Private Credit Jobs: 5 Do's And Don'ts For Success

Table of Contents

5 Do's for Success in Private Credit Jobs

Do 1: Network Strategically

Building a strong network is paramount for securing a private credit job. The industry thrives on relationships, and making connections can open doors to unadvertised opportunities.

- Private Credit Networking: Don't limit yourself to online networking. Attend industry events, conferences, and workshops to meet professionals face-to-face. Private Credit Conferences are particularly valuable for building relationships and learning about new trends.

- Private Equity Networking & Hedge Fund Networking: Expand your network beyond private credit to include professionals in related fields like private equity and hedge funds. These areas often have overlapping skills and opportunities.

- Leverage LinkedIn Effectively: Use LinkedIn to connect with recruiters, hiring managers, and professionals working in private credit. Join relevant groups and participate in discussions to increase your visibility.

- Alumni Networks: Tap into your university's alumni network. Many successful professionals are happy to mentor aspiring colleagues from their alma mater.

Do 2: Develop Specialized Skills

Private credit roles demand a specific skillset. Focusing on these areas will significantly boost your candidacy.

- Private Credit Skills: Master financial modeling, valuation, credit analysis, and due diligence – these are the cornerstones of private credit analysis.

- Essential Certifications: Obtain relevant certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) to demonstrate your expertise.

- Software Proficiency: Become highly proficient in Excel, Bloomberg Terminal, and other financial analysis tools used extensively in private credit.

- Market Awareness: Stay updated on current market trends and regulatory changes impacting the private credit industry. Reading industry publications and attending webinars is crucial.

Do 3: Tailor Your Resume and Cover Letter

Your application materials are your first impression. Make it count.

- Private Credit Resume: Highlight experience and skills directly relevant to the specific job description. Use action verbs and quantify your achievements whenever possible (e.g., "Increased portfolio returns by 15%").

- Private Credit Cover Letter: Craft a compelling cover letter that showcases your understanding of the private credit industry and the specific company's investment strategy.

- ATS Optimization: Use keywords from the job posting in your resume and cover letter to improve your chances of getting past Applicant Tracking Systems (ATS). These systems scan resumes for keywords before a human even sees them.

- Financial Services Resume Best Practices: Research best practices for creating effective resumes and cover letters within the broader financial services sector.

Do 4: Prepare for Behavioral and Technical Interviews

Thorough preparation is crucial for success in private credit interviews.

- Private Credit Interview Preparation: Practice answering common behavioral interview questions ("Tell me about a time you failed...") and technical questions related to financial analysis, valuation, and credit risk.

- Company Research: Research the company, its investment strategy, recent deals, and the interviewers. Demonstrate your understanding during the interview.

- Thoughtful Questions: Prepare insightful questions to ask the interviewer. This shows your engagement and genuine interest.

- Financial Interview Questions: Familiarize yourself with typical financial interview questions to ensure you can confidently discuss your experience and knowledge.

Do 5: Follow Up After Interviews

Maintaining communication after your interview shows professionalism and initiative.

- Job Interview Follow Up: Send a personalized thank-you note to each interviewer within 24 hours. Reiterate your interest and highlight key points from the conversation.

- Networking Follow Up: If you networked with individuals who helped you get the interview, thank them for their time and keep them updated on your progress.

- Application Status: Follow up on the status of your application after a reasonable timeframe, demonstrating continued interest without being overly persistent.

5 Don'ts for Success in Private Credit Jobs

Don't 1: Neglect Networking

Networking is not optional; it's essential. Actively cultivate relationships with professionals in the industry. A passive job search rarely yields optimal results. Understanding the importance of Private Credit Job Search strategies is crucial.

Don't 2: Underestimate the Importance of Soft Skills

Technical skills are essential, but strong communication, teamwork, and problem-solving abilities are equally important in private credit. Don't overlook the value of soft skills in finance and teamwork in finance.

Don't 3: Submit Generic Applications

Avoid using the same resume and cover letter for every application. Tailor each application to the specific requirements and culture of the target company. Using targeted resumes will significantly increase your chances.

