QBTS Stock And Upcoming Earnings: What To Expect

Table of Contents

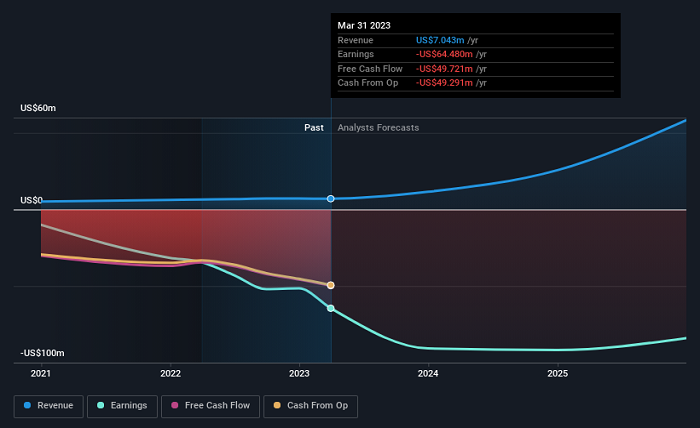

Analyzing QBTS's Recent Financial Performance

To gauge the potential of QBTS stock, let's delve into the company's recent financial performance. Understanding its revenue growth, profitability, and key financial ratios is crucial for informed investment decisions.

Revenue Growth and Trends

QBTS revenue has shown [Insert trend: e.g., consistent growth, stagnation, decline] over the past [Number] quarters/years. Analyzing QBTS revenue streams reveals [Insert key details: e.g., strong performance in the X segment, weakness in the Y segment].

- Q1 2024: [Insert Revenue Figure] – [Percentage Change compared to Q1 2023]

- Q2 2024: [Insert Revenue Figure] – [Percentage Change compared to Q2 2023]

- Q3 2024 (Projected): [Insert Projected Revenue Figure] – based on [Source of Projection]

This growth (or lack thereof) can be attributed to factors such as [Insert relevant factors: e.g., successful new product launches, increased competition, macroeconomic conditions]. Understanding these contributing factors to QBTS revenue is vital for predicting future performance.

Profitability and Margins

Examining QBTS profit margin and net income growth provides insights into the company's profitability. [Insert analysis of profit margins and net income – e.g., "Gross profit margins have remained relatively stable, while net income has shown a slight increase due to effective cost-cutting measures."]

- Net Income (Q1 2024): [Insert Figure]

- Net Income (Q2 2024): [Insert Figure]

- Operating Expenses (Q2 2024): [Insert Figure] – indicating [Interpretation of Operating Expenses].

Factors impacting QBTS profitability include [Insert factors: e.g., pricing strategies, efficient supply chain management, research and development investments].

Key Financial Ratios

Analyzing key financial ratios like the debt-to-equity ratio and current ratio offers a deeper understanding of QBTS's financial health and liquidity.

- Debt-to-Equity Ratio: [Insert Figure] – indicating [Interpretation of Debt-to-Equity Ratio - e.g., a manageable level of debt, or high leverage].

- Current Ratio: [Insert Figure] – suggesting [Interpretation of Current Ratio - e.g., sufficient liquidity to meet short-term obligations, or potential liquidity concerns].

Comparing these QBTS financial ratios to industry averages and competitors provides a valuable benchmark for assessing the company's financial strength relative to its peers.

Examining Analyst Predictions and Market Sentiment for QBTS Stock

Understanding analyst expectations and overall market sentiment is crucial for navigating the complexities of QBTS stock.

Consensus Earnings Estimates

Analysts' predictions for QBTS earnings vary. [Insert range of predictions - e.g., "Estimates range from $[Low Estimate] to $[High Estimate] per share."]. The consensus estimate is currently [Insert consensus estimate] per share, based on data from [Source: e.g., Bloomberg, Yahoo Finance]. The buy/sell recommendations from analysts are [Insert Summary of Analyst Ratings].

Market Sentiment and Trading Volume

Recent trading volume for QBTS stock has been [Insert description: e.g., relatively high, low, fluctuating]. Market sentiment appears [Insert description: e.g., cautiously optimistic, bearish, bullish], potentially influenced by [Insert influencing factors: e.g., recent news, competitor performance, broader market trends]. Significant price fluctuations in the past [Time period] include [Insert examples].

Strategies for Investing in QBTS Stock Before and After Earnings

Successful investing in QBTS stock requires careful consideration of pre- and post-earnings strategies.

Before Earnings

Before the QBTS earnings release, investors might consider [Insert strategies: e.g., holding their existing positions, carefully evaluating the risk-reward ratio before buying, implementing options strategies like buying puts or calls as a hedge]. Risk management and diversification are crucial for mitigating potential losses.

After Earnings

The QBTS stock price reaction after earnings will depend on whether the results exceed, meet, or fall short of expectations.

- Positive Surprise: A potential price increase. Investors might consider holding or even adding to their positions.

- Negative Surprise: A potential price drop. Investors might consider selling or averaging down (if they believe in the long-term prospects).

- Meeting Expectations: The price may remain relatively stable, or experience minor fluctuations. Investors should monitor the market carefully.

Post-earnings trading necessitates a reassessment of the investment thesis, taking into account the reported financials and revised analyst projections.

Conclusion: Making Informed Decisions about QBTS Stock

Analyzing QBTS's financial performance, considering analyst predictions, and understanding market sentiment are key to making informed decisions about investing in QBTS stock. While the potential for reward exists, investors must also acknowledge inherent risks. A wait-and-see approach might be prudent for some investors, particularly until the QBTS earnings report provides more clarity. Stay informed about QBTS stock and its upcoming earnings by regularly reviewing financial news and conducting your own thorough research before making any investment decisions. Learn more about QBTS stock and its investment potential by [linking to relevant resources, if applicable].

Featured Posts

-

Kroyz Azoyl Ston Teliko Champions League O Rolos Toy Giakoymaki Stin Prokrisi

May 20, 2025

Kroyz Azoyl Ston Teliko Champions League O Rolos Toy Giakoymaki Stin Prokrisi

May 20, 2025 -

Former Navy Second In Command Sentenced In Major Corruption Scandal

May 20, 2025

Former Navy Second In Command Sentenced In Major Corruption Scandal

May 20, 2025 -

Stade Toulousain Et Jaminet Trouvent Un Accord Sur Le Remboursement De 450 000 E

May 20, 2025

Stade Toulousain Et Jaminet Trouvent Un Accord Sur Le Remboursement De 450 000 E

May 20, 2025 -

Find The Answers Nyt Mini Crossword March 16 2025

May 20, 2025

Find The Answers Nyt Mini Crossword March 16 2025

May 20, 2025 -

Chinas Pressure Campaign Fails Manila Keeps Missile System

May 20, 2025

Chinas Pressure Campaign Fails Manila Keeps Missile System

May 20, 2025