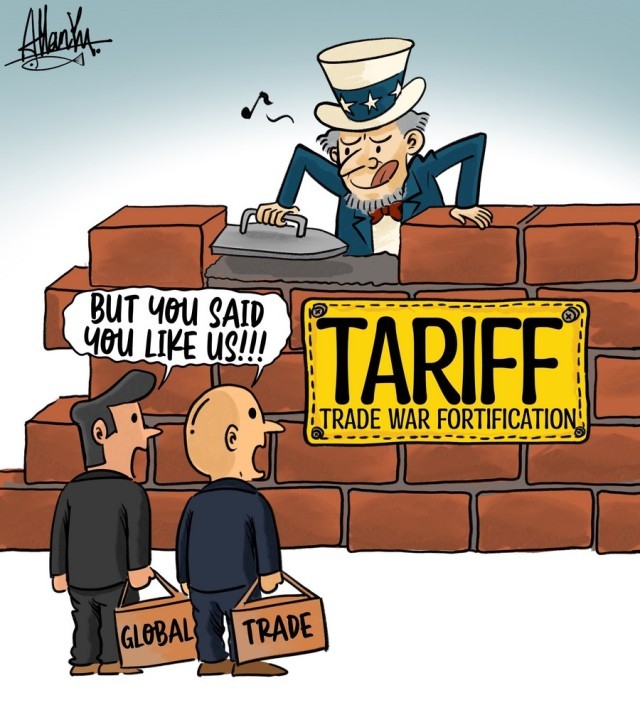

Powell's Warning: How Tariffs Could Jeopardize The Fed's Objectives

Table of Contents

Tariffs and Inflation: A Direct Threat to Price Stability

Tariffs, essentially taxes on imported goods, directly increase the cost of those goods for consumers. This leads to higher consumer prices and fuels inflation, a direct threat to the Fed's primary objective of price stability.

- Examples: Tariffs on steel and aluminum have increased the cost of cars, appliances, and construction materials. Tariffs on imported goods from China have impacted numerous consumer products.

- Statistical Data: Studies have shown a clear correlation between the implementation of tariffs and increases in the Consumer Price Index (CPI). For instance, [insert relevant statistical data or link to a reputable source showing the correlation between tariffs and inflation]. This pass-through effect, where the tariff's cost is largely passed on to consumers, exacerbates inflationary pressures.

- Pass-Through Effect: The extent of the pass-through effect depends on factors like market competition and the elasticity of demand. However, evidence suggests a significant portion of tariffs gets reflected in higher prices.

The Fed faces a significant challenge. While it aims to control inflation, combating tariff-induced inflation requires a different approach than addressing demand-pull inflation. There's also the risk of a wage-price spiral: higher prices lead to demands for higher wages, which further fuels inflation, creating a vicious cycle.

Tariffs and Economic Growth: Stifling Investment and Job Creation

Tariffs disrupt global supply chains, increasing uncertainty and reducing business investment. This slowdown in investment directly impacts economic growth and job creation, contradicting the Fed's goal of maximum employment.

- Industries Impacted: Industries heavily reliant on imported inputs, such as manufacturing and agriculture, are particularly vulnerable to tariff-related disruptions.

- Reduced Economic Activity: Trade wars and retaliatory tariffs lead to reduced international trade, negatively impacting GDP growth. [Insert relevant data or link to a reputable source illustrating this point].

- Uncertainty's Impact: Businesses hesitate to invest and expand when faced with unpredictable trade policies, leading to a chilling effect on economic activity.

Reduced investment translates to slower job creation. Furthermore, export-oriented sectors face job losses due to retaliatory tariffs imposed by other countries. The overall effect is a dampening of economic activity and employment opportunities.

The Fed's Limited Tools in a Tariff-Driven Economy

Monetary policy, the Fed's primary tool, has limited effectiveness in addressing supply-side shocks like those caused by tariffs.

- Interest Rate Adjustments: Raising interest rates to combat inflation might curb demand, but it won't address the underlying issue of increased input costs due to tariffs. It could even worsen the situation by slowing economic growth further.

- Targeting Inflation: When inflation is driven by external factors like tariffs, it’s challenging for the Fed to accurately target its monetary policy.

- Potential for Worsening the Situation: Inappropriate monetary policy responses could inadvertently amplify the negative effects of tariffs, leading to a deeper economic downturn.

The coordination between monetary (Fed) and fiscal (government) policies is crucial. However, conflicting objectives regarding trade policy can hinder effective coordination. The government's imposition of tariffs can directly counteract the Fed's attempts to stabilize the economy.

Powell's Statements and Actions: A Case Study

Jerome Powell has repeatedly expressed concerns about the negative economic consequences of tariffs. [Cite specific statements made by Powell regarding tariffs]. The Fed's response has been largely reactive, adapting its monetary policy to mitigate the effects of tariff-induced shocks. [Discuss the Fed's actions or inaction in response to tariffs]. It's also important to note the potential political pressures the Fed faces in navigating these complex trade issues. The Fed operates independently, but its actions have significant political ramifications.

Conclusion: Understanding the Risks of Tariffs on the Fed's Mandate

Tariffs pose a significant threat to the Fed's dual mandate. They increase inflation, jeopardizing price stability, and stifle investment and job creation, undermining the goal of maximum employment. Monetary policy alone has limited power to counteract the supply-side shocks created by tariffs. Understanding the complexities of trade policy and its impact on the broader economy is crucial. We must stay informed about Powell's concerns about tariffs and the Fed's actions in response. What steps do you believe are necessary to mitigate the negative economic effects of tariffs on the Fed’s objectives?

Featured Posts

-

Excess Water Use In North Myrtle Beach Poses Public Safety Risks

May 26, 2025

Excess Water Use In North Myrtle Beach Poses Public Safety Risks

May 26, 2025 -

Hells Angels Attend Funeral After Motorcycle Crash Death

May 26, 2025

Hells Angels Attend Funeral After Motorcycle Crash Death

May 26, 2025 -

Monacos Royal Family And A Shocking Financial Scandal

May 26, 2025

Monacos Royal Family And A Shocking Financial Scandal

May 26, 2025 -

Funeral Service Held For Hells Angels Member Following Fatal Accident

May 26, 2025

Funeral Service Held For Hells Angels Member Following Fatal Accident

May 26, 2025 -

Espanyol Un Atletico Madrid E Takilmasi Hakem Hatasi Mi

May 26, 2025

Espanyol Un Atletico Madrid E Takilmasi Hakem Hatasi Mi

May 26, 2025