QBTS Stock: Predicting The Earnings Reaction

Table of Contents

Analyzing Past QBTS Earnings Reports: Unveiling Patterns and Trends

Historical Performance: A Look at the Numbers

To predict future performance, understanding past trends is paramount. Let's examine QBTS's historical quarterly and annual earnings reports. Key performance indicators (KPIs) like Earnings Per Share (EPS), revenue growth, and guidance offer valuable insights.

- Q1 2023: EPS of $0.50, Revenue Growth of 15%, Guidance raised for the year.

- Q2 2023: EPS of $0.55, Revenue Growth of 12%, Guidance maintained.

- Q3 2023: EPS of $0.60, Revenue Growth of 18%, Guidance slightly lowered due to supply chain issues. (Note: These are example figures. Replace with actual QBTS data for accuracy.)

Visualizing this data through charts and graphs will reveal clear trends in QBTS's financial performance.

Market Reaction Analysis: How Did the Market Respond?

Analyzing past market reactions to QBTS earnings releases is critical. Did the stock price surge after positive reports or plummet following disappointing news?

- Q1 2023 Earnings: Stock price increased by 8% following the announcement.

- Q2 2023 Earnings: Stock price remained relatively flat.

- Q3 2023 Earnings: Stock price decreased by 3% despite exceeding expectations, likely due to the lowered guidance. (Note: These are example figures. Replace with actual QBTS data for accuracy.)

Understanding these reactions helps identify sensitivities in the market towards specific KPIs and external factors.

Identifying Key Drivers: What Factors Matter Most?

Consistent analysis of past earnings reveals key drivers of market reaction.

- Earnings Expectations: Beating or missing analyst estimates significantly impacts stock price.

- Revenue Growth: Sustained revenue growth generally leads to positive market sentiment.

- Management Commentary: Positive and confident guidance from management can boost investor confidence.

- Unexpected Events: Unforeseen circumstances like supply chain disruptions or regulatory changes can affect market reaction irrespective of core performance.

Evaluating Current Market Conditions and QBTS Fundamentals

Macroeconomic Factors: The Broader Economic Picture

The overall economic climate plays a crucial role in QBTS's stock performance.

- Interest Rates: Rising interest rates can impact borrowing costs and consumer spending, potentially affecting QBTS's revenue.

- Inflation: High inflation can erode consumer purchasing power, impacting demand for QBTS's products or services.

- Geopolitical Events: Global instability can create uncertainty in the market, impacting investor sentiment towards QBTS.

Industry Analysis: Competitive Landscape and Position

Analyzing QBTS's competitive landscape is essential.

- Market Share: QBTS's market share relative to its competitors indicates its competitive strength.

- Technological Advancements: Innovation and technological disruptions within the industry can impact QBTS's future prospects.

- Competitive Pressures: Aggressive pricing strategies or new entrants can influence QBTS's profitability.

Company-Specific Factors: Internal Drivers of Performance

Internal factors significantly influence QBTS's performance.

- New Product Launches: Successful product launches can drive revenue growth.

- Operational Efficiency: Improvements in operational efficiency can boost profitability.

- Debt Levels: High debt levels can increase financial risk, impacting investor sentiment.

- Management Changes: Changes in leadership can create uncertainty or boost confidence depending on the circumstances.

Forecasting Future QBTS Earnings and Stock Price Movement

Analyst Estimates: What Do the Experts Say?

Consensus earnings estimates from financial analysts provide valuable insights.

- Range of Estimates: A wide range of estimates suggests uncertainty among analysts.

- Revisions: Frequent upward or downward revisions of estimates signal changing market sentiment.

Qualitative Factors: Beyond the Numbers

Qualitative factors beyond numerical data influence earnings predictions.

- Potential Risks: Regulatory changes, supply chain vulnerabilities, and economic downturns pose potential risks.

- Opportunities: New market opportunities, technological advancements, and strategic partnerships can drive growth.

- Market Sentiment: Overall investor sentiment towards the stock and the broader market plays a significant role.

Scenario Planning: Mapping Potential Outcomes

Developing various scenarios helps visualize potential outcomes and their impact on the stock price.

- Optimistic Scenario: Exceeding expectations, positive market sentiment, and strong revenue growth leading to a significant price increase.

- Neutral Scenario: Meeting expectations, stable market conditions, resulting in a modest price change.

- Pessimistic Scenario: Missing expectations, negative market sentiment, and weak revenue growth leading to a significant price decrease.

Conclusion: Making Informed Decisions on QBTS Stock

Predicting QBTS stock earnings reaction requires a thorough analysis of past performance, current market conditions, and future expectations. Consider multiple factors, including KPIs, macroeconomic trends, industry dynamics, and company-specific factors. Remember that thorough research and diversification are crucial for sound investment strategies. Use the insights gained from this analysis to inform your investment decisions on QBTS stock earnings predictions. For more in-depth analysis and further resources on QBTS stock, continue your research using reputable financial news sources and analyst reports. Don't rely solely on predictions; always conduct your own thorough due diligence before making investment decisions.

Featured Posts

-

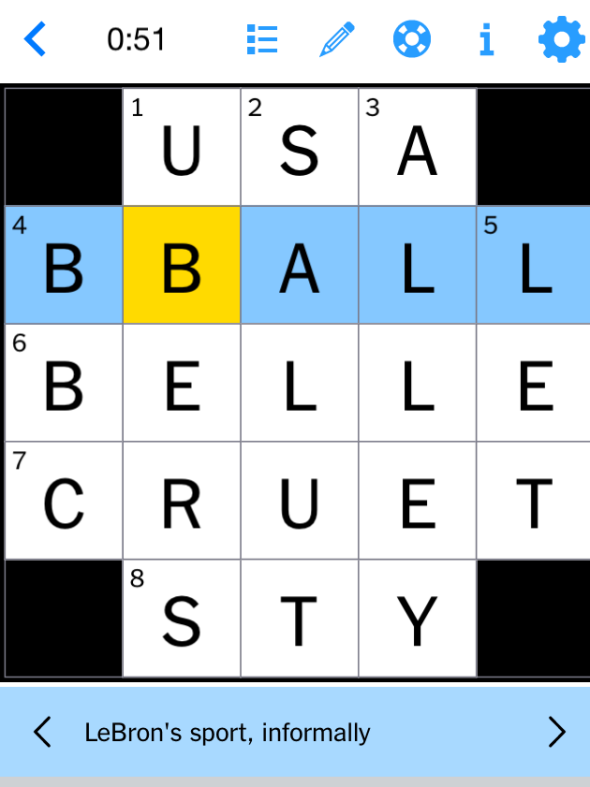

Solve The Nyt Mini Crossword March 8 Answers

May 20, 2025

Solve The Nyt Mini Crossword March 8 Answers

May 20, 2025 -

Jacob Friisin Avauskokoonpano Kamara Ja Pukki Vaihdossa

May 20, 2025

Jacob Friisin Avauskokoonpano Kamara Ja Pukki Vaihdossa

May 20, 2025 -

Giakoymakis I Megali Proklisi Toy Mls

May 20, 2025

Giakoymakis I Megali Proklisi Toy Mls

May 20, 2025 -

Four Star Admiral Convicted A Look At The Corruption Case

May 20, 2025

Four Star Admiral Convicted A Look At The Corruption Case

May 20, 2025 -

Gretzkys Canadian Loyalty Under Scrutiny Following Trumps Remarks On Tariffs And Statehood

May 20, 2025

Gretzkys Canadian Loyalty Under Scrutiny Following Trumps Remarks On Tariffs And Statehood

May 20, 2025