Posthaste: Understanding The Current Risks Within The Global Bond Market

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

Interest rate risk is arguably the most significant challenge facing the global bond market currently. Rising interest rates have a direct and inverse relationship with bond prices. As interest rates increase, the yields on newly issued bonds become more attractive, causing the prices of existing bonds with lower coupon rates to fall. This is particularly true for bonds with longer maturities, which are more sensitive to interest rate changes due to their longer duration.

- Rising interest rates lead to lower bond prices. This is a fundamental principle of bond valuation. When rates rise, the present value of future cash flows from a bond decreases, leading to a lower price.

- Longer-maturity bonds are more sensitive to interest rate changes. The longer the time until maturity, the greater the impact of interest rate fluctuations on the bond's price. This is known as duration risk.

- Reinvestment risk becomes a significant factor. When a bond matures, the investor must reinvest the proceeds at prevailing interest rates, which may be lower than the original yield.

- Active bond management strategies become crucial. In a rising rate environment, active management, including strategies like laddering maturities or utilizing derivatives, can help mitigate interest rate risk.

Recent interest rate hikes by the Federal Reserve in the US, and similar actions by central banks globally, have already demonstrably impacted bond markets. For example, the yields on US Treasury bonds have risen significantly, leading to a decline in their prices. Similar trends are observable in corporate bond markets worldwide.

Inflationary Pressures and Their Effect on Real Returns

Persistent inflation poses another significant threat to bond investors. Inflation erodes the purchasing power of future interest payments and the principal at maturity. Investors need to consider the real interest rate—the nominal interest rate minus the inflation rate—to assess the true return on their investment. A high inflation rate can easily offset the nominal yield, resulting in negative real returns.

- High inflation reduces the real value of bond returns. If inflation is higher than the bond's yield, the investor loses purchasing power.

- Investors need to consider the real yield, not just the nominal yield. The real yield is a more accurate measure of a bond's return after accounting for inflation.

- TIPS offer protection against inflation. Treasury Inflation-Protected Securities (TIPS) adjust their principal based on inflation, offering a hedge against this risk.

- Diversification across different asset classes is important. To mitigate inflation risk, investors should diversify their portfolios beyond just bonds, including assets like equities and real estate, which may perform better during inflationary periods.

Current inflation rates in many developed economies are significantly above central bank targets, raising concerns about the real returns from bond investments. Careful analysis of inflation forecasts is crucial for making informed investment decisions.

Credit Risk and the Potential for Defaults

Credit risk, the risk of a bond issuer defaulting on its debt obligations, is a critical concern, especially in the current economic climate. This risk varies significantly depending on the creditworthiness of the issuer, as assessed by credit rating agencies like Moody's, Standard & Poor's, and Fitch. Economic downturns increase the likelihood of defaults, especially for corporate bonds with lower credit ratings (high-yield or junk bonds).

- Credit risk varies significantly across different bond issuers. Investment-grade bonds generally have lower default risk than high-yield bonds.

- Economic downturns increase the likelihood of defaults. Recessions and economic slowdowns stress corporate balance sheets, raising the probability of defaults.

- High-yield bonds carry a higher default risk than investment-grade bonds. Investors demand higher yields to compensate for the increased risk associated with high-yield bonds.

- Careful credit analysis is crucial for bond investors. Investors should thoroughly assess the creditworthiness of issuers before investing in their bonds.

Recent examples of corporate bond defaults highlight the importance of careful credit analysis. Investors must assess factors like the issuer's financial health, industry trends, and macroeconomic conditions before allocating capital to bonds.

Geopolitical Risks and Their Influence on Bond Market Volatility

Geopolitical events such as wars, political instability, and trade disputes can significantly increase volatility in the global bond market. These events create uncertainty, affecting investor sentiment and leading to significant price swings. Government bonds, particularly those issued by countries perceived as politically stable, are often seen as safe-haven assets during times of geopolitical turmoil.

- Geopolitical events increase market uncertainty. This uncertainty can lead to increased volatility and price fluctuations.

