Quantum Computing Investment: Exploring D-Wave (QBTS) Stock Potential

Table of Contents

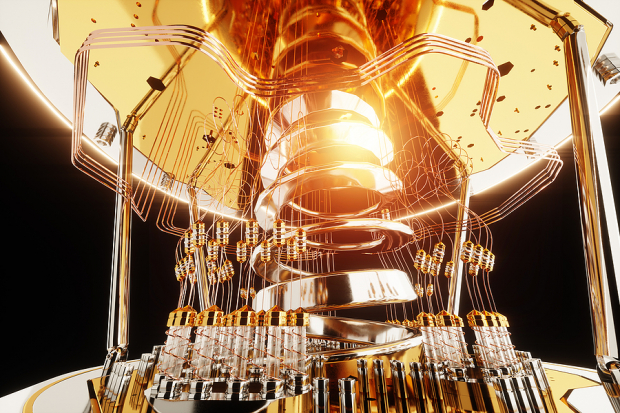

Understanding D-Wave Systems (QBTS) and its Technology

H3: What is Quantum Annealing?

Quantum computing harnesses the principles of quantum mechanics to solve complex problems beyond the capabilities of classical computers. While gate-based quantum computing is a prominent approach, D-Wave specializes in quantum annealing, a different method particularly adept at tackling optimization problems. Unlike gate-based systems that perform computations sequentially, quantum annealing leverages the quantum phenomenon of superposition to find the lowest energy state of a problem, representing the optimal solution. This makes it incredibly efficient for specific applications.

- Simpler Explanation: Imagine searching a vast landscape for the lowest point. Quantum annealing explores many points simultaneously, dramatically speeding up the search compared to traditional methods.

- Advantages of Quantum Annealing: Superior performance for optimization problems, potentially faster solutions for specific tasks, more readily available technology compared to some gate-based systems.

- Key Applications: Supply chain optimization, financial modeling, materials science, drug discovery, machine learning.

H3: D-Wave's Business Model and Market Position:

D-Wave generates revenue through several channels:

- Hardware Sales: Direct sales of their quantum annealing systems to research institutions and corporations.

- Cloud Access: Providing cloud-based access to their quantum computers, allowing users to experiment and develop applications without owning the hardware. This expands accessibility and potential revenue streams significantly.

- Partnerships: Collaborating with industry leaders to integrate quantum annealing solutions into their products and services. This expands their reach and builds credibility.

D-Wave holds a unique position in the quantum computing market, being one of the first companies to commercially offer quantum computers. While facing competition from other quantum computing companies developing gate-based systems, D-Wave's focus on quantum annealing provides a differentiated niche.

H3: Analyzing D-Wave's Financial Performance (QBTS Stock):

Analyzing QBTS stock requires examining its historical performance, including:

- Historical Trends: Review past stock price movements to understand volatility and identify potential patterns. Consider using reputable financial resources to analyze long-term and short-term trends.

- Recent Fluctuations: Assess the impact of recent news, announcements, and market conditions on QBTS's stock price.

- Key Financial Metrics: Examine revenue growth, profitability (or lack thereof), debt levels, and cash flow. This helps gauge the company's financial health and sustainability.

- Significant Events: Note any major announcements, partnerships, or technological breakthroughs that have significantly impacted the stock price.

Assessing the Risks and Rewards of Investing in QBTS

H3: Potential Risks Associated with QBTS Stock:

Investing in QBTS, like any early-stage technology company, carries inherent risks:

- High Volatility: QBTS stock price is likely to experience significant fluctuations due to the speculative nature of the quantum computing market and overall market conditions.

- Technological Disruption: Advancements in competing quantum computing technologies could render D-Wave's approach less competitive.

- Financial Performance: The company may not achieve profitability or meet market expectations, leading to a decline in stock value.

- Market Competition: The quantum computing field is rapidly evolving with new entrants and technological advancements constantly emerging.

