Protecting Family Wealth: Best Practices In Succession Planning For The Super Wealthy

Table of Contents

Legal Structures for Wealth Preservation

Choosing the right legal structure is paramount for protecting and preserving significant wealth across generations. The complexities of ultra-high-net-worth estates necessitate a carefully considered approach, often involving a combination of strategies. Here are some key legal structures to consider:

-

Irrevocable Trusts: These trusts offer robust asset protection by shielding assets from creditors and minimizing estate taxes. They provide control over how and when assets are distributed to beneficiaries, ensuring the long-term security of family wealth. Different types of irrevocable trusts exist, such as Spendthrift Trusts (protecting assets from beneficiaries' mismanagement) and Charitable Remainder Trusts (combining philanthropy with tax advantages).

-

Family Limited Partnerships (FLPs): FLPs allow for efficient transfer of assets while retaining control within the family. They can help minimize gift and estate taxes by transferring ownership interests to heirs over time. This structure offers flexibility in managing assets and provides a framework for family governance.

-

Dynasty Trusts: Designed for long-term wealth preservation, dynasty trusts can perpetuate wealth across multiple generations, minimizing estate taxes for centuries. The trust's life extends beyond the lives of the initial beneficiaries, offering significant tax advantages and minimizing estate tax liability for each subsequent generation. However, careful planning is crucial to ensure the trust's longevity and compliance with legal regulations.

-

Offshore Trusts: These trusts are established in jurisdictions outside a family's home country, often to achieve specific asset protection or tax optimization goals. However, it's crucial to consult with legal and tax professionals to ensure compliance with all applicable laws and ethical considerations. Transparency and proper disclosure are essential to avoid legal pitfalls.

Tax Optimization Strategies for High-Net-Worth Individuals

High-net-worth individuals face significant tax implications related to inheritance and wealth transfer. Proactive tax planning is crucial to minimizing tax liabilities and maximizing the transfer of wealth to future generations.

-

Estate Tax Planning: Minimizing estate taxes requires a comprehensive strategy, often involving strategic gifting, utilizing the annual gift tax exclusion, and establishing charitable trusts or foundations. Sophisticated techniques like grantor retained annuity trusts (GRATs) and qualified personal residence trusts (QPRTs) can significantly reduce estate tax liabilities.

-

Gift Tax Planning: Gifting assets strategically while remaining within annual gift tax exclusion limits allows for tax-efficient wealth transfer during your lifetime. This can reduce the overall estate tax burden upon death.

-

International Tax Planning: For families with assets held globally, navigating international tax laws is critical. This requires expertise in cross-border tax regulations to optimize tax efficiency and ensure full compliance.

-

Working with Tax Professionals: The complexity of tax laws necessitates the expertise of specialized tax advisors for high-net-worth individuals. These professionals can develop tailored strategies that address specific circumstances and ensure compliance with all applicable regulations.

Professional Advisory Teams: Building Your Support Network

Effective succession planning relies on a strong, multidisciplinary team of professionals. This collaborative approach ensures comprehensive coverage of all aspects of wealth preservation and family legacy.

-

Estate Planning Attorneys: These attorneys are crucial in drafting wills, trusts, and other legal documents necessary for efficient and legally sound wealth transfer.

-

Financial Advisors: Financial advisors guide investment strategies, developing long-term financial plans that align with the family's goals and risk tolerance. They manage investment portfolios and ensure consistent growth.

-

Tax Attorneys: These specialists navigate the complex landscape of tax laws, minimizing liabilities and ensuring compliance with all regulations.

-

Private Bankers: Private bankers provide personalized banking services, wealth management solutions, and access to specialized financial products tailored to high-net-worth individuals.

-

Family Therapists/Counselors: Addressing the emotional and relational aspects of wealth transfer is crucial. Family therapists help navigate family dynamics, potential conflicts, and ensure open communication amongst family members.

The Importance of Family Communication & Education

Open communication and education are pivotal for successful succession planning. Preparing heirs for their future roles in managing family wealth is essential.

-

Regular Family Meetings: Regular meetings allow for open discussion of financial matters, the family's legacy, and succession plans. This fosters transparency and understanding among family members.

-

Financial Literacy Education: Equipping heirs with financial literacy skills empowers them to manage their inheritance responsibly and make informed decisions.

-

Mentorship Programs: Mentorship programs guide younger generations, allowing them to learn from experienced family members or professionals. This fosters a smooth transition of wealth management responsibilities.

