Recordati's Strategic M&A Approach Amidst Italian Tariff Volatility

Table of Contents

Recordati's Historical M&A Activity

Recordati's growth trajectory is significantly marked by its strategic use of mergers and acquisitions. The company has consistently demonstrated a keen eye for identifying and acquiring companies that complement its existing portfolio and expand its market reach. This history of strategic acquisitions reveals a pattern of calculated growth, focusing on specific areas to bolster its overall strength and market position.

Recordati's past M&A activity reveals a preference for acquiring specialized drug developers and generic manufacturers. This targeted approach allows for both portfolio diversification and the expansion of its product offerings within specific therapeutic areas.

- Successful M&A Deals: Examples include [insert specific examples of successful acquisitions with financial outcomes, if available. Otherwise, use general examples and quantify successes where possible, e.g., "Acquisition X led to a 15% increase in market share in the Y therapeutic area"].

- Geographical Expansion: Acquisitions have facilitated Recordati's geographical expansion beyond Italy, allowing it to access new markets and reduce reliance on a single, volatile region. [mention specific geographic expansions if possible].

- Portfolio Diversification: Through M&A, Recordati has successfully diversified its product portfolio, mitigating risks associated with reliance on a limited number of products or therapeutic areas.

Impact of Italian Tariff Volatility on Recordati's Strategy

The Italian pharmaceutical sector experiences significant tariff fluctuations, creating uncertainty in pricing and profitability. These unpredictable changes directly impact Recordati's investment decisions and its long-term M&A planning. The inherent risk associated with tariff volatility necessitates a cautious yet opportunistic approach to acquisitions.

- Specific Tariff Impacts: [Insert specific examples of tariffs affecting Recordati's products, citing sources if possible]. For example, changes in tariffs on imported raw materials can directly influence production costs, requiring adjustments in pricing strategies.

- Pricing Strategy Adjustments: Recordati must constantly adapt its pricing strategies to absorb the impact of tariff changes while maintaining competitiveness and profitability. This requires sophisticated financial modeling and a deep understanding of the market dynamics.

- Risk Assessment in M&A: Thorough risk assessment is critical during periods of tariff volatility. Recordati must carefully evaluate the potential impact of future tariff adjustments on the financial viability of any acquisition target.

Recordati's M&A Strategy to Mitigate Tariff Risks

Recordati leverages M&A to strategically reduce its exposure to tariff fluctuations. Its strategy centers on diversification – both geographically and in its product portfolio. This proactive approach helps insulate the company from the negative impacts of unpredictable tariff changes.

- Reducing Reliance on Specific Products/Markets: Acquisitions targeting companies with complementary products or presence in diverse geographic markets directly lessen Recordati's dependence on any single area vulnerable to tariff changes.

- Strategic Partnerships: Collaborations with other companies can help mitigate tariff risks by sharing resources, diversifying supply chains, and creating more stable pricing agreements.

- Internal Product Development: Investing in the research and development of its own products minimizes reliance on imports and reduces exposure to external tariff influences.

Future Outlook and Predictions for Recordati's M&A Activity

Looking ahead, Recordati's M&A activity will likely continue to be driven by a desire for diversification and growth within the pharmaceutical sector. Considering current market trends and projected tariff forecasts, several potential future acquisition targets can be identified.

- Predictions for Future Acquisitions: Based on current market trends, Recordati might focus on acquiring companies specializing in innovative therapies, particularly those with strong potential in emerging markets [mention specific therapeutic areas or geographic regions].

- Challenges and Opportunities: The Italian pharmaceutical market presents both challenges (regulatory changes, price controls) and opportunities (aging population, rising healthcare spending). Recordati will need to balance these factors in its future M&A decisions.

- Role of Innovation and Technology: Technological advancements will likely play a crucial role in shaping future M&A activity. Recordati might target companies with advanced technologies or innovative drug delivery systems.

