Recent Economic Data And US Talks Boost Chinese Stock Market

Table of Contents

Positive Economic Indicators Fuel Market Growth

China's economy has shown encouraging signs of resilience in recent quarters. Positive economic indicators are a primary driver behind the recent surge in the Chinese stock market. Key data points support this assertion:

- GDP Growth: China's GDP growth for the [Insert Quarter and Year] quarter reached [Insert Percentage]%, exceeding expectations and marking a [Comparison to previous quarter – e.g., significant increase/modest improvement] compared to the previous quarter. This robust growth signifies a healthy and expanding economy.

- Inflation Rate: The inflation rate remains relatively stable at [Insert Percentage]%, indicating a manageable level of price increases and supporting sustained consumer spending and investment. This stability is crucial for maintaining economic confidence.

- Industrial Production & Retail Sales: Positive trends are also evident in industrial production, which saw a [Insert Percentage]% increase, and retail sales, which grew by [Insert Percentage]%. These figures point towards strong domestic demand and a thriving manufacturing sector.

- Government Stimulus: While not as significant as in previous years, targeted government stimulus packages in specific sectors have played a supportive role in boosting economic activity and investor confidence. These focused interventions address specific economic needs while avoiding excessive inflation.

US-China Trade Talks and Their Impact

The recent thaw in US-China trade relations has significantly contributed to the improved market sentiment. While tensions remain, a de-escalation of trade disputes has fostered a more positive outlook:

- Agreements & De-escalation: The [Mention specific agreements or phases of trade deals reached] have eased concerns about further escalation of trade wars, reducing uncertainty for investors. This clarity is a significant boost for investor confidence.

- Increased Foreign Investment: The reduced trade tensions are expected to attract increased foreign investment into China, further bolstering the economy and the stock market. Foreign investors are more willing to commit capital in a more stable environment.

- Reduced Trade Uncertainties: The improved dialogue between the US and China has lessened the uncertainty surrounding trade policies, allowing businesses to plan for the future with greater confidence. This certainty encourages investment and growth.

- Sector-Specific Impacts: The positive impact is felt across various sectors, particularly technology and manufacturing. The technology sector, after facing significant headwinds, is experiencing renewed growth, while manufacturing benefits from improved access to global markets.

Increased Investor Confidence and Market Sentiment

The combination of positive economic data and improved US-China relations has fostered a significantly more optimistic outlook among investors. This is reflected in several key market indicators:

- Rising Stock Indices & Trading Volumes: Key stock indices like the Shanghai Composite and Shenzhen Component have shown significant gains, coupled with increased trading volumes, indicating higher participation and bullish sentiment.

- Increased Foreign Investment Inflows: Foreign investors are increasingly allocating capital to the Chinese stock market, demonstrating a renewed confidence in the country's economic prospects. This influx of capital is further pushing up market values.

- Positive Investor Sentiment Surveys: Numerous investor sentiment surveys show a marked improvement in confidence levels, reflecting the positive impact of the recent economic news and trade developments. This reflects a shift in perception from uncertainty to opportunity.

- Positive Media Coverage: Positive media coverage amplifies the positive sentiment, attracting even more investor attention and reinforcing the upward trend in the market. Positive news fuels a self-reinforcing cycle of market growth.

Sector-Specific Performance

The positive market trend isn't uniform across all sectors. While most sectors are experiencing gains, some outperform others:

- Technology Stocks: Technology stocks have shown particularly strong performance, driven by both domestic demand and renewed access to global markets. The sector benefits from both domestic expansion and international collaboration.

- Consumer Goods Stocks: Consumer goods companies have also seen robust growth, reflecting the strength of domestic consumption. This demonstrates the positive effect of healthy consumer spending on the market.

- Energy & Industrial Stocks: The energy and industrial sectors are showing moderate gains, benefiting from the overall economic recovery. These sectors are important indicators of overall economic strength.

- Outperformers & Underperformers: While most sectors are positive, specific companies within each sector experience varying degrees of success based on individual performance and market conditions.

Potential Risks and Future Outlook

While the outlook is currently positive, potential risks and challenges remain:

- Geopolitical Risks & Trade Disputes: Lingering geopolitical tensions and the possibility of renewed trade friction pose significant risks. These uncertainties can quickly shift market sentiment.

- Economic Slowdown: The possibility of a future economic slowdown in China remains a concern, particularly considering global economic headwinds. A sustained period of economic weakness could reverse current trends.

- Global Economic Uncertainties: Global economic uncertainties, such as inflation and potential recessions in other major economies, could negatively impact China's growth. Global market conditions always have an impact on Chinese markets.

- Short-Term vs. Long-Term Outlook: While the short-term outlook appears bullish, the long-term trajectory depends on sustained economic growth and further improvements in US-China relations. Long-term prospects are generally positive but depend on several key factors.

