Prediction: 2 Stocks Outperforming Palantir In 3 Years

Table of Contents

Palantir Technologies has undeniably captured significant attention in the tech world, known for its powerful data analytics platform. However, predicting future stock performance is a complex endeavor. This article analyzes the current market landscape and identifies two stocks with the potential to significantly outperform Palantir within the next three years. We will delve into their competitive advantages, growth prospects, and market positioning to support our prediction. Remember, all investments carry risk, and this is not financial advice.

Stock #1: Snowflake – A Data Analytics Powerhouse

Keywords: Snowflake, data analytics, AI, machine learning, big data, competitive advantage, market share, revenue growth, financial projections, cloud computing, data warehousing

Snowflake (SNOW) is a leading cloud-based data warehousing and analytics company. Its unique architecture and scalability offer a significant competitive advantage over traditional data solutions, including some aspects of Palantir's offerings.

Superior Technology and Scalability

- Massively scalable architecture: Snowflake's cloud-native architecture allows it to scale compute and storage independently, offering unmatched flexibility and cost-efficiency compared to on-premise solutions or other cloud providers with less flexible models. This scalability is crucial for handling the ever-increasing volume of big data generated by businesses today.

- Data sharing capabilities: Snowflake facilitates easy and secure data sharing across organizations, fostering collaboration and insights that traditional data warehouses struggle to achieve. This advantage is particularly appealing in today's interconnected business world.

- Support for diverse data types: Snowflake seamlessly integrates with various data sources and formats, providing a comprehensive solution for businesses dealing with complex datasets. This contrasts with some limitations in the flexibility and breadth of data sources that certain competitors, including Palantir, support.

Strong Growth Trajectory and Market Penetration

- Exceptional revenue growth: Snowflake has consistently demonstrated impressive revenue growth, exceeding expectations quarter after quarter. [Insert specific data points from credible financial sources here, e.g., "Year-over-year revenue growth of X% in Q[quarter] 2024"]. This sustained growth indicates strong market adoption and a robust business model.

- Expanding customer base: Snowflake's customer base spans diverse industries, demonstrating the versatility and applicability of its platform across sectors. [Cite statistics on customer acquisition and growth]. This wide adoption signals a growing and sustainable market presence.

- Strategic partnerships: Snowflake strategically partners with major cloud providers and technology companies, expanding its reach and market penetration. This strengthens its position in the data analytics ecosystem.

Robust Financial Position and Investment Potential

- Strong cash flow: Snowflake's operating cash flow is steadily increasing, indicating strong financial health and the ability to fund future growth initiatives. [Provide relevant data points]. This financial stability suggests a low risk of failure.

- High gross margins: Snowflake boasts high gross margins, demonstrating efficiency in its operations and pricing strategy. This profitability contributes to its attractive investment proposition.

- Significant market opportunity: The overall market for cloud-based data warehousing and analytics is expected to grow significantly in the coming years, presenting substantial growth opportunities for Snowflake. [Cite market research data from reputable sources].

Stock #2: CrowdStrike – Disrupting the Cybersecurity Sector

Keywords: CrowdStrike, cybersecurity, disruption, innovation, first-mover advantage, market leader, expansion plans, long-term growth, endpoint protection, cloud security

CrowdStrike (CRWD) is a leading cybersecurity company specializing in endpoint protection and cloud security solutions. Its innovative approach and rapid adoption of new technologies position it for significant growth.

First-Mover Advantage and Market Dominance

- Early adoption of cloud-native architecture: CrowdStrike embraced cloud-native security early on, giving it a significant first-mover advantage in the market. This strategic decision provides advantages in terms of scalability and agility compared to traditional cybersecurity companies.

- AI-powered threat detection: CrowdStrike leverages AI and machine learning to proactively identify and mitigate cyber threats, offering superior threat detection capabilities. This advanced technology contributes to the company's strong market reputation.

- Strong brand recognition and reputation: CrowdStrike has established itself as a trusted name in the cybersecurity industry, with a strong reputation for innovation and effectiveness. This positive brand image attracts customers and supports the company's rapid market expansion.

