Refinancing Federal Student Loans: Is It Right For You?

Table of Contents

Understanding Federal Student Loan Refinancing

Refinancing federal student loans involves replacing your existing federal loans with a new private loan from a lender. This process consolidates multiple loans into a single, more manageable payment, often with a lower interest rate. It's vital to differentiate this from refinancing private student loans, as the implications and available options differ significantly.

Federal student loan refinancing differs from private loan refinancing in several key ways:

- Lender: Federal loans are government-backed, while refinanced loans are from private lenders.

- Benefits: Refinancing often means losing access to federal loan benefits, such as income-driven repayment plans and potential loan forgiveness programs.

- Eligibility: Private lenders have their own eligibility requirements, often based on credit score and income.

You can typically refinance the following federal student loan types:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans (for parents or graduate students)

- Consolidated federal loans (previously consolidated federal loans)

Impact on Federal Loan Benefits: This is a critical consideration. By refinancing, you generally lose access to:

- Income-driven repayment plans (IDR) – These plans tie your monthly payments to your income.

- Deferment and forbearance options – These offer temporary pauses in payments during financial hardship.

- Public Service Loan Forgiveness (PSLF) – This program forgives remaining balances after 10 years of qualifying payments in public service.

- Federal loan protections against wage garnishment – While private lenders can still pursue legal action, the collection process differs from federal agencies.

Benefits of Refinancing Federal Student Loans

While the loss of federal benefits is a significant concern, refinancing can offer several compelling advantages:

Lower Monthly Payments

By securing a lower interest rate and potentially extending your loan term, refinancing can significantly reduce your monthly payment. For example, refinancing a $50,000 loan from 6% to 4% interest could lower your monthly payment by hundreds of dollars, depending on the loan term.

Lower Interest Rates

A primary draw of refinancing is the potential to secure a substantially lower interest rate than your existing federal loan rate. This can lead to substantial savings over the life of the loan. This is particularly attractive if you initially had a variable interest rate and are seeking a fixed rate.

Simplified Repayment

Consolidating multiple loans into a single payment simplifies your finances and reduces the administrative burden of tracking various payment deadlines and interest rates. Managing one monthly payment is far easier than several.

Potential for Fixed-Rate Loans

Many borrowers originally had variable interest rates on their federal loans. Refinancing allows you to lock in a fixed interest rate, protecting you from future interest rate hikes and providing greater repayment predictability.

Risks of Refinancing Federal Student Loans

Despite the potential benefits, it's essential to carefully weigh the risks:

Loss of Federal Loan Benefits

As previously mentioned, this is the most significant risk. Losing access to income-driven repayment plans, loan forgiveness programs, and other federal protections could leave you with a substantially higher overall repayment cost. Be fully aware of the benefits you'll lose.

Higher Interest Rates (in certain scenarios)

While lower interest rates are a common goal, borrowers with lower credit scores or less stable financial situations may find it difficult to secure a lower rate. You could end up with a higher interest rate than your federal loan, negating any potential savings.

Increased Loan Term

Extending your loan term lowers monthly payments, but it drastically increases the total interest paid over the loan's lifespan. While seemingly beneficial at first, this could cost you thousands more in the long run.

Eligibility Requirements

Private lenders have specific eligibility requirements, including minimum credit scores and income levels. If you don't meet these requirements, you won't be able to refinance.

Determining If Refinancing is Right for You

Before making a decision, carefully consider these factors:

Assess Your Financial Situation

Evaluate your current debt, income, and expenses. Can you comfortably afford higher payments if interest rates rise, or if you lose income-driven repayment plan protections?

Compare Interest Rates

Obtain quotes from multiple lenders before making a choice. Don't settle for the first offer you receive; compare interest rates, fees, and repayment terms thoroughly.

Consider Your Long-Term Goals

Does refinancing align with your overall financial goals? Will the potential short-term benefits outweigh the long-term risks of losing federal loan protections?

Seek Professional Advice

Consulting a financial advisor can provide invaluable guidance and help you navigate the complexities of student loan refinancing. They can help determine if it's a suitable decision for your specific financial circumstances.

Conclusion: Making the Right Choice with Federal Student Loan Refinancing

Refinancing federal student loans can offer substantial benefits, such as lower monthly payments and potentially lower interest rates. However, the loss of crucial federal protections and the potential for higher interest rates are significant drawbacks. Carefully weigh the pros and cons, and thoroughly research various lenders before making a decision. Consider the long-term implications and don't hesitate to seek professional financial advice. Carefully evaluate your financial situation and explore your options with student loan refinancing. Do your research and speak to a financial advisor to determine if refinancing your federal student loans is the right choice for you.

