Private Equity Buys Boston Celtics For $6.1 Billion: Future Uncertain For Fans

Table of Contents

The $6.1 Billion Deal: A Record-Breaking Transaction

The $6.1 billion price tag attached to the Boston Celtics sale represents the highest price ever paid for an NBA franchise, shattering previous records and signifying a new era in professional sports valuations. This monumental sum reflects not only the Celtics' rich history and consistent on-court success, but also the growing influence of private equity in the sports industry. The previous ownership group, led by Wyc Grousbeck, oversaw a period of significant on-court success, including an NBA championship in 2008 and consistent playoff appearances. However, this sale marks a transition to a new era for the franchise. The private equity firm involved in the acquisition, [Insert Name of Private Equity Firm Here], is known for its investment strategies focused on maximizing returns, often through aggressive financial restructuring and operational improvements.

- Highest price ever paid for an NBA franchise. This underscores the immense value of established sports teams as lucrative investment opportunities.

- Signals a growing trend of private equity investment in sports. This investment model is becoming increasingly prevalent across various professional sports leagues.

- Potential for significant returns on investment for the buyers. The sheer magnitude of the purchase suggests a strong belief in the long-term financial potential of the Celtics.

Impact on the Boston Celtics' Operations and Management

The Boston Celtics sale inevitably leads to questions about the team's operational changes. A new ownership group often brings about shifts in team management and coaching staff. While the immediate impact may be subtle, the long-term implications could be significant. The new owners might prioritize short-term financial gains over long-term team building, leading to increased pressure on the team to achieve immediate results. This could potentially affect player recruitment, contract negotiations, and overall team strategy. Furthermore, there are concerns about potential increases in ticket prices and merchandise costs, potentially affecting fan accessibility and loyalty.

- New ownership may prioritize profitability over long-term team building. This could lead to roster changes driven by financial considerations rather than purely athletic performance.

- Potential for increased scrutiny on player performance and contract negotiations. Players might face greater pressure to deliver results to justify their salaries.

- Changes in front office personnel are likely. This could involve restructuring the management team to align with the new owners' vision and strategies.

Fan Concerns and the Future of the Boston Celtics

The biggest question on many fans' minds is: what does this Boston Celtics sale mean for the future of the team? Concerns extend beyond purely financial issues; the team's culture, identity, and its place within the Boston community are all potential points of concern. Will the new owners prioritize community engagement initiatives that have been integral to the Celtics' relationship with their fans? Will the team's winning tradition be maintained, or will the emphasis shift towards maximizing profits? These are legitimate anxieties shared by a loyal and passionate fanbase.

- Will the team's winning tradition be maintained? This is paramount for preserving the Celtics' legacy and sustaining fan engagement.

- Concerns about ticket prices and accessibility for long-time fans. Increased prices could alienate loyal supporters who have been attending games for years.

- Will the new owners prioritize community engagement? Maintaining a strong connection with the local community is crucial for the long-term success of the franchise.

Maintaining the Celtics' Legacy: A Balancing Act for New Ownership

The challenge for the new owners is immense: balancing the financial goals inherent in a private equity investment with the preservation of the Celtics' rich history and the expectations of a fiercely loyal fanbase. Strategies might include emphasizing community engagement initiatives, maintaining transparency in decision-making, and ensuring that player recruitment remains focused on building a championship-caliber team. Failing to strike this balance could lead to alienation of fans and damage the long-term value of the franchise.

The Broader Implications of Private Equity in Professional Sports

The Boston Celtics sale is just one example of a growing trend: the increasing influence of private equity in professional sports. This investment model offers significant financial resources to teams, but also introduces potential drawbacks. The pursuit of maximizing returns can often lead to increased pressure on team performance, potentially resulting in short-sighted decisions that sacrifice long-term success for immediate profitability.

- Increased financial pressure on teams and players. This can impact team building strategies and player morale.

- Potential for increased ticket prices and merchandise costs. This could make attending games and supporting the team less accessible to many fans.

- Changes in team ownership structures and governance. This could lead to a shift in priorities and decision-making processes.

