Protecting Your Financial Future: Avoiding Common Mistakes (Women)

Table of Contents

Keywords: financial future, women's finances, financial mistakes, women's financial planning, retirement planning for women, investing for women, budgeting for women, financial security for women.

Securing your financial future is crucial, and for women, navigating the unique financial landscape requires awareness and proactive planning. Many common pitfalls can derail even the best intentions. This article outlines common financial mistakes women make and provides actionable steps to protect your financial future, empowering you to achieve financial independence and security.

Underestimating the Importance of Financial Planning

Financial planning is often viewed as a task for "someday," but proactively managing your finances is essential for a secure future. For women, this is especially critical due to several factors.

The Gender Pay Gap and its Impact

The persistent gender pay gap significantly impacts women's long-term financial goals. This disparity means:

- Lower lifetime earnings: Women often earn less than their male counterparts over their careers, resulting in less money available for saving and investing.

- Impact on retirement savings: Lower lifetime earnings directly translate to smaller retirement nest eggs, potentially leading to financial insecurity in later life.

- Challenges in achieving financial independence: The pay gap makes it harder for women to achieve financial independence, leaving them more vulnerable to economic hardship.

Ignoring Long-Term Financial Goals

Many women fail to establish clear, long-term financial goals. Setting realistic goals, however, is paramount for success:

- Creating a financial roadmap: Develop a comprehensive plan outlining your short-term and long-term financial objectives, including retirement, homeownership, and education funding.

- Setting SMART goals: Use the SMART framework – Specific, Measurable, Achievable, Relevant, and Time-bound – to ensure your goals are attainable and trackable.

- Regular review and adjustment: Life changes necessitate regular review and adjustments to your financial plan. Make it a habit to reassess your goals annually or as needed.

Lack of Financial Literacy

A lack of financial knowledge can hinder your ability to make informed decisions. Improving your financial literacy is crucial:

- Resources for improving financial literacy: Numerous resources are available, including books, online courses (like Coursera or Khan Academy), and workshops offered by community organizations and financial institutions.

- Understanding investments: Learn about different investment options, their risks, and potential returns. Start with basic investment principles and gradually increase your knowledge.

- Budgeting strategies: Mastering budgeting techniques is fundamental to effective financial management. Explore different budgeting methods to find one that suits your needs.

Common Financial Mistakes Women Make

While many financial mistakes are common across genders, certain pitfalls disproportionately affect women. Addressing these proactively is vital for your financial well-being.

Failing to Budget Effectively

A well-structured budget is the cornerstone of sound financial management. Failing to budget effectively can lead to financial stress and debt:

- Tracking expenses: Monitor your spending to identify areas where you can cut back. Use budgeting apps or spreadsheets to track your income and expenses.

- Identifying areas for savings: Analyze your spending habits and pinpoint areas where you can reduce expenses without significantly impacting your lifestyle.

- Budgeting apps and tools: Numerous budgeting apps are available to simplify the process, automating tracking and providing insights into your spending patterns. Mint, YNAB (You Need A Budget), and Personal Capital are popular choices.

- Zero-based budgeting: This method involves allocating every dollar of your income to a specific category, ensuring all spending is planned and intentional.

Ignoring Debt Management

High-interest debt can significantly hinder your financial progress. Ignoring it can snowball into a major problem:

- Snowball method: Pay off your smallest debts first to gain momentum and motivation.

- Avalanche method: Focus on paying off debts with the highest interest rates first to minimize overall interest paid.

- Debt consolidation: Consolidating multiple debts into a single loan with a lower interest rate can simplify repayment and potentially save money.

- Seeking professional advice: If you're struggling with debt, consider seeking help from a credit counselor or financial advisor.

Not Investing Early Enough

The power of compound interest is often underestimated. Starting to invest early allows your money to grow exponentially over time:

- Different investment options: Explore various options such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs) to diversify your portfolio and mitigate risk.

- Risk tolerance: Understand your risk tolerance before investing. Don't invest in anything you don't fully understand.

- Diversification: Diversifying your investments across different asset classes reduces risk. Don't put all your eggs in one basket.

