Powell's Fed: A Calculated Risk – Why Delayed Interest Rate Cuts?

Table of Contents

The Lingering Threat of Inflation

Despite recent declines, inflation remains a significant concern, stubbornly above the Fed's target of 2%. This section details the ongoing worries about core inflation, highlighting the Fed's unwavering commitment to achieving price stability. The persistent threat of inflation significantly influences the timing of any interest rate cuts.

- Persistent core inflation readings: Core inflation, which excludes volatile food and energy prices, continues to show underlying inflationary pressures. This suggests that price increases are not merely temporary fluctuations but rather reflect deeper economic trends.

- The Fed's 2% inflation target: The Federal Reserve has consistently reiterated its dedication to achieving its 2% inflation target. Deviation from this target necessitates a cautious approach to monetary policy adjustments.

- Premature rate cuts could reignite inflation: Reducing interest rates too early could risk reigniting inflationary pressures, potentially undoing the progress made in taming inflation. The Fed is wary of this potential setback.

- CPI vs. PCE: The Fed considers both the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index when assessing inflation. Understanding the nuances of these different measures is critical to comprehending the Fed's decision-making process.

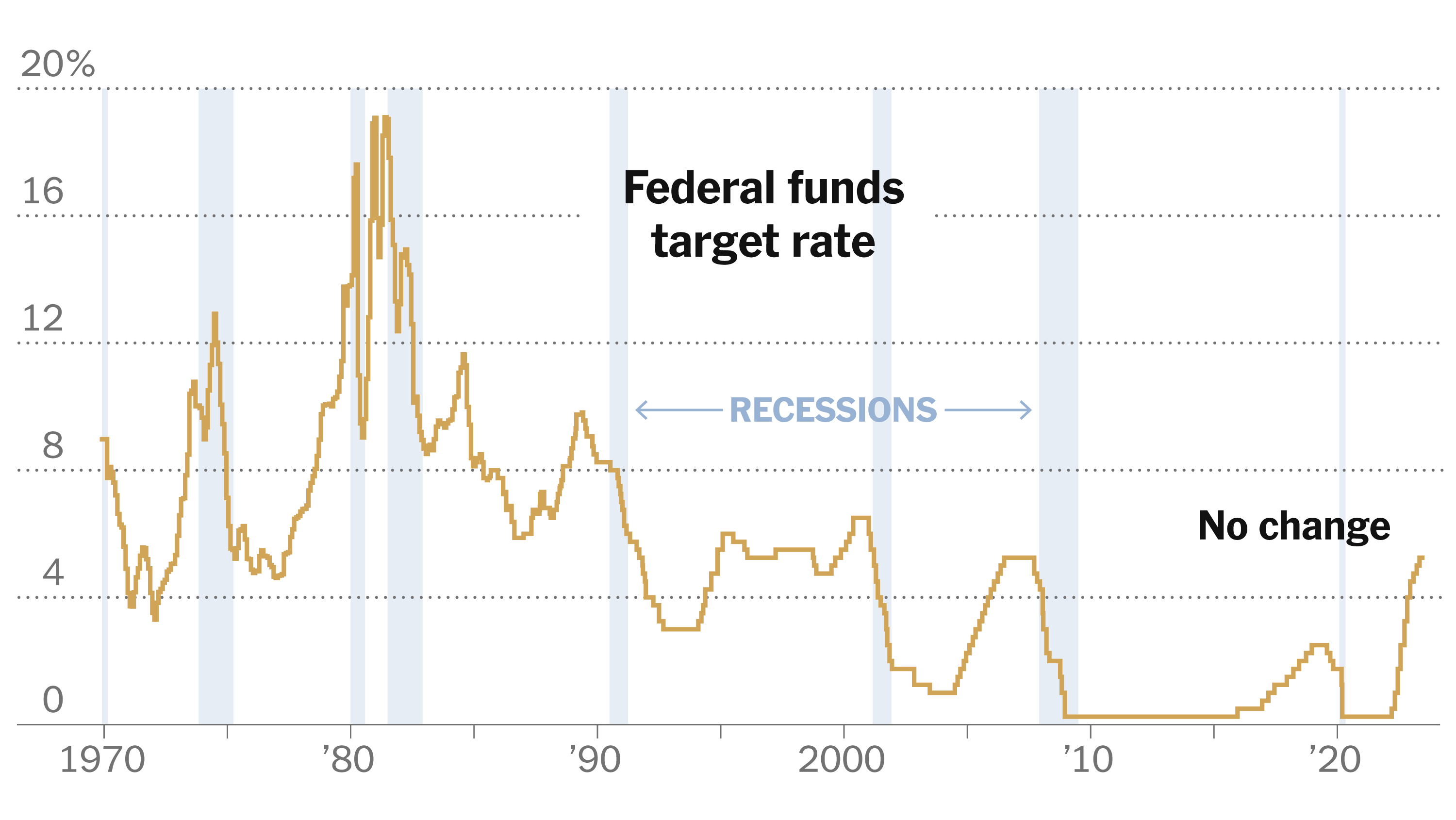

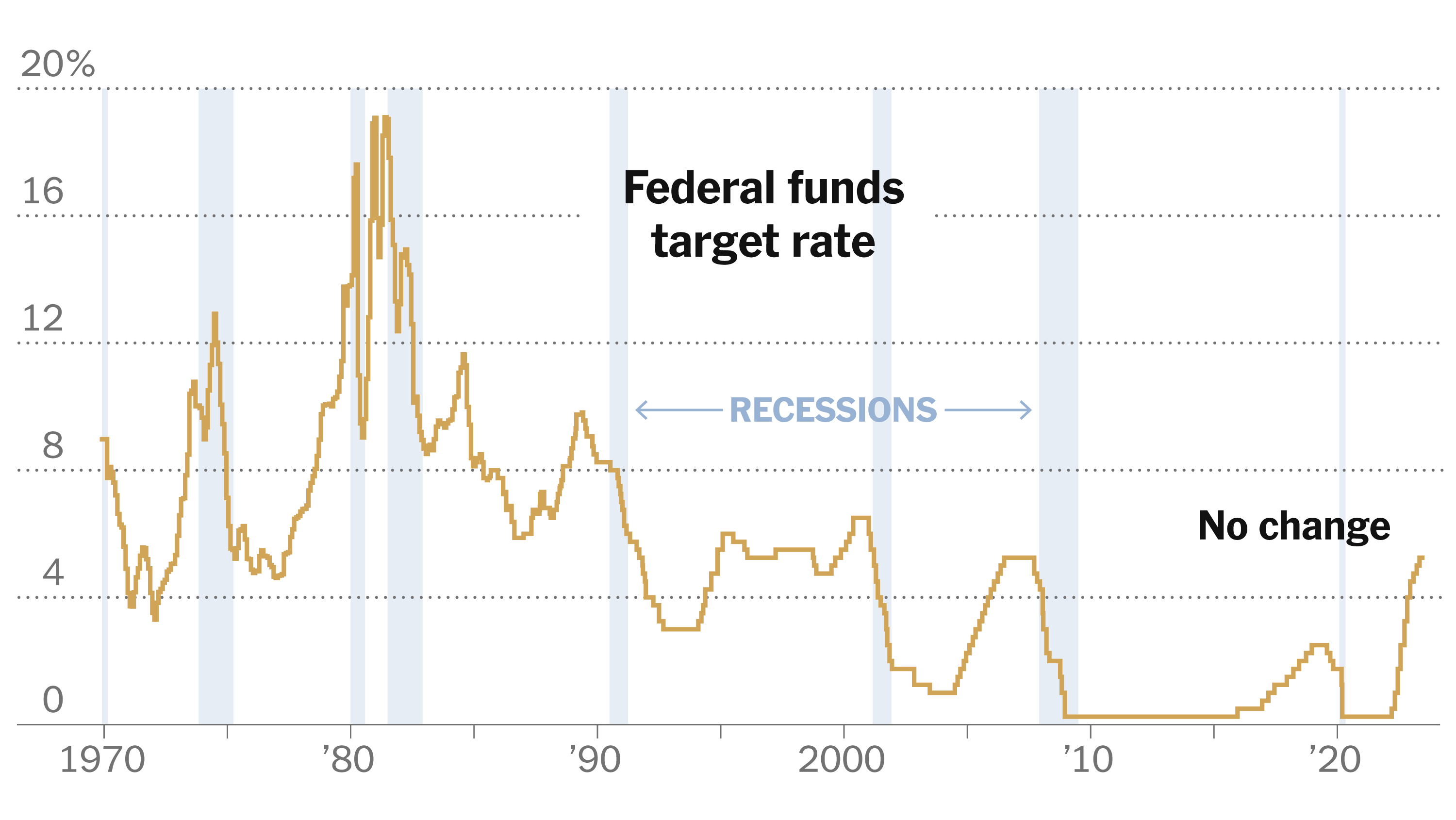

The Balancing Act: Growth vs. Inflation

The Federal Reserve faces a delicate balancing act: curbing inflation without triggering a significant economic downturn. This requires carefully navigating the complex interplay between economic growth and price stability. The possibility of a "soft landing"—slowing economic growth without causing a recession—is a primary consideration.

