Reduced Non-Essential Spending: A Challenge For Credit Card Issuers

Table of Contents

Declining Transaction Volumes and Revenue

Reduced non-essential spending directly correlates with lower credit card transaction volumes, impacting the profitability of credit card issuers. As consumers tighten their belts, discretionary spending takes the biggest hit. This translates to significantly lower revenue for credit card companies that rely heavily on transaction fees.

- Decreased spending on dining, entertainment, and travel: These categories, traditionally major drivers of credit card usage, have seen dramatic declines as consumers prioritize essential expenses.

- Lower overall credit card usage rates: Data shows a noticeable decrease in the overall frequency of credit card transactions, reflecting a broader shift in consumer behavior.

- Impact on credit card interchange fees (revenue for issuers): Interchange fees, paid by merchants to card networks, form a crucial part of credit card issuers' revenue. Reduced transaction volumes directly decrease these fees.

- Potential for reduced profitability and shareholder returns: The combined effect of lower transaction volumes and interchange fees can lead to reduced profitability and diminished shareholder returns for credit card companies.

Recent data from the Federal Reserve shows a significant slowdown in consumer spending on non-durable goods, further supporting the decline in credit card transactions. This trend underscores the urgent need for credit card issuers to adapt their strategies.

Increased Focus on Debt Management and Responsible Spending

The economic downturn has spurred a significant shift in consumer behavior towards debt reduction and mindful spending. Consumers are becoming increasingly aware of the implications of high-interest rates and the burden of credit card debt.

- Growing awareness of high-interest rates and debt burdens: The cost of carrying credit card debt is becoming more apparent, leading consumers to prioritize debt repayment.

- Increased use of budgeting apps and financial planning tools: Consumers are actively seeking tools and resources to manage their finances more effectively, leading to a greater focus on responsible spending.

- Consumers prioritizing essential expenses over discretionary purchases: Basic necessities like groceries, housing, and utilities are now taking precedence over non-essential spending.

- Implications for credit card rewards programs and loyalty initiatives: The effectiveness of traditional rewards programs is diminished as consumers focus on reducing spending rather than maximizing rewards.

This shift necessitates a reassessment of credit card marketing strategies. Companies must move beyond simple reward schemes and focus on building trust and providing genuine value to consumers, emphasizing financial wellness.

Strategic Adaptations by Credit Card Issuers

Facing the challenge of reduced non-essential spending, credit card issuers are employing various strategies to navigate this changing landscape and maintain profitability.

- Offering more competitive interest rates and fees: Attracting and retaining customers requires offering more appealing financial terms, particularly lower interest rates and fees.

- Developing financial wellness programs and resources: Providing budgeting tools, financial literacy resources, and debt management advice helps consumers manage their finances effectively.

- Focusing on essential spending categories (groceries, utilities): Credit card companies are actively targeting essential spending categories where consumer spending remains relatively stable.

- Leveraging digital platforms and personalized offers: Utilizing data analytics and digital marketing to deliver personalized offers and enhance the customer experience is crucial.

- Exploring new revenue streams beyond transaction fees (e.g., subscription services): Diversification into areas like subscription services provides alternative revenue streams, reducing reliance on transaction fees alone.

Examples include credit card companies offering cashback rewards on essential purchases or partnering with budgeting apps to integrate financial management tools.

The Rise of Buy Now, Pay Later (BNPL) and its Impact

The rise of Buy Now, Pay Later (BNPL) services presents both opportunities and challenges for traditional credit card issuers.

- Competition for consumer spending: BNPL services compete directly with credit cards for consumer spending, especially in the online retail sector.

- Different risk profiles associated with BNPL: The risk profiles of BNPL and credit cards differ significantly, with BNPL potentially leading to higher levels of consumer debt.

- Potential for increased consumer debt: The ease of access to BNPL financing could contribute to increased consumer debt if not managed responsibly.

- Impact on credit scoring and credit card applications: The growing use of BNPL may affect credit scoring models and influence credit card application approvals.

