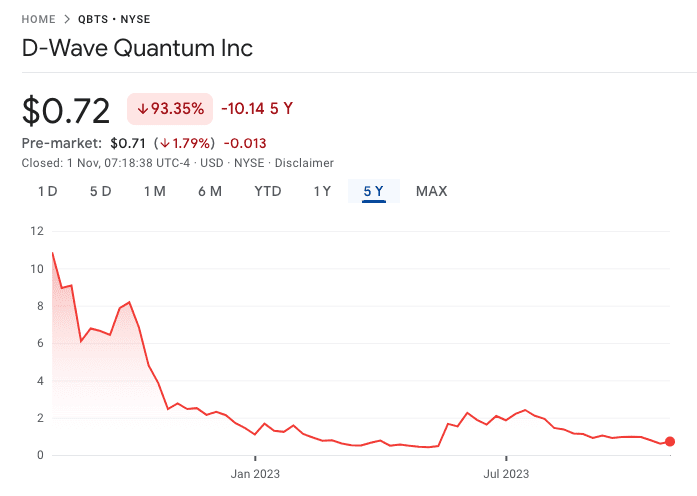

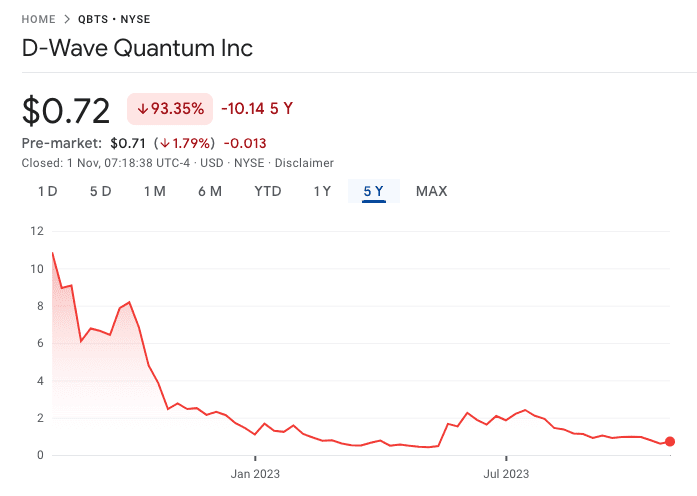

Recent D-Wave Quantum (QBTS) Stock Performance: A Detailed Look

Table of Contents

Recent QBTS Stock Price Trends

Short-Term Fluctuations

Analyzing the short-term fluctuations of QBTS stock price reveals a dynamic picture. Let's examine the daily, weekly, and monthly movements.

- July 24, 2024: QBTS experienced a significant dip following the release of a less-than-stellar quarterly earnings report. The price dropped by approximately 8%.

- August 10, 2024: A positive reaction to a new partnership announcement saw a 5% surge in the QBTS stock price.

- September 1, 2024: Market-wide corrections led to a general downturn, impacting QBTS, which fell by 3%.

[Insert Chart visualizing QBTS stock price from July 2024 to present, clearly showing the highlighted dates and price changes].

These short-term fluctuations highlight the sensitivity of QBTS price to news events and overall market sentiment. Understanding these QBTS price shifts requires careful monitoring of company announcements and broader market conditions. Tracking the QBTS stock chart daily is essential for active traders.

Long-Term Performance

Looking at the QBTS long-term performance over the past six months reveals a more nuanced picture. While experiencing short-term volatility, QBTS has shown a slight upward trend overall. Comparing its performance to the Nasdaq Composite index reveals a slightly better performance than the broader tech market during this period.

[Insert Chart visualizing QBTS stock price over the past six months, comparing it to a relevant benchmark].

While D-Wave Quantum stock growth hasn't been explosive, it suggests a degree of resilience amidst market fluctuations. The long-term outlook will depend on continued technological advancements and sustained investor confidence.