- Seeking professional financial advice: A financial advisor can help you create an investment strategy tailored to your goals and risk tolerance.

Underestimating Retirement Planning

Retirement planning is crucial, and starting early is key to ensuring a comfortable retirement:

- Retirement savings plans: Maximize contributions to retirement savings plans like 401(k)s, IRAs, and Roth IRAs to take advantage of tax benefits and compound interest.

- Calculating retirement needs: Estimate your retirement expenses to determine how much you need to save. Use online calculators or consult with a financial advisor.

- Adjusting contributions based on life changes: Adjust your contributions as your income and expenses change.

Strategies for Protecting Your Financial Future

Taking proactive steps now will safeguard your future financial well-being.

Seek Professional Financial Advice

A financial advisor can provide personalized guidance and support:

- Finding a qualified financial advisor: Seek referrals from trusted sources or use online resources to find a fee-only financial advisor who works in your best interest.

- Asking the right questions: Prepare a list of questions to ask potential advisors to ensure they understand your needs and goals.

- Reviewing your financial plan regularly: Schedule regular meetings with your advisor to review and update your financial plan as your circumstances change.

Build an Emergency Fund

An emergency fund provides a financial safety net for unexpected events:

- Aiming for 3-6 months of living expenses: Build an emergency fund that covers 3-6 months of essential living expenses.

- High-yield savings accounts: Keep your emergency fund in a high-yield savings account to earn interest while maintaining easy access to your funds.

Regularly Review and Adjust Your Financial Plan

Your financial plan should evolve with your life:

- Annual review: Review your financial plan annually to ensure it aligns with your current goals and circumstances.

- Adjustments based on career changes: Major life events like career changes, marriage, or having children necessitate adjustments to your financial plan.

- Market conditions: Monitor market conditions and adjust your investment strategy as needed.

Conclusion

Protecting your financial future requires proactive planning, financial literacy, and a commitment to avoiding common mistakes. By understanding the unique financial challenges faced by women and implementing the strategies discussed above, you can achieve greater financial security and independence.

Call to Action: Take control of your financial future today! Start by assessing your current financial situation, creating a budget, and developing a plan to achieve your long-term financial goals. Don't delay – securing your financial future is an investment in your peace of mind and independence. Learn more about women's financial planning and find resources to help you succeed!

