Recession Anxiety Impacts Canadian Housing Market: BMO Report Reveals

Table of Contents

BMO Report's Key Findings on Recession Anxiety and its Impact

The BMO report paints a picture of a Canadian housing market cautiously treading water amidst growing economic uncertainty. The report directly links the rise in recession anxiety to a slowdown in housing activity. While the exact figures vary depending on the region, the report indicates a measurable impact on key market indicators.

- Percentage change in housing activity: The report shows a noticeable decrease in both sales and new listings compared to the previous year, suggesting a more hesitant market. The precise percentages will vary depending on the specific region and data analyzed by BMO.

- Changes in average home prices: While not necessarily a dramatic crash, the BMO report suggests a slowing, or in some regions, a slight decrease in average home prices across Canada. This slowdown is most pronounced in previously overheated markets.

- Shift in buyer demographics and their purchasing power: The report indicates a shift towards more cautious buyers, with first-time homebuyers particularly affected by rising interest rates and reduced borrowing power. Higher-income brackets are also showing more hesitation.

- Impact on mortgage applications and approvals: The number of mortgage applications and approvals has decreased, reflecting the reduced confidence in the market and the tighter lending criteria of financial institutions.

How Recession Fears are Affecting Canadian Home Buyers

Recessionary fears are significantly impacting the psychology of Canadian homebuyers, leading to more conservative purchasing decisions. The uncertainty surrounding job security and the potential for further interest rate hikes are major contributing factors.

- Increased uncertainty about job security affecting buying power: The fear of job loss is a primary driver of hesitation, impacting buyer confidence and their willingness to commit to a large mortgage.

- Concerns about rising interest rates and affordability: The increase in interest rates has significantly reduced affordability for many potential buyers, forcing them to reconsider their purchasing power and potentially delay their home-buying plans.

- Shift towards more conservative home purchases (smaller homes, less expensive locations): Buyers are increasingly opting for smaller homes or less expensive locations to mitigate risk and manage their monthly mortgage payments.

- Increased demand for rental properties as an alternative: The uncertainty is pushing some potential buyers toward renting, allowing them to avoid the commitment of a mortgage in a volatile market.