Conclusion

The Boston Celtics sale for $6.1 billion marks a pivotal moment, and the future remains uncertain. While the new ownership brings substantial financial resources, concerns remain about the potential impact on team operations, fan experience, and the franchise's legacy. The success of this new chapter will hinge on the new owners’ ability to balance financial goals with the preservation of the team’s winning tradition and its relationship with the community. Careful consideration of fan engagement, transparent communication, and sustainable team-building strategies will be crucial. Stay informed on the latest developments regarding the Boston Celtics sale and its impact. Follow our updates to stay informed about the future of the Celtics under their new ownership.

Featured Posts

-

High Bids For Kid Cudis Personal Items At Auction

May 16, 2025

High Bids For Kid Cudis Personal Items At Auction

May 16, 2025 -

Will The Padres Win Outright Or Lose By One Against The Giants A Game Prediction

May 16, 2025

Will The Padres Win Outright Or Lose By One Against The Giants A Game Prediction

May 16, 2025 -

Resultados En Directo Venezia Contra Napoles

May 16, 2025

Resultados En Directo Venezia Contra Napoles

May 16, 2025 -

Will The Padres Finally Overcome The Rockies A Preview Of The Matchup

May 16, 2025

Will The Padres Finally Overcome The Rockies A Preview Of The Matchup

May 16, 2025 -

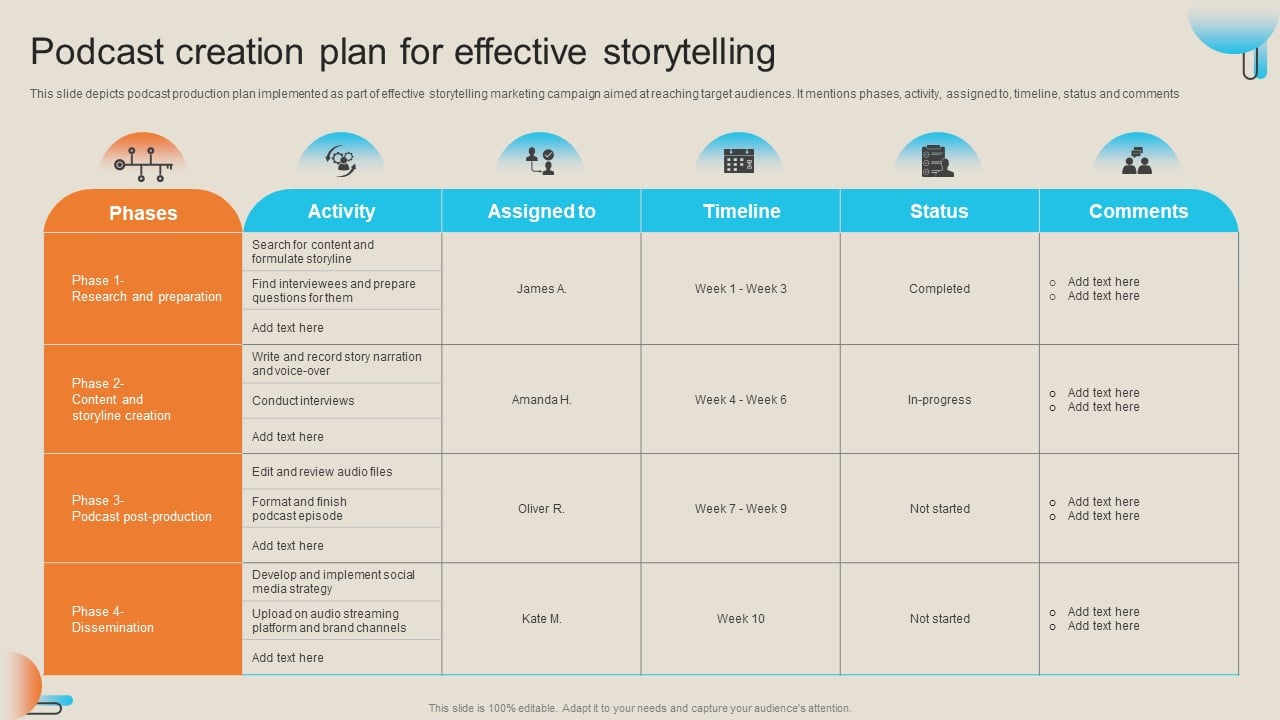

Ai Powered Podcast Creation Turning Repetitive Scatological Texts Into Engaging Content

May 16, 2025

Ai Powered Podcast Creation Turning Repetitive Scatological Texts Into Engaging Content

May 16, 2025