Featured Posts

-

Bbc Antiques Roadshow Couple Jailed For Unknowing National Treasure Trafficking

May 22, 2025

Bbc Antiques Roadshow Couple Jailed For Unknowing National Treasure Trafficking

May 22, 2025 -

Female Pub Landlords Explosive Tirade Raw Footage Of Staff Members Dismissal

May 22, 2025

Female Pub Landlords Explosive Tirade Raw Footage Of Staff Members Dismissal

May 22, 2025 -

Participating In The Wtt An Aimscap Perspective

May 22, 2025

Participating In The Wtt An Aimscap Perspective

May 22, 2025 -

Core Weaves Initial Public Offering 40 Per Share

May 22, 2025

Core Weaves Initial Public Offering 40 Per Share

May 22, 2025 -

What Caused Core Weave Inc Crwv Stock To Fall On Thursday

May 22, 2025

What Caused Core Weave Inc Crwv Stock To Fall On Thursday

May 22, 2025

Latest Posts

-

Tuyen Duong Huyet Mach Tp Hcm Ba Ria Vung Tau Diem Danh Cac Lua Chon

May 22, 2025

Tuyen Duong Huyet Mach Tp Hcm Ba Ria Vung Tau Diem Danh Cac Lua Chon

May 22, 2025 -

200 Van Dong Vien Tham Gia Chay Bo Lien Tinh Dak Lak Phu Yen

May 22, 2025

200 Van Dong Vien Tham Gia Chay Bo Lien Tinh Dak Lak Phu Yen

May 22, 2025 -

Hanh Trinh Chay Bo 200 Nguoi Kham Pha Ve Dep Dak Lak Va Phu Yen

May 22, 2025

Hanh Trinh Chay Bo 200 Nguoi Kham Pha Ve Dep Dak Lak Va Phu Yen

May 22, 2025 -

Ket Noi Giao Thong Tp Hcm Va Ba Ria Vung Tau Nhung Tuyen Duong Chinh

May 22, 2025

Ket Noi Giao Thong Tp Hcm Va Ba Ria Vung Tau Nhung Tuyen Duong Chinh

May 22, 2025 -

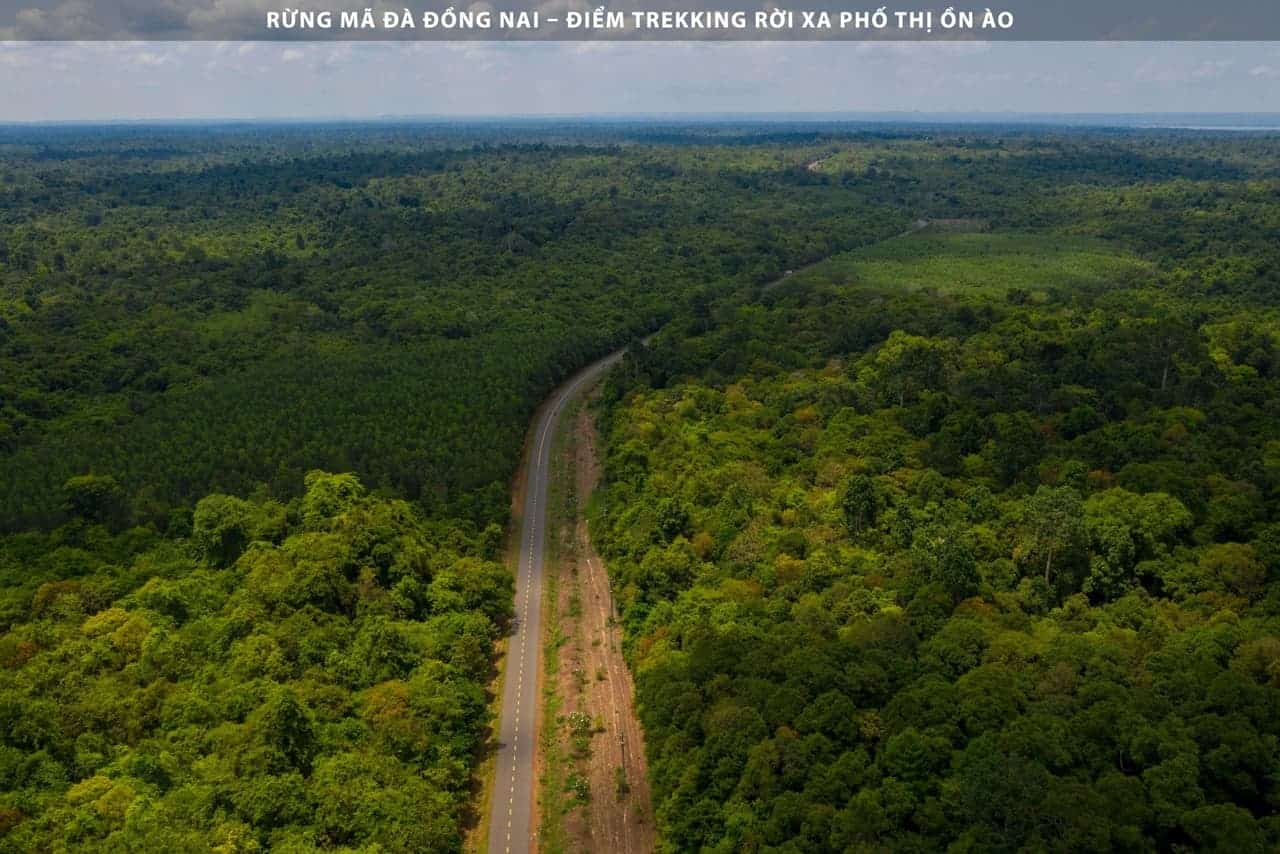

Cau Ma Da Noi Dong Nai Binh Phuoc Du Kien Khoi Cong Thang 6

May 22, 2025

Cau Ma Da Noi Dong Nai Binh Phuoc Du Kien Khoi Cong Thang 6

May 22, 2025