- Concerns about a potential recession: Aggressive interest rate cuts could risk stimulating economic activity too much, potentially pushing inflation back up. However, holding off on cuts for too long could lead to a recession. The Fed must weigh these competing risks.

- The trade-off between controlling inflation and fostering economic growth: This is the central challenge facing the Fed. Finding the optimal balance between these two competing objectives requires careful analysis of numerous economic indicators.

- Analyzing current GDP growth rates and projections: Current GDP growth rates and future projections are crucial inputs in the Fed's decision-making process. These data points provide insights into the health of the economy and the potential impact of interest rate changes.

- The Fed's assessment of the labor market: The strength of the labor market is a key factor. A strong labor market suggests the economy can withstand tighter monetary policy, while a weakening labor market might warrant more aggressive interest rate cuts.

Powell's Data-Dependent Approach

The Federal Reserve's monetary policy is data-dependent. This means the Fed carefully analyzes a wide range of economic indicators before making any significant changes to interest rates. This approach prioritizes a measured response based on real-time economic information.

- The Fed's data-driven decision-making process: The Fed meticulously reviews a variety of economic data, including inflation rates, employment figures, consumer spending, and industrial production, before making decisions regarding interest rates.

- The role of upcoming economic data releases: Upcoming data releases are crucial in shaping the Fed's assessment of the economic outlook. The Fed uses these data to revise their outlook and potentially influence monetary policy changes.

- Analysis of the Fed's forward guidance: The Fed's communication strategy, often referred to as "forward guidance," aims to influence market expectations regarding future interest rate changes. This communication is designed to guide and inform market behavior.

- Importance of FOMC meeting minutes and press conferences: The minutes of the Federal Open Market Committee (FOMC) meetings and Chair Powell's press conferences provide valuable insights into the Fed's reasoning and its future intentions.

The Risk of Delayed Action

Waiting too long to cut rates carries significant risks, including the potential for a deeper recession or prolonged economic stagnation. This section discusses potential negative consequences of delaying monetary policy adjustments.

- The risk of a prolonged period of high unemployment: Delaying rate cuts could exacerbate unemployment if economic growth slows down substantially. This risk weighs heavily on the Fed's considerations.

- The potential for increased market volatility and decreased investor confidence: Uncertainty surrounding the Fed's actions can increase market volatility and negatively impact investor confidence. This is a cost associated with delaying decisive action.

- The possibility of a stagflationary scenario: A prolonged period of slow economic growth combined with high inflation, commonly referred to as stagflation, represents a significant risk. The Fed aims to avoid such a scenario.

Conclusion

Powell's Fed's approach to interest rate cuts is indeed a calculated risk, carefully balancing the need to curb inflation with the avoidance of a severe economic downturn. The decision-making process is profoundly data-dependent, reflecting the complexity of navigating the current economic environment. The Fed's strategy involves a delicate balance between multiple competing economic factors.

Call to Action: Understanding the complexities of Powell's Fed and its interest rate policies is crucial for investors and businesses. Stay informed about upcoming economic data releases and FOMC decisions to effectively navigate the evolving landscape of interest rate cuts and their impact on the US economy. Keep an eye on future analysis regarding Powell’s Fed and its nuanced approach to managing interest rate cuts.

Featured Posts

-

10 Day Deal Cavaliers Sign Undrafted G League Player

May 07, 2025

10 Day Deal Cavaliers Sign Undrafted G League Player

May 07, 2025 -

Kht Shhn Jdyd Mn Laram Yrbt Byn Alsyn Almghrb Walbrazyl

May 07, 2025

Kht Shhn Jdyd Mn Laram Yrbt Byn Alsyn Almghrb Walbrazyl

May 07, 2025 -

John Wick 5 Making The Keanu Reeves Team Up A Reality

May 07, 2025

John Wick 5 Making The Keanu Reeves Team Up A Reality

May 07, 2025 -

The Young And The Restless March 7 2024 Recap Diane Saves Claire Kyles Romantic Evening

May 07, 2025

The Young And The Restless March 7 2024 Recap Diane Saves Claire Kyles Romantic Evening

May 07, 2025 -

Will Anthony Edwards Play Against The Lakers Injury News And Analysis

May 07, 2025

Will Anthony Edwards Play Against The Lakers Injury News And Analysis

May 07, 2025