Protect Your Portfolio: S&P 500 Downside Insurance Strategies

Table of Contents

Understanding S&P 500 Downside Risk

Market Volatility and its Impact

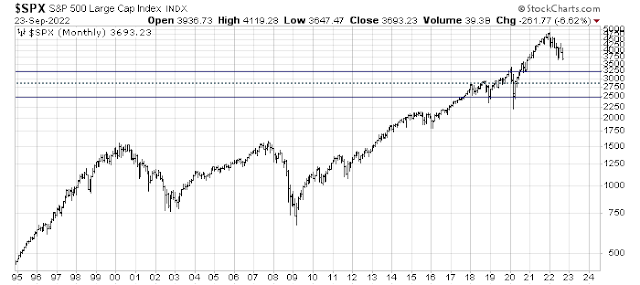

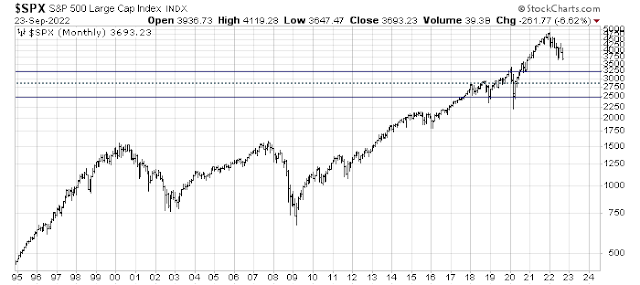

Investing in the S&P 500, even through index funds or ETFs like SPY or IVV, carries inherent risks. Market volatility, characterized by unpredictable price swings, can lead to significant losses. History shows numerous instances of market corrections and crashes impacting the S&P 500.

- Examples of past market crashes and their impact: The 1987 Black Monday crash, the dot-com bubble burst of 2000, and the 2008 financial crisis all resulted in substantial declines in the S&P 500, highlighting the potential for severe losses.

- Statistics on average market corrections: The S&P 500 experiences corrections (a 10% or more decline from a recent peak) relatively frequently. Understanding the historical frequency and depth of these corrections is crucial for managing expectations.

- Discussion of Black Swan events and their unpredictability: Unforeseeable events, like the COVID-19 pandemic, can cause sudden and sharp market downturns. These "Black Swan" events underscore the importance of robust risk management strategies.

Identifying Your Risk Tolerance

Before implementing any S&P 500 downside insurance strategy, you must understand your risk tolerance. This involves assessing your comfort level with potential investment losses.

- Questions to ask yourself to assess your risk tolerance: How much potential loss can you withstand without impacting your financial goals? What is your investment time horizon? What is your overall financial situation?

- Different investor profiles and their appropriate risk levels: Conservative investors prefer low-risk strategies, while aggressive investors may accept higher risk for potentially greater returns. Your risk profile dictates the appropriate level of downside protection.

Strategies for S&P 500 Downside Protection

Put Options

Put options give you the right, but not the obligation, to sell a specific asset (like an S&P 500 ETF) at a predetermined price (strike price) before a specific date (expiration date). They act as insurance against price declines.

- Advantages and disadvantages of using put options: Advantages include limiting potential losses and offering flexibility. Disadvantages include the cost of the premium and the potential for the option to expire worthless.

- Cost considerations and potential profit/loss scenarios: The cost of a put option depends on factors like the underlying asset's price, volatility, time to expiration, and the strike price.

- Examples of using put options for specific S&P 500 ETFs (SPY, IVV, etc.): Buying put options on SPY (SPDR S&P 500 ETF Trust) or IVV (iShares CORE S&P 500 ETF) can provide downside protection for your S&P 500 exposure.

Protective Puts

A protective put strategy involves buying put options on an asset you already own, providing a floor for your investment. If the market declines, the put option helps offset your losses.

- Step-by-step explanation of implementing a protective put strategy: 1) Own shares of the underlying asset (e.g., S&P 500 ETF shares). 2) Purchase put options with a strike price at or below your purchase price.