-

Dispute Resolution Mechanisms: Establishing clear guidelines and mechanisms for resolving potential conflicts among heirs is critical for preserving family unity and avoiding costly legal battles.

Investment Strategies for Long-Term Wealth Growth

Long-term wealth preservation requires sound investment strategies that focus on growth and risk mitigation.

-

Diversification: Diversifying investments across different asset classes, including stocks, bonds, real estate, and alternative investments, reduces risk and safeguards against market fluctuations.

-

Long-Term Investment Horizon: Focusing on long-term growth rather than short-term gains is essential for building and preserving wealth across generations.

-

Alternative Investments: Exploring options such as private equity, hedge funds, and real estate can provide diversification and potential for higher returns, but requires a thorough understanding of associated risks.

-

ESG Investing: Considering Environmental, Social, and Governance (ESG) factors in investment decisions aligns with long-term values and can provide opportunities for both financial returns and positive social impact.

Conclusion

Protecting family wealth effectively requires a proactive and comprehensive approach to succession planning. By establishing appropriate legal structures, optimizing tax strategies, building a strong advisory team, fostering open family communication, and employing sound investment principles, ultra-high-net-worth families can safeguard their assets and ensure the long-term prosperity of their legacy. Don't delay in securing your family's financial future. Contact a qualified professional today to begin developing your personalized plan for effective succession planning and protecting family wealth.

Featured Posts

-

The Future Of Saskatchewan Exploring The Provinces Political Identity And The Western Separation Movement

May 22, 2025

The Future Of Saskatchewan Exploring The Provinces Political Identity And The Western Separation Movement

May 22, 2025 -

Update Ex Tory Councillors Wifes Appeal On Racial Hatred Tweet

May 22, 2025

Update Ex Tory Councillors Wifes Appeal On Racial Hatred Tweet

May 22, 2025 -

Questionable Ai Reporting Practices At The Chicago Sun Times

May 22, 2025

Questionable Ai Reporting Practices At The Chicago Sun Times

May 22, 2025 -

New Business Hotspots Across The Country A Detailed Map And Analysis

May 22, 2025

New Business Hotspots Across The Country A Detailed Map And Analysis

May 22, 2025 -

Musique Du Hellfest Concert Exceptionnel Au Noumatrouff

May 22, 2025

Musique Du Hellfest Concert Exceptionnel Au Noumatrouff

May 22, 2025

Latest Posts

-

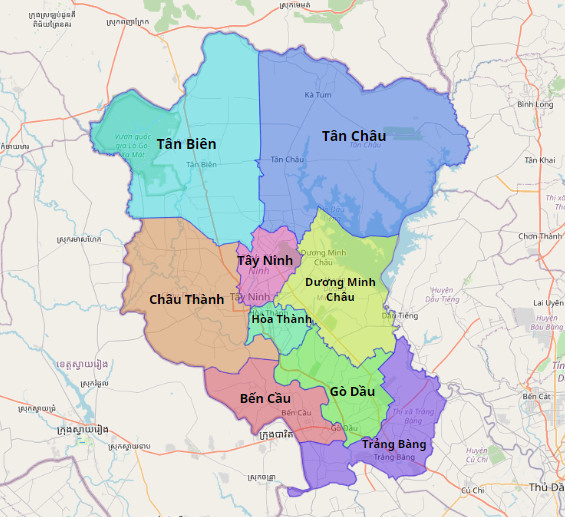

Cap Nhat Duong Va Cau Ket Noi Binh Duong Va Tay Ninh

May 22, 2025

Cap Nhat Duong Va Cau Ket Noi Binh Duong Va Tay Ninh

May 22, 2025 -

Cau Va Duong Cao Toc Binh Duong Tay Ninh Thong Tin Moi Nhat

May 22, 2025

Cau Va Duong Cao Toc Binh Duong Tay Ninh Thong Tin Moi Nhat

May 22, 2025 -

Binh Duong Tay Ninh Duong Bo Va Cau

May 22, 2025

Binh Duong Tay Ninh Duong Bo Va Cau

May 22, 2025 -

Tim Hieu Ve Cau Va Duong Ket Noi Binh Duong Tay Ninh

May 22, 2025

Tim Hieu Ve Cau Va Duong Ket Noi Binh Duong Tay Ninh

May 22, 2025 -

Tuyen Duong Va Cau Noi Binh Duong Voi Tay Ninh

May 22, 2025

Tuyen Duong Va Cau Noi Binh Duong Voi Tay Ninh

May 22, 2025