Private Credit Job Hunt: 5 Essential Dos And Don'ts

Table of Contents

Do: Network Strategically within the Private Credit Industry

The private credit industry thrives on relationships. Building a strong network is crucial for uncovering hidden job opportunities and gaining valuable insights.

Leverage LinkedIn Effectively

Your LinkedIn profile is your digital resume. Optimize it to attract recruiters and industry professionals searching for private credit talent.

- Keyword Optimization: Incorporate relevant keywords throughout your profile, including "private credit," "debt financing," "leveraged loans," "distressed debt," "private equity," "direct lending," "mezzanine financing," and specific fund strategies (e.g., "real estate private credit," "senior secured loans").

- Active Engagement: Don't just create a profile; engage! Comment on posts, share relevant articles, and participate in discussions within groups focused on private credit, alternative investments, and finance.

- Targeted Connections: Connect with recruiters specializing in private credit placements and individuals working at firms you admire.

Attend Industry Events

Networking events provide invaluable opportunities to connect with professionals face-to-face.

- Conference Attendance: Prioritize conferences and workshops focused on private credit, alternative investments, and related fields.

- Meaningful Interactions: Prepare concise and compelling introductions that highlight your skills and career aspirations. Go beyond a simple handshake; aim for genuine conversation.

- Follow-up: Always follow up with valuable contacts you meet, sending a brief email reiterating your interest and sharing something relevant you discussed.

Informational Interviews

Informational interviews offer a unique opportunity to learn about the industry from insiders.

- Strategic Outreach: Reach out to professionals working in private credit for informational interviews. Tailor your outreach to each individual, showing you've researched their background and work.

- Prepared Questions: Prepare thoughtful questions that demonstrate your genuine interest and understanding of the field. Focus on their career path, challenges, and advice for someone entering the field.

- Sustained Relationships: Express gratitude and maintain contact after the interview. A follow-up note expressing appreciation and mentioning something specific from your conversation shows professionalism and genuine interest.

Don't: Neglect Your Online Presence

Your online presence is often the first impression potential employers have. A strong online profile is as important as a strong resume.

Maintain a Professional Online Profile

Ensure all your online profiles project a professional image.

- Social Media Scrutiny: Review your social media profiles (LinkedIn, Twitter, etc.) and remove anything that could be perceived as unprofessional or controversial. Remember, potential employers will likely review your online presence.

- Regular Updates: Regularly update your online profiles to reflect your current skills, experience, and achievements. This shows you are actively engaged in your professional development.

- Consistent Branding: Maintain a consistent professional brand across all your online platforms. This reinforces your personal brand and demonstrates attention to detail.

Underestimate the Importance of Your Resume & Cover Letter

Your resume and cover letter are your marketing tools. They need to be compelling and targeted.

- Tailored Approach: Tailor your resume and cover letter to each specific private credit job application. Generic applications rarely succeed in a competitive field.

- Quantifiable Achievements: Quantify your accomplishments whenever possible. Use numbers and data to demonstrate your impact (e.g., "increased portfolio returns by 15%," "managed a $50 million loan portfolio").

- Keyword Integration: Incorporate keywords relevant to private credit roles and the specific job description into your resume and cover letter. Applicant Tracking Systems (ATS) often screen for these keywords.