- Example scenarios showing profit/loss under different market conditions: A protective put limits maximum loss while still allowing for upside potential.

Collar Strategies

Collar strategies involve simultaneously buying put options and selling call options on the same underlying asset. This limits both your upside and downside potential.

- Explanation of how collars limit both upside and downside potential: The sold call options generate income to offset the cost of the purchased puts, reducing the overall cost of downside protection.

- Suitable scenarios for using collar strategies: Collars are useful when you want to protect against significant losses while limiting potential gains above a certain level.

- Risk/reward profiles of different collar configurations: The specific strike prices of the puts and calls influence the risk/reward profile.

Diversification

Diversifying your portfolio beyond the S&P 500 is crucial for reducing overall risk. Don't put all your eggs in one basket!

- Examples of asset classes to diversify into (bonds, real estate, international stocks): Allocating a portion of your investments to less correlated assets can reduce portfolio volatility.

- Benefits of diversification in reducing overall portfolio volatility: Diversification helps smooth out market fluctuations and reduces the impact of any single asset's underperformance.

Stop-Loss Orders

Stop-loss orders are instructions to sell an asset when it reaches a predetermined price, helping to limit losses.

- How stop-loss orders work: A stop-loss order becomes a market order once the specified price is reached.

- Advantages and disadvantages of using stop-loss orders: Advantages include automatic loss limitation. Disadvantages include potential slippage (selling at a lower price than anticipated) and the risk of being prematurely stopped out during temporary market dips.

Choosing the Right S&P 500 Downside Insurance Strategy

Factors to Consider

Selecting the best S&P 500 downside insurance strategy requires careful consideration of several factors.

- Checklist for investors to consider before implementing a downside protection strategy: Investment goals, time horizon, risk tolerance, available capital, and understanding of the chosen strategy's complexities.

- Importance of consulting with a financial advisor: A financial advisor can help you tailor a strategy to your specific needs and risk profile.

Assessing Your Risk Profile

The chosen downside protection strategy must align with your individual risk tolerance and financial goals.

- Examples of how different strategies cater to various risk profiles (conservative vs. aggressive): Conservative investors might prefer protective puts or diversification, while more aggressive investors might consider collar strategies or a higher tolerance for stop-loss orders.

Conclusion

Protecting your S&P 500 investments requires a proactive approach and a carefully chosen downside insurance strategy. We've explored several options, each with its own benefits and drawbacks: put options, protective puts, collar strategies, diversification, and stop-loss orders. By understanding your risk tolerance and choosing strategies that align with your investment goals and time horizon, you can create a more resilient investment strategy and safeguard your portfolio against market downturns. Learn more about effective S&P 500 downside protection strategies today! Contact a financial advisor to discuss your options and create a personalized plan to protect your investment from market volatility.

Featured Posts

-

Ru Pauls Drag Race Live Celebrates 1 000th Show With Live Broadcast

Apr 30, 2025

Ru Pauls Drag Race Live Celebrates 1 000th Show With Live Broadcast

Apr 30, 2025 -

Emergency High Levels Of Natural Gas Cause Louisville Evacuations

Apr 30, 2025

Emergency High Levels Of Natural Gas Cause Louisville Evacuations

Apr 30, 2025 -

From 1991 To 2024 Beyonces Daring Reimagining Of A Levis Classic

Apr 30, 2025

From 1991 To 2024 Beyonces Daring Reimagining Of A Levis Classic

Apr 30, 2025 -

Pocono Centers Earth Day Festival Fun Learning And Celebration

Apr 30, 2025

Pocono Centers Earth Day Festival Fun Learning And Celebration

Apr 30, 2025 -

Tarykh Srf Meashat Abryl 2025 Melwmat Hamt L 13 Mlywn Mwatn

Apr 30, 2025

Tarykh Srf Meashat Abryl 2025 Melwmat Hamt L 13 Mlywn Mwatn

Apr 30, 2025