Conclusion

Recordati's success in navigating the complexities of the Italian pharmaceutical market and its inherent tariff volatility hinges on its proactive and strategic approach to mergers and acquisitions. Diversification, risk mitigation, and carefully planned strategic acquisitions are key elements of Recordati's growth strategy. By understanding and adapting to the challenges posed by tariff fluctuations, Recordati has established a strong foundation for continued success. To stay updated on Recordati’s strategic moves and their impact on the Italian pharmaceutical landscape, follow their mergers and acquisitions announcements and further research their M&A strategy. Understanding Recordati's M&A strategy offers valuable insights into navigating the complexities of the Italian pharmaceutical market.

Featured Posts

-

Creating Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 30, 2025

Creating Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 30, 2025 -

Blue Ivy And Rumi Beyonces Daughters Steal The Show At Super Bowl Lix

Apr 30, 2025

Blue Ivy And Rumi Beyonces Daughters Steal The Show At Super Bowl Lix

Apr 30, 2025 -

Basel Greenlights Funding For Eurovision Village 2025

Apr 30, 2025

Basel Greenlights Funding For Eurovision Village 2025

Apr 30, 2025 -

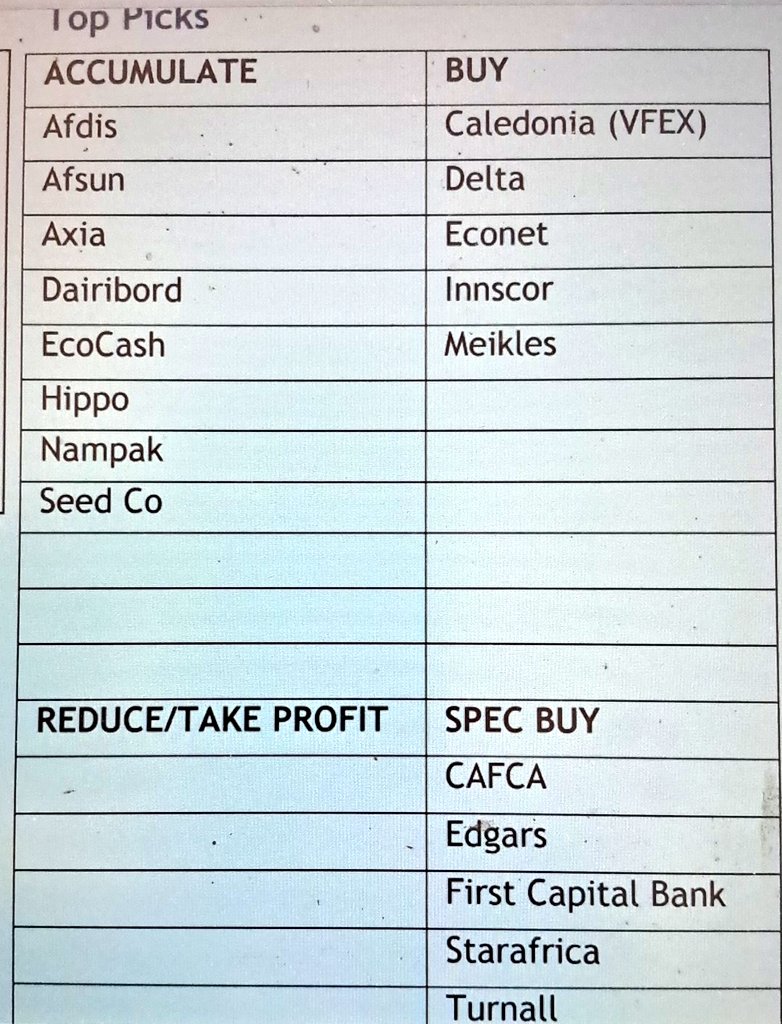

Summer 2025 Slide Selection Top Picks And Recommendations

Apr 30, 2025

Summer 2025 Slide Selection Top Picks And Recommendations

Apr 30, 2025 -

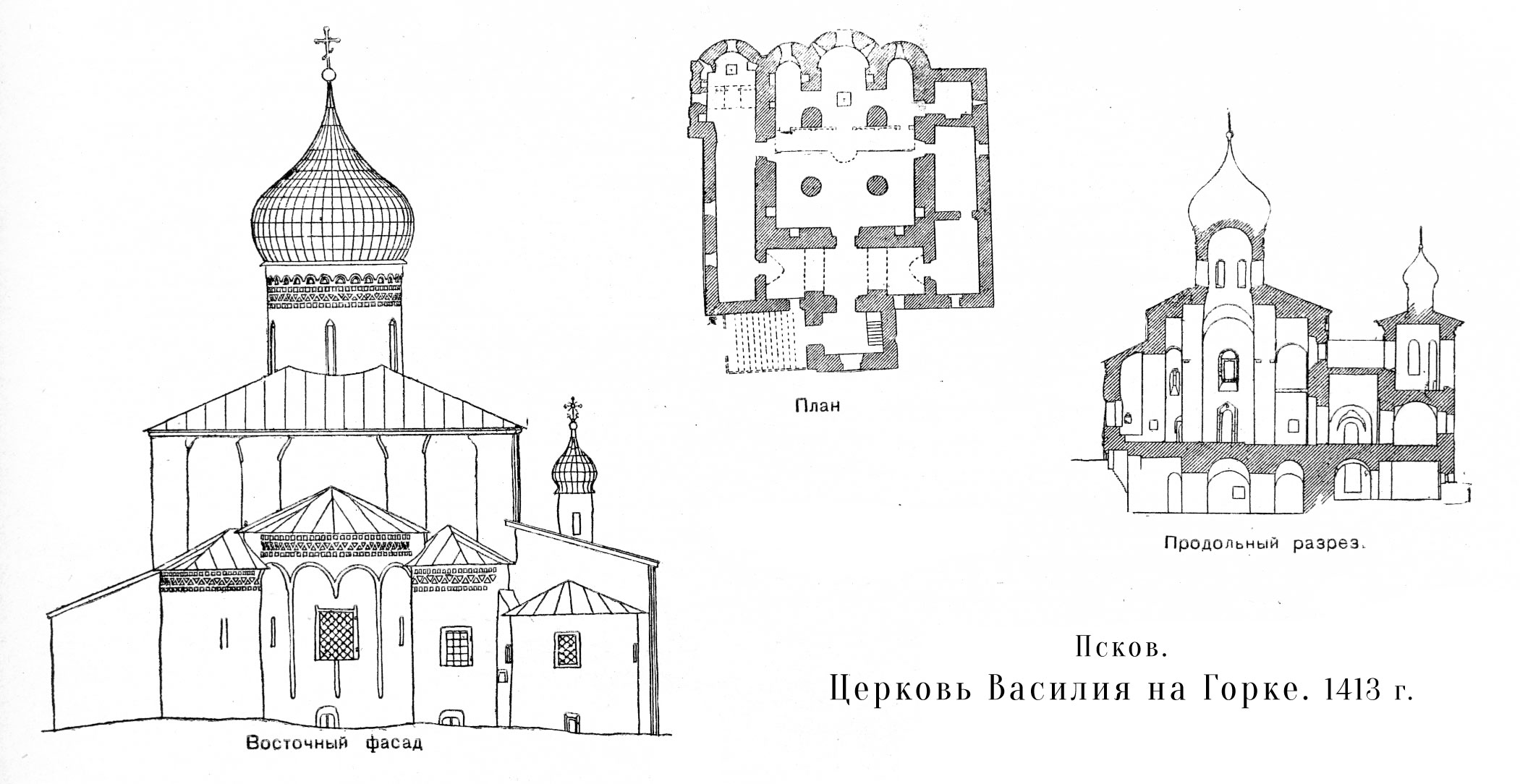

Tragediya Na Gorke V Tyumeni Postradavshie Otvergli Pomosch Vlastey

Apr 30, 2025

Tragediya Na Gorke V Tyumeni Postradavshie Otvergli Pomosch Vlastey

Apr 30, 2025