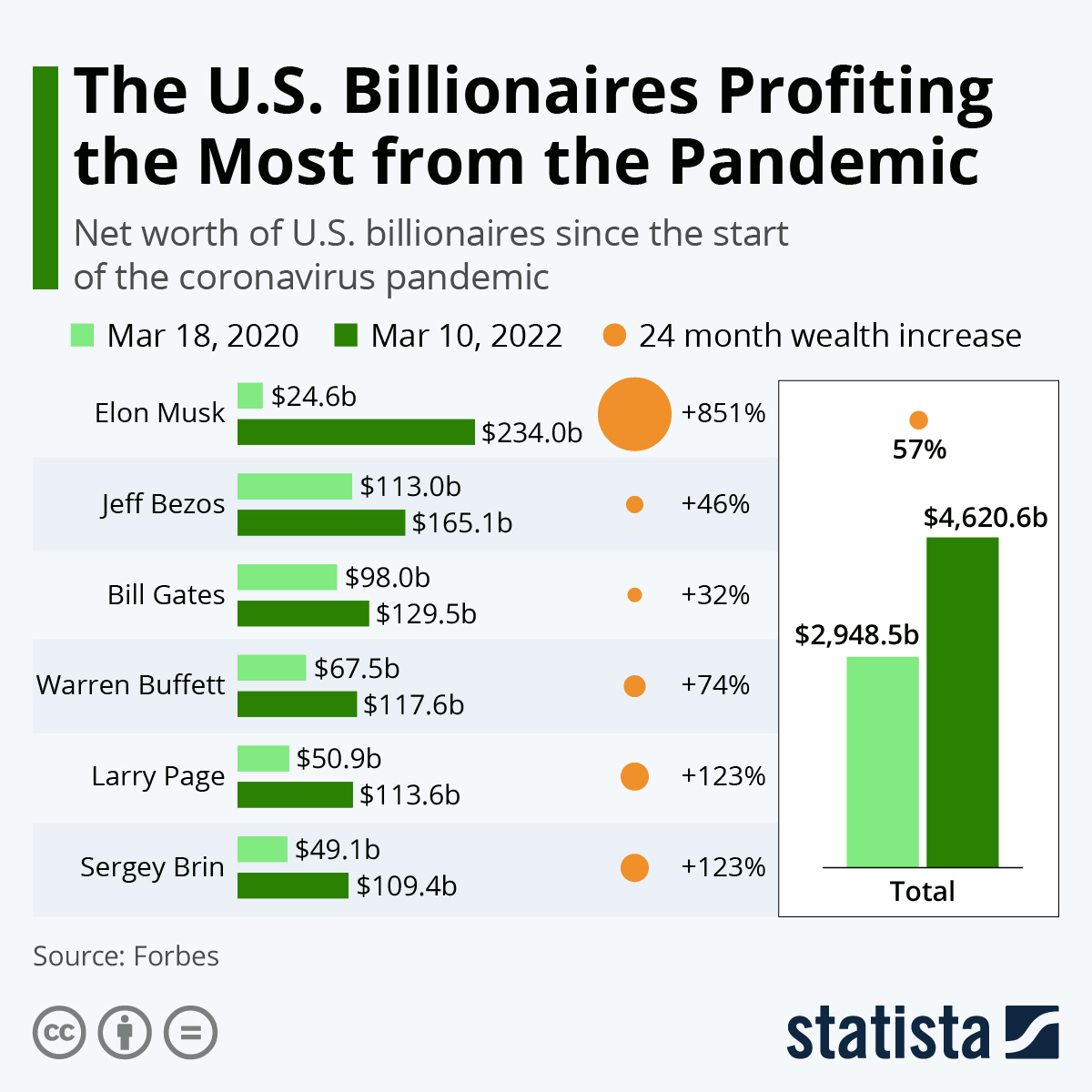

Case Study: Jeff Bezos (Amazon)

Analyzing Bezos' net worth post-inauguration requires correlating Amazon's performance with various political and economic factors. While Amazon benefited from tax cuts, antitrust investigations and trade wars presented challenges. His overall net worth reflects the complex interplay of these influences.

Case Study: Mark Zuckerberg (Meta)

Zuckerberg's net worth trajectory reflects Meta's (formerly Facebook) performance and its struggles with regulatory challenges. Data privacy concerns and antitrust investigations significantly impacted the company's stock price and consequently, Zuckerberg's net worth.

Case Study: Elon Musk (Tesla, SpaceX)

Musk's fluctuating net worth requires considering his diverse holdings in Tesla and SpaceX. Tesla's stock price was heavily influenced by investor sentiment towards electric vehicles and government policies supporting renewable energy, while SpaceX's valuations were influenced by its success in securing contracts.

| Billionaire | Company | Net Worth Change (Approximate) | Key Factors |

|---|---|---|---|

| Jeff Bezos | Amazon | +X% (or -X%) | Tax cuts, antitrust scrutiny, trade disputes |

| Mark Zuckerberg | Meta | +Y% (or -Y%) | Data privacy concerns, antitrust investigations |

| Elon Musk | Tesla, SpaceX | +Z% (or -Z%) | EV market trends, government contracts, market volatility |

(Note: Replace X%, Y%, and Z% with actual approximate percentage changes, sourced from reliable financial data.)

Conclusion: Post-Trump Inauguration: A Lasting Impact on Tech Billionaire Wealth

The post-Trump inauguration period witnessed significant changes in the net worth of leading tech billionaires. These changes were primarily driven by a complex interplay of market volatility, tax policy adjustments, regulatory shifts, and geopolitical events. Understanding this dynamic relationship between political events and economic impacts on high-net-worth individuals is crucial. Further research into "Analyzing the Net Worth of Tech Billionaires Post-Trump Presidency" or "Post-Trump Era: The Impact on Tech Billionaire Fortunes" is essential to fully grasp the long-term consequences and implications of these changes. This deeper dive would allow for a more nuanced understanding of the multifaceted factors influencing the financial well-being of the world’s most powerful tech moguls.

Featured Posts

-

The Billionaire Without Berkshire Shares A Potential Canadian Successor To Buffett

May 10, 2025

The Billionaire Without Berkshire Shares A Potential Canadian Successor To Buffett

May 10, 2025 -

Adani Ports Rally And Eternal Dip Sensex And Niftys Daily Performance

May 10, 2025

Adani Ports Rally And Eternal Dip Sensex And Niftys Daily Performance

May 10, 2025 -

Rhlt Fyraty Mn Alahly Almsry Ila Alerby Alqtry Ihsayyat Wadae

May 10, 2025

Rhlt Fyraty Mn Alahly Almsry Ila Alerby Alqtry Ihsayyat Wadae

May 10, 2025 -

New Tariff Baseline Trump Demands Exceptional Offers To Avoid 10 Increase

May 10, 2025

New Tariff Baseline Trump Demands Exceptional Offers To Avoid 10 Increase

May 10, 2025 -

Elon Musk Net Worth Dips Under 300 Billion Analysis Of Teslas Recent Challenges

May 10, 2025

Elon Musk Net Worth Dips Under 300 Billion Analysis Of Teslas Recent Challenges

May 10, 2025