Pound Strengthens After UK Inflation Report, BOE Rate Cut Expectations Fall

Table of Contents

UK Inflation Report Details & Market Reaction

The recent UK inflation report revealed key data points that surprised analysts and significantly impacted the Pound Sterling's performance.

Inflation Figures

The report showed that the Consumer Price Index (CPI) inflation for [Month, Year] came in at [Percentage]%, compared to [Percentage]% the previous month and the [Percentage]% predicted by analysts. The Retail Price Index (RPI), another key inflation measure, also showed a similar trend.

- CPI: [Percentage]% (down from [Previous Month's Percentage]%)

- RPI: [Percentage]% (down from [Previous Month's Percentage]%)

- Energy Prices: A significant decrease in energy prices contributed to the lower-than-expected inflation figures.

- Food Prices: While still elevated, food price inflation showed signs of easing.

This unexpected slowdown in inflation, defying analyst predictions of a more persistent inflationary pressure, triggered a positive market response.

Market Response to Inflation Data

The immediate market reaction to the lower-than-expected inflation figures was a sharp appreciation of the Pound. The GBP strengthened against the US dollar (USD), gaining [Percentage]%, and against the Euro (EUR), appreciating by [Percentage]%.

- GBP/USD: Increased from [Previous Rate] to [New Rate]

- GBP/EUR: Increased from [Previous Rate] to [New Rate]

The positive market response can be attributed to the reduced pressure on the Bank of England to implement further interest rate cuts. Lower inflation reduces the need for aggressive monetary policy easing, bolstering investor confidence in the UK economy.

Diminished Expectations of a BOE Rate Cut

The unexpected inflation data significantly altered market expectations regarding the Bank of England's future monetary policy decisions.

BOE's Current Monetary Policy Stance

The BOE has been grappling with managing inflation while supporting economic growth. Recent actions included [Mention previous rate decisions, e.g., a rate hike or holding rates steady]. These decisions directly impacted the Pound Sterling's value, with rate hikes generally strengthening the currency and vice-versa.

Impact of Inflation Report on BOE Decision-Making

The lower-than-anticipated inflation figures significantly reduce the pressure on the BOE to implement a rate cut in the near future. This suggests a more hawkish stance from the central bank, potentially implying a less accommodative monetary policy going forward. The implications for the UK economy include a potentially slower pace of economic growth, but also a reduced risk of runaway inflation. No official statements regarding future rate decisions have been made yet, but market speculation points towards a hold or even a potential future rate hike.

Market Speculation on Future Rate Hikes

Following the inflation report, market speculation regarding future interest rate hikes by the BOE has increased. Interest rate futures contracts are now pricing in a [Percentage]% probability of a rate hike by [Date]. This suggests a growing confidence in the UK economy's ability to manage inflation without the need for further easing of monetary policy.

Longer-Term Outlook for the Pound and UK Economy

While the recent strengthening of the Pound is positive, several factors will influence its longer-term performance and the overall health of the UK economy.

Factors Influencing GBP Strength

Several factors beyond the recent inflation data will influence the GBP's strength in the coming months and years.

- Global Economic Conditions: Global economic growth and stability will play a key role, influencing investor sentiment towards the GBP.

- Brexit's Continued Influence: The ongoing consequences of Brexit continue to impact the UK economy and the Pound's value. Trade deals and regulatory changes will continue to exert an influence.

- Geopolitical Events: Global geopolitical instability can significantly impact investor confidence and currency markets.

Risks and Uncertainties

Despite the positive news, several risks and uncertainties remain. Persistently high inflation, although currently easing, could still pressure the BOE to act. Geopolitical risks and unforeseen economic shocks could also negatively impact the Pound.

Conclusion

The recent UK inflation report has resulted in a significant strengthening of the Pound Sterling. This is primarily due to the diminished market expectations of a BOE rate cut, suggesting a potentially more positive short-term outlook for the UK economy. However, the longer-term outlook remains subject to various factors, including global economic conditions, the ongoing impact of Brexit, and potential geopolitical risks. Stay informed about fluctuations in the Pound Sterling and the UK's economic landscape. Continue to monitor the latest developments regarding UK inflation and BOE policy for a comprehensive understanding of the GBP's future performance. Regularly check reputable financial news sources for updates on Pound Sterling strength and its potential for future growth or decline.