Significant Growth Opportunities in an Expanding Market

- Growing cybersecurity market: The cybersecurity market is booming, driven by the increasing digitalization of businesses and the rising frequency and sophistication of cyberattacks. [Cite market research data highlighting the growth of the cybersecurity market]. This creates a large and growing market for CrowdStrike's services.

- Expanding product portfolio: CrowdStrike continuously expands its product portfolio to address the evolving needs of its customers, enhancing its market reach and positioning. This proactive approach to innovation is key to its ability to attract new customers.

- Global expansion: CrowdStrike is actively expanding its operations globally, capitalizing on the increasing demand for cybersecurity solutions worldwide. [Include data points about CrowdStrike's international expansion].

Strategic Partnerships and Future Outlook

- Strategic alliances: CrowdStrike strategically partners with other technology companies to broaden its reach and integrate its solutions into existing ecosystems. This collaboration amplifies its impact in the market.

- Acquisitions: CrowdStrike strategically acquires smaller companies to enhance its technology and expand its service offerings. This M&A strategy further strengthens its competitive advantage and accelerates growth.

- Long-term vision: CrowdStrike has a clear long-term vision for growth, focused on innovation and market expansion. Its commitment to research and development ensures the company remains at the forefront of cybersecurity technology.

Conclusion

Snowflake's superior technology and scalability in the data analytics space, coupled with CrowdStrike's innovation and leadership in the rapidly expanding cybersecurity sector, position these companies for substantial growth. Their strong financial positions, aggressive growth strategies, and unique market advantages suggest a high probability of outperforming Palantir's growth trajectory over the next three years. However, it's crucial to remember that this is a prediction and not financial advice. All investments carry risk. Conduct your own thorough due diligence, explore various investment strategies, and consider consulting a financial advisor before investing in any stock, including high-growth potential stocks like those mentioned here that may outperform Palantir. Learn more about smart investing strategies and make informed decisions regarding stocks that might outperform Palantir.

Featured Posts

-

Red Wings Fall To Golden Knights Hertls Impressive Performance

May 09, 2025

Red Wings Fall To Golden Knights Hertls Impressive Performance

May 09, 2025 -

Can Lam Gi De Ngan Chan Bao Hanh Tre Em Sau Vu Viec O Tien Giang

May 09, 2025

Can Lam Gi De Ngan Chan Bao Hanh Tre Em Sau Vu Viec O Tien Giang

May 09, 2025 -

Barbashevs Ot Goal Propels Vegas Golden Knights To Game 4 Victory Over Minnesota Wild

May 09, 2025

Barbashevs Ot Goal Propels Vegas Golden Knights To Game 4 Victory Over Minnesota Wild

