QBTS Earnings Report: Potential Market Impact On Stock Price

Table of Contents

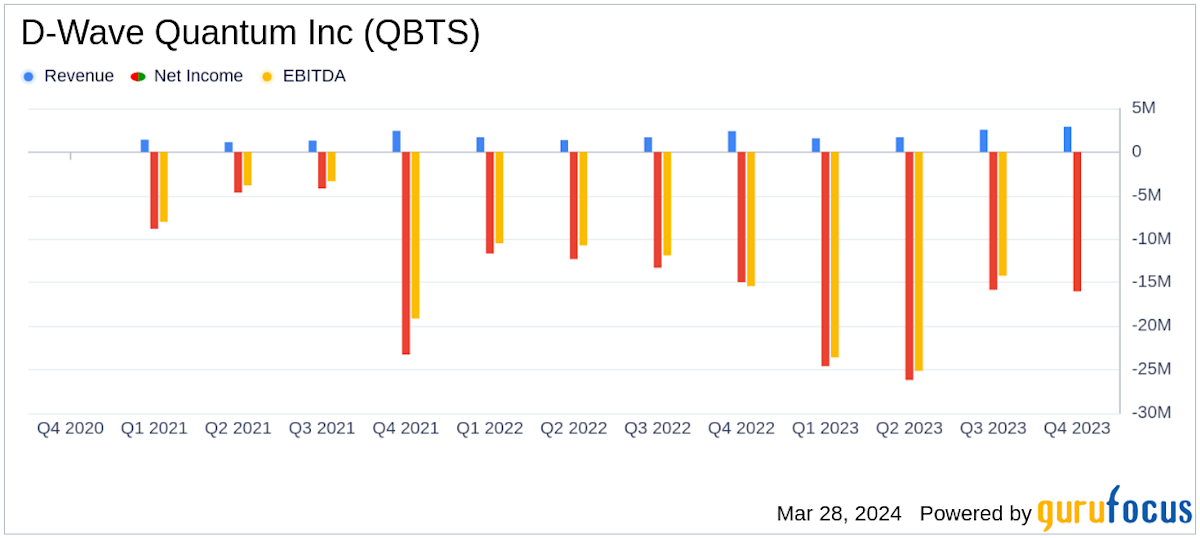

Analyzing Key Financial Metrics from the QBTS Earnings Report

Analyzing the key financial metrics presented in the QBTS earnings report is vital for assessing its potential impact on the QBTS stock price. A thorough understanding of revenue growth, profitability, and cash flow provides a strong foundation for predicting future performance.

Revenue Growth and Projections

The reported revenue figures for QBTS are a primary indicator of its financial health and future potential. Comparing these figures to previous quarters and analyst predictions is essential.

- Year-over-year growth: A [Insert Percentage]% increase/decrease in revenue compared to the same period last year signals [positive/negative] momentum.

- Quarterly growth: A [Insert Percentage]% increase/decrease in revenue compared to the previous quarter indicates [positive/negative] short-term trends.

- Deviations from expectations: If revenue significantly deviates from analyst consensus, this could trigger a strong market reaction, potentially impacting the QBTS stock price positively or negatively. For example, surpassing expectations by [Insert Percentage]% might lead to a price surge, while falling short could cause a decline. [Insert specific revenue numbers from the report for context].

The implications of revenue trends on the QBTS stock price are significant. Sustained revenue growth usually translates to higher investor confidence and a potentially higher QBTS stock price. Conversely, declining revenue can signal underlying issues and put downward pressure on the price.

Profitability and Margins

Profitability is a crucial metric for evaluating the financial health and sustainability of QBTS. Net income, operating income, and profit margins all provide valuable insights.

- Changes in profitability: Comparing net income and operating income to previous periods reveals the trend in QBTS's profitability. An upward trend generally indicates strong financial performance and can boost the QBTS stock price.

- Factors contributing to margin changes: Changes in profit margins (gross, operating, and net) should be carefully analyzed. Factors such as increased production costs, pricing strategies, or changes in the competitive landscape can influence margins. [Insert specific data points from the report, e.g., net income figures, margin percentages].

- Impact on investor sentiment: High profitability demonstrates efficient operations and strong earning potential, attracting investors and potentially driving up the QBTS stock price. Conversely, declining profitability can lead to negative investor sentiment and a lower QBTS stock price.

Cash Flow and Debt

Cash flow and debt levels are critical indicators of QBTS's financial stability and ability to meet its obligations.

- Cash flow implications: Analyzing cash flow from operations, investing, and financing activities is essential. Strong positive cash flow from operations signals healthy business operations and reinforces investor confidence, potentially boosting the QBTS stock price. Negative cash flow, however, could be a warning sign.

- Debt metrics: Examining metrics like the debt-to-equity ratio provides insights into QBTS's financial leverage. High debt levels can increase financial risk and potentially negatively affect the QBTS stock price. [Insert relevant data points from the report, e.g., cash flow figures, debt ratios].