Factors Influencing QBTS Stock Performance

Company Performance and News

D-Wave Quantum's stock price is intrinsically linked to its operational performance and news announcements.

- New Partnerships: Recent partnerships with major corporations have positively impacted investor sentiment and, consequently, the stock price.

- Technological Advancements: Announcements regarding improvements in qubit technology and advancements in quantum algorithms generally lead to positive short-term price movements.

- Financial Reports: Quarterly earnings reports are pivotal. Strong revenue growth and positive earnings typically boost the QBTS stock price. Conversely, underwhelming results can trigger significant drops. Analyzing D-Wave Quantum earnings is therefore crucial.

These events directly influence the D-Wave Quantum technology perception and, in turn, the market's valuation of QBTS.

Market Sentiment and Investor Confidence

Investor sentiment plays a significant role in the QBTS stock price. Positive news about quantum computing as a whole often boosts QBTS, while negative news or skepticism can lead to declines. The overall perception of quantum computing investment significantly impacts the sector's performance. QBTS investor sentiment is therefore critical to monitor.

Macroeconomic Factors

Broader macroeconomic trends also influence QBTS. High interest rates, for example, can discourage investment in riskier assets like quantum computing stocks, leading to decreased QBTS stock price. Conversely, periods of low inflation and economic growth could be supportive. Understanding the macroeconomic impact on QBTS requires paying attention to general market dynamics.

Comparing QBTS to Competitors

[Insert a table comparing key performance indicators (e.g., market capitalization, revenue growth, stock price performance) of QBTS against other publicly traded companies in the quantum computing sector, if any are available. This section may be omitted if no direct public competitors exist].

This comparison, illustrating QBTS vs competitors, offers a broader perspective on the company's position within the market.

Conclusion

Analyzing recent D-Wave Quantum (QBTS) stock performance reveals a complex interplay of company-specific factors, market sentiment, and macroeconomic conditions. While short-term fluctuations are common, the long-term outlook hinges on continued technological innovation, strategic partnerships, and positive investor sentiment. Key takeaways include the sensitivity of the QBTS price to news events and the importance of understanding broader market trends. While predicting the future is always challenging, monitoring the D-Wave Quantum stock price and staying informed about company developments remains crucial. We encourage readers to conduct thorough due diligence and continuously monitor D-Wave Quantum (QBTS) stock performance and the quantum computing market before making any investment decisions.