May 09, 2025 -

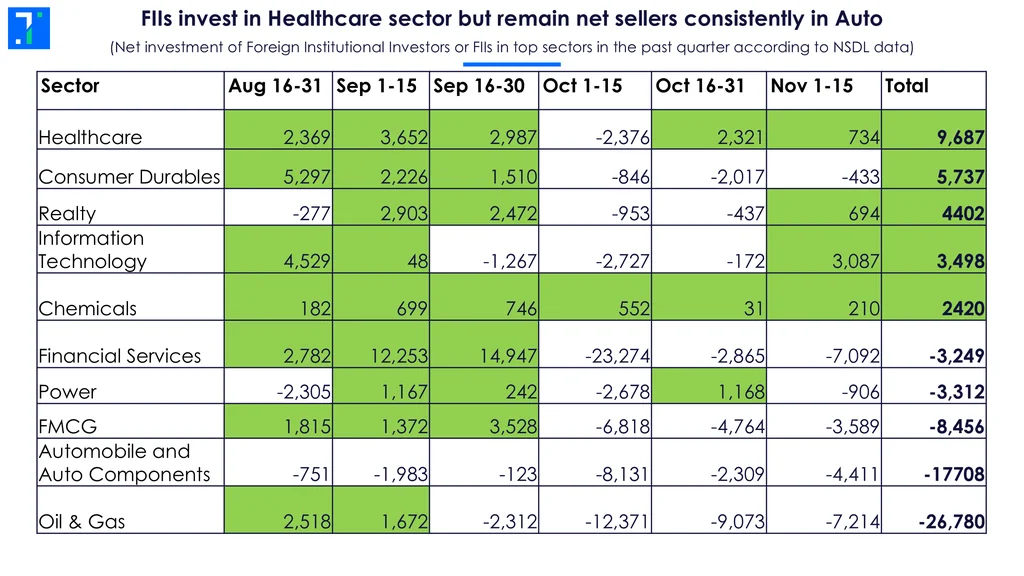

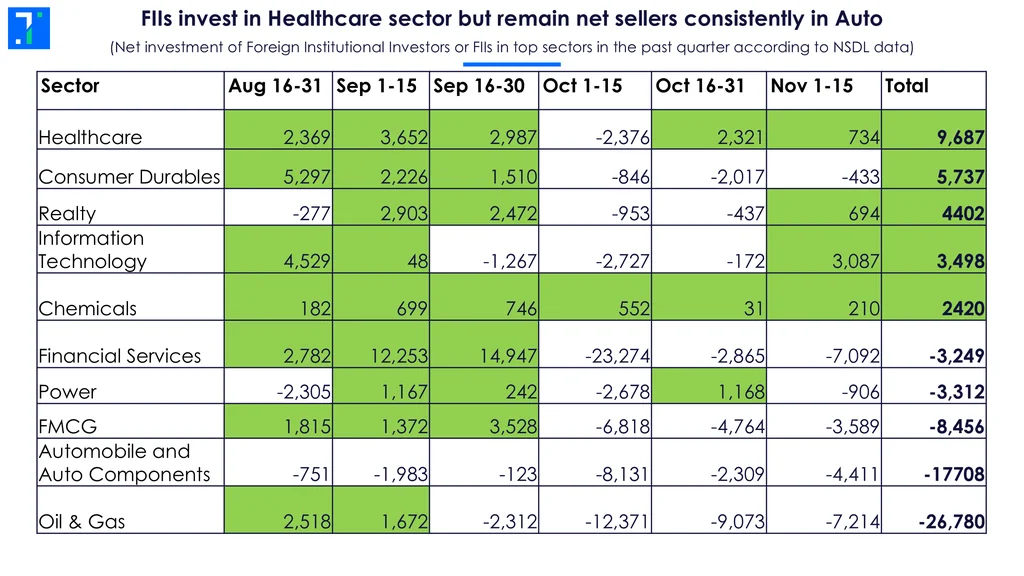

Operation Sindoors Impact Kse 100 Halted After Sharp 6 Decline

May 09, 2025

Operation Sindoors Impact Kse 100 Halted After Sharp 6 Decline

May 09, 2025 -

Should You Buy Palantir Stock Before May 5th A Prudent Investors Guide

May 09, 2025

Should You Buy Palantir Stock Before May 5th A Prudent Investors Guide

May 09, 2025

Latest Posts

-

Fate Of Historic Broad Street Diner Sealed Hyatt Hotel Plans Proceed

May 09, 2025

Fate Of Historic Broad Street Diner Sealed Hyatt Hotel Plans Proceed

May 09, 2025 -

Demolition Of Beloved Broad Street Diner For New Hyatt Hotel

May 09, 2025

Demolition Of Beloved Broad Street Diner For New Hyatt Hotel

May 09, 2025 -

Broad Street Diners Demise Hyatt Hotel Construction To Begin

May 09, 2025

Broad Street Diners Demise Hyatt Hotel Construction To Begin

May 09, 2025 -

Historic Broad Street Diner Demolition Hyatt Hotel Development

May 09, 2025

Historic Broad Street Diner Demolition Hyatt Hotel Development

May 09, 2025 -

Man Dies In Racist Stabbing Woman Arrested For Unprovoked Attack

May 09, 2025

Man Dies In Racist Stabbing Woman Arrested For Unprovoked Attack

May 09, 2025