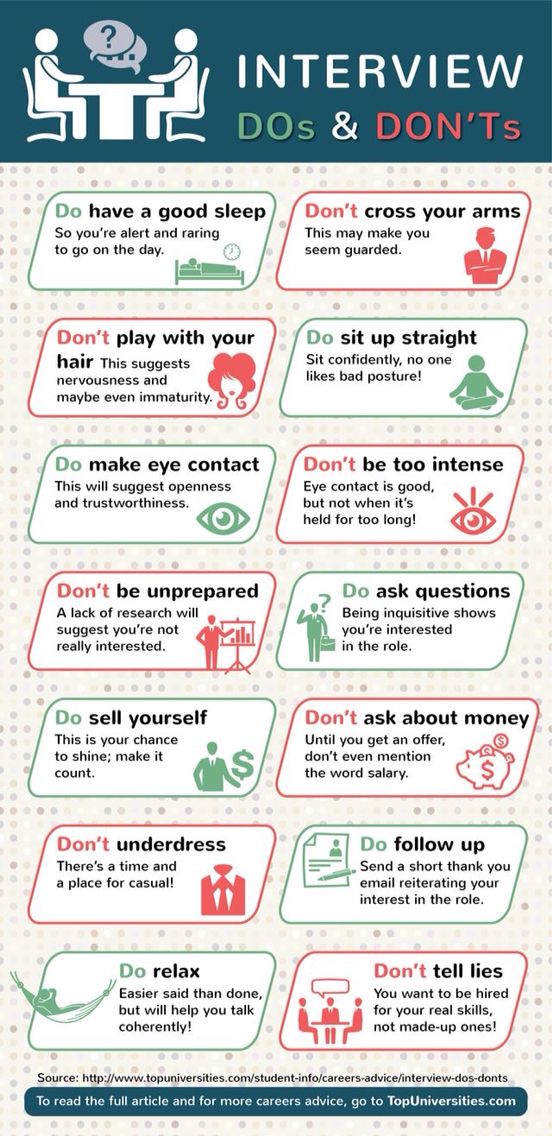

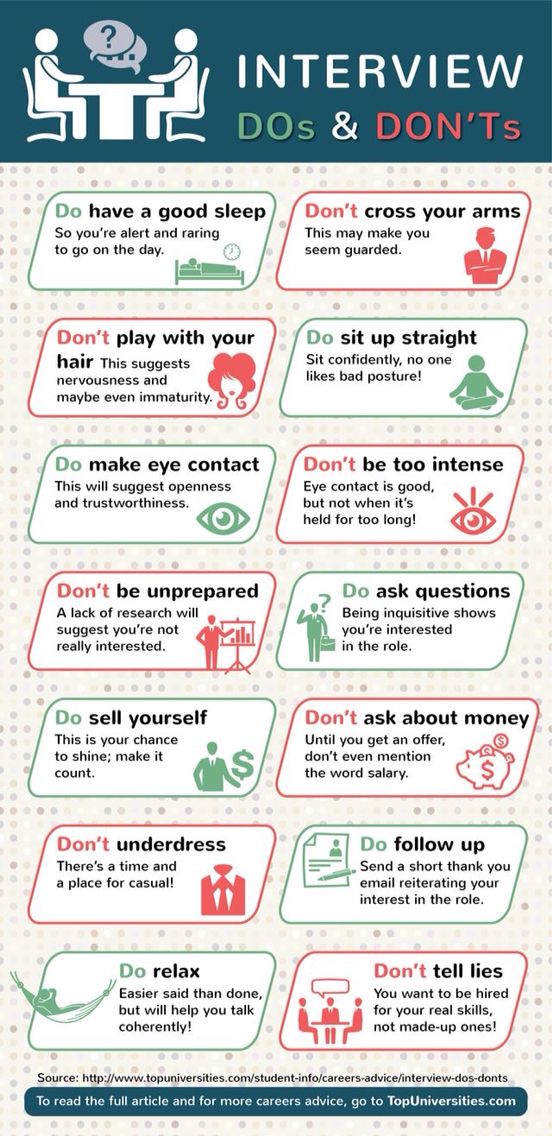

Do: Prepare Thoroughly for Private Credit Interviews

Thorough preparation is key to succeeding in private credit interviews, which often involve technical and behavioral components.

Understand the Firm's Investment Strategy

Research is crucial. Demonstrate your understanding of the private credit firm and the market.

- Due Diligence: Research the specific private credit firm you're interviewing with, including their investment strategy, portfolio companies, recent transactions, and key team members.

- Informed Discussion: Demonstrate your knowledge during the interview. Ask insightful questions that show you’ve done your homework.

- Industry Trends: Stay updated on current industry trends and market conditions.

Practice Behavioral Interview Questions

Behavioral questions assess your soft skills and how you've handled past situations.

- Common Questions: Prepare for common behavioral interview questions (e.g., "Tell me about a time you failed," "Describe a challenging situation you overcame," "How do you handle conflict?").

- STAR Method: Use the STAR method (Situation, Task, Action, Result) to structure your responses, providing concrete examples.