Featured Posts

-

Dexter Resurrection Bevestigt De Terugkeer Van John Lithgow En Jimmy Smits

May 21, 2025

Dexter Resurrection Bevestigt De Terugkeer Van John Lithgow En Jimmy Smits

May 21, 2025 -

Half Dome Secures Abn Group Victorias Media Business

May 21, 2025

Half Dome Secures Abn Group Victorias Media Business

May 21, 2025 -

The Love Monster Helping Children Manage Anxiety And Fear

May 21, 2025

The Love Monster Helping Children Manage Anxiety And Fear

May 21, 2025 -

Jail Term For Wife Of Southport Councillor Following Racist Tweets

May 21, 2025

Jail Term For Wife Of Southport Councillor Following Racist Tweets

May 21, 2025 -

Australian Foot Crossing New Speed Record Set By Man

May 21, 2025

Australian Foot Crossing New Speed Record Set By Man

May 21, 2025

Latest Posts

-

The Goldbergs Character Analysis And Relationships

May 22, 2025

The Goldbergs Character Analysis And Relationships

May 22, 2025 -

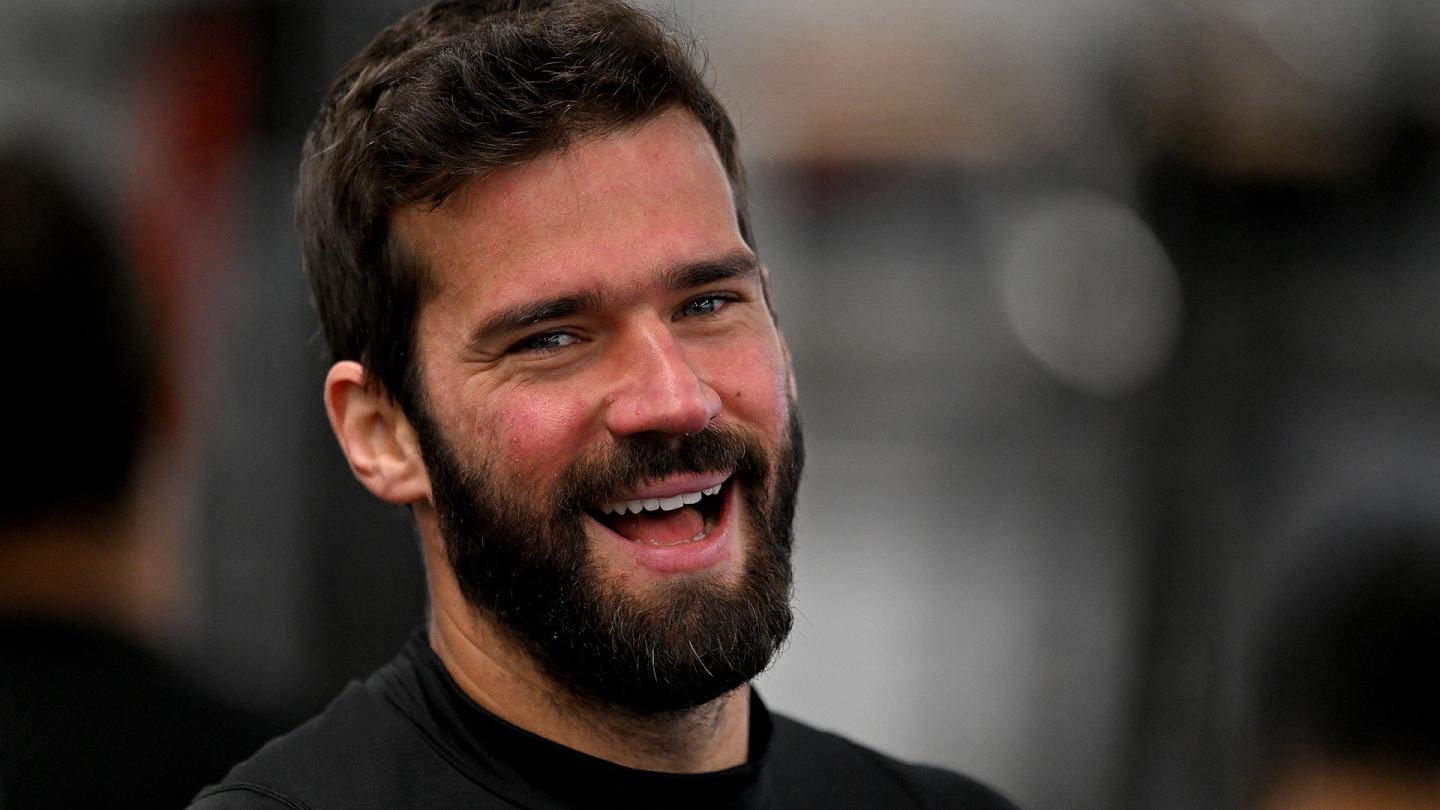

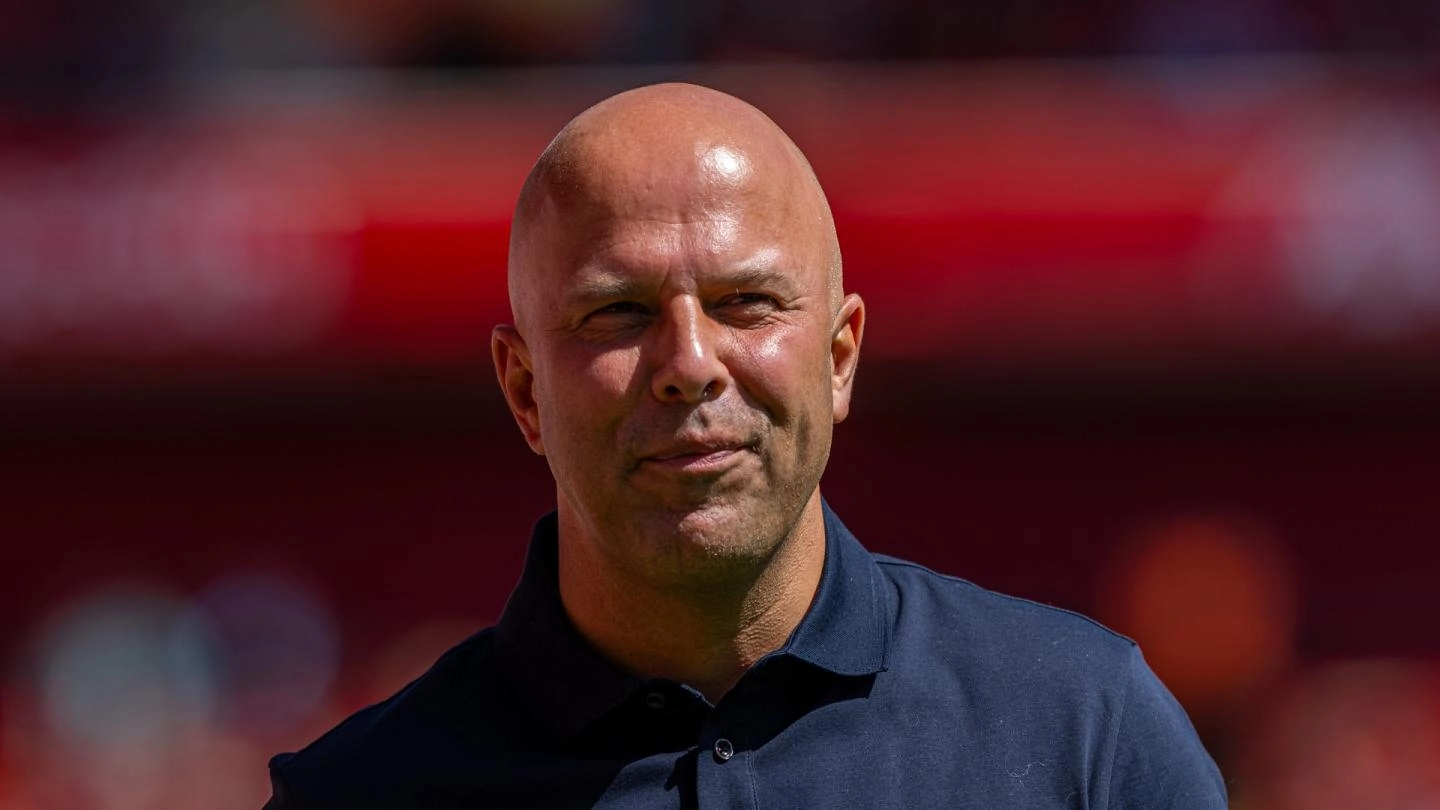

Slot And Enrique Assess Liverpools Victory And Alissons Role

May 22, 2025

Slot And Enrique Assess Liverpools Victory And Alissons Role

May 22, 2025 -

Post Match Analysis Slot And Enrique On Liverpool And Alisson

May 22, 2025

Post Match Analysis Slot And Enrique On Liverpool And Alisson

May 22, 2025 -

Alissons Performance Slot And Enriques Post Match Analysis

May 22, 2025

Alissons Performance Slot And Enriques Post Match Analysis

May 22, 2025 -

Slot Admits Liverpools Fortune Enrique Analyzes Alissons Performance

May 22, 2025

Slot Admits Liverpools Fortune Enrique Analyzes Alissons Performance

May 22, 2025