Impact on Housing Prices and Market Trends

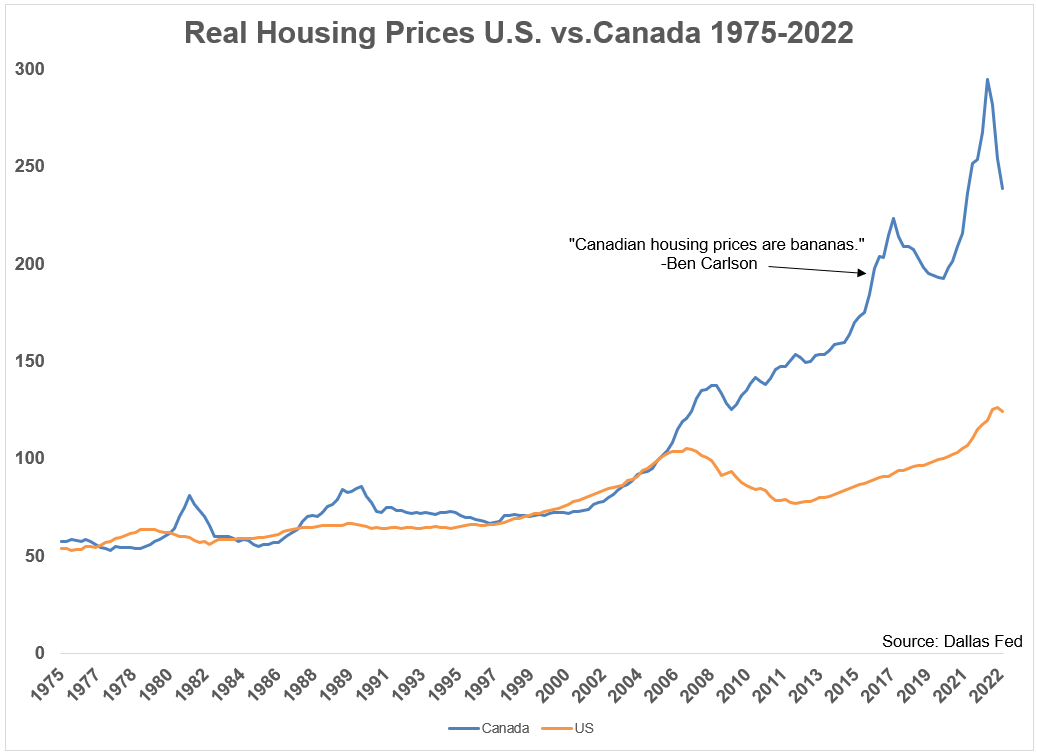

The impact of recession anxiety on Canadian housing prices is multifaceted. While a dramatic price crash isn't universally predicted, the BMO report suggests a slowing of price growth and even price decreases in certain regions.

- Regional variations in price adjustments: The impact varies significantly across Canada. Markets like Toronto and Vancouver, which experienced rapid price increases in recent years, are showing signs of slowing down more significantly than other regions.

- Impact on different housing segments: The effects are not uniform across all housing segments. Condos may experience a more pronounced price correction than single-family homes, depending on the region and local market conditions.

- Analysis of inventory levels and market supply: Increased inventory levels in certain areas point towards a potential shift towards a buyer's market, giving purchasers more negotiating power.

- Mention any potential for a "buyer's market" emerging: While not a full-blown buyer's market yet, some regions are exhibiting characteristics that indicate a shift in favor of buyers, presenting opportunities for those prepared to act strategically.

Strategies for Navigating the Market During Recession Anxiety

Navigating the Canadian housing market during a period of recession anxiety requires careful planning and a strategic approach. Both buyers and sellers need to adapt their strategies to the current climate.

- Tips for buyers: Be patient, budget carefully, secure pre-approval for a mortgage, and seek expert advice from a real estate professional and financial advisor.

- Strategies for sellers: Price your property realistically, stage it effectively, and be prepared for a potentially longer selling timeframe. Consider offering incentives to attract buyers.

- Importance of financial planning and securing pre-approval: Thorough financial planning and obtaining pre-approval for a mortgage are crucial steps in mitigating risk and demonstrating your financial readiness to sellers.

- The role of real estate professionals in navigating the market: Experienced real estate professionals can provide invaluable insights into market trends and assist buyers and sellers in making informed decisions.

Conclusion: Understanding Recession Anxiety's Impact on the Canadian Housing Market

The BMO report underscores the significant impact of recession anxiety on the Canadian housing market. The report's findings reveal a slowdown in housing activity, price adjustments, and shifts in buyer behavior, highlighting the importance of understanding this evolving landscape. To successfully navigate this market, buyers and sellers must stay updated on the Canadian housing market, manage their recession anxiety regarding housing, and understand the implications of the BMO report on Canadian housing. Consult with financial and real estate professionals to make informed decisions and continue monitoring the effects of recession anxiety on the Canadian housing market. By understanding these dynamics, you can effectively manage your risk and make strategic choices in this evolving market.

Featured Posts

-

Simone Biles Luxury Shopping Trip Jonathan Owens Role And Fan Reactions

May 07, 2025

Simone Biles Luxury Shopping Trip Jonathan Owens Role And Fan Reactions

May 07, 2025 -

Ravens Release Veteran Kicker Justin Tucker A Football Decision

May 07, 2025

Ravens Release Veteran Kicker Justin Tucker A Football Decision

May 07, 2025 -

See The April 12th 2025 Lotto And Lotto Plus Results Here

May 07, 2025

See The April 12th 2025 Lotto And Lotto Plus Results Here

May 07, 2025 -

Julius Randles Playoff Redemption Can He Lead The Timberwolves To Success

May 07, 2025

Julius Randles Playoff Redemption Can He Lead The Timberwolves To Success

May 07, 2025 -

Finding A Ps 5 Before The Expected Price Hike

May 07, 2025

Finding A Ps 5 Before The Expected Price Hike

May 07, 2025