- Self-Reflection: Reflect on your past experiences and identify examples that highlight your strengths and relevant skills.

Prepare Technical Questions

Private credit interviews often include technical questions related to finance and the industry.

- Financial Modeling: Brush up on your financial modeling skills, including discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and credit analysis.

- Valuation: Be prepared to discuss various valuation methodologies and their applications in private credit.

- Software Proficiency: Demonstrate your proficiency with relevant software such as Excel, Bloomberg Terminal, and potentially other financial modeling tools.

Don't: Undersell Your Skills and Experience

Confidence and clear communication are crucial to highlight your strengths effectively.

Highlight Relevant Achievements

Showcase your accomplishments and contributions clearly and concisely.

- Quantifiable Results: Use quantifiable data to demonstrate your impact. Focus on the value you’ve added in past roles.

- Storytelling: Craft compelling narratives around your accomplishments, emphasizing your role in achieving success.

- Impactful Language: Use strong action verbs and descriptive language to highlight your skills and contributions.

Be Prepared to Discuss Your Salary Expectations

Researching industry salary ranges is essential for negotiating effectively.

- Industry Benchmarks: Research industry salary ranges for private credit roles at your experience level using resources like Glassdoor, Salary.com, or industry reports.

- Confidence in Negotiation: Be confident and assertive when discussing your salary expectations. Clearly articulate your value and justify your desired compensation.

- Flexibility: While having a target salary in mind, be prepared to discuss a range and remain flexible based on the overall compensation package.

Forget to Ask Questions

Asking thoughtful questions shows your interest and engagement.

- Prepared Questions: Prepare a list of insightful questions to ask the interviewer(s). This demonstrates your genuine interest and proactive nature.

- Follow-up Questions: Listen attentively to the interviewer's responses and ask relevant follow-up questions to show you are engaged.

- Company Culture: Don't hesitate to ask questions about the company culture, team dynamics, and career development opportunities.

Do: Follow Up After the Interview

A strong follow-up reinforces your interest and professionalism.

Send a Thank-You Note

Sending a personalized thank-you note demonstrates your appreciation and professionalism.

- Prompt Delivery: Send a personalized thank-you note within 24 hours of the interview.

- Key Highlights: Reiterate your interest and highlight key aspects of the conversation, showing you were actively listening.

- Professionalism: Maintain a professional and courteous tone throughout your communication.

Maintain Contact

Following up appropriately after the interview can be a deciding factor.

- Appropriate Timing: Follow up with the interviewer(s) after a reasonable timeframe (e.g., a week) if you haven't heard back.

- Professional Reminder: Your follow-up should be brief and professional, simply reiterating your interest in the position.

- Respectful Persistence: Avoid excessive follow-up; one or two polite reminders are usually sufficient.

Conclusion

Securing a position in private credit requires dedication, preparation, and a strategic approach. By following these dos and don'ts for your private credit job hunt, you'll significantly increase your chances of success. Remember to network effectively, maintain a strong online presence, prepare thoroughly for interviews, and confidently present your skills and experience. Start your successful private credit job hunt today by implementing these strategies. Good luck!

Featured Posts

-

500 000 Pei Bill For Nhl 4 Nations Face Off Legislature Details

May 07, 2025

500 000 Pei Bill For Nhl 4 Nations Face Off Legislature Details

May 07, 2025 -

Fatal Crash Claims Life Of Jailed Street Racer Leaving Two Orphans

May 07, 2025

Fatal Crash Claims Life Of Jailed Street Racer Leaving Two Orphans

May 07, 2025 -

Who Voices Kenny In The White Lotus Season 3 Revealing Tims Coworker

May 07, 2025

Who Voices Kenny In The White Lotus Season 3 Revealing Tims Coworker

May 07, 2025 -

Papal Election A Guide To The Conclave Process

May 07, 2025

Papal Election A Guide To The Conclave Process

May 07, 2025 -

Jenna Ortegas Scream Departure The Real Reason After Melissa Barrera Left

May 07, 2025

Jenna Ortegas Scream Departure The Real Reason After Melissa Barrera Left

May 07, 2025