Reciprocal Tariffs: Assessing Second-Order Risks To Key Indian Sectors

Table of Contents

Impact on the Indian Textile Sector

The Indian textile sector, a significant contributor to employment and exports, faces considerable risks from reciprocal tariffs.

Reduced Export Competitiveness

Reciprocal tariffs significantly increase the cost of Indian textile exports, making them less competitive in global markets. This leads to:

- Loss of market share: Higher prices reduce demand for Indian textiles compared to competitors with lower tariff burdens.

- Decreased profitability for textile manufacturers: Reduced export volumes and increased production costs squeeze profit margins, potentially forcing businesses to close.

- Job losses in the textile industry: Declining profitability leads to layoffs and reduced hiring in the sector.

- Potential for increased domestic prices: Reduced export volumes could lead to a surplus of goods domestically, potentially depressing prices for domestic producers but this effect is not guaranteed and may be outweighed by increased input costs.

A recent study by the [Insert credible source, e.g., Confederation of Indian Industry (CII)] indicates that a 10% increase in tariffs on Indian textiles could lead to a [Insert percentage]% decrease in exports.

Dependence on Specific Export Markets

India's textile sector relies heavily on specific export markets, creating vulnerability to tariffs imposed by those nations. For example, significant portions of Indian textile exports go to [mention specific countries, e.g., the US, EU]. Tariffs imposed by these countries directly impact export revenues. Diversification strategies, including exploring new markets and developing higher-value products, are crucial for mitigating this risk.

- Example: A tariff imposed by the European Union on cotton textiles could severely impact Indian exporters dependent on this market.

- Mitigation: Investing in marketing and trade promotion in new and emerging markets in Asia and Africa could lessen this dependence.

Supply Chain Disruptions

Reciprocal tariffs can disrupt the supply chain for raw materials and intermediate goods, impacting the textile industry's production capabilities.

- Increased costs of raw materials: Tariffs on imported cotton, dyes, or machinery directly increase production costs.

- Delays in production: Supply chain disruptions can lead to delays in obtaining necessary inputs, impacting production schedules and delivery timelines.

- Potential for shortages: Severe disruptions could lead to shortages of critical materials, hindering production.

Consequences for Indian Agriculture

The agricultural sector, a cornerstone of the Indian economy, faces multifaceted challenges from reciprocal tariffs.

Reduced Agricultural Exports

Reciprocal tariffs can severely restrict India's ability to export agricultural products.

- Decreased farm income: Reduced export volumes directly impact farmers' earnings, potentially leading to financial hardship.

- Food security concerns: While export restrictions might benefit domestic consumers temporarily by keeping prices down, long-term dependence on export markets needs to be considered.

- Potential for surplus production: A drop in export demand can lead to excess production, potentially depressing domestic prices and creating storage problems. Examples include rice exports to [mention countries] and wheat to [mention countries].

Impact on Domestic Prices

Retaliatory tariffs can significantly affect domestic prices of agricultural goods, with far-reaching consequences.

- Inflationary pressures: Increased input costs and reduced supply due to export restrictions can push up domestic prices.

- Decreased consumer purchasing power: Higher food prices erode consumer purchasing power, especially for low-income households.

- Potential for social unrest: Sharp price increases in essential food commodities can lead to social unrest and political instability.

Dependence on Global Markets for Inputs

Indian agriculture relies on imported inputs like fertilizers and machinery. Tariffs on these inputs increase costs and hamper productivity.

- Increased input costs: Higher prices for fertilizers and machinery reduce farm profitability.

- Reduced agricultural output: Increased input costs can lead to decreased agricultural production, exacerbating the effects of reduced export markets.

- Negative impact on farm profitability: The combination of reduced export earnings and increased input costs can severely harm farm profitability.

Risks to the Indian Pharmaceutical Industry

The Indian pharmaceutical industry, known globally for its generic drug production, faces unique challenges from reciprocal tariffs.

Export Market Vulnerability

Reciprocal tariffs threaten the competitiveness of Indian pharmaceutical exports.

- Loss of market share: Higher prices for Indian generic drugs reduce their competitiveness in international markets.

- Decreased profitability for pharmaceutical companies: Lower export volumes and increased production costs impact profitability.

- Potential impact on access to affordable medicines globally: Increased prices of Indian generic drugs reduce access to essential medicines in developing countries.