- Government bonds are often viewed as safe havens. Investors tend to flock to government bonds during times of crisis.

- Increased volatility can lead to significant price swings. Rapid price movements can create opportunities and risks for investors.

- Diversification and risk management are vital. A diversified portfolio across different asset classes and geographies can help mitigate geopolitical risk.

Recent geopolitical events, such as the war in Ukraine, have demonstrated the impact of global uncertainty on bond markets. Investors need to actively monitor geopolitical developments and their potential implications for their bond portfolios.

Conclusion

The global bond market is currently facing a complex interplay of risks, including rising interest rates, persistent inflation, credit risk, and geopolitical uncertainty. These factors contribute to increased volatility and potential losses for bond investors. Understanding these posthaste risks is crucial for navigating the current global bond market effectively. By carefully assessing interest rate risk, inflation risk, credit risk, and geopolitical risk, investors can make informed decisions to mitigate potential losses and potentially capitalize on opportunities within this dynamic landscape. Conduct thorough due diligence and consider seeking professional advice before making any investment decisions in the global bond market. Navigating the complexities of the global bond market requires a proactive approach to risk management.

Featured Posts

-

Ecb Your Source For England And Wales Cricket News And Results

May 23, 2025

Ecb Your Source For England And Wales Cricket News And Results

May 23, 2025 -

Malayalam Movie News Debunking The Suraj Venjaramoodu Kieran Culkin Oscar Speech Rumor

May 23, 2025

Malayalam Movie News Debunking The Suraj Venjaramoodu Kieran Culkin Oscar Speech Rumor

May 23, 2025 -

Washntn Tshhd Hjwma Mutlq Alnar Ydafe En Alqdyt Alflstynyt

May 23, 2025

Washntn Tshhd Hjwma Mutlq Alnar Ydafe En Alqdyt Alflstynyt

May 23, 2025 -

Currans Prediction A Difficult Bd Rollout

May 23, 2025

Currans Prediction A Difficult Bd Rollout

May 23, 2025 -

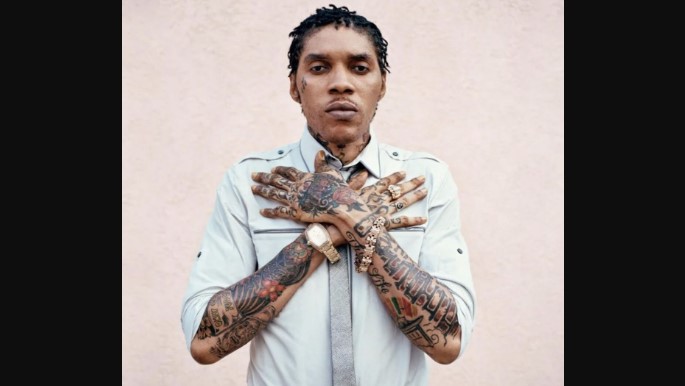

From Prison To Studio Vybz Kartels Exclusive Update On Music And Life

May 23, 2025

From Prison To Studio Vybz Kartels Exclusive Update On Music And Life

May 23, 2025

Latest Posts

-

Essen Tragik Und Hoffnung Nahe Dem Uniklinikum

May 23, 2025

Essen Tragik Und Hoffnung Nahe Dem Uniklinikum

May 23, 2025 -

Das Uniklinikum Essen Und Seine Bewegende Umgebung

May 23, 2025

Das Uniklinikum Essen Und Seine Bewegende Umgebung

May 23, 2025 -

Nrw Eis Ranking Essen Praesentiert Den Ueberraschungssieger

May 23, 2025

Nrw Eis Ranking Essen Praesentiert Den Ueberraschungssieger

May 23, 2025 -

Beruehrende Geschichten Rund Um Das Essener Uniklinikum

May 23, 2025

Beruehrende Geschichten Rund Um Das Essener Uniklinikum

May 23, 2025 -

Grossfeuer In Essen Heisingen Polizeimeldung Vom 07 04 2025

May 23, 2025

Grossfeuer In Essen Heisingen Polizeimeldung Vom 07 04 2025

May 23, 2025