Conclusion: Recent Economic Data and US Talks Continue to Boost Chinese Stock Market

In summary, the recent surge in the Chinese stock market is directly attributable to the positive impact of recent economic data and the improved outlook resulting from US-China trade talks. Strong GDP growth, stable inflation, and increased investor confidence, fueled by reduced trade uncertainties, have driven this upward trend. While risks remain, the overall outlook appears positive for the short term. To capitalize on potential opportunities and stay ahead of the curve, stay informed about Chinese stock market trends, China's economic outlook, and the ongoing evolution of US-China trade relations and their impact on the market.

Featured Posts

-

Exclusive Investigation Into Hegseths Use Of Signal For Defense Department Communications

May 07, 2025

Exclusive Investigation Into Hegseths Use Of Signal For Defense Department Communications

May 07, 2025 -

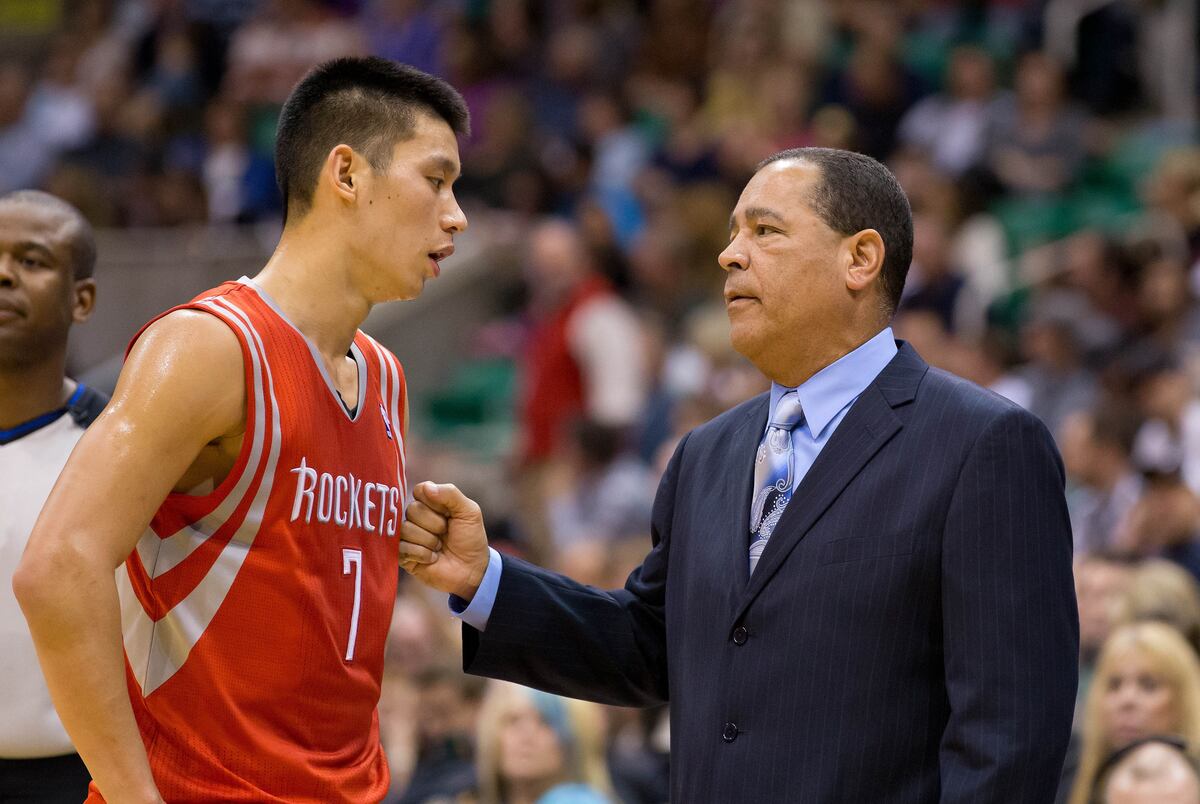

Jazz Vs Rockets Conley And Edwards To Carry The Load Without Gobert

May 07, 2025

Jazz Vs Rockets Conley And Edwards To Carry The Load Without Gobert

May 07, 2025 -

The Closure Of Anchor Brewing Company A Look Back At Its Legacy

May 07, 2025

The Closure Of Anchor Brewing Company A Look Back At Its Legacy

May 07, 2025 -

Insider Explains The Real Reason Behind The Steelers Pickens Non Trade

May 07, 2025

Insider Explains The Real Reason Behind The Steelers Pickens Non Trade

May 07, 2025 -

Las Vegas Aces Center Megan Gustafsons Leg Injury Out Indefinitely

May 07, 2025

Las Vegas Aces Center Megan Gustafsons Leg Injury Out Indefinitely

May 07, 2025