Reliance on Imported Raw Materials

The Indian pharmaceutical industry relies heavily on imported Active Pharmaceutical Ingredients (APIs). Tariffs on these APIs create major risks.

- Increased production costs: Higher prices for APIs directly increase drug production costs, affecting profitability and affordability.

- Shortages of essential medicines: Supply chain disruptions could lead to shortages of crucial medicines.

- Potential for price increases: Increased production costs are almost inevitably passed onto consumers.

Trade Disputes and Regulatory Barriers

Reciprocal tariffs can trigger trade disputes, further complicating matters.

- Increased regulatory scrutiny: Trade disputes can lead to increased regulatory scrutiny and barriers to market access.

- Potential for trade sanctions: Escalating trade disputes could result in retaliatory trade sanctions, further harming the industry.

- Difficulties in navigating international trade regulations: Navigating the complexities of international trade regulations during trade disputes adds to the challenges faced by Indian pharmaceutical companies.

Mitigation Strategies and Policy Recommendations

Mitigating the risks of reciprocal tariffs requires a multifaceted approach.

- Diversification of export markets: Reducing reliance on specific markets through exploring new export destinations.

- Strengthening domestic industries: Boosting domestic production and reducing reliance on imports.

- Promoting regional trade agreements: Negotiating and strengthening regional trade agreements to reduce reliance on affected countries.

Policy Recommendations:

- Invest in research and development: Promote innovation to develop higher-value products less susceptible to tariff impacts.

- Strengthen supply chain resilience: Diversify sourcing of raw materials and intermediate goods to reduce reliance on vulnerable sources.

- Support small and medium-sized enterprises (SMEs): Provide financial and technical assistance to help SMEs adapt to changing trade environments.

- Negotiate bilateral and multilateral trade agreements: Actively participate in negotiations to reduce trade barriers and promote free trade.

Conclusion: Reciprocal Tariffs and the Future of Key Indian Sectors

Reciprocal tariffs pose significant second-order risks to India's textile, agricultural, and pharmaceutical sectors. The potential consequences include reduced export competitiveness, increased domestic prices, supply chain disruptions, and job losses. Proactive strategies are crucial to mitigate these negative impacts. Understanding and addressing the potential repercussions of reciprocal tariffs is critical for safeguarding the future of key Indian sectors. Further research and proactive policy responses are urgently needed to navigate this complex trade landscape effectively. India must prioritize diversification, supply chain resilience, and strategic trade negotiations to ensure the long-term health and competitiveness of its vital industries.

Featured Posts

-

The Gsw Lockdown Could Things Have Turned Out Worse A Student Perspective

May 15, 2025

The Gsw Lockdown Could Things Have Turned Out Worse A Student Perspective

May 15, 2025 -

Knicks Playoff Hopes Rise As Jalen Brunson Nears Return Vs Pistons

May 15, 2025

Knicks Playoff Hopes Rise As Jalen Brunson Nears Return Vs Pistons

May 15, 2025 -

Jimmy Butler No Miami Thoughts Ahead Of Crucial Game

May 15, 2025

Jimmy Butler No Miami Thoughts Ahead Of Crucial Game

May 15, 2025 -

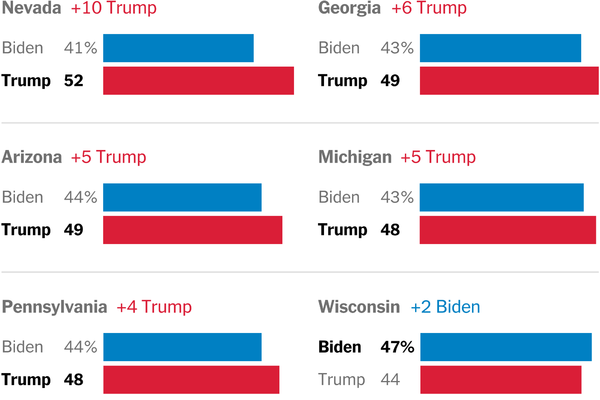

Trump Vs Biden A Comparison Of Their Presidential Performances

May 15, 2025

Trump Vs Biden A Comparison Of Their Presidential Performances

May 15, 2025 -

Paysandu 0 1 Bahia Resultado Resumen Y Goles Del Partido

May 15, 2025

Paysandu 0 1 Bahia Resultado Resumen Y Goles Del Partido

May 15, 2025