Featured Posts

-

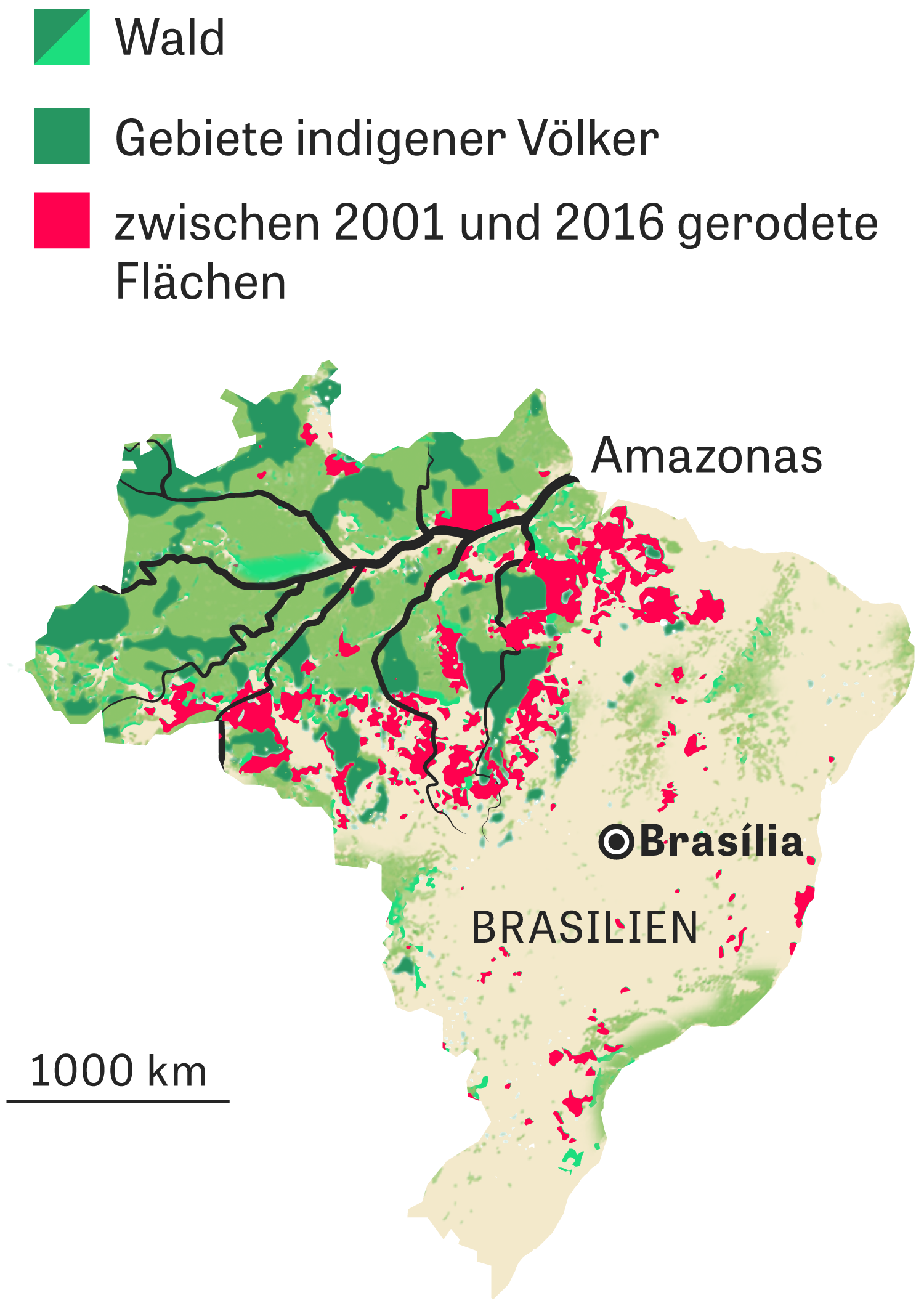

Zukunftsmarkt Brasilien Emiratische Investitionen In Favelas

May 17, 2025

Zukunftsmarkt Brasilien Emiratische Investitionen In Favelas

May 17, 2025 -

Knicks News Brunsons Status Koleks Impact And The Crucial Remaining Games

May 17, 2025

Knicks News Brunsons Status Koleks Impact And The Crucial Remaining Games

May 17, 2025 -

Cade Cunningham The Key To The Pistons Potential Knicks Playoff Spoiler

May 17, 2025

Cade Cunningham The Key To The Pistons Potential Knicks Playoff Spoiler

May 17, 2025 -

Andor Cast Provides Exclusive Bts Look At The Rogue One Prequel Series Finale

May 17, 2025

Andor Cast Provides Exclusive Bts Look At The Rogue One Prequel Series Finale

May 17, 2025 -

Reddit Service Restored After Outage Users Report Full Functionality

May 17, 2025

Reddit Service Restored After Outage Users Report Full Functionality

May 17, 2025