Featured Posts

-

Nouvelle Brasserie Pres Du Hellfest Bienvenue A Hell City

May 22, 2025

Nouvelle Brasserie Pres Du Hellfest Bienvenue A Hell City

May 22, 2025 -

Loto Du Patrimoine 2025 Images Exclusives Du Theatre Tivoli A Clisson

May 22, 2025

Loto Du Patrimoine 2025 Images Exclusives Du Theatre Tivoli A Clisson

May 22, 2025 -

Liverpools Pursuit Of Jeremie Frimpong Awaiting Club Contact

May 22, 2025

Liverpools Pursuit Of Jeremie Frimpong Awaiting Club Contact

May 22, 2025 -

The Love Monster And The Importance Of Emotional Literacy In Children

May 22, 2025

The Love Monster And The Importance Of Emotional Literacy In Children

May 22, 2025 -

Chat Gpt And Open Ai The Ftc Investigation And Its Ramifications

May 22, 2025

Chat Gpt And Open Ai The Ftc Investigation And Its Ramifications

May 22, 2025

Latest Posts

-

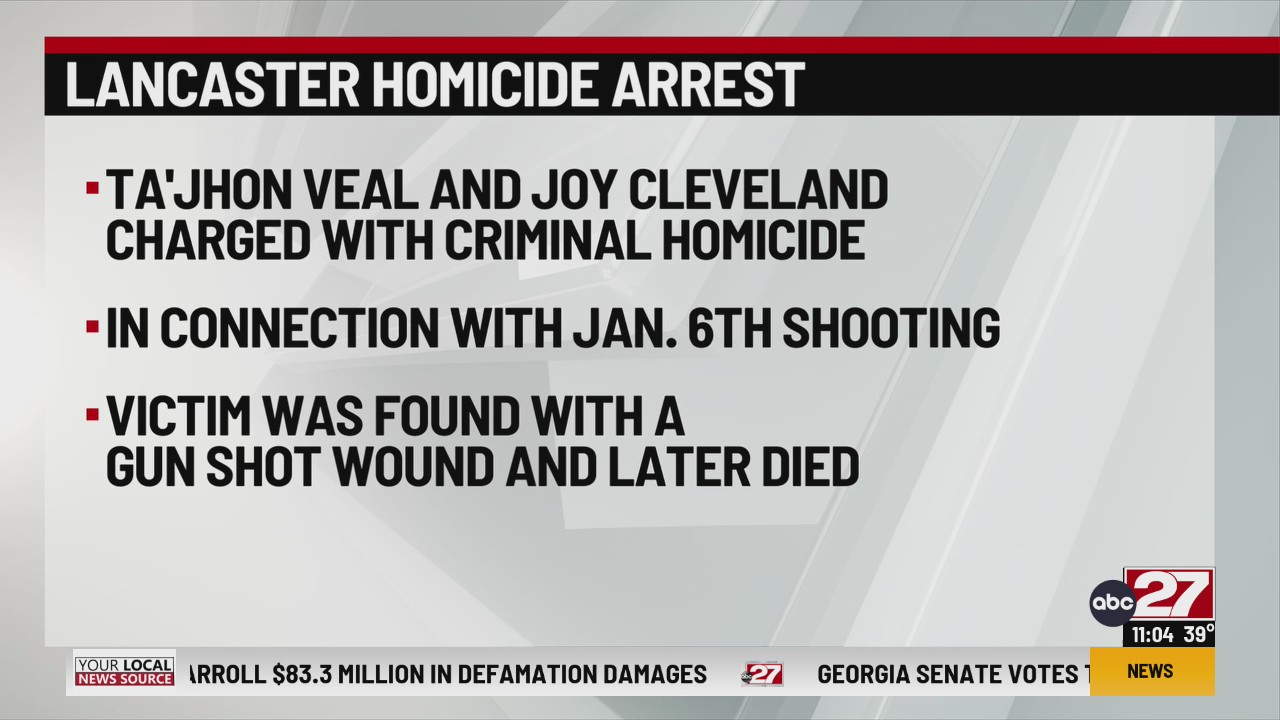

Lancaster County Pa Shooting Police Probe Ongoing

May 22, 2025

Lancaster County Pa Shooting Police Probe Ongoing

May 22, 2025 -

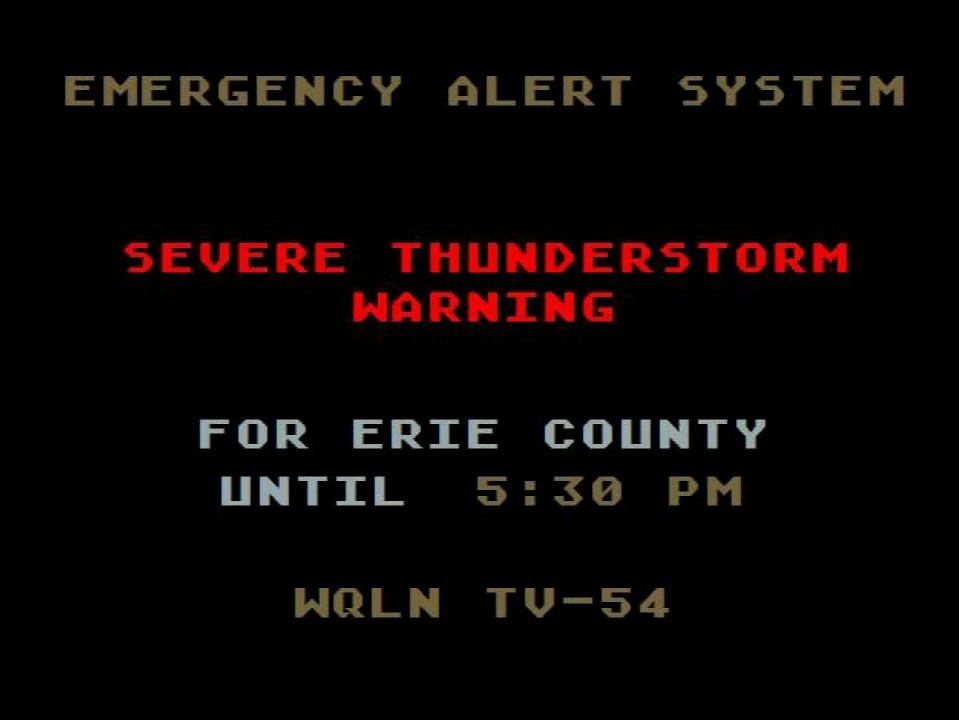

Severe Weather Alert Thunderstorm Watch Issued For South Central Pa

May 22, 2025

Severe Weather Alert Thunderstorm Watch Issued For South Central Pa

May 22, 2025 -

Police Investigate Lancaster County Shooting Updates And Details

May 22, 2025

Police Investigate Lancaster County Shooting Updates And Details

May 22, 2025 -

Lancaster County Shooting Police Investigation Underway

May 22, 2025

Lancaster County Shooting Police Investigation Underway

May 22, 2025 -

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025