Don't 4: Lack Preparation for Interviews

Improper preparation can severely hinder your chances. Practice your responses, research the company, and prepare thoughtful questions. A well-prepared candidate exudes confidence. Understanding Interview Preparation Tips and Finance Interview best practices will set you apart.

Don't 5: Neglect Continuing Education

The private credit industry is dynamic. Stay updated on the latest trends, regulations, and technologies through continuous learning. Continuing education and knowledge of Private Credit Industry Trends are vital for long-term success.

Conclusion

Securing a coveted position in private credit jobs requires dedication, strategic planning, and a proactive approach. By following these five do's and don'ts, you can significantly improve your chances of success. Remember to prioritize networking, develop specialized skills, tailor your applications, prepare thoroughly for interviews, and remain committed to ongoing professional development. Start building your career in private credit today – your dream job is within reach! Begin your search for fulfilling private credit jobs now!

Featured Posts

-

Stay Updated Latest Lotto Lotto Plus 1 And Lotto Plus 2 Draw Results

May 02, 2025

Stay Updated Latest Lotto Lotto Plus 1 And Lotto Plus 2 Draw Results

May 02, 2025 -

Lotto 6aus49 Ergebnis Mittwoch 9 April 2025 Zahlen Ueberpruefen

May 02, 2025

Lotto 6aus49 Ergebnis Mittwoch 9 April 2025 Zahlen Ueberpruefen

May 02, 2025 -

Fortnite Item Shop Free Captain America Items For A Limited Time

May 02, 2025

Fortnite Item Shop Free Captain America Items For A Limited Time

May 02, 2025 -

Fortnite Update 34 20 Server Downtime And Whats New

May 02, 2025

Fortnite Update 34 20 Server Downtime And Whats New

May 02, 2025 -

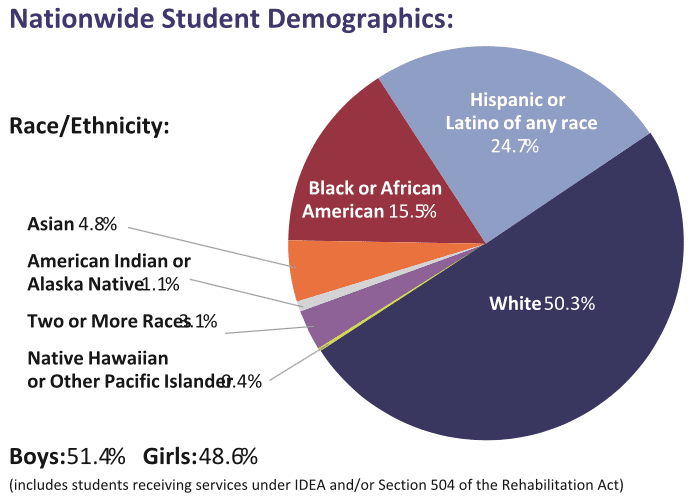

The Negative Impact Of School Suspensions Evidence And Solutions

May 02, 2025

The Negative Impact Of School Suspensions Evidence And Solutions

May 02, 2025

Latest Posts

-

Elizabeth Stewarts Spring Designs A Collaboration With Lilysilk

May 10, 2025

Elizabeth Stewarts Spring Designs A Collaboration With Lilysilk

May 10, 2025 -

A Look At Elizabeth Stewart And Lilysilks Collaborative Spring Line

May 10, 2025

A Look At Elizabeth Stewart And Lilysilks Collaborative Spring Line

May 10, 2025 -

New Spring Collection Elizabeth Stewarts Designs For Lilysilk

May 10, 2025

New Spring Collection Elizabeth Stewarts Designs For Lilysilk

May 10, 2025 -

Go Compare Drops Wynne Evans After Strictly Come Dancing Scandal

May 10, 2025

Go Compare Drops Wynne Evans After Strictly Come Dancing Scandal

May 10, 2025 -

Celebrity Stylist Elizabeth Stewart Designs Exclusive Capsule Collection For Lilysilk

May 10, 2025

Celebrity Stylist Elizabeth Stewart Designs Exclusive Capsule Collection For Lilysilk

May 10, 2025