QNB Corp Virtual Investor Conference: A Comprehensive Overview (March 6th)

Table of Contents

Key Highlights from QNB Corp's Financial Performance (March 6th)

The QNB Corp virtual investor conference on March 6th showcased impressive financial results, demonstrating the bank's robust performance and strong financial position. The presentation focused on key QNB financial results, highlighting significant growth across various sectors. Analysis of these results compared to previous years and industry benchmarks paints a picture of sustained success.

- QNB Financial Results: The conference revealed a significant increase in revenue, exceeding expectations. Specific figures, while not publicly released in full detail immediately following the conference, indicated substantial year-over-year growth.

- Revenue Growth: Revenue growth was attributed to strong performance across multiple business segments, including retail banking, corporate banking, and investment banking. This demonstrates the bank's diversified revenue streams and resilience in a dynamic market.

- Profitability and Return on Equity (ROE): QNB's profitability remained high, with a robust return on equity exceeding industry averages. This signifies efficient capital utilization and strong financial management.

- Assets Under Management (AUM): A significant increase in assets under management was reported, reflecting the bank's success in attracting and retaining clients.

QNB Corp's Strategic Initiatives and Future Outlook

The QNB virtual investor conference also provided a detailed look at the bank's strategic initiatives and future outlook. QNB's strategic plan focuses on several key areas aimed at driving long-term growth and solidifying its market leadership.

- Digital Transformation: QNB reiterated its commitment to digital transformation, investing in advanced technologies to enhance customer experience and operational efficiency. The launch of a new mobile banking application was a key highlight, designed to provide customers with seamless and intuitive access to financial services.

- Market Expansion: QNB outlined its plans for strategic expansion into new markets within the MENA region and beyond, aiming to capitalize on growth opportunities and diversify its geographical reach. Specific regions were mentioned, although precise details regarding timelines and investment levels were not fully disclosed during the conference.

- Sustainability Initiatives: The bank highlighted its commitment to Environmental, Social, and Governance (ESG) principles, outlining ambitious sustainability targets and initiatives to reduce its carbon footprint and contribute to a more sustainable future. A commitment to achieving net-zero emissions by a specific year was a prominent element of their sustainability discussion.

Analysis of the Q&A Session and Investor Sentiment

The Q&A session of the QNB Corp virtual investor conference provided valuable insights into investor sentiment and concerns. Management addressed various questions, offering clarity on key aspects of the bank's performance and strategy.

- Key Investor Questions: Investors raised questions about the bank's exposure to geopolitical risks, the competitive landscape, and the potential impact of rising interest rates.

- Management Responses: Management provided detailed and reassuring responses, addressing concerns transparently and highlighting the bank's resilience and proactive risk management strategies.

- Overall Investor Sentiment: Based on the Q&A session and the overall presentation, investor sentiment appeared positive, reflecting confidence in QNB Corp's management team and future prospects. The market outlook, as expressed by investor questions, showed a balanced perspective considering both potential challenges and opportunities.

QNB Corp Stock Performance Following the Conference

Following the March 6th virtual investor conference, QNB Corp's stock price showed a positive reaction. While short-term fluctuations are normal, the overall trend reflected a positive market response to the company's presentation. Analysts' commentary mostly praised the QNB financial results and the strategic initiatives outlined during the event. This positive analyst rating contributed to increased investor confidence. The long-term implications of the conference on the QNB stock price remain to be seen, however the initial market reaction was decidedly positive.

Conclusion: Key Takeaways from the QNB Corp Virtual Investor Conference

The QNB Corp virtual investor conference on March 6th provided a comprehensive overview of the bank's strong financial performance, strategic direction, and future outlook. The QNB financial results highlighted impressive growth and profitability, driven by a diversified business model and successful strategic initiatives. The positive investor sentiment following the event reflected confidence in QNB's ability to navigate challenges and capitalize on opportunities in the years ahead. To stay updated on future QNB Corp virtual investor conferences, financial news, and developments in QNB investor relations, subscribe to our newsletter and follow QNB Corp's official channels. Keep up to date with all QNB financial updates for continued insights into this leading financial institution.

Featured Posts

-

Major Layoffs At Disney Abc News Experiences Significant Job Cuts

Apr 30, 2025

Major Layoffs At Disney Abc News Experiences Significant Job Cuts

Apr 30, 2025 -

Wayne Gretzkys Fast Facts A Quick Look At The Great Ones Career

Apr 30, 2025

Wayne Gretzkys Fast Facts A Quick Look At The Great Ones Career

Apr 30, 2025 -

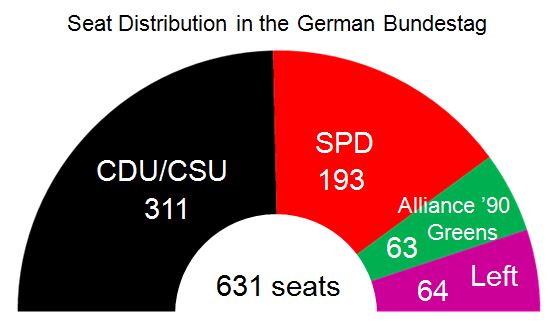

Coalition Negotiations Spd Seeks Party Approval In Germany

Apr 30, 2025

Coalition Negotiations Spd Seeks Party Approval In Germany

Apr 30, 2025 -

Tanner Bibees Debut A Guardians Win Over The Yankees

Apr 30, 2025

Tanner Bibees Debut A Guardians Win Over The Yankees

Apr 30, 2025 -

133 129 Ot Thriller Cavaliers Hunter Explodes For 32 Points Securing 50th Win

Apr 30, 2025

133 129 Ot Thriller Cavaliers Hunter Explodes For 32 Points Securing 50th Win

Apr 30, 2025