Pre-May 5th Palantir Stock Outlook: Is It A Good Investment Opportunity?

Table of Contents

Palantir's Recent Performance and Financial Health

Analyzing Palantir's recent performance and financial health is crucial for any investment decision. A thorough understanding of the company's financial standing provides valuable insight into its potential for future growth.

Q4 2022 Earnings and Revenue Growth

Palantir's Q4 2022 earnings report offered a mixed bag for investors. While revenue growth showed promise, surpassing some analyst predictions, profitability remained a concern. Let's look at the key metrics:

- Revenue: [Insert actual Q4 2022 revenue figures here]. This represents a [percentage]% increase compared to Q4 2021, showing continued growth, though perhaps at a slower pace than some previous quarters.

- EPS (Earnings Per Share): [Insert actual Q4 2022 EPS figures here]. This figure needs to be considered in context with the company's overall financial picture.

- Key Metrics: A deeper dive into metrics such as operating margin and free cash flow is necessary to fully assess the company's financial health and stability. [Insert analysis of these metrics here, referencing specific numbers and comparing to previous quarters].

The overall financial health of Palantir shows a company actively growing revenue, but further analysis is needed to determine the long-term sustainability of its current trajectory.

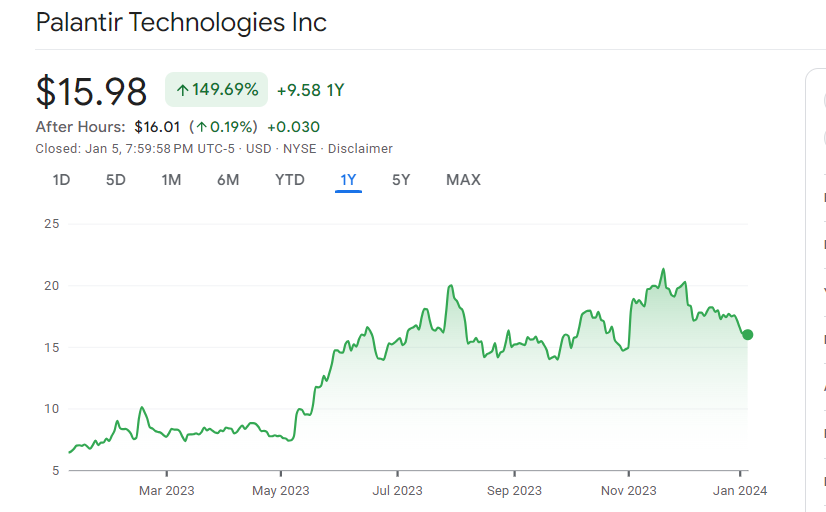

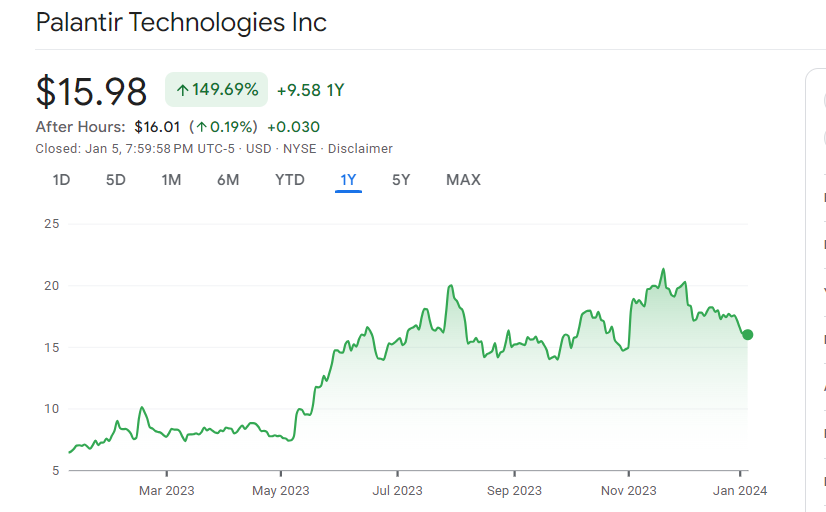

Stock Price Trends and Volatility

The Palantir stock price has exhibited considerable volatility in recent months. [Insert a brief description of recent stock price trends, mentioning significant highs and lows, and including a chart if possible]. Several factors have contributed to this fluctuation:

- Market Sentiment: The overall stock market sentiment has undoubtedly played a role. Broader market downturns often impact technology stocks like Palantir.