H3: Potential Rewards and Future Growth Outlook:

Despite the risks, investing in QBTS offers significant potential rewards:

- Long-Term Growth: The quantum computing market is projected for substantial growth, presenting opportunities for significant returns on investment.

- First-Mover Advantage: D-Wave's early entry into the market provides a first-mover advantage, allowing it to establish itself and build valuable relationships.

- Expanding Applications: As quantum annealing's capabilities become better understood, the potential applications will expand, driving revenue growth.

- Strategic Partnerships: Successful collaborations could accelerate adoption and enhance D-Wave's market position.

Practical Considerations for Investing in Quantum Computing Stocks

H3: Due Diligence and Research:

Before investing in QBTS or any quantum computing stock, conduct thorough due diligence:

- Company Research: Analyze D-Wave's financial statements, technology, competitive landscape, and management team.

- Market Research: Understand the overall quantum computing market, its growth potential, and the various technologies involved.

- Expert Advice: Consult with a qualified financial advisor who can provide personalized advice based on your risk tolerance and investment goals.

H3: Diversification and Risk Management:

Diversification is crucial when investing in high-growth, high-risk stocks:

- Diversify Your Portfolio: Don't put all your eggs in one basket. Allocate your investments across different asset classes to reduce overall risk.

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of price fluctuations, to mitigate risk.

- Stop-Loss Orders: Set stop-loss orders to automatically sell your shares if the price falls below a predetermined level.

Conclusion: Making Informed Decisions on Quantum Computing Investments with D-Wave (QBTS)

Investing in D-Wave (QBTS) presents a high-risk, high-reward opportunity within the burgeoning quantum computing market. While the potential for long-term growth is substantial, the risks associated with investing in an early-stage technology company must be carefully considered. Thorough research, due diligence, and a sound risk management strategy are essential for making informed decisions. This includes understanding D-Wave's unique quantum annealing approach, its market position, and the competitive landscape. Before making any investment, conduct further research, consult with a financial advisor, and explore additional resources for in-depth analysis of Quantum Computing Investment and D-Wave (QBTS) stock. Don't hesitate to consult reputable financial news sources and analyst reports to stay updated on the latest developments.

Featured Posts

-

Teletoon Spring Streaming Jellystone And Pinata Smashling Highlight New Shows

May 21, 2025

Teletoon Spring Streaming Jellystone And Pinata Smashling Highlight New Shows

May 21, 2025 -

Arda Gueler Ve Real Madrid In Yeni Teknik Direktoerue Birlikte Basari Mi

May 21, 2025

Arda Gueler Ve Real Madrid In Yeni Teknik Direktoerue Birlikte Basari Mi

May 21, 2025 -

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan

May 21, 2025

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan

May 21, 2025 -

Ex Tory Councillors Wife Awaits Racial Hatred Tweet Appeal Ruling

May 21, 2025

Ex Tory Councillors Wife Awaits Racial Hatred Tweet Appeal Ruling

May 21, 2025 -

Could This Runner Shatter The Trans Australia Run World Record

May 21, 2025

Could This Runner Shatter The Trans Australia Run World Record

May 21, 2025

Latest Posts

-

Update Ex Tory Councillors Wifes Appeal On Racial Hatred Tweet

May 22, 2025

Update Ex Tory Councillors Wifes Appeal On Racial Hatred Tweet

May 22, 2025 -

Racial Hatred Tweet Former Tory Councillors Wifes Appeal Delayed

May 22, 2025

Racial Hatred Tweet Former Tory Councillors Wifes Appeal Delayed

May 22, 2025 -

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 22, 2025

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 22, 2025 -

Appeal Pending Ex Tory Councillors Wife And Racial Hatred Tweet

May 22, 2025

Appeal Pending Ex Tory Councillors Wife And Racial Hatred Tweet

May 22, 2025 -

Wife Of Jailed Tory Councillor Claims Migrant Hotel Remarks Were Misinterpreted

May 22, 2025

Wife Of Jailed Tory Councillor Claims Migrant Hotel Remarks Were Misinterpreted

May 22, 2025