The integration of BNPL into the financial ecosystem requires careful monitoring and strategic responses from credit card issuers.

Conclusion

Reduced non-essential spending represents a significant challenge for credit card issuers, forcing them to adapt their strategies and offerings to maintain revenue and profitability. The shift toward responsible spending and debt management has reshaped the landscape, demanding innovative solutions from the financial industry. The rise of BNPL services adds another layer of complexity to this dynamic market. Understanding the implications of reduced non-essential spending is crucial for both credit card issuers and consumers alike. Stay informed on the latest trends in consumer finance and adapt your spending habits accordingly. Learn more about managing your finances effectively during periods of reduced non-essential spending and explore strategies for navigating this evolving financial landscape.

Featured Posts

-

Market Response To Trumps Remarks On Powell And Us Futures

Apr 24, 2025

Market Response To Trumps Remarks On Powell And Us Futures

Apr 24, 2025 -

Nba Launches Formal Probe Into Ja Morant Incident

Apr 24, 2025

Nba Launches Formal Probe Into Ja Morant Incident

Apr 24, 2025 -

China Diversifies Lpg Imports Turning To The Middle East

Apr 24, 2025

China Diversifies Lpg Imports Turning To The Middle East

Apr 24, 2025 -

Conservative Party Promises Tax Cuts And Smaller Deficits In Canada

Apr 24, 2025

Conservative Party Promises Tax Cuts And Smaller Deficits In Canada

Apr 24, 2025 -

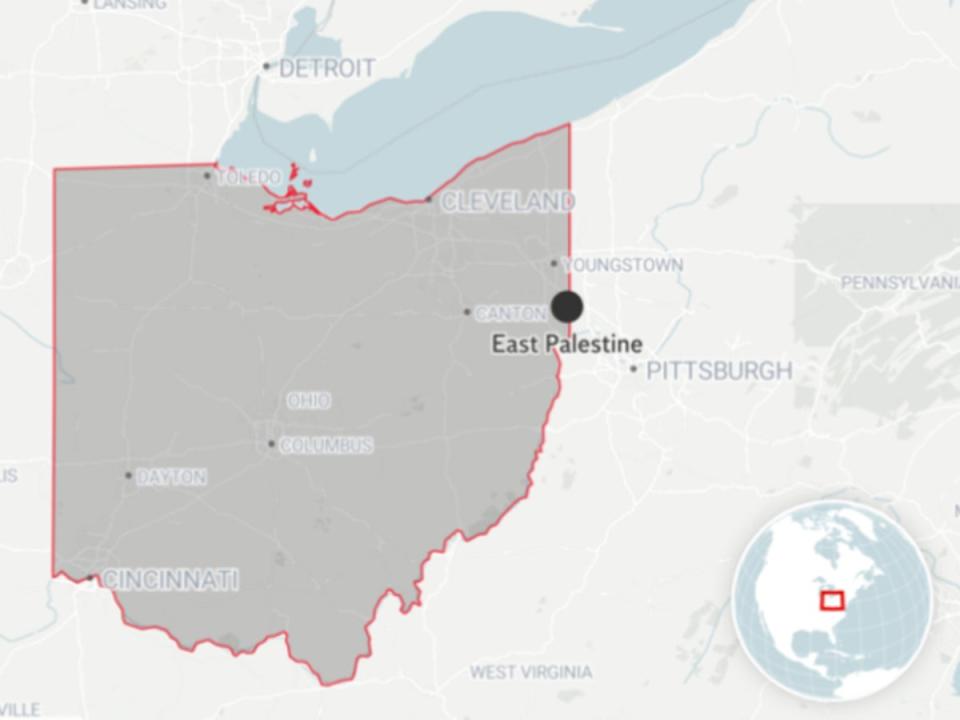

Ohio Train Derailment Months Of Lingering Toxic Chemical Contamination In Buildings

Apr 24, 2025

Ohio Train Derailment Months Of Lingering Toxic Chemical Contamination In Buildings

Apr 24, 2025