- Company Announcements: Significant news or announcements, such as new contracts or partnership agreements, often cause short-term fluctuations in the Palantir stock price. [Mention any specific examples].

- Analyst Ratings: Changes in analyst ratings and price targets can also significantly influence investor sentiment and subsequently, the stock price.

Future Growth Prospects and Potential Catalysts

Despite recent volatility, Palantir's future growth prospects remain promising due to several potential catalysts.

Government Contracts and Commercial Growth

Palantir's business model is dual-pronged, relying on both government contracts and commercial partnerships. This diversification offers some resilience against market fluctuations.

- Government Contracts: Palantir continues to secure significant government contracts, particularly in defense and intelligence. [Mention specific examples of recent large contracts and their estimated value]. These contracts provide a steady revenue stream and demonstrate the government's continued reliance on Palantir's technology.

- Commercial Growth: Palantir is actively expanding its commercial footprint, targeting large enterprises in various sectors. [Mention specific examples of new commercial partnerships and their potential impact on revenue]. This expansion is crucial for long-term growth and reduced reliance on government contracts alone.

Technological Innovation and Competitive Advantage

Palantir's continued investment in technological innovation is a key driver of its competitive advantage.

- AI and Machine Learning: Palantir is actively integrating AI and machine learning capabilities into its platform, enhancing its data analysis and decision-making capabilities. This positions them favorably in the competitive landscape.

- Platform Enhancements: The ongoing development and enhancement of Palantir's platform provide scalability and flexibility, attracting new clients and maintaining its competitive edge.

Risks and Challenges Facing Palantir

While the Palantir stock outlook presents opportunities, investors must also acknowledge significant risks and challenges.

Competition and Market Saturation

The data analytics market is highly competitive, with established players and emerging startups vying for market share.

- Key Competitors: [Mention key competitors, such as Microsoft, AWS, Google Cloud, etc., and briefly discuss their market share and competitive advantages].

- Market Saturation: The potential for market saturation remains a concern, requiring Palantir to continuously innovate and adapt to stay ahead of the curve.

Dependence on Government Contracts

A significant portion of Palantir's revenue comes from government contracts. This reliance presents both opportunities and risks.

- Government Spending: Changes in government spending policies or priorities could negatively impact Palantir's revenue streams.

- Geopolitical Risks: Global political instability could affect the timing and success of government contracts.

Conclusion

The pre-May 5th Palantir stock outlook presents a mixed bag. While Palantir demonstrates revenue growth and promising technological advancements, considerable risks exist, particularly concerning competition and reliance on government contracts. Thorough due diligence is crucial before investing in Palantir stock. Analyzing the Palantir stock price prediction alongside the company's financial health and future growth prospects is essential. This analysis should form just one piece of a comprehensive investment strategy.

Call to Action: Based on this analysis, whether Palantir stock presents a good investment opportunity before May 5th depends on your individual risk tolerance and investment goals. Remember to conduct thorough research and consult with a qualified financial advisor before making any investment decisions regarding Palantir stock or any other stock market investment. Stay informed on the Palantir stock outlook and continue monitoring the company's progress for a more complete picture. Learn more about investing in Palantir stock by conducting further research.

Featured Posts

-

Dijon Ou Donner Ses Cheveux Pour Une Bonne Cause

May 10, 2025

Dijon Ou Donner Ses Cheveux Pour Une Bonne Cause

May 10, 2025 -

Don De Cheveux A Dijon Comment Participer Et Quelles Associations Soutenir

May 10, 2025

Don De Cheveux A Dijon Comment Participer Et Quelles Associations Soutenir

May 10, 2025 -

Accident A Dijon Vehicule Percute Un Mur Rue Michel Servet Le Conducteur Se Constitue Prisonnier

May 10, 2025

Accident A Dijon Vehicule Percute Un Mur Rue Michel Servet Le Conducteur Se Constitue Prisonnier

May 10, 2025 -

Wheelchair Accessibility Issues And Solutions On The Elizabeth Line

May 10, 2025

Wheelchair Accessibility Issues And Solutions On The Elizabeth Line

May 10, 2025 -

New Uk Visa Restrictions Impact On International Applicants

May 10, 2025

New Uk Visa Restrictions Impact On International Applicants

May 10, 2025