- Influence on investor confidence: A healthy balance sheet with manageable debt levels increases investor confidence, which positively impacts the QBTS stock price. Conversely, high debt levels and poor cash flow can lead to investor concerns and lower prices.

Market Sentiment and External Factors Influencing QBTS Stock Price

Beyond the financial statements, external factors significantly influence the QBTS stock price. Understanding these factors provides a more comprehensive perspective.

Industry Trends and Competition

The overall health of QBTS's industry and the competitive landscape play a crucial role in its stock price.

- Industry trends: Technological advancements, shifts in consumer demand, and regulatory changes all impact the industry. For example, the emergence of [mention relevant technology or trend] could either threaten or benefit QBTS, influencing its stock price.

- Competitive analysis: Analyzing QBTS's competitors (e.g., [mention competitors]) and their performance sheds light on QBTS's market position and future prospects. Increased competition can put downward pressure on QBTS's stock price.

- Market share: QBTS's market share reflects its competitiveness. Gaining market share suggests strong performance and can positively influence the QBTS stock price.

Economic Conditions and Macroeconomic Factors

Broader economic factors influence investor behavior and stock valuations.

- Interest rates: Rising interest rates can increase borrowing costs and reduce corporate profits, potentially negatively impacting QBTS's stock price.

- Inflation: High inflation erodes purchasing power and increases costs, which can affect QBTS's profitability and stock price.

- Recessionary risks: During economic downturns, investors are more risk-averse, which can lead to lower stock valuations, including for QBTS.

- Investor risk appetite: Market uncertainty and investor sentiment heavily influence stock prices. Increased risk aversion can lead to a decline in the QBTS stock price, even if its fundamentals remain strong.

Analyst Ratings and Investor Expectations

Analyst ratings and investor sentiment directly influence the QBTS stock price.

- Analyst upgrades/downgrades: Positive analyst ratings and upgrades often boost investor confidence and the QBTS stock price. Conversely, downgrades can trigger sell-offs.

- Media coverage: Positive media coverage can improve investor perception, while negative news can negatively impact the QBTS stock price.

- Investor expectations: If QBTS consistently surpasses or falls short of investor expectations, it can significantly influence the QBTS stock price.

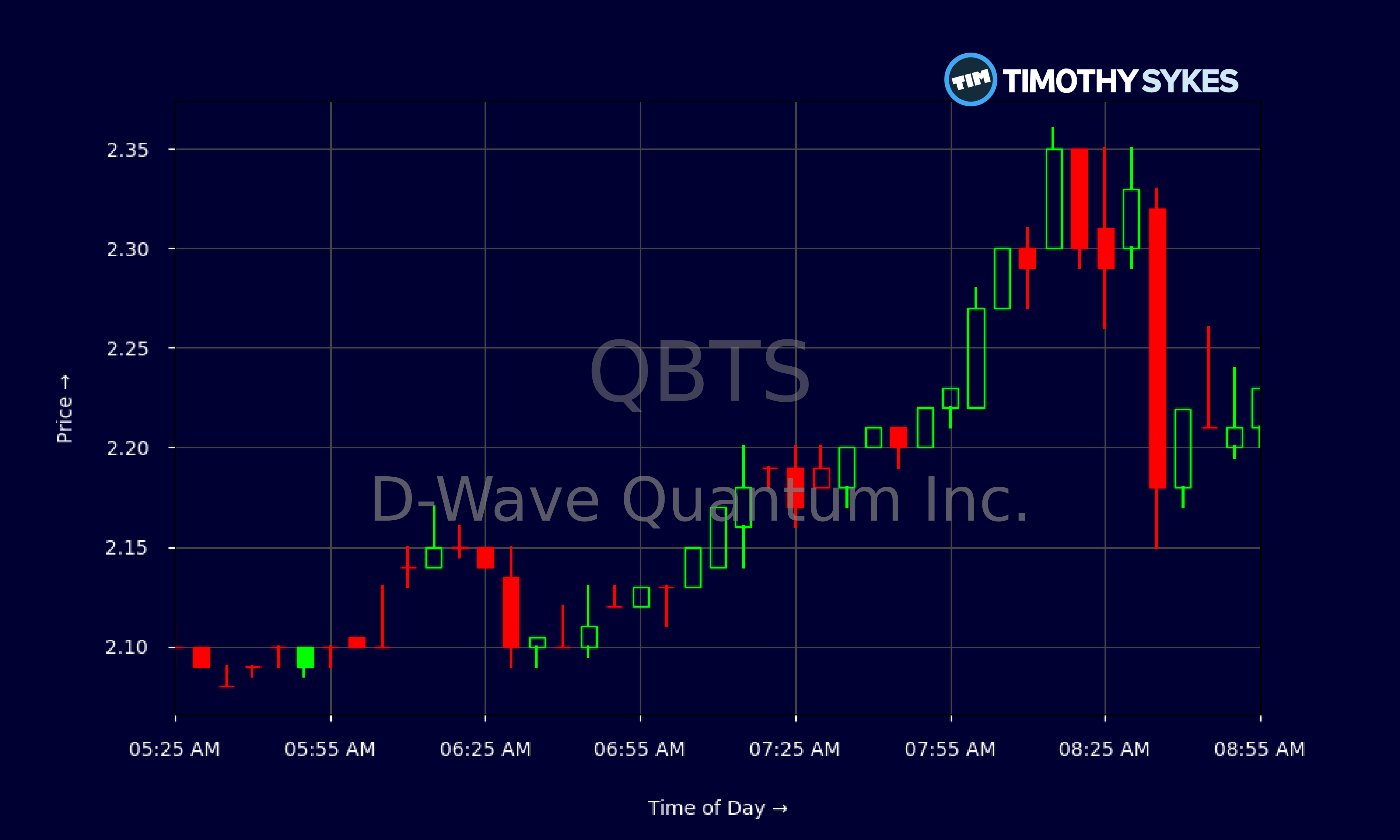

Predicting Future QBTS Stock Price Movement

Predicting future price movements is inherently challenging, but analyzing valuation and growth potential provides a framework.

Valuation and Future Growth Potential

Assessing QBTS's valuation using metrics like the Price-to-Earnings ratio (P/E) and comparing it to industry peers helps determine whether it's overvalued or undervalued.

- P/E ratio: A high P/E ratio suggests investors expect high future growth, while a low P/E ratio might indicate undervaluation. [Compare QBTS's P/E ratio to industry averages].

- Growth potential: Analyzing QBTS's long-term growth potential, considering factors like market expansion, new product launches, and technological advancements, is crucial for predicting future stock price movements.

- Upside and downside risks: Potential upside could come from successful product launches or expansion into new markets. Downside risks include increased competition, regulatory hurdles, or macroeconomic challenges.

Investment Strategies and Risk Management

Investment strategies should align with individual risk tolerance.

- Buy and hold: A long-term strategy suitable for investors with higher risk tolerance.

- Day trading: A short-term, high-risk strategy requiring expertise and experience.

- Diversification: Spreading investments across various assets to reduce overall portfolio risk.

- Due diligence: Thorough research is essential before making any investment decisions regarding QBTS stock price.

Conclusion

The QBTS earnings report provides valuable insights into the company's financial health and future prospects. By analyzing key financial metrics, market trends, and investor sentiment, we can gain a better understanding of the potential impact on the QBTS stock price. While there are inherent risks associated with any investment, careful consideration of these factors can help investors make informed decisions regarding their holdings or potential investments in QBTS stock. Remember to conduct your own thorough research before making any investment decisions related to the QBTS stock price. Monitor the QBTS stock price and related news for further updates.

Featured Posts

-

Factors Contributing To D Wave Quantum Qbts Stocks Friday Gains

May 21, 2025

Factors Contributing To D Wave Quantum Qbts Stocks Friday Gains

May 21, 2025 -

Huuhkajien Mm Karsintavalmistelut Valmennuksen Rooli

May 21, 2025

Huuhkajien Mm Karsintavalmistelut Valmennuksen Rooli

May 21, 2025 -

Vanja Mijatovic Demantira Glasine O Razvodu Prava Prica

May 21, 2025

Vanja Mijatovic Demantira Glasine O Razvodu Prava Prica

May 21, 2025 -

Dancehall Star Faces Travel Restrictions To Trinidad

May 21, 2025

Dancehall Star Faces Travel Restrictions To Trinidad

May 21, 2025 -

D Wave Quantum Qbts Explaining The Recent Stock Market Rally

May 21, 2025

D Wave Quantum Qbts Explaining The Recent Stock Market Rally

May 21, 2025

Latest Posts

-

Historic New York Show Vybz Kartel Live

May 22, 2025

Historic New York Show Vybz Kartel Live

May 22, 2025 -

Debate Over Kartels Trinidad Concert Age Limits And Song Bans Under Consideration

May 22, 2025

Debate Over Kartels Trinidad Concert Age Limits And Song Bans Under Consideration

May 22, 2025 -

Vybz Kartel A Landmark Concert In New York

May 22, 2025

Vybz Kartel A Landmark Concert In New York

May 22, 2025 -

Trinidad Considering Restrictions On Kartel Concert Age Limits And Song Bans Debated

May 22, 2025

Trinidad Considering Restrictions On Kartel Concert Age Limits And Song Bans Debated

May 22, 2025 -

The Goldbergs Impact And Cultural Significance

May 22, 2025

The Goldbergs Impact And Cultural Significance

May 22, 2025